-

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Lending (1549)

First United Reports Net Income of $10.7M for 2018

First United Corp. reported consolidated net income available was $10.7 million for the year ended Dec. 31, 2018, compared to $4.1 million for 2017. First United is a holding company and the parent company of First United Bank & Trust. Basic and diluted net income per common share for the year ended Dec. 31, 2018 … Read more...

Tagged under

CoreLogic Integrates OnSite with Encompass Platform

CoreLogic has integrated its OnSite property condition reports with the Ellie Mae Encompass platform. OnSite is a property condition report coupled along with a local market conditions and patent-pending features that are specifically designed to help institutions meet the Federal requirements when an automated valuation model is used for mortgage lending purposes. “Organizations are always… Read more...

Tagged under

Trade Groups Urge FASB to Delay CECL

Nine financial services trade organizations are urging in a joint letter to the Financial Accounting Standards Board to delay implementation of its current expected credit loss standard to ensure there are no unintended consequences. Among the nine groups are CUNA and the Mortgage Bankers Association. In response to a proposed change in implementation of CECL,… Read more...

Tagged under

Fannie's HPSI Holds Steady in February, Borrowers Less Bullish on Home Prices

The Fannie Mae Home Purchase Sentiment Index decreased 0.4 points in February to 84.3, reversing some of the increase seen in January. The HPSI is down 1.5 points compared with the same time last year. The largest change among the HPSI components this month was a 9-percentage point drop in the net share of Americans… Read more...

Tagged under

Rates Rise, Reports Freddie Mac

Freddie Mac reported that mortgage rates rose after weeks of moderating, according to its “Primary Mortgage Market Survey.” [caption id="attachment_9187" align="alignleft" width="241"] Sam Khater[/caption] “While mortgage rates very modestly rose to 4.41 percent this week, they remain below year-ago levels for the fourth week in a row,” said Sam Khater, chief economist for Freddie Mac.… Read more...

Tagged under

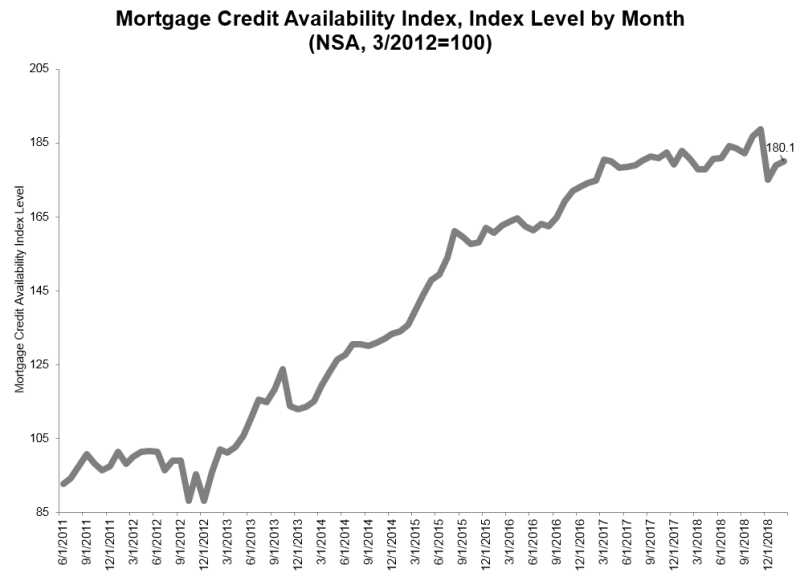

Mortgage Credit Availability Index Increases in February

The Mortgage Credit Availability Index rose 0.6 percent to 180.1 in February, according to a report from the Mortgage Bankers Association that analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The… Read more...

Tagged under

LoanBeam Integrates with Freddie Mac’s Automated Underwriting System

LoanBeam, a provider of automated income calculations from digital tax return data, that their technology was integrated with Freddie Mac's automated underwriting system. Loan Product Advisor's asset and income modeler for self-employed borrowers, along with LoanBeam's platform, can speed the loan-origination process for them. "In today's competitive housing market, lenders rely on technology to help… Read more...

Tagged under

CoreLogic Offers Automated Valuation Solutions

CoreLogic has unveiled its Total Home Value for Marketing solution. This is the latest addition to the CoreLogic Total Home Value suite, or Automated Valuation Models, that incorporate new technologies to help deliver more accurate home values. This step is part of the company’s plan to enhance its appraisal management company services, attain a 30… Read more...

Tagged under

American Mortgage Consultants Inc. Acquires String Real Estate Information Services, LLC

American Mortgage Consultants, Inc., a leading nationwide residential and consumer loan due diligence, quality control, securitization review, MSR review, advance assessment, servicing oversight, consulting, and technology provider, has acquired String Real Estate Information Services, LLC (“String”), a leading provider of title search outsourcing services. This Strategic expansion adds title search capabilities and a variety… Read more...

Tagged under

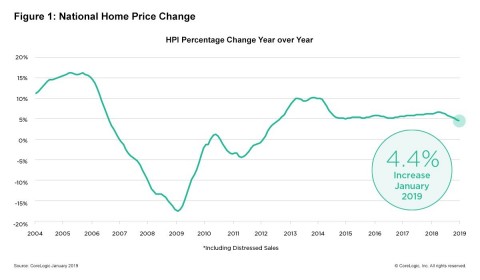

CoreLogic Reports January Home Prices Increased by 4.4 Percent Year Over Year

CoreLogic released the CoreLogic Home Price Index and HPI Forecast for January 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 4.4 percent year over year from January 2018. This represents the slowest twelve-month home price growth rate since August 2012. On a month-over-month basis,… Read more...

Tagged under

MOST READ STORIES

Fast,Easy & Free