In LendingTree’s recently released Mortgage Offers Report, which analyzes data from actual loan terms offered to borrowers on LendingTree.com by lenders on LendingTree's network, the data suggests that borrowers with lower credit scores aren’t realizing the full benefit of declining interest rates.

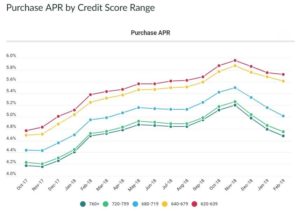

"Of note, since rates started falling in December, lenders are passing through those benefits to higher credit borrowers, but not so much to lower credit borrowers," said Tendayi Kapfidze, chief economist at LendingTree. "You can see in the chart that tracks annual percentage rate by credit score, the top two lines representing lower credit scores have not moved down much.”

"Of note, since rates started falling in December, lenders are passing through those benefits to higher credit borrowers, but not so much to lower credit borrowers," said Tendayi Kapfidze, chief economist at LendingTree. "You can see in the chart that tracks annual percentage rate by credit score, the top two lines representing lower credit scores have not moved down much.”

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

In fact, borrowers with scores of 760 plus have seen a decline of 52 basis points, but those with scores of 620 to 639 realized just 24 bps from November to February.

“A lot of the difference is being driven by risk. Many of the lower credit score and non-QM loans come in with exceptions. These exceptions are adding another quarter point almost every time” said Carl Markman, director of national sales at REMN.

One of the things driving the higher pricing for the borrowers with lower credit scores seems to be risk layering. According to a recent Federal Housing Administration, there is an increasing concentration of loans that have both credit scores below 640 and debt to income ratios above 50 percent. This has led to the FHA making changes to it’s Technology Open to Approved Lenders Mortgage Scorecard system that reinstates manual underwriting requirements for certain mortgages with credit scores below 620 and debt to income ratios above 43 percent.

When Fannie increased the maximum debt to income to 50 percent from 45 percent in an update to Desktop Underwriter last year. It brought the limit in line with competitor Freddie Mac, removed maximum loan-to-value ratios and minimum reserves requirements for those loans.

But, after examining the loans, it received since last year's update, Fannie implemented some fine tuning that would limit that risk layering.

“Operational costs are also playing a role. Borrowers with non-QM and lower credit scores often take more hand holding and more documentation,” said Markman. “These operational costs have to be factored into the pricing.”

A third reason why the lower credit score pricing hasn’t fallen as fast as the upper ranges is because the non-QM loans are very investor specific. They offer specialized pricing for specialized products which can’t be shopped around as easily in the secondary market.

This decreased level of commoditization allows private-label securitizers to look for yield. Pricing on the lower credit score loans is often changed only a handful of times a month. “These loans are sticky on the way down and sticky on the way up,” said a long-time industry executive, who declined to be named because he isn't an approved company spokesperson.