OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

Allied Mortgage Unveils Loan Tailored to Newly Minted Professionals

- Thursday, 28 February 2019

- Originating

Allied Mortgage Group, a lender and servicer, has unveiled the Professional Choice Mortgage Loan, designed for the medical, dental, legal and accounting professionals--who may not qualify for a traditional home loan.

The Professional Choice Mortgage Loan combines good credit, and future earnings potential along with a low-down payment, to make home ownership accessible for those clients in specialized professional degree programs who live, work, or worship in Chester, Delaware, Montgomery, Bucks, Philadelphia or Lancaster counties in Pennsylvania.

Allied Mortgage Group recognizes the financial challenges that many professionals face who have just completed their residency, started their professional careers, or are already active in a fast-growing medical, dental, legal, or accounting practice.

“Rather than qualifying on their past or current income, we developed a loan that looks to the future potential of these professionals who have invested so much of their time and money,” said Bob Wexler, vice president of strategic initiatives for Allied. “One of the best features of the Professional Choice Mortgage Loan is that those professionals with student loan debt can still qualify.”

In addition, there is no down payment on a single-family home up to $850,000, three percent down up to $1million, no mortgage insurance requirement, and no prepayment penalty.

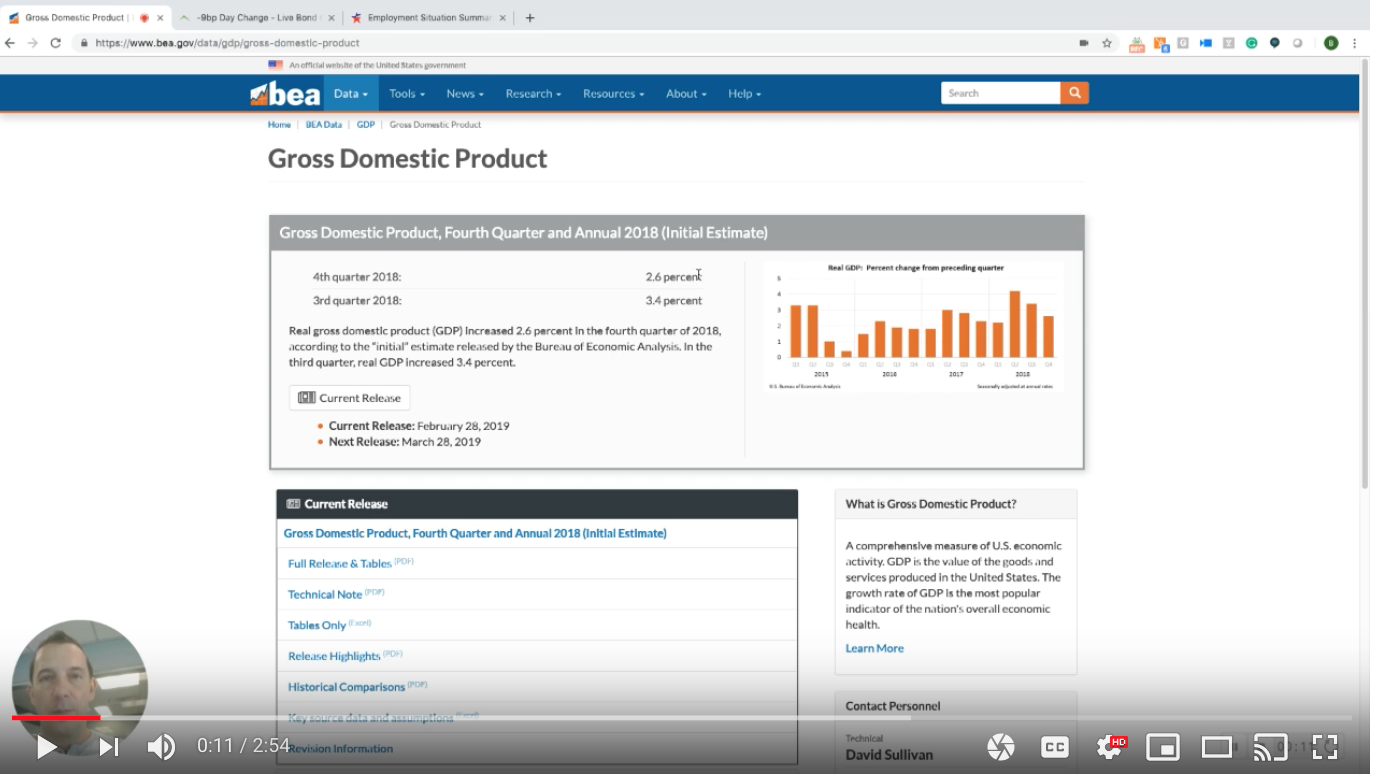

Read more...The Week’s Market Insights with Bill Bodnar and the Mortgage Market Guide

- Friday, 01 March 2019

- Originating

Bill Bodnar discussed the mortgage market, significant economic indicators and more. For his insightful analysis, please tune in to the video.

Read more...This Week In the Markets with Bill Bodnar from the Mortgage Market Guide

- Thursday, 31 January 2019

- Originating

https://youtu.be/5Ivnu4HGx0s

Bill Bodnar of The Mortgage Guide discusses the factors that will effect real estate finance over the next week.

Read more...NewRez Offers Originators Social Media, Content Training

- Tuesday, 26 February 2019

- Originating

National mortgage lender, NewRez is offering loan originators an innovative social media training program.

The aim is to deliver leadership and social media training that helps loan officers understand how to better connect with clients in a digital world—and in the process gain a competitive advantage. New Rez has retained Cultural Outreach to train originators on developing content, such as infographics, videos, and social-media posts that resonate with first-time home buyers.

The lender is one of only a few mortgage lenders nationwide to offer this program to its loan professionals. NewRez was formerly New Penn Financial.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

[caption id="attachment_10589" align="alignleft" width="300"] Gerard McGeever[/caption]

Gerard McGeever[/caption]

"We know that in order to be competitive in today's marketplace, we have to understand the nuances of millennial consumers and how to be active and compliant in the fast-changing environment of social media,” said Gerard McGeever, vice president of marketing JV/Retail and TPO for New Rez. “That's why we partnered with Cultural Outreach to empower our loan officers with the content and training to be successful."

With 75 percent of household growth coming from multicultural families and 33 percent of home purchases being made by millennials, now is the perfect time to focus on these markets for an opportunity to build new and lasting relationships.

The training program was designed to provide mortgage originators with access to content that is relevant and engaging for borrowers.

“Content is the driving force behind building a strong online presence,” said Kristin Messerli, founder of Cultural Outreach. “We understand how overwhelming it can feel to keep up with the demand for content, so our team of experts have tapped into an impactful strategy that empowers loan [originators] to use storytelling and new media to build an authentic personal brand without taking significant time away from their work.”

Read more...