TRENDING WHITEPAPERS,VIDEOS & MORE

tim

Best Practices for Choosing a Lien Release Partner

- Thursday, 23 May 2019

By Danny Byrnes, VP Sales & Marketing, Nationwide Title Clearing Inc.

The key word here is partner. You want to be sure to engage a company that you feel confident will work with you to meet your needs and go that extra mile for you. Before embarking on a search for a new vendor partner, it is recommended that you create a list of criteria that any prospective vendor must meet in order to be considered. The following criteria can be considered best practices for establishing such a partnership.

1) Demand a specific commitment to accuracy and compliance. As mentioned above, the highest concern among mortgage servicers is typically compliance. This boils down to the accuracy of the database containing the statutory deadlines, requirements and document format guidelines for all recording jurisdictions nationwide. An effective way to gauge preparer performance is by monitoring the county document rejection percentage. This should be well below 3%. But beyond that, the vendor must address the proactive as well as the reactive by maintaining constant proactive contact with recorders and working with them to perfect the submission process.

Regardless of how well a potential lien release partner performs, a strong indemnity policy is a must. This coverage protects the mortgage servicer by putting any potential liabilities springing from non-performance or noncompliance on the shoulders of the vendor hired to perform the task. In the lien release market this is an indication of the vendor’s confidence in its own ability to provide timely and accurate lien releases.

Regardless of how well a potential lien release partner performs, a strong indemnity policy is a must. This coverage protects the mortgage servicer by putting any potential liabilities springing from non-performance or noncompliance on the shoulders of the vendor hired to perform the task. In the lien release market this is an indication of the vendor’s confidence in its own ability to provide timely and accurate lien releases.

This is the best way to avoid problems that could potentially lead to a class action in the courts. While a good SLA will indemnify the servicer in the event of a problem, you need more than that. Once a class action is certified, the public relations damage to the servicer has already been done. A commitment to accuracy and compliance is your best defense against this risk.

2) Demand a commitment to fulfilling the SLA. Most vendors typically agree to meet your service level agreement (SLA) requirements. Most do, but there always exists the possibility that SLA timelines will be compromised. When the completion of the work is dependent upon outside parties, service level agreements can become hard promises to keep.

If the outsourcer is competent and accurate, maintaining service level agreements should never be a problem. With that said, it is important to be leery of outsourcers that promise service level agreements that sound too good to be true; as with most things, they usually are. If an outsourcer seems to be promising a service level that’s extremely expedient, look at their rejection percentage. If it is above 3 percent, they may be making errors due to rushed and improperly managed work.

3) Require a strong focus on the lien release business. Most good vendors in this market segment will find that the infrastructure they maintain is suitable for a range of services. Regardless of which services the vendor offers, a good lien release partner will demonstrate a strong focus on lien releases.

A dedicated infrastructure not only means providing a sufficient number of full time employees, but that the complement is filled with knowledgeable staff. If the company’s core competencies are focused on lien releases, then they should have no problem staffing up quickly to meet the servicer’s volume demands with an experienced team.

Some outsourcing companies make the mistake of redeploying human resources when they perceive higher profit potential in another area. A quality outsourcing partner will have a dedicated staff seasoned in handling lien releases.

One measure of a company’s expertise has to do with previous experience with the loans it later releases. If the company also offers additional services, such as collateral file audits, assignments or MERS services, information about the loan may already be on file within the company, making it far less likely that an error will occur when the lien is finally released. NTC, for instance, has released 23 million liens, but we have touched many more loans with our other various services. By the time the lien is released, it’s likely that NTC has touched that loan six or seven times.

4) Require the vendor to conform to your business. One should not confuse a proficiency in a certain process with a standard for doing business for the servicing company as a whole. Too often, outsourcers will put undue demands on a servicing shop, disguising those demands as required conditions necessary to achieve success. Experience indicates that the surest path to success lies in changing as little as possible about the servicer’s infrastructure while delivering a high quality service that meets a realistic service level agreement. The best results are achieved when both the servicer and the vendor can share best practices that make both more effective.

In most cases, servicers will find that to be most effective, the vendor should develop a custom workflow to interface smoothly with the servicer’s team. The best vendors are adept at doing this.

