OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

Ellie Mae: 30-Year Note Rate Continues to Decline; Time to Close Drops

- Wednesday, 15 May 2019

- Originating

According to the April Origination Insight Report from Ellie Mae®, a leading cloud-based platform provider for the mortgage finance industry, the 30-year note rate dropped for the fourth straight month to 4.61%, down from 4.77% in March and the high of 5.01% in January. Additionally, the time to close all loans dropped two days to 40 days, down from 42 in March. Time to close a refinance dropped one day to 33 days and time to close a purchase dropped two days to 43 days.

“We are seeing closing times drop across the board as our lenders leverage technology for a more efficient and streamlined loan origination process,” said Jonathan Corr, president and CEO of Ellie Mae. “And as the 30-year note rate continues to decline and closing rates remain high, we expect to see an active spring home buying cycle.”

Other statistics of note in April included:

- The percentage of refinances held at 35% while purchases made up 65% of total closed loans

- The percentage of Adjustable Rate Mortgages (ARMs)decreased to 6.8%, down from 7.4% in March

- Closing rates dropped slightly to 74.8%, down from 75.3% in March.

The Origination Insight Report mines data from a robust sampling of approximately 80% of all mortgage applications that were initiated on the Encompass® all-in-one mortgage management solution. Ellie Mae believes the Origination Insight Report is a strong proxy of the underwriting standards employed by lenders across the country.

| MONTHLY ORIGINATION OVERVIEW FOR APRIL 2019 | |||||||||

| Apr. 2019* | Mar. 2019* | 6 Months Ago

(Oct. 2018*) |

1 Year Ago

(Apr. 2018*) |

||||||

| Closed Loans | |||||||||

| Purpose | |||||||||

| Refinance | 35% | 35% | 32% | 34% | |||||

| Purchase | 65% | 65% | 68% | 66% | |||||

| Type | |||||||||

| FHA | 20% | 20% | 19% | 20% | |||||

| Conventional | 66% | 64% | 65% | 66% | |||||

| VA | 10% | 11% | 10% | 9% | |||||

| Days to Close | |||||||||

| All | 40 | 42 | 45 | 41 | |||||

| Refinance | 33 | 34 | 43 | 37 | |||||

| Purchase | 43 | 45 | 46 | 42 | |||||

| Percentage of ARM and Fixed Loan Volume | |||||||||

| ARM % | 6.8% | 7.4% | 8.2% | 6.6% | |||||

| 30-Year Rate | |||||||||

| Average | 4.61% | 4.77% | 5.01% | 4.79% | |||||

| *All references to months should be read as month ended. | |||||||||

| PROFILES OF CLOSED LOANS FOR APRIL 2019 | |||||||||

| Closed First-Lien Loans (All Types) |

|||||||||

| FICO Score (FICO) | 728 | ||||||||

| Loan-to-Value (LTV) | 79 | ||||||||

| Debt-to-Income (DTI) | 25/38 | ||||||||

Angel Oak Mortgage Solutions Expands Correspondent Lending Unit, Welcomes Four New Executives

- Monday, 13 May 2019

- Originating

Angel Oak Mortgage Solutions, LLC is enhancing its correspondent lending channel with new technology, infrastructure and high-level talent that reflect the growth in the non-qualified mortgage marketplace. The company has officially branded this channel as Angel Oak Correspondent to solidify its position in the correspondent lending space. The enhanced channel will allow Angel Oak to further its dominance of the non-QM market. Over the past few years, Angel Oak has consistently originated more non-QM loans than any other non-bank lender. With the enhanced correspondent channel, the firm is positioned to nearly double its production this year.

Angel Oak Correspondent furthers Angel Oak’s initiative to set the industry standard for innovation in the non-QM market. Following its most successful Q1 ever, with non-QM originations up 82% from the same period a year ago, the company is now exploring new frontiers. Angel Oak Correspondent brings non-QM products to lenders all across the industry.

[adbutler zone_id="325884" type="asyncjs1.1" ]

[adbutler zone_id="325888" type="asyncjs1.1" ]

“Angel Oak continues to pave the way for non-QM lending,” says Tom Hutchens, EVP of Production at Angel Oak Mortgage Solutions. “More national lenders are catching on to the non-QM trend we’ve seen all along. Our correspondent team brings a new level of expertise to keep us ahead of the competition.”

Angel Oak Correspondent Lending welcomes four new executives to lead this initiative:

- Andy Steben, Senior Vice President of Correspondent Lending

- Dave Ryan, Vice President of Operations and Credit, Correspondent Lending

- Dan Bayer, Vice President of Correspondent Sales

- Bill Fanks, Director of Training

These four executives bring 68 years of combined mortgage industry experience to Angel Oak Correspondent. That experience is already being leveraged in the development of new technology and infrastructure that enable Angel Oak to deliver an unmatched level of customer service.

