NestReady, a technology firm that develops platforms to put lenders at the center of the homebuying process, released its 2019 Marketing Technology Report. The report is based on a survey of the use of digital marketing technologies by mortgage lenders this year.

NestReady surveyed 500 of the largest mortgage lenders in the U.S. about 350 different digital marketing platforms in 11 categories. The categories included web analytics, audience data management (DMPs), media buying/demand-side platforms (DPSs), cross-channel retargeting, digital ad exchanges, A/B testing and content/conversion optimization, live chat, marketing automation, video platforms, tag management solutions and social media tools. When compared to other industries such as retail, the results concluded that lenders are significantly behind other industries in the use of the technology.

“In today’s competitive age, lenders need to leverage the proper digital marketing tools and channels to attract and retain customers,” said Mauro Repacci, co-founder and CEO of NestReady. “By understanding how some of the larger lenders are using technology for their business growth, other lenders can learn how to improve their businesses and attract a larger customer base.”

Some of the key takeaways from the report showed:

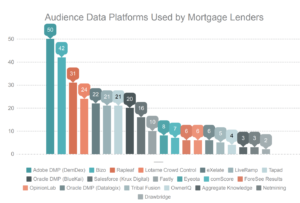

- 60% of the top 500 U.S. mortgage lenders are using audience data platforms, which help users understand their audiences' behaviors and interests, as well as target them across the Internet.

- 55% of top lenders are leveraging cross channel display advertising platforms, which enable users to run hyper-targeted campaigns with advanced bidding tactics across multiple channels. Among these lenders, 12.5% are using Trade Desk, making it the most popular cross channel display platform.

- When compared to other industries for example companies in the Retail sector - mortgage lenders are lagging a bit behind. For example a strong retail will normally leverage 4-5 analytics system in combination with Google Analytics and variety of platforms used would be 30-40% higher. There is a room to grow and explore.

- More than 56% of lenders on our list use a tag management solution to deploy various marketing technologies across their websites from a centralized location, suggesting that top lenders consider organizing and streamlining their digital marketing efforts to be a significant priority.

- 2 out of 3 top mortgage lenders will use this class of audience data capturing technology to gain strategic understanding of their visitors across 1000s of categories that can be later on targeted via display advertising.

The majority of the audience data platforms (or Data Management Platforms - DMP's as they are know) integrate with programmatic display advertising solutions (DSPs). This allows companies to analyze, segment, and target their audiences more precisely, as well as perform "lookalike" modeling to target users that are similar to their top prospects or customers.

“It is important to look at the systems being used and seriously consider how we can increase efficiencies while providing better customer service,” Repacci said. “We need to learn from other industries when it comes to harnessing technology.”

The Mortgage Technology Report, including detailed analysis and takeaways is available here.