-

The Current Landscape of Mortgage Origination: Trends and Challenges

The Current Landscape of Mortgage Origination: Trends and Challenges Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Originating (1392)

Angel Oak Mortgage Solutions Expands Correspondent Lending Unit, Welcomes Four New Executives

- Monday, 13 May 2019

- Originating

- Written by tim

Tagged under

Different Training Needed for Different Types of Originators

- Monday, 13 May 2019

- Originating

- Written by tim

Tagged under

Ask the Expert: How to Reply To Callers Asking About Your 30 Year Rate

- Sunday, 12 May 2019

- Originating

- Written by tim

Tagged under

Bill Bodnar of MMG Discusses This Weeks Interest Rate Events

- Thursday, 09 May 2019

- Originating

- Written by tim

Tagged under

Dear Brian: Brian Discusses How to Meet New Real Estate Agents

- Thursday, 09 May 2019

- Originating

- Written by tim

Tagged under

State Flood Insurance Rates Vary Greatly, Even Among Coastal States

- Wednesday, 08 May 2019

- Originating

- Written by tim

Tagged under

14% of Consumers Feel Its a Good Time to Buy, 43% Feel Its a Good Time to Sell

- Tuesday, 07 May 2019

- Originating

- Written by tim

Tagged under

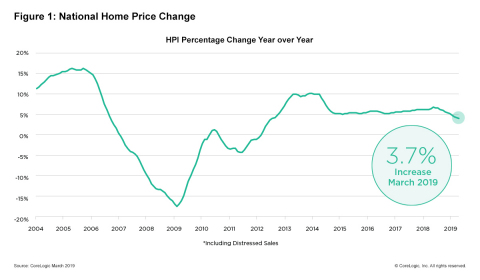

CoreLogic: Housing Prices Continue to Increase

- Tuesday, 07 May 2019

- Originating

- Written by tim

Tagged under

Reshaping the Role of the Mortgage Originator

- Monday, 06 May 2019

- Originating

- Written by tim

Tagged under

Ginnie Mae Rethinking High LTV Loans for Cash-Out Purposes

- Monday, 06 May 2019

- Originating

- Written by tim

More...

MOST READ STORIES

Fast,Easy & Free