This means that an effective lien release partner must be willing to customize everything about its service in order to fit well with the way the servicer does business.

5) Require a commitment to providing adequate technology. Successful outsourcing arrangements today are built on solid technology that provides seamless integration with appropriate data security and transparency from the first time data is touched until the process is completed. While there are many ways to judge a technology platform, there are certain elements that must be included in order to create an effective outsourcing partnership.

Full integration with a new vendor should take no more than 30 days. Reporting and auditing should be built in, real time and accessible remotely. Workflow should be completely automated and the outsource partner should be able to quickly locate any release in the pipeline at any time. Because of federal regulation, these technologies should be certified by a third party. See more below.

6) Require third party validation of vendor claims. An important part of the due diligence process for any outsourcing initiative involves seeking out third party endorsements of the prospective partner.

Most firms will have a set of business references handy. In the case of the lien release business, a good partner will also have paperwork available to establish its successful completion of third party audits and reviews.

The best vendors have invested a significant amount of money meeting these requirements. The audit costs required to operate as a service provider to mortgage banking and financial service companies have nearly tripled in the past few years. In today’s marketplace your vendor must be SSAE-16 SOC-I certified (previously called a SAS-70 Type II audit), and have regular ISO audits, reviewed financials, disaster recovery, business continuity plans, HR audits, and security audits. All of which should be readily available for your review.

7) Well-established training for every employee involved in the process Make any vendor responding to your RFP demonstrate their process for training internal staff. The need for near constant training and employee testing cannot be overestimated. With regulations changing all the time, any vendor partner the servicer chooses must have a special department that is dedicated to constant training and development.

8) Demand Transparency. Arguably the most important point in the use of any vendor is their transparency. Will that vendor act as if they are a part of your shop, seemingly “working right down the hall” from you, or will communication and interaction be few and far between? Will they show you everything and make it easy to manage ongoing volumes, or will they attempt to make you conform to their system, causing possible data gaps? Communication and transparency shouldn’t be a challenge. It should be free-flowing and flexible to adapt to your needs.

In Conclusion

The foundation for success with any outsourcing initiative is built by establishing the basis for a strong partnership from the very beginning and tracking the right metrics throughout the engagement.

A well-written contract based on a clearly scoped project is the basis for a good partnership. However, no contract, regardless of the service level agreements it contains, will force a vendor to meet the company’s real needs. Making sure that the new vendor satisfies the criteria above will do more than any contract to establish a good working relationship. As they say in Hollywood, casting is 90 percent of success.

Even so, a good set of written contracts that specify how the work is to be completed and within what time frame is a requirement for doing business. Good vendors can supply sample agreements that have served well with other clients in the industry.

In the lien release business, there is only one metric that really matters: Out of Compliance (OOC) Percentage. Specifically, this is the number of lien releases not filed in a timely, accurate and compliant manner. In this business, success can be clearly defined. There is no gray area in which to hide. Demand metrics and reports that provide true transparency. Insist on selecting a company that runs their business on a model of accuracy and compliance above all else.

About the author Danny Byrnes serves as Vice President of Sales and Marketing for Nationwide Title Clearing, Inc., the nation’s largest provider of lien release services.

Read more...Maxwell's View On The Mortgage Industry Evolution : Three Decades of Red Flags — Mortgage Policy & Praxis, 1970-1999

- Tuesday, 21 May 2019

Posted by Chelsea Mize, Maxwell

In the digital age, industries evolve at a breakneck pace, spurred on by technological advents and process enhancements. And yet, as anyone in the mortgage industry knows, change here is less accelerated. We adapt more slowly, seeking respite in the comfort of our well-worn processes and traditions.

The complexity of the mortgage industry necessitates that evolution occurs slowly, and the powers (and policies) that be often set the rate of change. As we look towards the future of our industry, it’s imperative to scrutinize our past to understand the possibilities of our future.

Welcome to “A Crack in the Foundation?”, Maxwell's four-part series in which they examine the evolution of the mortgage industry and homeownership in America, with an eye on government policies and how GSEs can promote (or prohibit) periods of economic growth.

