-

The Current Landscape of Mortgage Origination: Trends and Challenges

The Current Landscape of Mortgage Origination: Trends and Challenges Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Originating (1392)

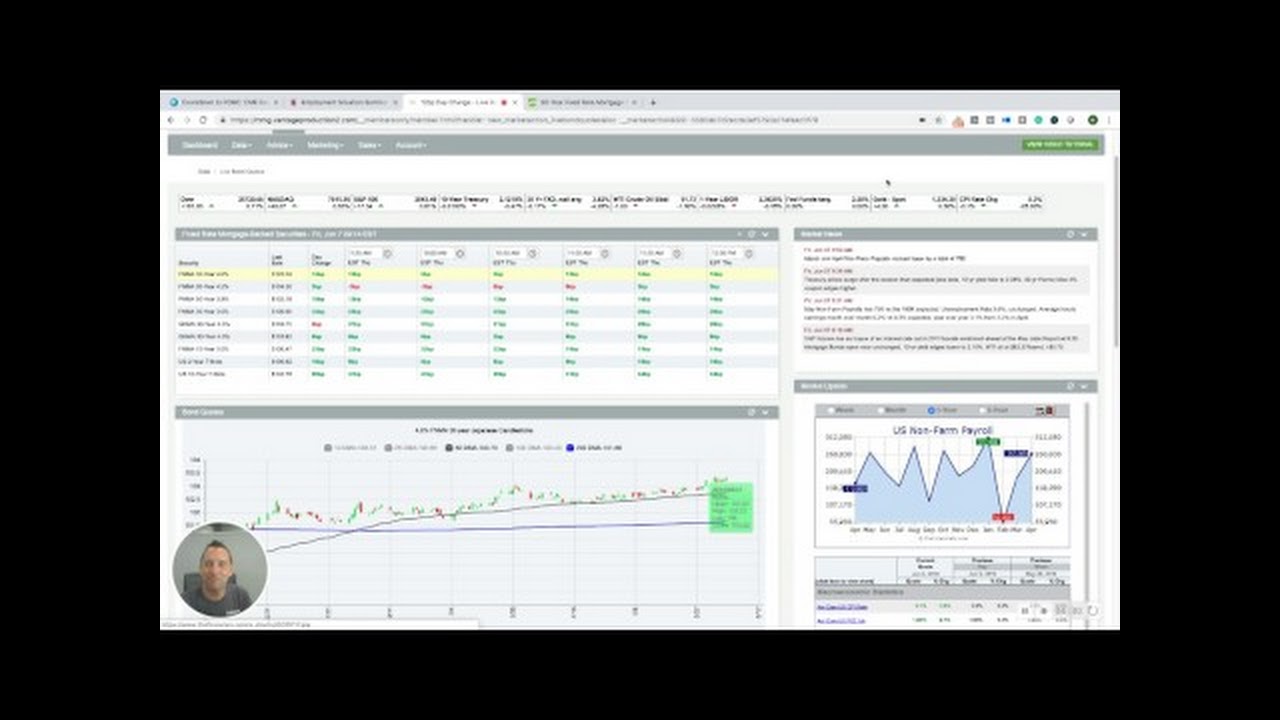

Bill Bodnar of MMG: Should Be Floating Clients Into the Fed Meeting Next Week

- Thursday, 13 June 2019

- Originating

- Written by tim

Tagged under

Dear Brian: I Should Still Use Traditional Mail?

- Thursday, 13 June 2019

- Originating

- Written by tim

Tagged under

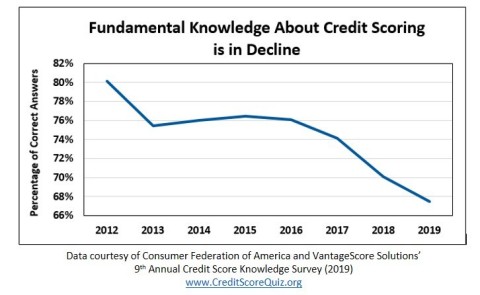

Survey Reveals That Consumer Knowledge about Credit Scores Has Steadily Declined over the Past Eight Years

- Wednesday, 12 June 2019

- Originating

- Written by tim

Tagged under

Statewide Closing Costs Avg Between .88% and 4.95% of Sales Price

- Tuesday, 11 June 2019

- Originating

- Written by tim

Tagged under

Three Signs That It Is Time to Fire an Originator

- Monday, 10 June 2019

- Originating

- Written by tim

Tagged under

Ask The Expert: Am I Better Hiring Quality or Quantity?

- Monday, 10 June 2019

- Originating

- Written by tim

Tagged under

Bill Bodnar of Mortgage Market Guide on Interest Rates - Trend is Still Your Friend

- Friday, 07 June 2019

- Originating

- Written by tim

Tagged under

Millennials Handle Homeownership by Taking Advantage of Refinance Opportunities

- Wednesday, 05 June 2019

- Originating

- Written by tim

Tagged under

Zillow Suggests 25 Things You Can Do Right Now To Grow Your Mortgage Business.

- Thursday, 06 June 2019

- Originating

- Written by tim

Tagged under

Maxwell Suggests Three Ways to Improve Your Website

- Tuesday, 04 June 2019

- Originating

- Written by tim

Tagged under

MOST READ STORIES

Fast,Easy & Free