-

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Lending (1549)

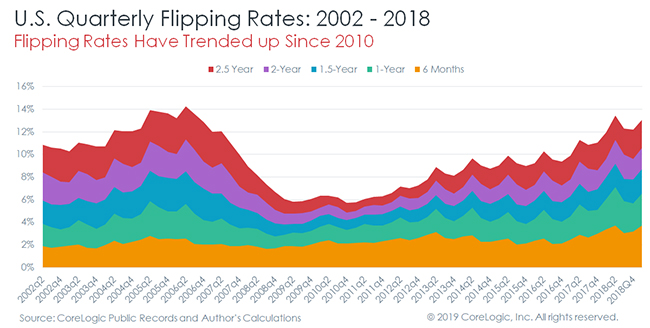

Flipping Rates Near Historic Highs, But Flippers Are Playing a Different Game

According to recent report issued by Corelogic, home flipping continues to rise and is currently at the hightes level since they started tracking in 2002. This time however it isn’t just a matter of investors focusing on quick fix based on speculative house price movements, like in the past. Now short-term investors are focused on… Read more...

The 30 Year Loan Is Riskier and Drives Up Entry Level Home Prices

In a recently posted article, Edward J. Pinto, a resident fellow and the codirector of the Center on Housing Markets and Finance at the American Enterprise Institute (AEI), took aim at the usefulness of the 30- year mortgage. His feeling is that the slow amortization makes it nearly twice as risky as a similar loan… Read more...

