-

The Current Landscape of Mortgage Origination: Trends and Challenges

The Current Landscape of Mortgage Origination: Trends and Challenges Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Originating (1392)

Habits, Tricks and Traits of High Performing Loan Officers

- Tuesday, 30 April 2019

- Originating

- Written by tim

Tagged under

Optimal Blue Adds Publishing Capabilities To It's Social Media Platform.

- Monday, 29 April 2019

- Originating

- Written by tim

Tagged under

Six Cities Leading Shift Toward a Buyers’ Market

- Monday, 29 April 2019

- Originating

- Written by tim

Tagged under

MGIC Offers Business Planning Strategies.

- Sunday, 28 April 2019

- Originating

- Written by tim

Tagged under

Bill Bodnar from Mortgage Market Guide Discusses Interest Rates

- Friday, 26 April 2019

- Originating

- Written by tim

Tagged under

Ask Brian: Should I Advertise In the Local Newspaper?

- Thursday, 25 April 2019

- Originating

- Written by tim

Tagged under

Fannie Mae is Looking for Your Ideas

- Wednesday, 24 April 2019

- Originating

- Written by tim

Tagged under

MBA: Refi Applications Drop 28% Over the Last Three Weeks

- Wednesday, 24 April 2019

- Originating

- Written by tim

Tagged under

Radian MI Now Available Through Compass Analytics

- Tuesday, 23 April 2019

- Originating

- Written by tim

Tagged under

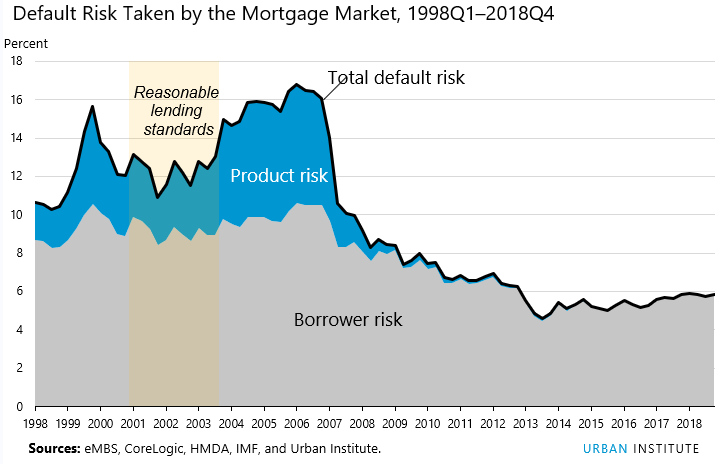

Urban Institute's Index Shows Credit Easing Has Room to Increase

- Tuesday, 23 April 2019

- Originating

- Written by tim

Tagged under

MOST READ STORIES

Fast,Easy & Free