-

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Lending (1549)

Fidelity National Launches Digital Title Closing Capability

Fidelity National Financial has launched its digital title closings capability. Developed in partnership with Black Knight Inc. this new closing experience supports both hybrid and digital closing options and is integrated with FNF's title production systems. Designed to digitally engage homebuyers and sellers in the process well in advance of the closing signature ceremony, the… Read more...

Kroll: M&A Deals Are Slow to Materialize

Although the time is ideal for mergers and acquisitions between mortgage lenders there was just one large deal and a handful of small deals. The BB&T Corp.’s acquisition of SunTrust Banks Inc. creates the ninth largest mortgage lender in the U.S. with a 2.3 percent market share, according to the “Residential Mortgage Bank Update” from… Read more...

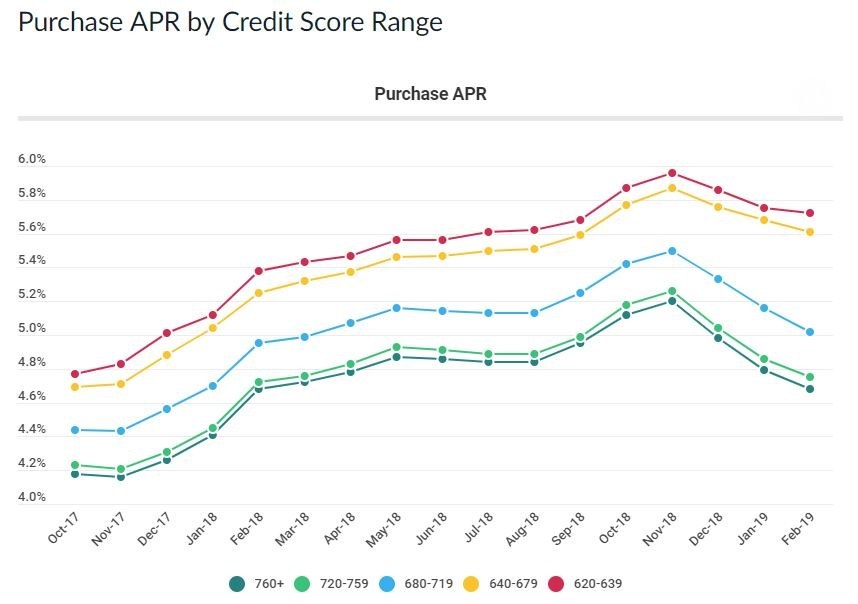

3 Reasons for Increased Price Disparity Based on Credit Scores

In LendingTree’s recently released Mortgage Offers Report, which analyzes data from actual loan terms offered to borrowers on LendingTree.com by lenders on LendingTree's network, the data suggests that borrowers with lower credit scores aren’t realizing the full benefit of declining interest rates. "Of note, since rates started falling in December, lenders are passing through those… Read more...

Consumer Defaults Stable in February, Notes S&P-Experian

The S&P-Experian Consumer Credit Default Indices, which measure changes in consumer credit defaults, show that the composite rate rose two basis points from last month to 0.92 percent. The first mortgage default rate was one basis point higher at 0.70 percent. The bank card default rate rose six basis points to 3.48 percent. The auto… Read more...

ARMCO: Critical Defects Rate Rises 11%

The critical defect rate reached 1.89 percent in the third quarter of 2018, an increase of 11 percent, compared with 1.71 percent defect rate reported in the second quarter. It’s the second highest critical defect level since the TRID rule went into effect in October 2015, according to the “ARMCO Mortgage QC Trends Report” from… Read more...

Tagged under

First American Enhances Collateral Inspections with Mobile Tools

First American Mortgage Solutions LLC has upgraded its collateral inspection services with mobile-enabled technology. “Valuations, like all other aspects of the mortgage lifecycle, are becoming increasingly modernized and technology-driven,” said Kevin Wall, president at First American Mortgage Solutions. “With our enhanced mobile and data delivery capabilities, we’re helping lenders and valuation professionals stay ahead of… Read more...