Part 2 begins at the start of the 1970s and follows the uneasy path of government policy and economic turmoil as we creep towards the end of the century. (Missed Part 1? Read it here). This section will follow the astronomical growth in the secondary market, the mounting government pressure put on Fannie and Freddie to increase their offerings to lower- and moderate-income borrowers, as well as a widespread shift towards deregulation in the market that (spoiler alert) will prove to have disastrous consequences as the new millennium begins

_____________________________

1970s

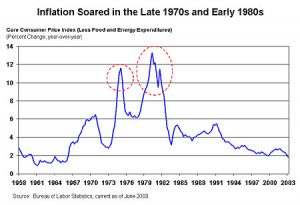

Upon his election in 1969, President Nixon inherited a recession from President Johnson, who had spent generously on Great Society and the Vietnam War. The stock market had seen a 40% loss in 18 months at the turn of the decade. Inflation rates soared, largely due to the Fed slashing interest rates for ‘easy money’ in the late 1960s. By 1970, the inflation rate had risen to 6.5%, and by 1973 it was at 8.8%.

In his book Stocks for the Long Run: A Guide for Long-Term Growth, Wharton professor Jeremy Siegel refers to the Great Inflation of the 1970s as “the greatest failure of American macroeconomic policy in the Postwar period.”

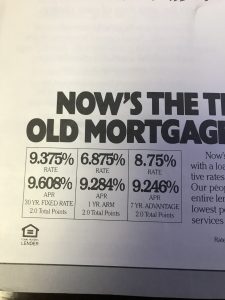

As for the mortgage market, the fallout from the liberal lending guidelines in the 1960s were still being felt. As interest rates soared in the early 1970s, eventually rising above 20%, borrowers began choosing mortgages that included one, three, or five-year terms due to the astronomical mortgage rates.

Meanwhile, as Baby Boomers aged, their housing demands increased. They wanted larger, more expensive homes. Unfortunately, the mortgage market didn’t have enough capital to finance those needs.

To infuse the mortgage market with more capital, an emphasis was placed on stimulating the secondary market. In 1970, Congress chartered the Federal Home Loan Mortgage Corporation — more commonly known as Freddie Mac — as a GSE. Freddie Mac was designed to increase the amount of capital available to lenders and, by extension, to borrowers.

Whereas Fannie Mae guaranteed and securitized mortgage loans and bought them from lenders to sell in the secondary market (with comfortable assurance that losses in the case of borrower default would be reimbursed by the government), Freddie Mac was set up to buy conventional loans from lenders to pool and sell as mortgage-backed securities on the secondary market without any guarantee.

Thus, Freddie Mac passed the risk of default from lender to investor. These loans could, however, be insured by private mortgage insurance companies (PMIs), which had seen an uptick in business that increased throughout the 1970s, partially due to the large number of FHA foreclosures in the ‘60s which had destabilized the notion of FHA loans as a ‘safe’ bet.

On the political front, as Nixon began his re-election campaign, he increasingly relied on Keynesian economics in his approach to the economic recession and rising inflation. More classical economic theories encouraged governments in hard times to maintain balanced budgets and wait for badly allocated business investments to liquidate, allowing market forces to bring a recovery. Keynesian economic theory, by contrast, encouraged governments to use countercyclical policies, running deficits in recessions and depressions.

As 1971 drew to a close and inflation remained a considerable problem, Nixon wanted low-interest rates that would promote short-term growth and make the economy seem strong as voters were casting their ballots.

Thus, in August 1971 at Camp David, Nixon imposed temporary wage and price controls as a stop-gap measure.

This strategy worked during 1972 but would have disastrous consequences later in the decade as inflation rates soared to 12% by the late 1970s.

Nixon’s price controls were increasingly met with resistance by the mid-1970s as Americans experienced food shortages, with meat disappearing off shelves and farmers drowning their chickens rather than sell them at a loss (no seriously, that actually happened).

From 1970 to 1980, the United States would experience three different recessions. And yet, the housing market remained strong.

As Fannie and Freddie aggressively purchased mortgages, the secondary market boomed and interest rates stabilized. As the resounding failure of the 1968 Fair Housing Act (which, if you’ll remember from Part 1, failed because the policy actually targeted minority borrowers with risky loans that resulted in high-foreclosure rates) still reverberated through the housing market, discrimination in lending was pushed to the forefront.

