OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

Ask Brian: How Do You Get Borrowers During Pre-Qualification To Share Their Information

- Monday, 08 April 2019

- Originating

[caption id="attachment_11630" align="aligncenter" width="185"] Brian Sacks[/caption]

Brian Sacks[/caption]

Dear Brian,

I am having challenges getting buyers who I am pre qualifying to share accurate information with me. Any suggestions?

Tammy P

Detroit

Dear Tammy,

Thanks so much for writing in and asking your question. Of course, every originator including me has struggled with this question. Take a minute and think about our job when we are first meeting or speaking with client.“ Hi How are you ? How’s your credit? How much do you make? How much money do you have in the bank?” It’s awkward at best and very scary for most buyers. So, let me share some ideas and suggestions with you. There are a number of areas to focus on.

How Are They Finding You?

When clients are referred to you from a professional they trust, such as an agent, attorney, financial planner or accountant they are often more likely to already have a degree of comfort with you. This is the same with clients referred by their friends or family. But there is also another way to establish trust and creditability and that is by using the media. Many of my clients find me from articles I have written or tv and radio appearances.

Do They Understand Your Role and Why It’s Important to Get Pre-Approved?

It’s important that the client understands that they are going through this process, so they know what programs are best for them and what their options are. They will also need to know what their own comfort levels are for out of pocket cash and monthly payments and that all starts with your conversation getting pre-approved.

Is the meeting by phone, in person or a video call?

I may be old-school, but I always prefer to meet with my clients in person. If they are out of state, or not able to come in, I like to arrange a skype or join.me call so we can actually see each other. Talking to a faceless person on the phone is scary, because they can’t see your expressions or exactly what you are intending to get across. The benefit of in person meetings is often your ability to have them get to know you and this leads to referrals!

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Would You Give Me a $1,000 Question?

When all else fails, I will ask them the $1,000 question. I ask them if they would give me 1000 dollars if I promised to never give it back. There is usually a pause on their part as they try to process this question.

I then go on to explain that if they go out and don’t get pre-approved they risk losing $1,000. If they go to contract and their mortgage is not approved, they will have spent $500 for an appraisal and another $500 on other inspections. This money will not be refunded since services were performed.

Besides, getting pre-approved allows the seller to know that they are able to move forward and will likely help them get their offer accepted. This is also important to explain to your prospects.

This usually breaks the ice and allows them to understand that this is an important starting point for purchasing a new home.

Tammy, I hope this helps and gives you some ideas you can implement right away.

If you have a question in an upcoming Ask Brian column please send them to me at This email address is being protected from spambots. You need JavaScript enabled to view it.with the Subject line Ask Brian Article

About the Author: Brian Sacks is a branch manger and originator with HomeBridge Financial in Owings Mills Maryland. He is also the author of 48 Proven Ways To Immediately Close More Loans https://briansacks.samcart.com/products/48books---tml/and the founder of http://toporiginatorsecrets.com

Read more...Housing Market Reminds Bodnar of Goldilocks Fable: Not Too Hot, or Cold, But Just Right

- Wednesday, 03 April 2019

- Originating

https://youtu.be/MkzfYueEr0k

Hi Bill Bodnar here with the Mortgage Market Guide. Thanks for tuning in to the MMG recap.

So up on the screen, you can see another week and another week of low rates. Rates continue to hover near 14-month lows. We came a little bit off the best levels last week. But again, just another great week, and what I'd like to share with you is what I think is happening.

Right now we are into the spring home-buying season.

It's what I call the Goldilocks scenario, right Goldilocks: We're not too hot, not too cold. Kind of just right and that's what's happening in the housing market.

So, there's a list of things I think are going to really make this spring housing market likely the best in the last couple of years. You know, when we look at the last couple years, there were affordability issues. There was low-housing inventory.

This year's a bit different, so I'm going to run through these. No. 1, we know the Fed is not going to raise rates in 2019. They said that. In fact, there's a better chance of a Fed rate cut in 2019 than a hike, so that's a big change from where we were just a few months ago.

This year's a bit different, so I'm going to run through these. No. 1, we know the Fed is not going to raise rates in 2019. They said that. In fact, there's a better chance of a Fed rate cut in 2019 than a hike, so that's a big change from where we were just a few months ago.

No. 2, inflation is subdued. Inflation is not a threat. if inflation doesn't tick higher, long-term rates, like mortgages, can’t tick higher.

No. 3, home prices are moderating. The gains are moderating. This is a big deal because this goes right to the affordability piece.

Home prices a few years back we're running at 10 percent, 15 percent a year, and wages were only rising at two percent, so now they're much closer. Home prices are gaining at four percent to five percent. Wages are closer to four percent, so there’s much more of an equilibrium.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

The labor market remains solid. I mean we are seeing unemployment at 50-year lows. Wages are rising because of that tight labor market. People buy homes because they have a job, not because interest rates are low.

Another one that doesn't get a lot of play: Europe can't get out of its own way. We've been talking a lot about how Europe has been struggling, and with the economy struggling, that makes their bond yields low, real low, and there's only a couple of big bond markets on the planet that investors can go to. Germany. I think of Japan and those yields are zero to negative.