Tagged under

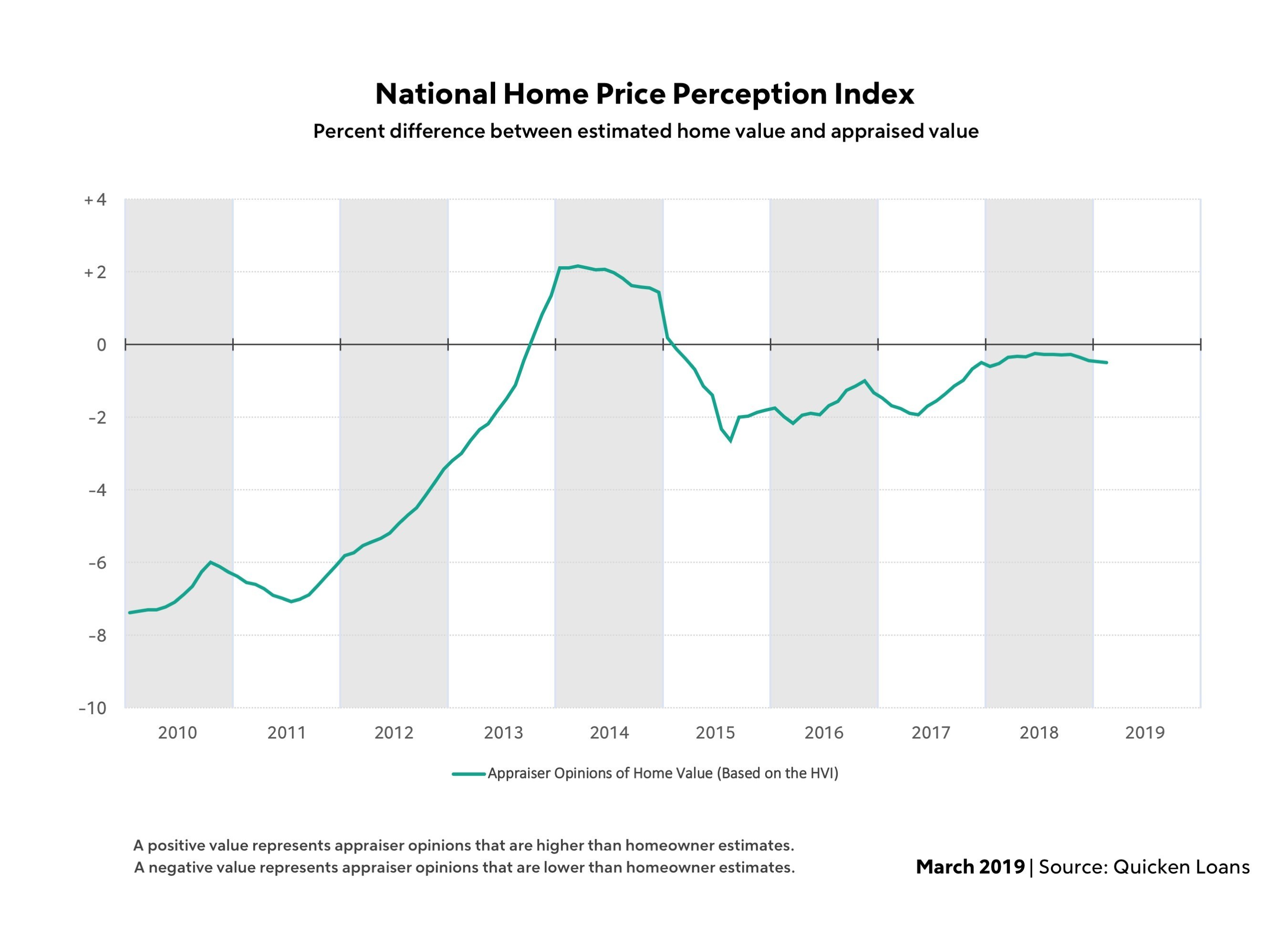

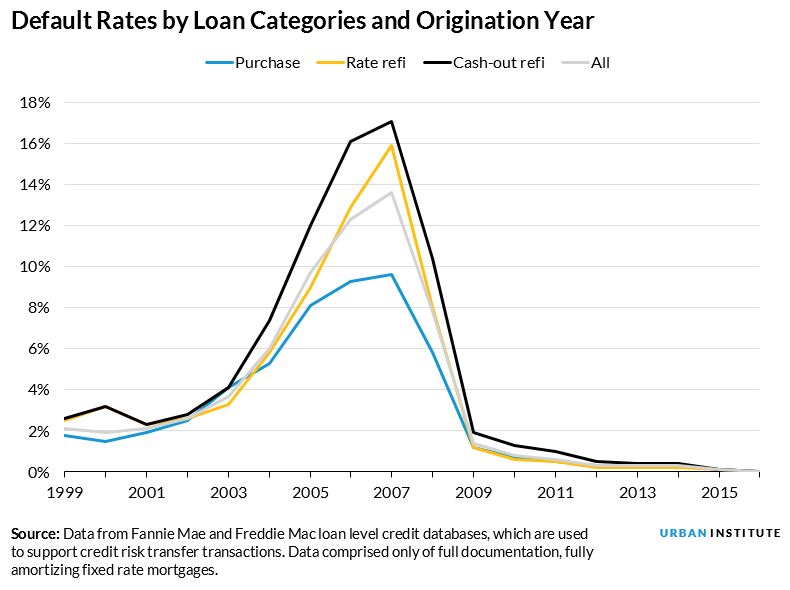

A Significantly Improved Appraisal Process Has Reduced the Riskiness of Refinance Mortgages

