OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

The Ability To I.D. The Borrowers Intent Shifts The Origination Process

- Tuesday, 16 April 2019

- Originating

For mortgage lenders there is a big battle to be one of the first people to reach a potential borrower. That’s because statistics show that 88% of consumers go with the first or second lender they talk to. That’s no surprise, how often do consumers really want to have a one-hour conversation regarding the same financial topics. Especially millennials.

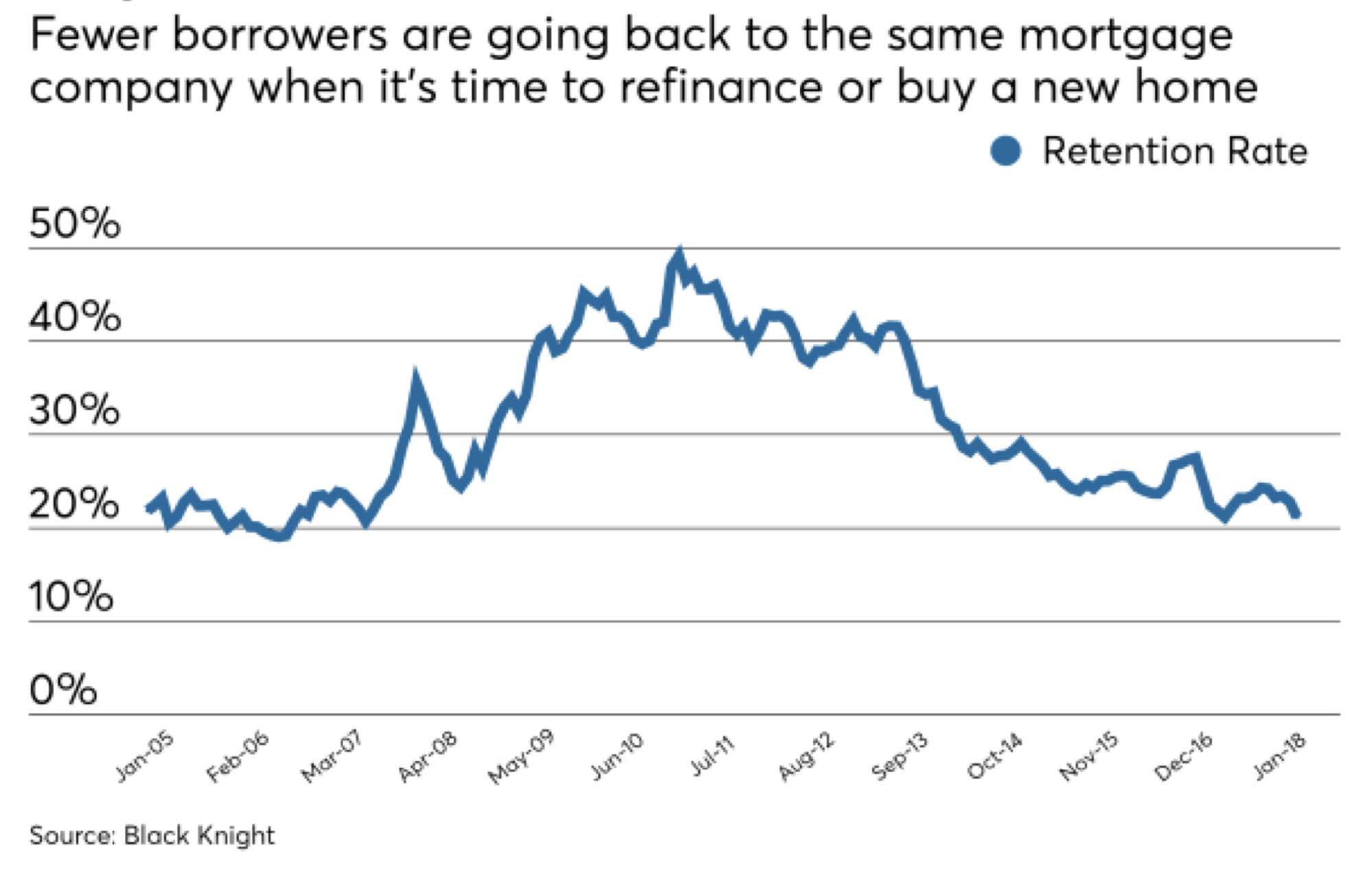

According to Mike Eshelman, Head of Consumer Finance for Jornaya, recent MBA statistics show that the servicer recapture rates have fallen 17%. He quotes Marina Walsh, the MBA’s VP of Industry Analysis and Research, as saying that only one in five borrowers who are looking to refinance or buy a home will use the same servicer.

According to Mike Eshelman, Head of Consumer Finance for Jornaya, recent MBA statistics show that the servicer recapture rates have fallen 17%. He quotes Marina Walsh, the MBA’s VP of Industry Analysis and Research, as saying that only one in five borrowers who are looking to refinance or buy a home will use the same servicer.

Current strategies to compete for the consumer include:

- Getting a lead from a credit trigger – problem here is that the consumer might have already filled out a loan application with someone else and the credit bureau is selling the same lead to other people. Are you really going to be the first or second lender?

- MLS Listing Alerts – the borrower is already talking to a realtor, who is likely to refer them to a loan officer they know and consistently work with

- “In the Money” models – usually used for refinancing on portfolios

- Call, text, email, direct mail and retargeting – this can be expensive and can cause customer dissatisfaction.

- Lenders are forming real estate partnerships for referral business ( Zillow/Zillow Home Loans; Opendoor/Movement Mortgage/VIP Mortgage; Quicken/Rocket Mortgage).