So, you know, seeing the 10-year note at 2.5 percent; it's pretty darn juicy, and so that's going to keep mortgage rates at low levels thanks to what's going on in Europe.

Next, the stock market is near all-time highs. That has a positive wealth effect. People feel wealthy. You know even if it's locked up in 401(k)s and IRAs they feel wealthy. They are more apt to buy and believe me there’s a wealth effect happening right now. People feel really good.

Also, consumer confidence is rising again. Why? Pretty much for a lot of these factors. You know the Fed's out of the way. Stocks are rising. Interest rates are low. The prospect of getting a job feels good, and then finally, home-loan rates sit now at 14-month lows—for a lot of the reasons that we just mentioned.

And there's no pressure to put them up much higher, much lower, I should say. So when you look over the foreseeable future, there's a difficulty of seeing rates get much better. But at the same time, it's really difficult to see them much higher.

We have this kind of Goldilocks scenario, as you move into this housing market, and it's not just the spring housing. This is for the foreseeable future, so I think it's a really good story that you need to be sharing with not just clients, but also your partners.

And, when we take a look at the chart, you know again this peak from last week that was a 14-month high, and we're a little bit off of it, but still an unbelievable scenario.

I hope this finds you well. Have yourself a great weekend. We'll be back at it soon.

Bye for now.

Read more...Thinking Good Rates, Great Service Will Get You Business Is Simply Foolish

- Monday, 01 April 2019

- Originating

By Brian Sacks

In honor of April Fools, I decided to dedicate this article to one of the most foolish things we do.

As originators, we all make mistakes. All sales people do. But one of the biggest one’s we make is thinking that having the best rates is the only determining factor.

I constantly hear originators moaning about their rates, or the service they get from their support teams. If I am being totally honest, I do as that as well but rarely.

The truth is that good rates and great service are just basic in this day and age.

If you aren’t able to provide competitive rates and provide outstanding service, you are simply in the wrong business. Stop and think about all the reasons someone should use you, without saying it’s about the rate and service. There are so many other ways you are able to provide value to your partners and clients.

There are two big issues with thinking that service and rates will generate new business for you.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

For service, the buyers only see the service after the transaction closes. In terms of the rates, there will always be someone cheaper than you in the market, so you must find other ways to show your value.

Now, I want you to take out a sheet of paper or pull up a new Google or Word document and start thinking about this mistake.

What else could you do to provide value?

Here are some things I do:

[caption id="attachment_7900" align="alignleft" width="332"] Brian Sacks[/caption]

Brian Sacks[/caption]

For Consumers:

- I will actually meet with my clients and go over the entire process and answer questions, so they are educated.

- I will provide them with a book that provides excellent information.

- I offer a vacation to them after closing as a thank you.

For Agents:

- I am available to generate pre -approval letters on Saturdays and Sundays, when banks and credit unions are closed.

- I teach education classes for continuing education credits.

- I do homebuyer seminars with them.

- I provide weekly status updates.

- I have unique programs and qualifications like working with boomerang buyers, renovation loans and buyers going through a divorce.

Did you catch the last sentence? That one truly is the key because when you can provide a unique expertise and program that solves a problem agents and borrowers have than rates, points and even service truly don’t matter, do they?

About the Author: Brian Sacks is an originator with Homebridge Financial in Baltimore, Md., with over 35 years of experience and closings of over $1.5 billion and 5,977 loans. He is the author of “48 Proven Ways to Close More Loans.” To learn more, visit https://48waysbook.com/special . He is also the founder of the “Top Originator Secrets Blog” which is available online at http://toporiginatorsecrets.com

Read more...

