-

The Current Landscape of Mortgage Origination: Trends and Challenges

The Current Landscape of Mortgage Origination: Trends and Challenges Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Originating (1392)

NAR: Pending Home Sales Rise 4.6% in January

- Wednesday, 27 February 2019

- Originating

- Written by matt

Tagged under

Cottonwood Title Inks Deal to Protect Wire Transactions

- Monday, 25 February 2019

- Originating

- Written by matt

Tagged under

Angel Oak Expands into Fix and Flip Financing

- Tuesday, 26 February 2019

- Originating

- Written by matt

Tagged under

In an AI World Originators' Roles Will Focus on Creating Loan Demand

- Sunday, 24 February 2019

- Originating

- Written by matt

Tagged under

Expanding Your 'Sphere' Means More Business

- Monday, 25 February 2019

- Originating

- Written by matt

Tagged under

Zillow Group Reshuffles Leadership Roles

- Friday, 22 February 2019

- Originating

- Written by matt

Tagged under

New Home Sales Dipped 8% in January

- Friday, 22 February 2019

- Originating

- Written by matt

Tagged under

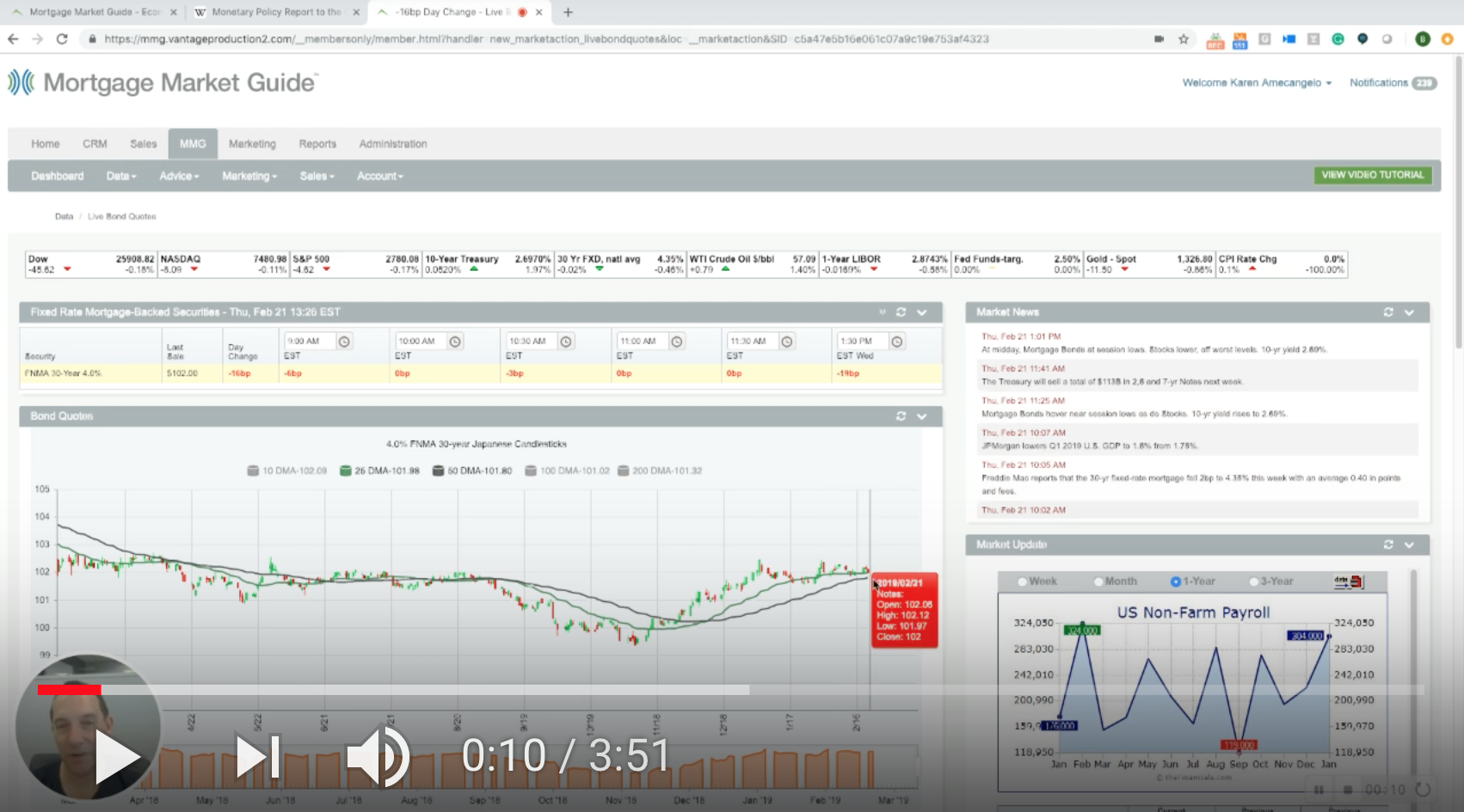

The Week's Market Insights with Bill Bodnar from the Mortgage Market Guide

- Thursday, 21 February 2019

- Originating

- Written by matt

Tagged under

Existing Home Sales Weak in January, But Have 'Likely' Reached a Low

- Thursday, 21 February 2019

- Originating

- Written by matt

Tagged under

loanDepot Technology Brings 8-Day Closings (Possibly)

- Wednesday, 20 February 2019

- Originating

- Written by matt

MOST READ STORIES

Fast,Easy & Free