TRENDING WHITEPAPERS,VIDEOS & MORE

tim

Redfin: Millennials Could Buy Homes 3 Years Faster under Sen. Warren's Student Debt Cancellation Plan

- Monday, 03 June 2019

A typical aspiring first-time homebuyer could save a down payment three years faster under Senator Elizabeth Warren's plan to cancel up to $50,000 of student loan debt per person, according to a new analysis of student loan and home price data from Redfin (www.redfin.com), the tech-powered real estate brokerage.

The Redfin analysis looked at a typical potential first-time homebuyer earning the national average salary of $65,879 for the Census Bureau's 24-44 year old age bracket, with an average of $17,938 in student debt, based on data from Lending Tree. If said potential homebuyer spent 10 percent of her income ($549 per month) on debt repayment at the average 5.8 percent interest rate, it would take 3 years to pay off the student debt. If after paying off her student debt she started saving that 10 percent of her income toward a 20 percent down payment on the national median-priced home ($308,000), it would take a total of 12.3 years to both pay off her student loans and save enough money for the full 20 percent down payment ($61,600), assuming home price and income did not change. Under Sen. Warren's plan to cancel up to $50,000 in student loan debt, the time it would take to save for a down payment would shrink to 9.4 years.

The Redfin analysis looked at a typical potential first-time homebuyer earning the national average salary of $65,879 for the Census Bureau's 24-44 year old age bracket, with an average of $17,938 in student debt, based on data from Lending Tree. If said potential homebuyer spent 10 percent of her income ($549 per month) on debt repayment at the average 5.8 percent interest rate, it would take 3 years to pay off the student debt. If after paying off her student debt she started saving that 10 percent of her income toward a 20 percent down payment on the national median-priced home ($308,000), it would take a total of 12.3 years to both pay off her student loans and save enough money for the full 20 percent down payment ($61,600), assuming home price and income did not change. Under Sen. Warren's plan to cancel up to $50,000 in student loan debt, the time it would take to save for a down payment would shrink to 9.4 years.

Nearly 400 graduating seniors at Morehouse College in Atlanta recently had their student loans eliminated as part of a massive graduation gift from billionaire Robert F. Smith. This gift of debt forgiveness could get them into their own home 3.7 years faster than if they'd retained that debt. Based on estimates of $31,833 in average debt per Morehousegraduate and Atlanta's median income of $66,357 for 24-44 year olds, the graduates could save for a down payment on a median-priced Atlanta home in just 7.3 years, compared to 12.9 years if they had to pay off their student loans on their own before saving for a downpayment.

"The idea of taking on a mortgage when you're still paying off tens of thousands of dollars in student loans is a non-starter for many people," said Redfin chief economist Daryl Fairweather. "If student debt were eliminated, college grads would be able to start building wealth through homeownership, laying down roots and contributing to their communities years earlier in their lives. An influx of young, educated homeowners could have positive impacts on neighborhoods and society at large. "

| Metro Area | Median Remaining Student Debt Balance | Median Annual Income of 24-44 year-olds | Median Home Price | Years to Pay Off Student Debt, Then Save 10% of Income Toward a Down Payment | Years to Save Down Payment Without Student Debt | Time to Homeownership Saved (Years) if Student Debt were Eliminated |

