OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

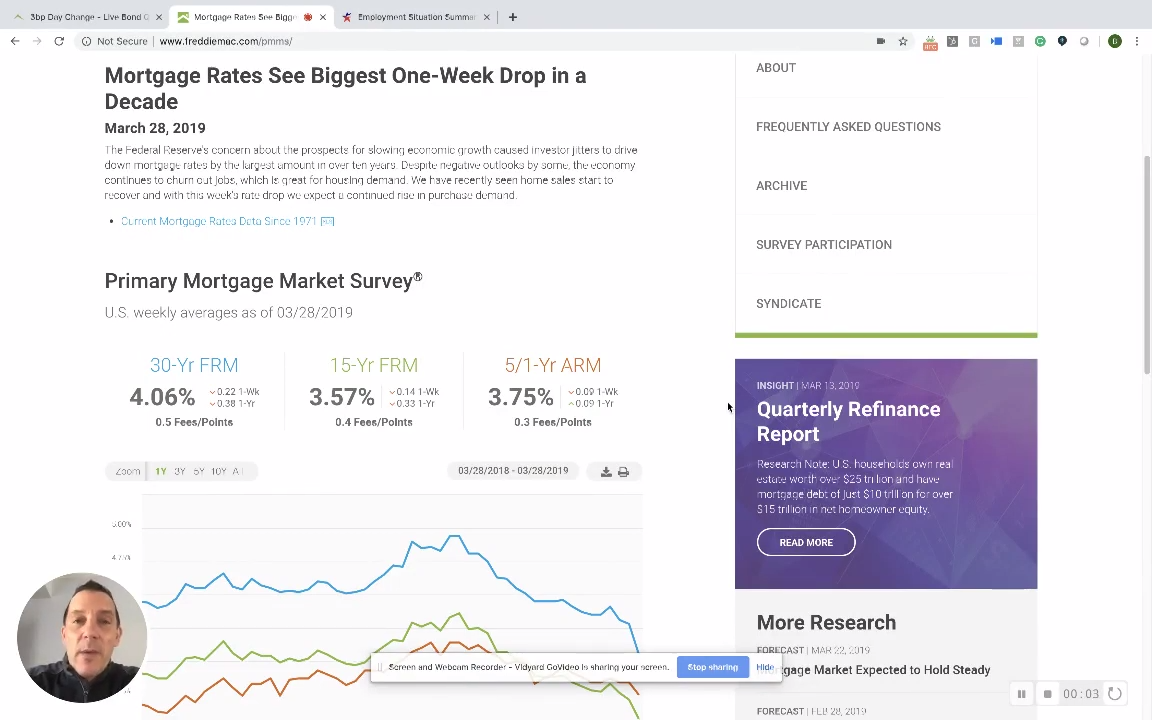

Mortgage Rates Have Largest One-Week Drop in a Decade

- Thursday, 28 March 2019

- Originating

https://youtu.be/gchIC9xNux0

Hi, it’s Bill Bodnar from the Mortgage Market Guide, and thanks for tuning in to our weekly recap.

So up on the screen some good news came out on Thursday.

That mortgage rates had their biggest one-week drop in a decade, and that coincided with that breakout. You know we've been talking about how the 10-year note has seen support at 260.

Goodness, when the yield finally punched through 260, we've seen to 230s in the middle of the week. Pretty remarkable. And it's something we've seen over and over when these barriers are broken—how bonds can really take off.

So that's what happened this past week, so really interesting. I think you know some of the fuel to this decline in rates, and raising prices, was this economic slowdown that's not only a concern abroad. It’s well documented what's going on in Europe and negative yields in Germany's 10-year bonus is yielding you know beneath zero--which is just really remarkable.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

But you know some of that slowdown was even kind of showing here in the U.S. And so what was the real catalyst was that in the middle of the week Steven Moore, who's been nominated to the Federal Reserve. He said if he gets on the Fed they’re going to vote to cut rates by 50 basis points, which is pretty remarkable, and a real departure from where the Fed was just last year.

You may recall back in the fall there was a lot of volatility right. Where the stock mark was declining significantly, and the bond market was kind of rallying a little bit. Because the Fed said, “Hey, we're going to hike rates three times in 2019, regardless of what the data shows.”

And so boy did they back off of that. Not only are they not hiking rates in 2019, but they came out and said that there's a 75% chance they will actually cut rates this year, which is just remarkable. And just shows the change how things changing while you need to be watching this stuff closely because it does move.

We were having a tough time at these ceilings; we broke out above it and this doesn't look like much in a two-year chart, but that's a pretty material price move. That's why we have seen the sharpest decline in rates in a decade.

Because it was a breakout above a ceiling, prices are at levels we haven't seen in 14 months, which is beautiful. There's a lot of complacency, especially in the bond market, but that can change quickly. It's almost like a rubber band being wound tight, eventually it kind of snaps.

So we need to watch, especially after our rally in bond market.

With an extended bond market rally, there can be a turnaround, and it can reverse quickly, so there are some headline risk events happening this week that you need to be reminded of. But you need to be thinking that we’ve got retail sales Monday. So right out

of the gate retail sales comes up, but then you can see here up on the screen we have the Bureau of Labor Statistics. They report the jobs report next Friday.

Now the previous jobs report was a stinker, only 20,000 jobs created. You could probably get a good bet that will be upgraded, or it will be revised higher. But there are some other readings within the report that can create a surprise and negative surprise that bonds can react: One is hourly earnings are currently running at three to four percent year-over-year, the highest in a decade.

