OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

Fannie Mae is Looking for Your Ideas

- Wednesday, 24 April 2019

- Originating

In a recent poll commissioned by Fannie Mae, 46% of American adults said they would prefer to live in a community with access to better schools and/or childcare, but cannot afford to do so; while 58% say communities with better job opportunities are too expensive for them to live in.*

"When families live in stable and affordable homes in a sustainable community, they have greater opportunities to prosper in other aspects of life, including educational and economic advancement," said Maria Evans, Vice President of Sustainable Communities, Fannie Mae. "When nearly 6 in 10 Americans have to sacrifice economic opportunities and nearly half have to sacrifice quality education and childcare because of housing affordability, it's clear we need to bring new ideas to the marketplace."

"The affordability, quality, and location of where one lives has substantial implications for outcomes in education and economic mobility," said Evans. "Through the Sustainable Communities Initiative, Fannie Mae aims not only to create stability through housing, but also to catalyze opportunities in education and forge pathways to economic mobility."

"The affordability, quality, and location of where one lives has substantial implications for outcomes in education and economic mobility," said Evans. "Through the Sustainable Communities Initiative, Fannie Mae aims not only to create stability through housing, but also to catalyze opportunities in education and forge pathways to economic mobility."

To identify innovative solutions to this housing affordability crisis, today Fannie Mae (FNMA/OTCQB) announced a Call for Ideas that expand access to and increase the supply of quality affordable housing, and use housing as a lever to improve education outcomes and economic mobility for low-income households.

[adbutler zone_id="325884" type="asyncjs1.1" ]

[adbutler zone_id="325888" type="asyncjs1.1" ]

Fannie is seeking innovative ideas, including mature ideas and proven models that are ready to scale, that expand access to quality affordable housing for underserved and low-income people, while creating opportunities in education and forging pathways to economic mobility. An Expert Advisory Panel will assist in the evaluation of ideas and Fannie Mae will select contract awards up to $1.5 million.

The Call for Ideas on The Challenge opens today, April 24, 2019 and ends on May 30, 2019 at 5:00 p.m., Pacific Standard Time.

Applicants are asked to submit ideas that respond to one of the following problem statements:

- How might we prepare a workforce that is ready to participate in job opportunities that drive technological innovation in the housing industry?

- How might large employers or anchor institutions partner with the housing industry to ensure every resident in a community has a path to safe, quality, affordable housing?

- How might we use housing to increase the availability of and access to high-quality early childhood care and education that meets the needs of families in underserved areas?

- How might housing and education entities from the public, private, or nonprofit sectors partner to provide stable home and school experiences for very low-income students?

For more information about The Challenge and to apply, please visit FannieMae.com/TheChallenge.

*The PSB Pulse Poll is an online survey among the General Population that covers a variety of topics, and is designed to gain fast, broad-reaching insights in a methodologically optimized environment. The Pulse Poll sample is weighted to match the US Census. This month's Pulse Poll was conducted between April 8-12, 2019. Fannie Mae commissioned PSB to conduct this Pulse Poll. To view an executive summary of the PSB Pulse Poll, please click here.

Sample Size: 988

Margin of Error: ±3.12%

Read more...

Urban Institute's Index Shows Credit Easing Has Room to Increase

- Tuesday, 23 April 2019

- Originating

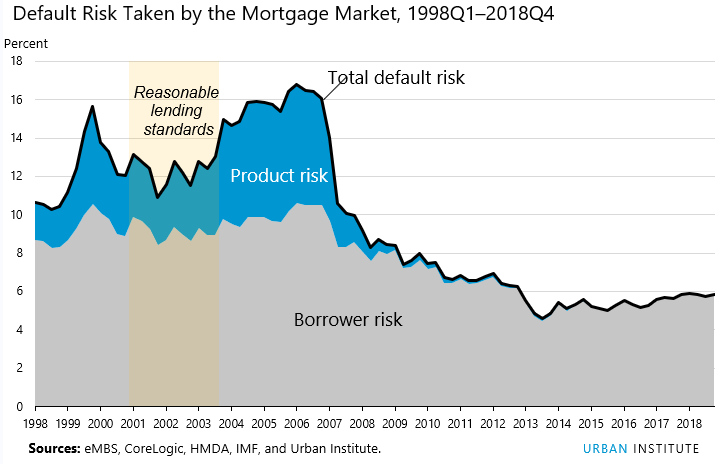

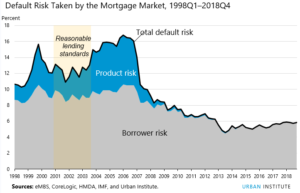

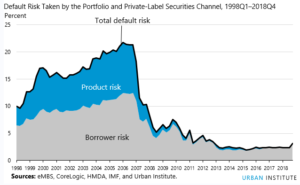

The Urban Institute’s Housing Finance Policy Center updated their Housing Credit Availability Index (HCAI) last Friday. The HCAI measures the percentage of owner-occupied home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.