| Atlanta, GA | $22,232 | $66,357 | $241K | 11 | 7.3 | 3.7 |

| Austin, TX | $17,963 | $76,969 | $305K | 10.4 | 7.9 | 2.5 |

| Baltimore, MD | $19,854 | $85,562 | $255K | 8.5 | 6 | 2.5 |

| Birmingham, AL | $20,679 | $57,502 | $203K | 11.1 | 7.1 | 4 |

| Boston, MA | $17,869 | $97,871 | $472K | 11.6 | 9.6 | 1.9 |

| Charlotte, NC | $19,385 | $66,867 | $245K | 10.5 | 7.3 | 3.2 |

| Chicago, IL | $19,307 | $73,392 | $240K | 9.4 | 6.5 | 2.9 |

| Cincinnati, OH | $18,704 | $68,511 | $177K | 8.1 | 5.2 | 3 |

| Cleveland, OH | $18,743 | $56,161 | $145K | 8.9 | 5.2 | 3.7 |

| Columbus, OH | $19,125 | $71,181 | $200K | 8.5 | 5.6 | 2.9 |

| Dallas, TX | $18,257 | $70,064 | $295K | 11.3 | 8.4 | 2.8 |

| Denver, CO | $20,180 | $81,787 | $409K | 12.7 | 10 | 2.7 |

| Detroit, MI | $18,552 | $62,628 | $130K | 7.4 | 4.2 | 3.3 |

| Hartford, CT | $16,948 | $76,235 | $205K | 7.8 | 5.4 | 2.4 |

| Houston, TX | $18,524 | $64,590 | $240K | 10.6 | 7.4 | 3.1 |

| Indianapolis, IN | $19,065 | $62,054 | $180K | 9.2 | 5.8 | 3.4 |

| Jacksonville, FL | $18,390 | $62,115 | $226K | 10.5 | 7.3 | 3.3 |

| Kansas City, MO | $18,854 | $71,313 | $215K | 8.9 | 6 | 2.9 |

| Las Vegas, NV | $16,184 | $60,460 | $280K | 12.2 | 9.3 | 2.9 |

| Los Angeles, CA | $17,265 | $72,654 | $620K | 19.6 | 17.1 | 2.6 |

| Louisville, KY | $17,372 | $61,088 | $180K | 9 | 5.9 | 3.1 |

| Memphis, TN | $18,866 | $49,834 | $165K | 10.9 | 6.6 | 4.3 |

| Miami, FL | $19,265 | $59,520 | $300K | 13.7 | 10.1 | 3.6 |

| Milwaukee, WI | $17,418 | $65,527 | $208K | 9.2 | 6.3 | 2.9 |

| Minneapolis, MN | $17,715 | $83,933 | $275K | 8.8 | 6.6 | 2.3 |

| Nashville, TN | $18,917 | $67,802 | $288K | 11.5 | 8.5 | 3.1 |

| New Orleans, LA | $18,592 | $52,910 | $209K | 11.8 | 7.9 | 3.9 |

| New York, NY | $18,054 | $83,410 | $380K | 11.4 | 9.1 | 2.3 |

| Oklahoma City, OK | $17,278 | $60,462 | $179K | 9.1 | 5.9 | 3.1 |

| Orlando, FL | $18,997 | $57,270 | $250K | 12.4 | 8.7 | 3.7 |

| Philadelphia, PA | $18,226 | $74,413 | $196K | 7.9 | 5.3 | 2.6 |

| Phoenix, AZ | $17,500 | $65,451 | $270K | 11.2 | 8.3 | 2.9 |

| Pittsburgh, PA | $18,927 | $70,169 | $162K | 7.6 | 4.6 | 2.9 |

| Portland, OR | $18,765 | $80,348 | $392K | 12.3 | 9.8 | 2.5 |

| Providence, RI | $15,025 | $71,118 | $267K | 9.8 | 7.5 | 2.3 |

| Raleigh, NC | $21,357 | $76,729 | $285K | 10.5 | 7.4 | 3 |

| Richmond, VA | $21,915 | $68,105 | $250K | 10.9 | 7.3 | 3.6 |

| Riverside, CA | $16,642 | $65,395 | $370K | 14.1 | 11.3 | 2.8 |

| Sacramento, CA | $17,592 | $69,851 | $395K | 14 | 11.3 | 2.7 |

| Salt Lake City, UT | $15,165 | $75,706 | $321K | 10.6 | 8.5 | 2.1 |

| San Antonio, TX | $17,089 | $57,888 | $225K | 11 | 7.8 | 3.2 |

| San Diego, CA | $15,984 | $78,433 | $565K | 16.6 | 14.4 | 2.2 |

| San Francisco, CA | $18,750 | $120,587 | $1.4M | 24.9 | 23.2 | 1.6 |

| San Jose, CA | $15,273 | $132,609 | $1.1M | 18 | 16.8 | 1.2 |

| Seattle, WA | $16,003 | $91,364 | $560K | 14.1 | 12.3 | 1.9 |

| St. Louis, MO | $19,229 | $68,805 | $176K | 8.2 | 5.1 | 3.1 |

| Tampa, FL | $19,313 | $57,591 | $225K | 11.6 | 7.8 | 3.7 |

| Virginia Beach, VA | $20,395 | $62,557 | $220K | 10.7 | 7 | 3.6 |

| Washington, D.C. | $22,803 | $100,467 | $390K | 10.2 | 7.8 | 2.4 |

| National | $17,938 | $65,879 | $308K | 12.3 | 9.4 | 3 |

| * Note: Years have been rounded to the nearest tenth and may not add up across each row. | ||||||

Under Warren's student debt forgiveness plan, the median 24 to 44-year-old homebuyer in Detroit, where the typical home costs $130,000, could save for a down payment in just 4.2 years—the shortest time in the nation—down from 7.4 years currently.

Metro areas with the highest ratios of student debt to income could see the biggest decrease in the time it takes to save for a down payment, with metros in the South like Memphis (4.3 years quicker), Birmingham (4.0 years quicker), and New Orleans (3.9 years quicker) among those where student-debt laden homebuyers stand to benefit the most.

To read the full report, complete with market-level data and methodology, visit: https://www.redfin.com/blog/elizabeth-warren-student-debt-forgiveness.

Read more...Consumer Financial Protection Bureau Settles with BSI Financial Services

- Thursday, 30 May 2019

The Consumer Financial Protection Bureau (Bureau) today announced a settlement with BSI Financial Services (BSI), a mortgage servicer headquartered in Irving, Texas. BSI Financial Services is the operating name for Servis One, Inc.

