TRENDING WHITEPAPERS,VIDEOS & MORE

tim

NestReady Study Finds Lenders Not Using Audience Data, Cross-Channel Marketing Platforms as Much as They Could

- Tuesday, 04 June 2019

NestReady, a technology firm that develops platforms to put lenders at the center of the homebuying process, released its 2019 Marketing Technology Report. The report is based on a survey of the use of digital marketing technologies by mortgage lenders this year.

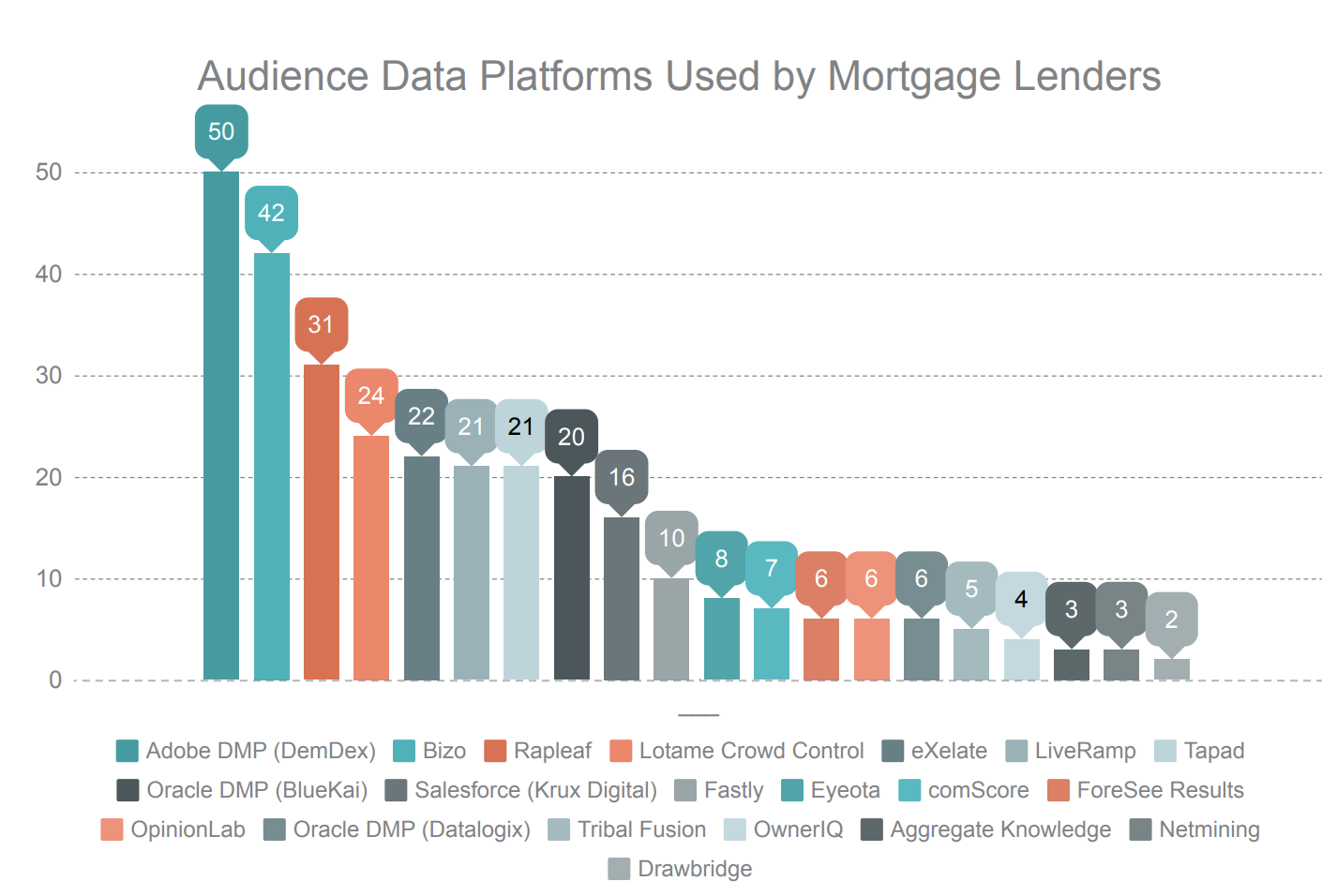

NestReady surveyed 500 of the largest mortgage lenders in the U.S. about 350 different digital marketing platforms in 11 categories. The categories included web analytics, audience data management (DMPs), media buying/demand-side platforms (DPSs), cross-channel retargeting, digital ad exchanges, A/B testing and content/conversion optimization, live chat, marketing automation, video platforms, tag management solutions and social media tools. When compared to other industries such as retail, the results concluded that lenders are significantly behind other industries in the use of the technology.