If that ticks up higher because of this tight labor market we're seeing, you know the bond market may react negatively to that, so we need to watch that one carefully.

Read more...

SoFi Upgrades Home-Loan Origination Process

- Tuesday, 26 March 2019

- Originating

SoFi Home Loans has completed a re-engineered origination process that provides the capability for borrowers to buy or refinance a home with an online application, no-hidden fees, or prepayment penalties. Also, SoFi Home Loans is comprised of SoFi’s long-established mortgage operations.

"For most people, buying a home is the most important financial decision and, at the same time, the most complicated and stressful one they will ever make," said Anthony Noto, chief executive officer at SoFi. "We've taken everything we've learned in making lending convenient and painless, and brought it to SoFi Home Loans."

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

The SoFi Home Loans offering is built around a fast and easy application process. Applicants can prequalify in as little as two minutes online without any impact to their credit score. A dedicated support team helps borrowers from the time the home is selected to when the loan is closed.

SoFi Home Loans offer competitive rates including affordable down payments, with as little as 10 percent down on loans up to $3 million, with no-hidden fees or prepayment penalties. SoFi allows applicants to choose between four different loan terms and fixed or adjustable rates.

Those interested in refinancing can choose among traditional mortgage refinancing, cash-out refinancing, and student loan cash-out refinancing. If SoFi Home Loans isn't able to handle a loan request, SoFi provides an easy option to digitally transfer member information to its affiliate partner who may be able to help.

SoFi membership, which comes with usage of any SoFi product, offers benefits including exclusive events across the country, complementary financial planning, and career coaching through an exclusive partnership with Korn Ferry. Members also receive rate discounts on other types of loans.

Read more...Plaza Home Unveils One-Time Close Construction-to-Permanent Loan Program

- Monday, 25 March 2019

- Originating

Plaza Home Mortgage, Inc., a wholesale and correspondent mortgage lender, has unveiled a One-Time Close Construction-to-Permanent loan program designed for mortgage brokers and their borrower and builder clients.

The new program, which is offered through Plaza’s wholesale channel, provides 30-year fixed- rate financing to be locked-in at the beginning of a home-building project and the efficiency and cost savings of a single closing as opposed to dual closing.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

[caption id="attachment_11233" align="alignleft" width="259"] Jeff Leinan[/caption]

Jeff Leinan[/caption]

“The borrower is approved for both the construction loan and a permanent 30-year mortgage at the outset of the project,” said Jeff Leinan, executive vice president for national wholesale production at Plaza Home Mortgage. “There is one closing and one set of closing costs, and the interest rate is locked during the construction period and has a float down option. This is just the kind of product that mortgage originators need to build their business.”

The program can be used for a number of owner-occupied primary residences and second home properties, and can cover construction periods of six, nine or 12 months. Standard conforming and high balance loan amounts are available with loan to value ratios of up to 70 percent. Closing costs may be financed, and there is no cost to the builder. The borrower is qualified at the beginning of the project and there is no need to re-qualify once the construction is completed.

Read more...TD Bank: Med School Debt Makes Home Buying Difficult

- Thursday, 21 March 2019

- Originating

Around 25 percent of medical doctors who own homes say their student debt made buying a home more difficult, according to a new survey by TD Bank. Of those that don't own a home but plan to buy one, one in six are worried that student debt will make the process more difficult.

TD Bank has unveiled a Medical Professional Mortgage Product, that’s designed to alleviate the issues by accounting for the unique challenges doctors who are in the early stages of their career face buying a home.

According to the survey, just under one in five medical professionals are aware of Medical Professional Mortgages, meaning they could be missing out on the opportunity to leverage a product that is tailored to their unique financial needs.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Considering medical school loans and earning potential, TD's dedicated product helps address physicians' and dentists' pain points by helping applicants qualify for higher loan financing than standard mortgages, allowing them to use their money for investing or paying off student debt while still reaching their home ownership goals.

"Medical professionals dedicate their lives to caring for the health of our communities and in turn spend many years pursuing higher education and building up debt," said Rick Bechtel, head of residential lending at

[caption id="attachment_11165" align="alignleft" width="300"] Rick Bechtel[/caption]

Rick Bechtel[/caption]

TD Bank. "We dedicate the same amount of care to designing products, such as TD Bank's new Medical Professional Mortgage, which alleviates some of the biggest challenges those in the medical field face following graduation and residency, such as large amounts of debt and a lack of earning history."

This competitive new offering, available in both fixed and adjustable rate options, provides the following features for practicing physicians and dentists, fellows and third-year residents:

- Applicants may secure 100 percent financing. This was among one of the most appealing features according to the survey, with 44 percent of respondents selecting this option.

- No private mortgage insurance is required, another appealing feature selected by 44 percent of respondents.

- Applicants may take out a maximum loan amount of up to $750,000 with 100 percent financing or up to $1,250,000 with only 5 percent down. Only 18 percent of respondents were aware that medical mortgage offerings offered loans up to $750,000, indicating a need for further education in this area.

- Applicants may have flexible debt-to-income ratios, depending on income.

Eligible borrowers of TD's Medical Professional Mortgage Product include licensed residents with a minimum of two years of completed residency and fellows; as well as practicing dentists and physicians and who are less than 10 years out of residency.

Read more...