The Bureau found that BSI violated the Consumer Financial Protection Act of 2010, the Real Estate Settlement Procedures Act, or the Truth in Lending Act by:

The Bureau found that BSI violated the Consumer Financial Protection Act of 2010, the Real Estate Settlement Procedures Act, or the Truth in Lending Act by:

- Handling mortgage servicing transfers with incomplete or inaccurate loss mitigation information. This resulted in failures to recognize transferred mortgage loans with pending loss mitigation applications, in-process loan modifications, and permanent loan modifications;

- Handling mortgage servicing transfers with incomplete or inaccurate escrow information resulting in untimely escrow disbursements;

- Inadequately overseeing service providers, resulting in untimely escrow disbursements to pay borrowers’ property taxes and homeowners' insurance premiums;

- Failing to promptly enter interest rate adjustment loan data for adjustable rate mortgage (ARM) loans into its servicing system, resulting in BSI sending monthly statements to consumers that sought to collect inaccurate principal and interest payments; and

- Maintaining an inadequate document management system that prevented BSI’s personnel or consumers from readily obtaining accurate information about mortgage loans.

Under the terms of the consent order, BSI must, among other provisions, pay a civil money penalty of $200,000 and pay restitution estimated to be at least $36,500. It must also establish and maintain a comprehensive data integrity program to ensure the accuracy, integrity, and completeness of the data for loans that it services, and implement an information technology plan to ensure BSI’s systems are appropriate give the nature, size, complexity, and scope of BSI’s operations.

Read more...AEI Releases It's Home Price Appreciation Index and Market Conditions Report

- Friday, 31 May 2019

Key Takeaways:

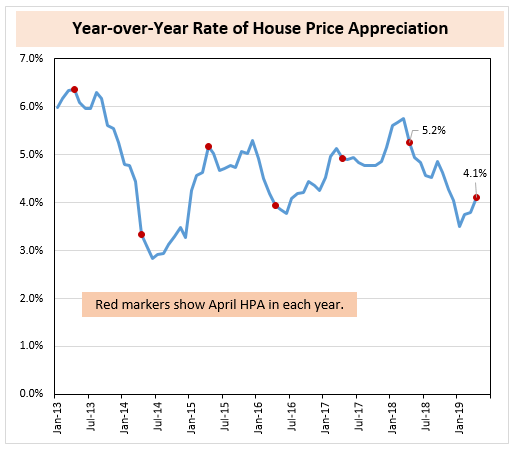

- Home Price Appreciation Rose 4.1% Year-over-Year in April 2019;

- Low Price Tier Continues to Overheat;

- Seller’s Market Conditions Persist, but Show Some Moderation on a National Basis.

Home price appreciation (HPA) for April 2019, as reported by the AEI Housing Center, was 4.1%, down from 5.2% in April 2018. However, HPA has begun to re-accelerate--the April rate is up from 3.8% in March 2019 and the recent low of 3.5% in January 2019. Note: all rates are year-over-year (y-o-y).

For the nation, house prices since 2012 have increased 42%, well in excess of wage growth of 25% over the same period. When broken down by price tier, the low tier continues to overheat, having increased by 55% since 2012. The low-medium tier has increased by 41%, the medium-high by 35%, and the high tier by 18%.

Seller’s market conditions continue, but show some moderation on a national basis. The national seller’s market, now entering its sixth year, continues to be largely driven by strong demand and tight supply in the low and low-medium price tiers.

“The U.S. housing market continues to heat up, due to sharply lower interest rates, continued easy credit availability, and persistently tight supply,” said Edward Pinto, co-director of the AEI Housing Center. He added: “The national seller’s market, now in its sixth year, is largely driven by month’s inventory for the low and low-medium tiers of [2.5] and [3] months respectively.” Pinto also noted: “Rising HPA with respect to the low and low-medium tiers (about 75% of which are first-time buyers (FTBs)) continue to strain the budgets of these buyers. In February (latest data available) 37% of all FTBs had a total debt-to-income ratio in excess of 43%, the Qualified Mortgage regulatory limit due to become effective for most loans starting in January 2021.”

“The low, low-medium, and medium-high price segments, accounting for over 90% of the market, are all showing accelerating house price appreciation year-over-year,” observed Tobias Peter, senior research analyst at the AEI Housing Center. He added: “It is only the high price segment, accounting for less than 10% of the market, that has April still showing a year-over-year decline, however that 0.4% decline is a marked improvement from February’s decline of 2.1%.” He also noted: “With mortgage rates now down a full point since November 2018, we can expect a further rebound in the rate of house price appreciation and a strengthening of seller’s market conditions.”

HPA and months’ supply data are available for download on the Housing Center’s website.

To view the full report as a PDF and to view the methodology, please click here.

Read more...