“In today’s competitive age, lenders need to leverage the proper digital marketing tools and channels to attract and retain customers,” said Mauro Repacci, co-founder and CEO of NestReady. “By understanding how some of the larger lenders are using technology for their business growth, other lenders can learn how to improve their businesses and attract a larger customer base.”

Some of the key takeaways from the report showed:

- 60% of the top 500 U.S. mortgage lenders are using audience data platforms, which help users understand their audiences' behaviors and interests, as well as target them across the Internet.

- 55% of top lenders are leveraging cross channel display advertising platforms, which enable users to run hyper-targeted campaigns with advanced bidding tactics across multiple channels. Among these lenders, 12.5% are using Trade Desk, making it the most popular cross channel display platform.

- When compared to other industries for example companies in the Retail sector - mortgage lenders are lagging a bit behind. For example a strong retail will normally leverage 4-5 analytics system in combination with Google Analytics and variety of platforms used would be 30-40% higher. There is a room to grow and explore.

- More than 56% of lenders on our list use a tag management solution to deploy various marketing technologies across their websites from a centralized location, suggesting that top lenders consider organizing and streamlining their digital marketing efforts to be a significant priority.

- 2 out of 3 top mortgage lenders will use this class of audience data capturing technology to gain strategic understanding of their visitors across 1000s of categories that can be later on targeted via display advertising.

The majority of the audience data platforms (or Data Management Platforms - DMP's as they are know) integrate with programmatic display advertising solutions (DSPs). This allows companies to analyze, segment, and target their audiences more precisely, as well as perform "lookalike" modeling to target users that are similar to their top prospects or customers.

“It is important to look at the systems being used and seriously consider how we can increase efficiencies while providing better customer service,” Repacci said. “We need to learn from other industries when it comes to harnessing technology.”

The Mortgage Technology Report, including detailed analysis and takeaways is available here.

Read more...Regrets About Mortgages Don't Dim Millennials' Love for Their Homes

- Wednesday, 29 May 2019

Younger homeowners more often say they rushed through the buying process and have regrets about their mortgage, likely resulting from the challenges young buyers face entering today's expensive housing market.

Still, homeowners of all ages are, for the most part, happy with their home purchases, a recent Zillow® survey shows.

The Zillow Housing Aspirations Report is a semiannual survey conducted by Ipsos of 10,000 homeowners and renters in 20 large metro areas across the country, asking the respondents about their views on homeownership and their personal housing expectations. In the latest survey, it also asked about regrets.

The Zillow Housing Aspirations Report is a semiannual survey conducted by Ipsos of 10,000 homeowners and renters in 20 large metro areas across the country, asking the respondents about their views on homeownership and their personal housing expectations. In the latest survey, it also asked about regrets.

Overall, 81% of young homeowners (between 18 and 34 years old) had at least one regret about their home, compared with 65% of those 55 years and older. Some of the biggest disparity was related to regrets about their mortgages. Millennial and Generation Z homeowners are more likely to think their mortgage payments and interest rates are too high, and have more regrets about the type of mortgage they have.

The increased likelihood for regrets could be due to their inexperience with the home buying process. Young owners are likely still living in their first homes, which means they went through the process of finding a lender and getting a mortgage for the first time. Navigating this process for the first time may explain why they are more likely to say they rushed the home buying decision without considering all their options – 29% of young homeowners regret rushing the process, compared with 12% of older buyers.

The Zillow Group Consumer Housing Trends Report shows that millennials (ages 24-38) contact more lenders when planning to buy a home than older generations - so they are doing their homework when it comes to finding the best mortgage partner, but may have smaller down payments or more debt affecting their credit scores, and therefore their interest rates.

"The American Dream of homeownership is still alive and well, and younger buyers who are building families and forging their careers must stretch their budgets to achieve it," said Zillow Director of Economic Research Skylar Olsen. "They have long wish lists to fit their needs, and are often navigating the process of buying for the first time. While their inexperience may lead to wishing they'd done some things differently, few homeowners regret making the decision to buy instead of rent."

First-time buyers already make up nearly half of all buyers, and there is a growing population of millennials set to turn 34, the median age of first-time buyers. For these potential new buyers, being educated and prepared can help avoid some of these common regrets. In addition to contacting multiple lenders to find the best rate and mortgage product, working with an agent with a winning track record can help navigate the process so buyers don't end up feeling rushed and regretting their decision. The Best of Zillow program, which recognizes the top-rated agents based on customer feedback, can help buyers find the best agent partner for them.

Homeowner Regrets

| 55+ years old | ||

|

18-34 years old

|

||

| Rushed the process without evaluating all the options | 29% | 12% |

| Mortgage payments are too high | 30% | 12% |

| Interest rate is too high | 27% | 12% |

| Type of mortgage | 22% | 7% |

| Purchasing a home instead of renting | 17% | 4% |

STRATMOR: Lenders Turn to Alternative Technologies as Loan Origination Costs Continue to Climb

- Tuesday, 28 May 2019