-

The Current Landscape of Mortgage Origination: Trends and Challenges

The Current Landscape of Mortgage Origination: Trends and Challenges Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Originating (1392)

Getting a Stuck Loan Originator Back on Track

- Monday, 18 March 2019

- Originating

- Written by matt

Tagged under

Work smarter, Commit to Performing the Right Sales Activities

- Monday, 18 March 2019

- Originating

- Written by matt

Recent Operations Expansions...

- Sunday, 17 March 2019

- Originating

- Written by tim

Tagged under

Encountering Objections Means You're Closer to a Sale

- Friday, 15 March 2019

- Originating

- Written by tim

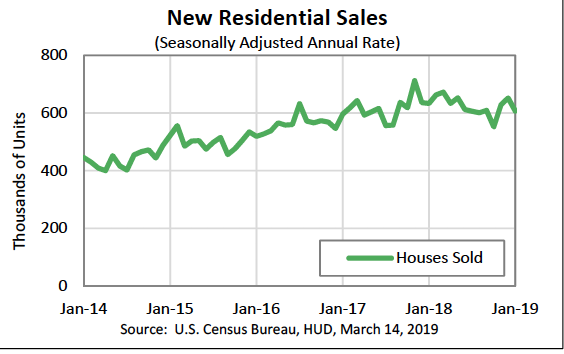

New Home Sales Statistics Show a Slow Start to 2019

- Thursday, 14 March 2019

- Originating

- Written by tim

Tagged under

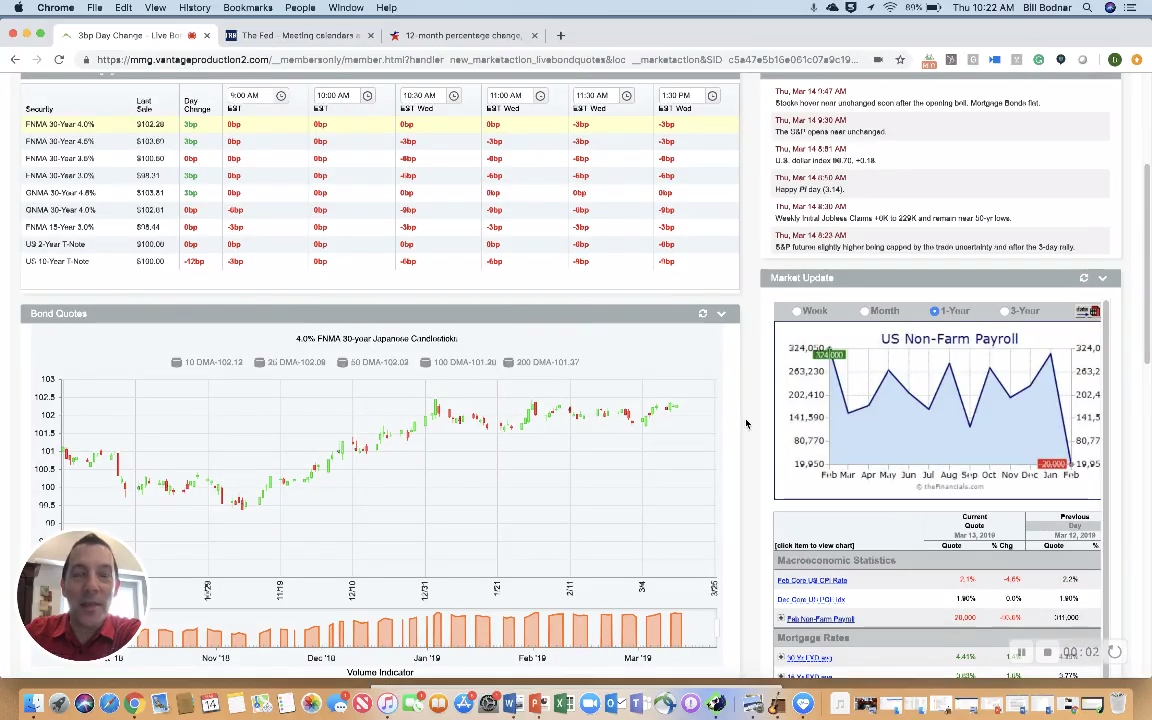

Mortgage Market Guide's Bodnar: Smooth Sailing Ahead, Unless Inflation Returns

- Thursday, 14 March 2019

- Originating

- Written by matt

Tagged under

American Dream Originators Deliver Financial Strategies to Borrowers

- Wednesday, 13 March 2019

- Originating

- Written by matt

Mortgage Applications Rise 2.3%

- Wednesday, 13 March 2019

- Originating

- Written by matt

Tagged under

Wells Fargo CEO Tells Congress Bank Is Stronger

- Monday, 11 March 2019

- Originating

- Written by matt

Tagged under

Affording a Down Payment Prevents Many Millennials from Owning Homes

- Tuesday, 12 March 2019

- Originating

- Written by matt

Tagged under

MOST READ STORIES

Fast,Easy & Free