So why are servicers having such a hard time? The potential problem is that these tactics are either reactive or just very general in nature. Also, the top of the sales funnel seems to have moved. Now that companies like Jornaya can identify online search habits of consumers the funnel moves to when borrowers are thinking about taking out a new loan, not when they trigger a lead. According to Jornaya, borrowers start shopping online 171 days prior to filling out an application, they go to an MLS site about 71 days prior and pull credit 68 days prior.

[caption id="attachment_11849" align="alignleft" width="225"] Mike Eshelman, Head of Consumer Finance, Jornaya[/caption]

Mike Eshelman, Head of Consumer Finance, Jornaya[/caption]

Ellie Mae statistics show that 95% of consumers start their search online. Yet on average 5% of web visitors completed an application online. This means there is a large number of potential borrowers online but not fully engaged. Jornaya looks for signals that a borrower might be “in market” by monitoring their behaviors across the consortium of participating partners across their 35,000 website network. This data is then supplied to lenders and servicers to help increase retention rates and origination efficiency.

Read more...

Bodnar's Market Recap

- Friday, 12 April 2019

- Originating

https://youtu.be/JR4t40_4Smg

Hi Bill Bodnar here from the Mortgage Market Guide.

Thanks for tuning in to our MMG recap, so on the screen I have the Federal Reserve Bank of St. Louis and we're showing the initial claims report, which was out on Thursday and you can see this 196,000.

And this is a really important number to track because what we're seeing in this chart, you could see here, we're making new cycle lows. We had gone sideways a bit and now we're seeing new lows and in these let's call them initial claims, which are fresh people seeking unemployment benefits.

This is a good thing, because if you're not seeking benefits, you're actually working, which is a great thing, and here's another big takeaway for us: The market is now sensing that a recession is off the table.

This is a big deal and this is what as you know is giving the stock market a little bit of a lift as of late and it also has removed the fears of a Fed rate cut, so those are really, I think off the table because of this number right here. The initial claims for the last two weeks is getting real strong.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

There's also another benefit with initial claims: Obviously the labor market continues to remain very tight and will be tighter with this indicator getting stronger again.

This is a leading indicator and the final thing I would say is, you know if you look when we hit these troughs, this gray area is when the recessions hit. The average recession hits 13 months after the trough, so we're still making lows.

We haven't bottomed out yet, so let's call a recession in 2019 off the table. Could it happen next year, and could things change quickly? And then in the foreseeable future? Possibly and so next week is a big one. We have to watch stock earnings or corporate earnings and those can be like the canary in the coal mine.

But obviously the big thing is their guidance. What do these corporate firms say about the

future? So we couple that with some of that initial jobless claims data.

Here is a chart of mortgage-backed securities heading into the weekend, you know we are right near 14-month highs which is a great deal. We're looking a 10-year note, hovering around 250, not getting much better but still a fantastic story, and so go ahead and take this to your clients and your partner's going into this week.

Read more...

New American Funding Announces New Mortgage Programs for Self-Employed & Non-Traditional Income Borrowers

- Thursday, 11 April 2019

- Originating

National Mortgage Lender New American Funding, announces today the launch of a new home loan program, Non-Qualified Mortgage (Non-QM). This loan program fills a growing demand of credit worthy borrowers who are self-employed, have non-traditional incomes, have assets and no income, or have had difficulty qualifying for a traditional mortgage.

"We're dedicated to making sure everyone has an equal opportunity to achieve the American dream," said Rick Arvielo, CEO of New American Funding. "At New American Funding, we're excited to offer more options to a more diverse set of consumers and help them through the homeownership process."

Non-QM loans provide purchase or refinance opportunities for individuals that don't have traditional, full-time employment or income-verification documentation.

The Non-QM home loan can fill the niche for those who don't necessarily fit into the "qualified-mortgage box." This loan can be customized and use alternate methods of income verification to help the borrower get approved for a mortgage.

Income sources consist of:

- Self-employed

- Fluctuating and non-traditional incomes

- Workers with fluctuating income

- Qualifying assets, but no income

- Alternative income verification methods accepted

- Second homes and investment properties may be eligible

Ways for borrowers to prove their income or assets for a Non-QM loan include:

- Full Documentation

- One-Year Tax Return Program

- Bank Statement Program (6 or 12 months)

- Asset Depletion/Asset Qualification

The Non-QM loan can be used for a rate-and-term refinance, a cash out refinance, or a new home purchase for owner-occupied, second homes or investment homes.

Residential Capital Acquires 3L Finance

- Tuesday, 09 April 2019

- Originating

Residential Capital Partners has acquired 3L Finance, a subsidiary of 2020 REI Group.

In the wake of the acquisition, the lender is now the national hard money and rental finance lending partner to 2020 REI Group. Residential Capital Partners and 3L Finance have been active in the single-family rehab financing space for more than 10 years.

Residential will continue as a hard-money and rental-finance lender in the entire U.S. It understands the demands of one-to-four family residential properties as well as the rehabilitation process. The lender encourages borrowers to enroll in the pre-approval process, so it can move swiftly through the property application when an opportunity presents itself.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

“The impact of both teams coming together with a borrower [oriented] platform will mean reach more customers,” said Richard Morgan, a senior executive for Residential Capital.

3L Finance was a subsidiary of the 2020 REI Group, created to support real-estate investors. “We have always loved facilitating and partnering with investors as they pursue their goals through the real-estate investment process. Residential Capital gives us the ability to expand our reach and impact,” saidTim Herriage, founder of the 2020 REI Group.

Read more...