In 1974, the Equal Credit Opportunity Act was passed, which imposed heavy sanctions for financial institutions found guilty of discrimination based on “religion, race, color, national origin, age, sex, marital status, receiving income from a public assistance program, or exercising any right under the Consumer Credit Protection Act.”

While this put consequences in place for discrimination in mortgage lending, there was little incentive for lenders to develop business in low- and moderate-income (LMI) areas. This prompted the Community Reinvestment Act (CRA) in 1977, which encouraged banks and savings and loan (S&L) associations to offer credit to minority groups of lower incomes (12 U.S.C. § 290).

The CRA was intended to increase access to credit for LMI borrowers who had previously been denied access to mortgage capital due to strategies like redlining. The logic underlying the CRA was that, because banks receive certain benefits (low interest rates, federal charters, federal deposits, etc.) from the government, banks should reinvest in LMI communities.

The CRA did not force banks to loan to LMI communities or set specific quotas for lending, as Congress didn’t want to dictate individual lending practices. Instead, the CRA mandated that banks must originate loans in the area where they take deposits (determined by locations of main offices, branches, and deposit-taking ATMs). Non-deposit lenders were not subject to the CRA.

While a good idea in theory, the CRA was not very effective in practice. It was loosely written, and thus difficult for regulatory agencies to determine what constitutes compliance. As a result, the CRA has historically not been widely enforced.

All told, the 1970s saw a thriving mortgage market despite larger economic troubles, due largely in part to the stimulation of the secondary market and a surplus of Baby Boomers entering the housing market and keeping demand high. This good fortune could only last so long, as the next decade began to show signs of trouble in the market.

1980s

By 1980, the inflation rate had risen to an astonishing 14%. Prime interest rates peaked in August of 1981 at 20.5%. It is no coincidence that the adjustable rate mortgage (ARM) emerged at this point in time, as ARMs could be helpful in times of high interest rates (unfortunately, ARMs also created a concerted opportunity for predatory lending via attractive teaser rates, which we will obviously see the fallout from later in this series).

To quell rampant inflation, the Federal Reserve implemented stringent fiscal policy in 1981, which temporarily led to a severe recession in 1982 as inflation leveled out. The housing market was not immune from the recession this time — whereas 1978 had seen four million homes sold, the housing market saw just two million homes sold in 1982.

Nonetheless, the mortgage market experienced a period of growth in the early ‘80s, which was partially a response to the rapid inflation of the 1970s. Furthermore, real estate was commonly accepted as a safe hedge against inflation, and the subsequent over-building that started in the early 1980s mean that supply was plentiful. However, the high interest rates of the period resulted in higher quantities of ARMs.

During this time, private mortgage insurance companies often viewed themselves more as service providers than risk managers, and many PMIs began insuring riskier loans during this time period. By 1984, 50% of PMI loans had loan-to-value ratios greater than 90%, and 60% of those loans were ARMs or other loans with negative amortization.

Meanwhile, the secondary mortgage market had truly hit its stride in the early ‘80s. In 1970, 33% of mortgages in the $36.5B market were sold on the secondary market (so, that is 33% of $243.38B in today’s currency).

By contrast, in 1980, 50% of all mortgage loans in the $133.78B market were sold off in the secondary market (50% of $436.86B in 2019 dollars).

One New York Times article from 1984 praised the secondary market for its contribution in sustaining the market during periods of instability:

“The new market for mortgage securities has made possible the survival of a financial instrument many thought was doomed — 20- or 30-years, fixed-rate mortgage. Without the assurance that they can sell off such loans when interest rates rise, lenders would insist on variable or adjustable rates for their mortgage.”

By 1984, Freddie Mac had topped the $100B mark for home financing. That same year, Freddie Mac distributed 15M shares of participating, preferred nonvoting stock to individual member savings institutions around the country.

The Secondary Mortgage Market Enhancement Act (SMMEA) was also passed in 1984. The SMMEA permitted the ratings agencies, Moody’s and Standard & Poor’s, to rate mortgage pools. These mortgage pools could be sold as mortgage-related securities if at least one of the ratings organizations rated the pools with one of the top two ratings.