What this index shows is that while credit seems to be easing it is nowhere near pre-crises levels.The study states that “If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.” This implies that there is still significant space remaining to safely expand the credit box, something we are seeing as more and more lenders move into non-QM.

The latest HCAI shows that mortgage credit availability increased to 5.85 percent in the fourth quarter of 2018 (Q4 2018), up from the previous quarter (5.75 percent), but still down from peak reached in the first quarter of 2018 (5.89 percent). This quarter’s increase was caused by an increase in risk taken in the portfolio and private-label securities channel. Credit also expanded in both the GSE and government channels, but by a smaller margin.

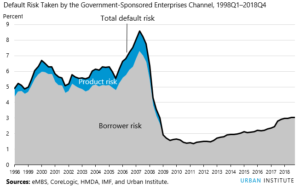

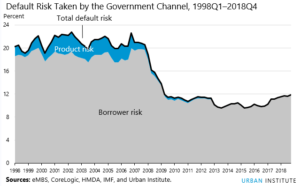

Mortgage credit availability in the GSE channel—Fannie Mae and Freddie Mac— has been increasing steadily since the financial crisis. Last quarter, Q3 2018, the index reached 3 percent for the first time since 2008, and this quarter, it continued to increase slightly. The government channel (FVR) increased to 11.8 percent, the highest level since 2009. The FVR channel includes the Federal Housing Administration, the US Department of Veterans Affairs, and the US Department of Agriculture’s Rural Development program. The portfolio and private-label securities channel increased to 3.1 percent, but still remains near the record low for the amount of default risk taken.

The HCAI by Channels

GSE Loans

The GSE market has expanded the credit box for borrowers more effectively than the FVR government channel has in recent years. The downward trend of credit availability in the GSE channel began a reversal in Q2 2011. From Q2 2011 to Q4 2018, the total risk taken by the GSE channel has more than doubled, from 1.4 percent to 3.0 percent.

Government Loans

The total default risk the government loan channel is willing to take bottomed out at 9.6 percent in Q3 2013. It has fluctuated at or above that number since then. In the past nine quarters starting in Q4 2016, the risk in the government channel has risen significantly from 9.9 to 11.8 percent, the highest level since 2009, but still about half the pre-bubble level of 19 – 23 percent.

Portfolio and Private-Label Securities Loans

The portfolio and private-label securities (PP) channel took on more product risk than the FVR and GSE channels during the bubble. After the crisis, the channel’s product and borrower risks dropped sharply. The numbers have stabilized since 2013, with product risk fluctuating below 0.6 percent and borrower risk around 2.0 percent. Borrower risk increased substantially in the fourth quarter of 2019, driven primarily a decline in FICO scores and an increase in high-LTV lending. Total risk in the PP channel was 3.1 percent in Q4 2019, the highest level since 2012.

Read more...

Bill Bodnar’s Mortgage Market Recap

- Wednesday, 17 April 2019

- Originating

https://youtu.be/hJ0SnZFePfU

Rates rose this week and U.S. market is resurgent and so is China. The economy is reinvigorated.

The spring season is the largest in nine years. Employees are not getting fired because the job market is so tight.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Recession occur 13 months after the low, but the economy keeps making lows. In 2019 a recession is off the table.

For more, tune in to Bill Bodnar’s Market Recap Video.

Read more...Hybrid Products Being Developed For HELOC's

- Wednesday, 17 April 2019

- Originating

Premium Title, a national provider of title and escrow services, and Springhouse, a full-service valuation solutions and appraisal management company, today announced the launch of HomeVal, a home equity line of credit (HELOC) hybrid solution that provides combined title search and valuation data for lenders. Consolidation of title and valuation information in one report can help lenders shorten the amount of time it takes to close a HELOC loan.

Lenders originating HELOC loans often absorb consumer closing costs due to market demands on small balance transactions. HomeVal provides lenders an economical solution to satisfy title and valuation requirements at a lower cost than traditional title insurance policies and property appraisal reports.

Key features of HomeVal include:

- Tier I: Express – Provides estimated value, confidence score, last sold price and date, assessed value and year, current owner and full legal description.

- Tier II: Full – Provides features included in Tier I: Express, plus historical listing and sales information, sales comparable details, market analysis, property photographs and property taxes.

- Tier III: Complete – Provides features included in Tier II: Full, plus manual review of comparable selections to ensure property characteristics are relevant to the subject valuation and a full report of monetary liens recorded after the first mortgage.

“We are in a unique position to leverage two Altisource businesses, Premium Title and Springhouse, and provide a unified solution to support the HELOC lending market,” said Ben Hall, Vice President, Premium Title. “Receiving title search and valuation data in one report, at a low-cost and in a timely manner, helps lenders to be more efficient in underwriting HELOC loans. We continue to listen to and anticipate the challenges that arise for our customers.”

Read more...