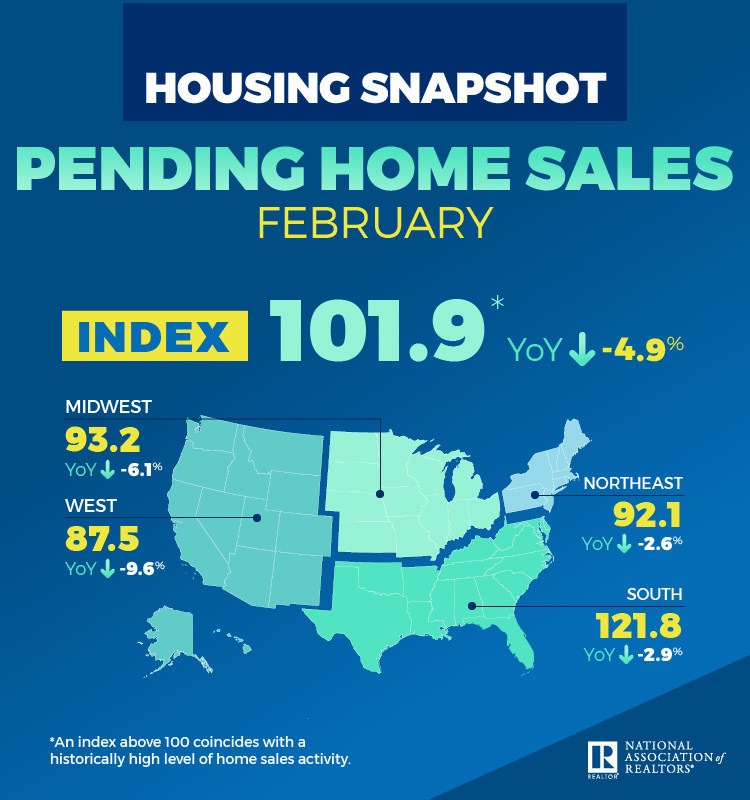

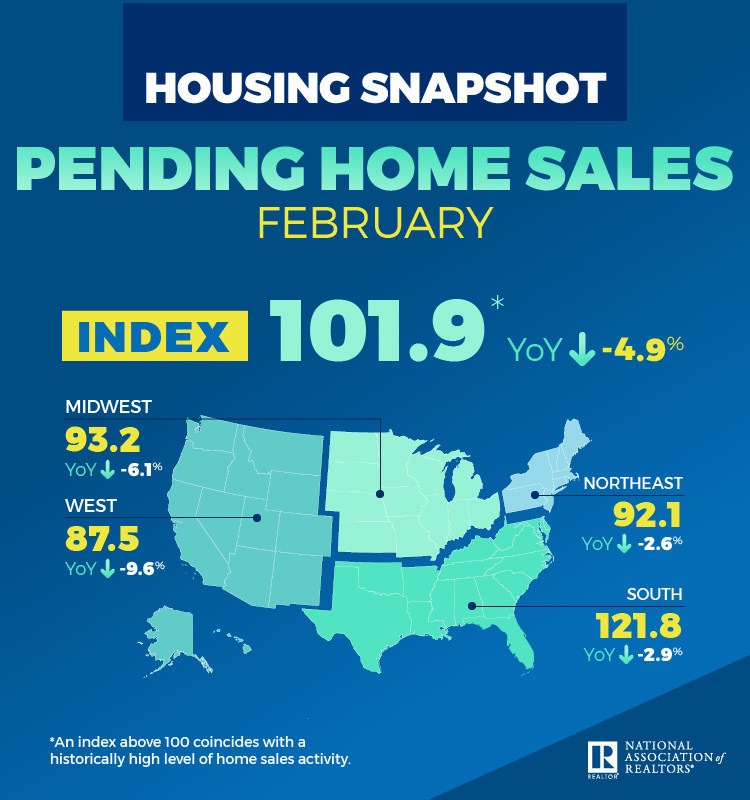

Pending Home Sales Dropped in February

- Friday, 29 March 2019

- Originating

Pending home sales suffered a minor drop in February, according to the National Association of Realtors. On a regional basis, the South and West saw a bump in contract activity and the Northeast and Midwest reported slight declines.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 1.0 percent to 101.9 in February, down from 102.9 in January. Year-over-year contract signings declined 4.9 percent, making this the fourteenth straight month of annual decreases.

Although pending home sales declined in February, in the same time period one month earlier sales reported a solid gain. "In January, pending contracts were up close to 5 percent, so this month's 1 percent drop is not a significant concern," said Lawrence Yun, chief economist at NAR. "As a whole, these numbers indicate that a cyclical low in sales is in the past but activity is not matching the frenzied pace of last spring."

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Despite the growth in the West, the region's current sales are well below the sales activity from the same time period one year earlier. "There is a lack of inventory in the West and prices have risen too fast. Job creation in the West is solid, but there is still a desperate need for more home construction," said Yun.

[caption id="attachment_11413" align="alignleft" width="327"] Pending Home Sales for February[/caption]

Pending Home Sales for February[/caption]

There markets with the largest increase in active listings compared with a year ago are as follows: Denver-Aurora-Lakewood, Colo.; Seattle-Tacoma-Bellevue, Wash.; San Diego-Carlsbad, Calif.; Portland-Vancouver-Hillsboro, Ore.-Wash.; and Nashville-Davidson-Murfreesboro-Franklin, Tenn.

Yun doesn’t anticipate any interest rate increases from the Federal Reserve in 2019.

"If there is a change at all, I would say the Fed will lower interest rates in 2019 or 2020. That would stimulate the economy and the housing market," Yun said. "But the expectation is no change at all in the current monetary policy, which will help mortgage rates stay at attractive levels."

Yun expects existing-home sales this year to decrease 0.7 percent to 5.3 million, and the national median existing-home price to increase around 2.7 percent. Looking ahead to 2020, existing sales are forecast to increase 3 percent and home prices are also around 3 percent.

The Pending Home Sales Index in the Northeast declined 0.8 percent to 92.1 in February and is now 2.6 percent below a year ago. In the Midwest, the index fell 7.2 percent to 93.2 in February, 6.1 percent lower than the same time period one year earlier.

Pending home sales in the South inched up 1.7 percent to 121.8 in February, which is 2.9 percent lower compared to this time last year. The index in the West increased 0.5 percent in February to 87.5 and fell 9.6 percent below a year ago.

Read more...