Savvy readers will begin to feel a creeping sense of unease at this point in our story, but few involved at this point in time had the same sense of foresight, and those that did saw their worries fall on deaf ears:

“At a 1984 Congressional hearing, Democratic ‘Representative Tim Wirth [of Colorado]voiced a lone and passionate cry of skepticism. Why set up private investment banks to do the same thing that [Ginnie, Fannie, and Freddie] already could legally accomplish? And why trust the inscrutable, unaccountable ratings agencies which have already shown a tendency to give high scores to failing bonds?’”

Representative Wirth’s fears went unanswered. Instead, the secondary market chugged along uninhibited. You see, with Reagan’s election in 1980, so began a shift towards a period of dramatic deregulation with far fewer restrictions across the board. This deregulation began almost immediately with the passage of the Depository Institutions Deregulation and Monetary Control Act of 1980, which granted the power to make consumer and commercial loans to all thrifts (including S&Ls), with little regulatory oversight.

The Tax Reform Act of 1986 eliminated tax deduction for interest paid on credit cards, thereby encouraging the use of home equity via refinancing, second mortgages, and home equity lines of credit (HELOC).

Next up on the legislative front was the Low Income Housing Tax Credit of 1987 which incentivized developers to build low-income housing by subsidizing the cost of capital.

Meanwhile, the commercial real estate boom that had peaked in the mid-eighties went bust, as the banking industry reported heavy losses and bank insurance funds suffered. Around that time, in 1987, the world stock market crashed. After that, monetary policy was relaxed and the mortgage industry showed increasingly poor underwriting standards.

In spite of it all, the GSEs — Fannie and Freddie in particular — continued on, seemingly unscathed.

Fannie Mae had more than doubled its profits from 1983 to 1988, boasting $381M in profits in 1988, and Freddie Mac was listed on the New York Stock Exchange in 1989.

Before its NYSE debut, Warren Buffet said of Freddie Mac in Fortune Magazine:

“Freddie Mac is a triple dip. You’ve got a low price to earnings ratio on a company with a terrific record. You’ve got growing earnings. And you have a stock that is bound to become much better known to equity investors.”

Meanwhile, new home construction had dropped from 1.8M to 1M from 1986 to 1991. This was the lowest rate since World War II, and was yet another indicator of what was to come as the ‘90s came into view.

1990s

By 1991, another recession was on the horizon and the mortgage market continued to wane. New home construction prices had fallen, and high interest rates discouraged people from buying homes. Between 1991 and 1997, home prices remained flat.

However, early in the decade, the U.S. government wanted to increase homeownership to a historical high of 70%. To get there, the government encouraged reducing mortgage requirements and focusing more on subprime loans.

Because the housing market was less than ideal, Wall Street and financial industry lenders began to create new products to attract first-time homebuyers. One such product was the option adjustable-rate mortgage loan, which often featured repayment options where buyers owed more at the end of each month than they did at the beginning of the month, resulting in massive mortgages that grew larger each month.

Another example commonly seen in the early ‘90s was the 80/20 mortgage loan. Mortgages with LTV greater than 80% usually required mortgage insurance. To avoid costly insurance, these 80/20 mortgages were really two mortgage loans: an 80% first mortgage and a 20% second mortgage.

Meanwhile, a crisis had been unfolding in the Savings & Loan segment of the banking sector since 1985. As you may remember, the Depository Institutions Deregulation and Monetary Control Act of 1980 had given thrifts (including S&Ls) more power with little oversight.

Between 1982 and 1985, S&L assets grew by 56%, whereas growth in commercial banks was just 24%. Growth was weighted towards financially weaker institutions, in part because they could only attract deposits by offering very high rates, and they could only afford those rates by investing in high-yield, risky investments. Unsurprisingly, the tumultuous economy of the late ‘80s and early ‘90s, coupled with the end of inflation and an uptick in fraud in the S&L sector, spelled the demise of 1,043 (out of 3,234) S&Ls during this period.