Small Dollar Mortgages Are No Riskier Than Mid-Size Mortgages

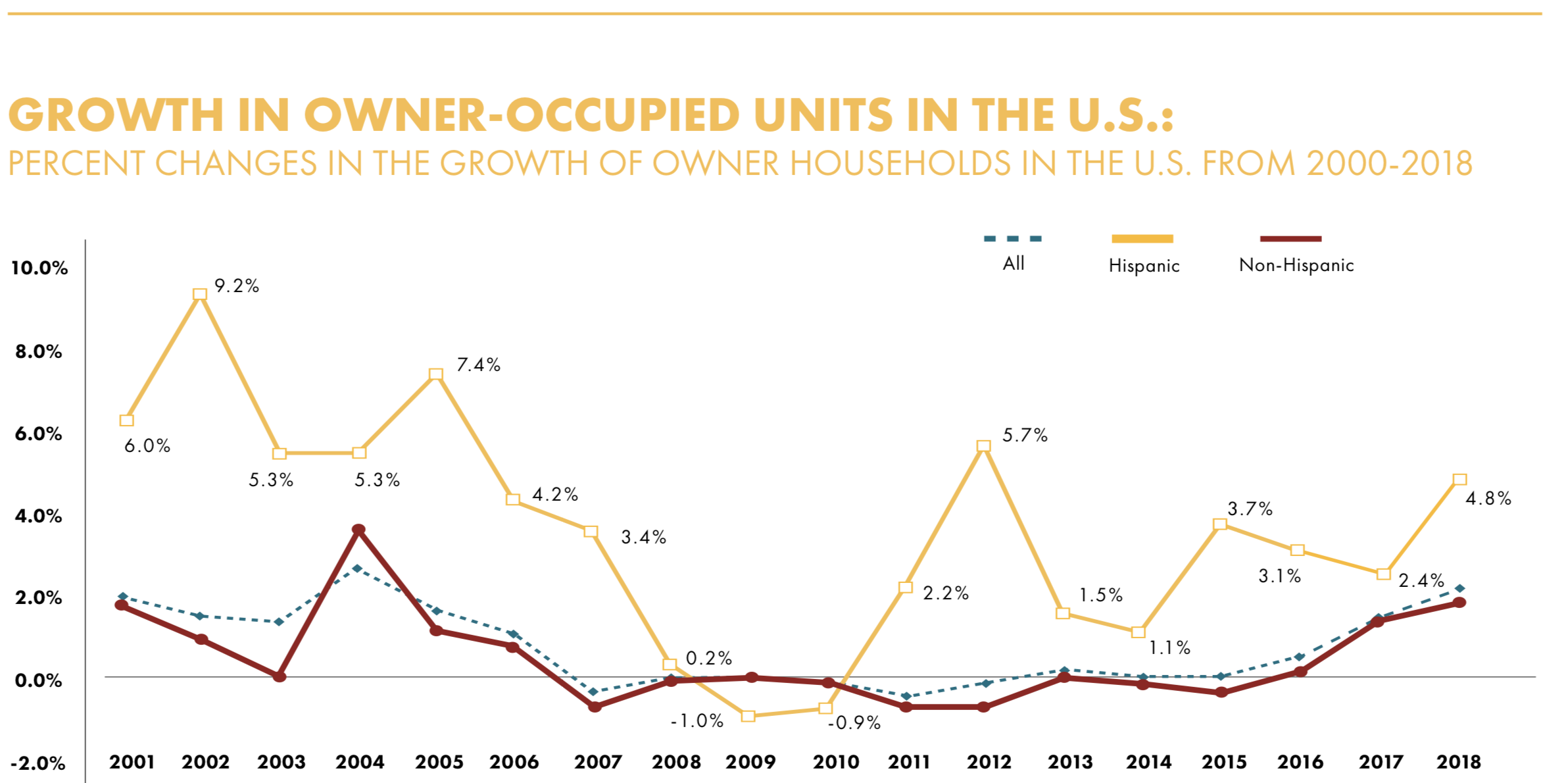

By Alanna McCargo and Sarah Strochak, Urban Institute The difficulty of obtaining mortgages for low-cost homes has made homeownership even harder at the most affordable end of the spectrum. Only one in four homes purchased for $70,000 or less in 2015 was financed with a mortgage, compared with almost 80 percent of homes worth between… Read more...

CFPB Announces Policy Change Regarding Bureau Civil Investigative Demands

In an effort to increase transparency and move away from its “regualation by enforcement” stereotype, the CFPB on Tuesday announced that it is changing it’s policy on Civil Investigation Demands (CID’s). The new poicy will ensure the CFPB provides more information about the potentially wrongful conduct under investigation.CIDs will also typically specify the business activities… Read more...

Black Knight's "First Look" Shows Delinquencies Down, Prepayments Up

According to Black Knight’s “first look” report on March mortgage performance statistics, total U.S. loan delinquency ( defined as loans 30 or more days past due but not in foreclosure) fell 5.3% to 3.65%. This is down almost 2% from this time last year. This represented the smallest improvement for any March, typically the strongest… Read more...

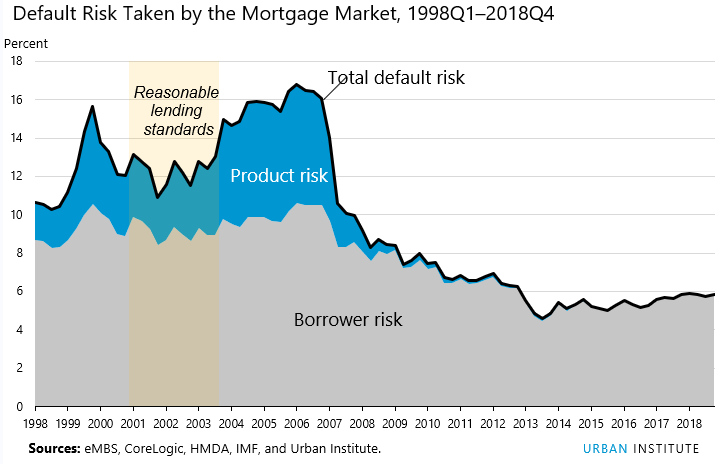

Urban Institute's Index Shows Credit Easing Has Room to Increase

The Urban Institute’s Housing Finance Policy Center updated their Housing Credit Availability Index (HCAI) last Friday. The HCAI measures the percentage of owner-occupied home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and… Read more...

Home Insurance Rates Up As Much As 88% In The Last Decade, Study Finds

QuoteWizard®, a LendingTree company, and one of the nation's leading online insurance marketplaces, today released its report that found natural disasters have dramatically increased home insurance rates in every state around the country. Every year in the United States, natural disasters account for tens of billions of dollars in damages. A significant portion of those… Read more...

NAR Existing Home Sales Report Shows Sales Down In March

Existing-home sales retreated in March, following February’s surge of sales, according to the National Association of Realtors®. Each of the four major U.S. regions saw a drop-off in sales, with the Midwest enduring the largest decline last month. Total existing-home sales completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 4.9% from February… Read more...

Executives Discuss the Outlook for Liquidity and M&A

At the IMN Residential Mortgage Servicing Rights Forum last week the issues of liquidity and the outlook for mergers and acquistions (M&A) came up. Liquidity is something that many of the CEO’s are focused on. Aaron Samples, CEO of First Guarantee commented “ Where the last cycle was credit driven more than anything else, for… Read more...

U.S. Economy Still on Track to Slow in 2019

Housing Market Supported by Lower Rates, Improved Wage Growth In the just released Fannie Mae Economic and Strategic Research (ESR) Group’s April outlook, economic growth for 2019 continues to be forecast at 2.2 percent, down from 3.0 percent in 2018. The report goes on to say "The fading impact of last year’s fiscal stimulus as… Read more...MOST READ STORIES

Fast,Easy & Free