By Laurie Goodman and Jun Zhu Historically, purchase mortgages have performed better than refinance mortgages, or “refis,” defaulting less often. But changes made in response to widespread appraisal bias during the crisis have improved the industry’s risk assessment and management abilities overall and, accordingly, have decreased the expected default rate on all mortgages. We looked… Read more...

Tagged under

QuestSoft Adds ALTA Registry to Subscription Services Offered Through Compliance EAGLE

QuestSoft Corporation announced it has added the ALTA Registry check to its growing list of Compliance EAGLE subscription services. The ALTA Registry functions as a searchable online database of underwriter-confirmed title agent companies, real estate attorneys and underwriter direct offices. “The ALTA Registry identifies a title vendor with unprecedented accuracy and is a great fit… Read more...

Javelin Strategy & Research Names Austin Kilgore to Lead Digital Lending Practice

Javelin Strategy & Research today announced the hiring of consumer finance and fintech expert, Austin Kilgore. In his new role, Kilgore will lead Javelin's expansion into Digital Lending. After Kilgore will advise clients on emerging technologies and strategies that provide an exceptional experience and deliver faster and more accurate underwriting and portfolio management decisions across… Read more...

Tagged under

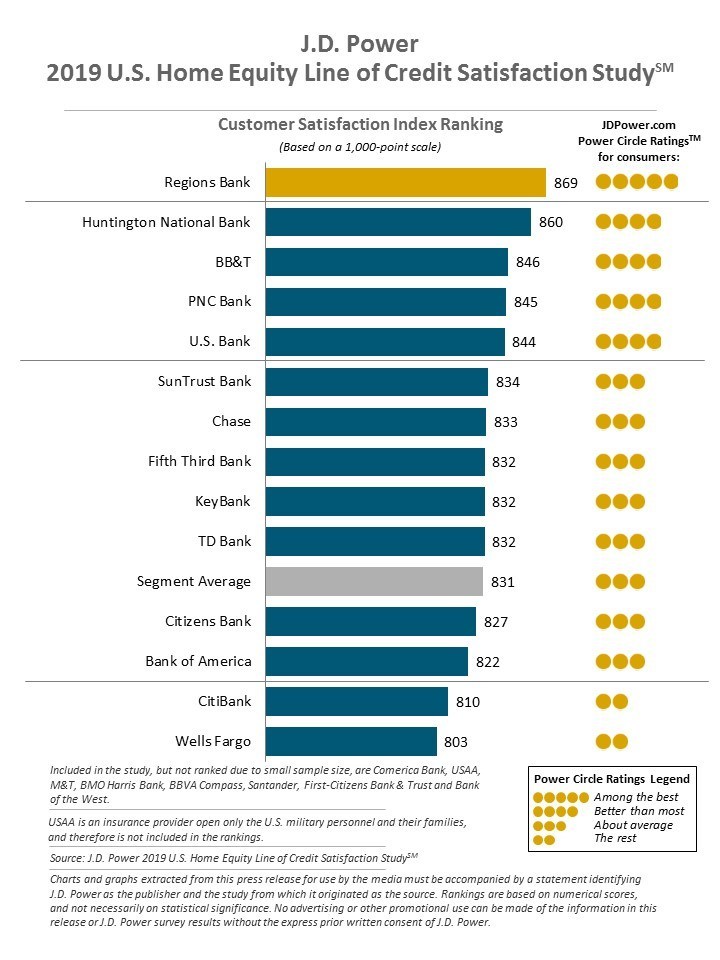

HELOC Customers Crave Alternative Funding Sources, Digital Offerings

HELOC customers are more likely than ever to shop for alternative sources of funding and lenders are falling short on digital offerings, according to the “J.D. Power 2019 U.S. Home Equity Line of Credit Satisfaction Study.” "HELOC providers have a privileged position in the consumer lending space by virtue of the relationships they already have… Read more...

Tagged under

MOST READ STORIES

Fast,Easy & Free