By 1990, S&Ls were required to hold bigger reserves against loan losses on ordinary mortgages as opposed to securitized mortgages, further incentivizing them to deal in the secondary market. With thrifts and banks increasingly playing in the secondary market, Fannie, Freddie, and Ginnie’s exponential growth became a bigger threat.

In the early ‘90s, thrifts and banks successfully lobbied the Bush administration to push for increased capital requirements on GSEs, as well as an increased percentage of loans in the LMI sectors.

This led to the Federal Housing Enterprises Financial Safety & Soundness Act of 1992. Also known as “The GSE Act”, this policy was designed to increase government oversight of the mortgage industry. The GSE Act created the Office of Federal Housing Enterprise Oversight (OFHEO) which would have authority over Fannie and Freddie.

The GSE Act also established minimum capital standards for both entities. Before the GSE Act, Fannie and Freddie had approximately one-fifth the capital requirements of other financial institutions which meant a) that they wouldn’t be able to cover their losses as well as other institutions during a time of crisis and b) that they had a competitive advantage over other financial institutions. The GSE Act also required Freddie Mac to meet certain goals pertaining to LMI mortgages, starting in 1996.

In spite of more rigorous capital demands, Fannie and Freddie continued to excel. By 1993, Freddie Mac’s cumulative finances had topped the $1T mark. In the primary market, however, struggle continued. By the end of 1994, more than 50% of all mortgages were adjustable rate, and the average home price had fallen from $151,700 in 1990 ($304,290 in 2019) to $147,400 by 1995 ($250,617 in 2019).

By the mid ‘90s, the government had begun to see how government policies had contributed to disparity between urban and suburban homeownership rates, particularly for lower- and middle-income groups. The lofty 70% homeownership rate the government wanted could not be achieved if LMI borrowers continued to be excluded from the market, so the late ‘90s saw more policies put in place to stimulate homeownership.

You may recall the Community Reinvestment Act that was passed in the ‘70s to encourage LMI homeownership (and you may also recall how it was vaguely worded, did not incentivize lenders to cater to LMI communities, and was rarely enforced).

To combat this, President Clinton began to push for changes in CRA criteria in 1995, mainly to make the criteria easier to understand, make the forms easier for banks to file, and place an increasing focus on actual lending. One such change was to make lending to LMI neighborhoods a requisite to receive an “Outstanding” rating.

You see, banks are periodically evaluated for their ability to meet the credit needs of those in the communities in which they operate. Banks receives one of four ratings from these evaluations: Outstanding, Satisfactory, Needs to Improve, or Substantial Non-Compliance. This was a step in the right direction, but unfortunately, banks were only evaluated on their volume of loans to LMI borrowers, but not on how those loans performed.

In January 1995, new CRA regulations were put in place. One regulation required home loan data to be broken down by neighborhood, income, and race. This regulation also encouraged community groups to complain to banks and regulators and allowed community groups that marketed loans to collect a broker’s fee. This regulation also allowed Fannie Mae to receive affordable housing credit by buying subprime securities.

Under increased pressure from the government, Fannie Mae increased their share of LMI mortgages by 100% from 1992-1995, and Freddie Mac increased their share by 50% in the same timeframe. LMI lending as a whole more than doubled from $150B in 1995 ($255B in 2019 dollars) to $397B in 1997 ($637.6B in 2019 dollars).

In November 1997, Fannie Mae helped First Union Capital Markets and Bear, Stearns & Co. to launch the firstpublicly available securitization of CRA loans. They issued $384.6M in these securities, all of which carried Fannie’s guarantee with regard to timely interest and principal.

By 1997, the primary market was seeing a 29% mortgage denial rate for conventional home purchase loans. In 1999, Fannie was pushed to start pilot programs to further increase access for LMI homebuyers. In September 1999, Fannie Mae eased credit requirements to encourage banks to extend mortgages to people whose credit wasn’t good enough to qualify for conventional loans.

In November 1999, The Gramm-Leach-Bliley Act (a.k.a. the Financial Services Modernization Act) was passed which repealed the Glass-Steagall Act of 1932 (which, if you need a refresher, separated investment and commercial banking activities). This new act effectively deregulated banking, insurance, and securities into a financial services industry allowing financial institutions to grow very large.

