-

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Lending (1549)

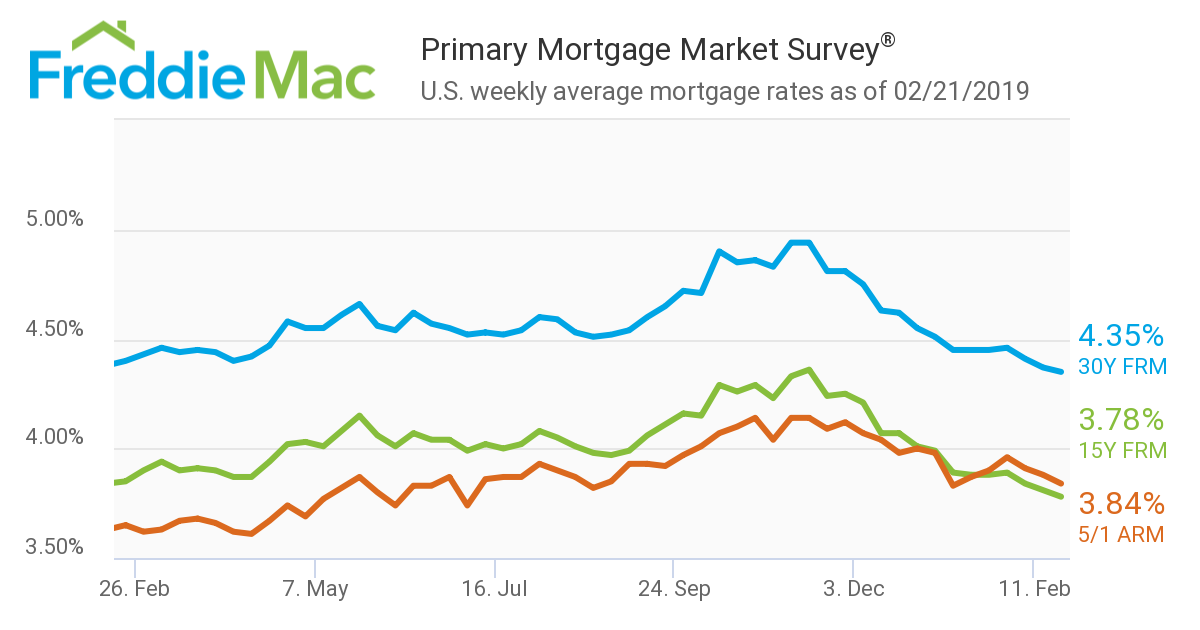

Mortgage Rates Unchanged

Mortgage rates held steady after declining for three consecutive weeks, according to the “Primary Mortgage market Survey” from Freddie Mac. “Mortgage rates remained mostly unchanged this week, while mortgage applications rose 5.3 percent from the previous week,” said Sam Khater, chief economist for Freddie Mac. “The general decline in rates we have seen recently, combined… Read more...

Tagged under

Fewer First Time Homebuyers in Q4: Genworth

There were fewer first-time homebuyers amid housing slowdown in the fourth quarter of 2018. Fully 480,000 single-family homes were purchased—a decline of three percent from a year ago, compared to a one percent increase in the third quarter, according to the First-Time Homebuyer Market Report from Genworth Mortgage Insurance. "The first-time homebuyer market once again… Read more...

Tagged under

Exclusive: Class Valuation Invests in InsideMaps, Looks Drive Appraisal Innovation

Class Valuation has made an equity investment in and is partnering with InsideMaps, a technology company using computer vision to digitize the home. This partnership allows Class Valuation to develop solutions designed to meet the needs of the evolving mortgage industry. [caption id="attachment_8871" align="alignleft" width="300"] Detwiler: InsideMap investment is latest step to modernize the appraisal… Read more...

Tagged under

MBA: Apps Up 5.3%

Mortgage applications increased 5.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending Feb. 22, 2019. This week’s results include an adjustment for the Washington's Birthday (Presidents’ Day) holiday. The Market Composite Index, a measure of mortgage loan application volume, increased 5.3 percent… Read more...

Tagged under

Ocwen Reports $70.8M Loss for 2018

Ocwen Financial Corp. reported a net loss of $70.8 million, or $0.53 per share, for the full year 2018 compared to a net loss of $128 million, or $1.01 per share, for the full year of 2017, a $57.2 million improvement. For the three months ended Dec. 31, 2018, Ocwen reported a net loss of… Read more...

Tagged under

CoreLogic Revenues Dip 3% in 2018: Originations, AMC Segments Decline

CoreLogic reported revenues of $1.788 billion for 2018, down 3 percent as organic growth and benefits of acquisitions weren't enough to offset an estimated 15 percent drop in U.S. mortgage origination unit volumes and lower appraisal management company revenues. The company had U.S. mortgage loan origination unit volumes expected to decline around 5 percent from… Read more...

Black Knight: Prepayment Rate Marks 18 Year Low

Despite recent declines in interest rates, January's prepayment rate was the lowest since November 2000. Seasonal reductions in home sales outweighed any early, rate-driven rise in refinance incentive, according to the “first look” data from Black Knight. Housing turnover typically bottoms out in January and February, so prepayments could pick up again if rates remain… Read more...

Tagged under

Ellie Mae-AI Foundry Create Partnership in Bid to Enhance Originations

Ellie Mae and AI Foundry have established a partnership in which they will integrate their respective technologies and use artificial intelligence and machine learning to help lenders improve the mortgage origination process. Lenders will benefit from the partnership through the availability of artificial intelligence-driven automation capabilities that significantly reduce labor-intensive processes associated with mortgage origination.… Read more...

Tagged under

Nierenberg: NewRez to Originate Around $15B in 2019, Twice 2018's Volume

The volume of originations NewRez has targeted for 2019 is around $15 billion, double the $7.2 billion in originations the company completed in 2018. NewRez, formerly New Penn, is a subsidiary of New Residential Investment Corp. “As we look at 2019, a lot of that [growth] has to do with our own recapture and some… Read more...

Construction Starts Rise 2%

The value of new construction starts in January advanced 2% compared to December, reaching a seasonally adjusted annual rate of $722.5 billion, according to Dodge Data & Analytics. The slight gain followed the loss of momentum that was reported toward year-end 2018, with [caption id="attachment_5116" align="alignleft" width="319"] Robert Murray, chief economist for Dodge Data[/caption] construction… Read more...

Tagged under

MOST READ STORIES

Fast,Easy & Free