This deregulation would continue into the 2000s to disastrous ends.

Conclusion

Starting in the 1970s, a few commonalities emerge that become more consistent as we inch closer to the end of the century.

The first thing we see is the use of short-term fixes in times of economic distress that temporarily (and falsely) seem to show economic recovery, only to yield disastrous results in the long-term as economic forces run their course.

The second commonality that arises from 1970 to 1999 is the continued trend that started in the post-war era to throw government money at the secondary market to create more capital in the mortgage industry and compensate for slow growth or stagnation in the primary market.

The third commonality is the (arguably lackluster) attempts by the U.S. government to create policies that stymy discrimination in lending and make mortgage capital more accessible to borrowers in low- and moderate-income communities. Starting with the Fair Housing Act in 1968, we regularly see policies put in place that are theoretically designed to reduce discrimination in lending and empower LMI homeownership, but in practice end up being either wholly ineffective, having the opposite impact (as is the case with the Fair Housing Act), or increasing LMI homeownership by means of risky or downright predatory lending practices.

Finally, these final few decades preceding the turn of the century show an alarming shift towards deregulation, as well as the gradual relaxing of loan standards. With nearly 70 years of mortgage history and policy behind us at this point, it’s fair to note that nearly every period of reduced lending standards and riskier lending practices in the past has led to spikes in foreclosures, losses to lenders/PMIs, and/or wide-scale economic distress in the decade(s) that follow.

With the advantage (or, in this case, the curse) of hindsight, these red flags become increasingly worrisome (and glaringly obvious) as we near the new millennium.

_____________________

Read more...

Optimal Blue Delivers on “Lights-Out” Integration Between Hedge Advisory and Loan Trading Platforms

- Tuesday, 04 June 2019

Optimal Blue, a provider of secondary marketing automation and services in the mortgage industry, announced the completion of a “lights-out” integration between its comprehensive hedge advisory and loan trading platforms. The announcement exemplifies Optimal Blue’s ongoing commitment to provide enterprise, end-to-end automation through superior technology with functional depth.

The only one of its kind, this real-time integration uses a library of proprietary APIs to seamlessly automate vital functions within the secondary marketing process that to date, have been increasingly complex and resource intensive. Further, the two-way integration builds on the advanced workflow automation that is already established within the Optimal Blue platform.

For years, Optimal Blue clients have recognized the significant competitive advantage of a seamless integration between the company’s flagship product eligibility and pricing and hedge advisory platforms by automatically updating the hedge position based on loans locked in the product eligibility and pricing engine. The new and highly anticipated “lights-out” integration between the hedge analytics and trading platform takes it a step further by fully automating the feed of loans that are “ready-to-sell” and returning post-trade updates to sync hedge positions in real time.

For years, Optimal Blue clients have recognized the significant competitive advantage of a seamless integration between the company’s flagship product eligibility and pricing and hedge advisory platforms by automatically updating the hedge position based on loans locked in the product eligibility and pricing engine. The new and highly anticipated “lights-out” integration between the hedge analytics and trading platform takes it a step further by fully automating the feed of loans that are “ready-to-sell” and returning post-trade updates to sync hedge positions in real time.

“We are thrilled to deliver this next generation of automation to our clients,” said John Ardy, Vice President of Resitrader by Optimal Blue. “More than half of our clients have already transitioned to the integrated platform and those that remain will be migrated over the next several months.” Optimal Blue anticipates monthly trading volumes to exceed $5 billion upon completion of client onboarding.

Optimal Blue views this integration as the foundation for several significant innovations and ongoing enhancements, like the use of proprietary machine learning algorithms to assist buyers and sellers optimize their trading strategies, as well as a fully automated “lights-out” loan execution to deliver a full roundtrip automation experience linking buyers and sellers. In addition, Optimal Blue is pursuing the expansion of axe posting for CRA, non-QM, and Jumbo transactions.

“There is considerable value in a unified technology platform,” explained Scott Happ, CEO of Optimal Blue. “This integration provides further transparency into whole loan transactions and delivers the connectivity, efficiency, and liquidity necessary to thrive in today’s competitive environment.”

Read more...