In addition, Angel Oak Correspondent is launching a new website, angeloakcorr.com. Future expansion of the site will include a version of its proprietary QuickQuote engine specifically for correspondents as well as a portal for marketing materials.

“The Angel Oak family of companies has industry-leading experience in every aspect of the non-agency market,” says Andy Steben, Senior Vice President of Correspondent Lending. “We integrated the best aspects of our non-QM underwriting, lending and securitization practices to provide a similar opportunity for correspondents.”

Angel Oak has a proven track record of success in the non-QM industry. Its vertical integration in the lending, origination and securitization space provides a unique perspective as the company refocuses on underserved areas of the market. In Q1 of 2019, the Angel Oak lending entities originated a record $563 million. The Angel Oak lending platform and its affiliates also hired 70 new employees during this quarter, bringing its total workforce to 675. Angel Oak Correspondent will be a catalyst for significant growth in 2019 and beyond.

Read more...Ask the Expert: How to Reply To Callers Asking About Your 30 Year Rate

- Sunday, 12 May 2019

- Originating

By Dave Hershman

Part 2; to the Question: I keep getting the same question over the phone—what is your rate on a 30-year fixed mortgage? How do I reply in a way that will assure that I get the loan? Eddie from New Hampshire

In Part I of my answer,we discussed getting the client comfortable with us before we started finding out their needs. Building a relationship and trust over the phone is a difficult task when we are dealing with people who don’t know us. This is why converting the cold call is so much more difficult than a personal referral. Thus, the first question you ask should be structured to determine where the lead came from. It can be as simple as saying -- where did you hear about us?

[caption id="attachment_9654" align="alignright" width="268"] Dave Hershman[/caption]

Dave Hershman[/caption]

If it is a cold call, you then will start asking about their transaction, such as -- is this your first home?You must find out more about what they are doing so that you can uncover their needs -- and develop a relationship. If they ask why you need to know this information to provide a rate, you might reply that there are special programs for first time buyers.

If it is a referral, your first questions should be about the referral source. Where did they meet them? How long have they known them? If you both have known the referral source for ten years, then you have something important in common. Don't forget to say good things about the referral source, especially if they are a real estate agent. Next week we will provide a dichotomy-- rate vs. payment.

One this question is answered, and we have started the relationship process, we can start going deeper and take a closer look at the potential needs of a prospect. Without establishing a rapport, you will not get deep enough to see their real needs.

[adbutler zone_id="325884" type="asyncjs1.1" ]

[adbutler zone_id="325888" type="asyncjs1.1" ]

They are calling to ask about the rate. But the reason they are interested in the rate is because the rate is directly related to the payment. Their need is not the rate, as they don't make a rate every month, they make a payment every month. If you asked their rate six months after closing, they would not remember it. But they will know their payment.

Therefore, you must move the question from rate to payment as quickly as possible. You can do this by asking questions such as -- What payment are you looking for?-Or- Are you interested in achieving the lowest possible payment or conserving your cash/capital?

These are true need questions and should start a conversation which will enable you to get deeper. Though rate and payment are directly related, there are other factors which will affect the payment. For example, the loan term and mortgage insurance. If they are interested in building equity more quickly (another question) -- have they looked at a 20-year option? You can see where just blurting out a rate will bring an end to the conversation more quickly, but we want it to just be beginning.

Dave Hershman is Senior VP of Sales of Weichert Financial and the top author in the mortgage industry. Dave has published seven books, as well as hundreds of articles and is the founder of the OriginationPro Marketing System and Mortgage School – the online choice for expert mortgage learning and marketing content. His site is www.OriginationPro.comand he can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it..

Read more...

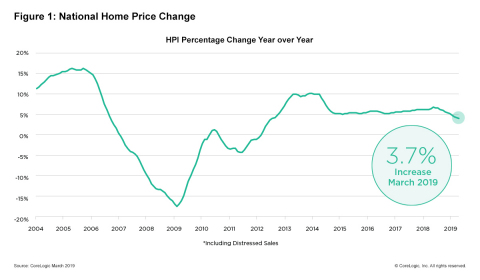

CoreLogic: Housing Prices Continue to Increase

- Tuesday, 07 May 2019

- Originating

CoreLogic® just released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for March 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 3.7% year over year from March 2018. On a month-over-month basis, prices increased by 1% in March 2019. (February 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Looking ahead, after some initial moderation in early 2019, the CoreLogic HPI Forecast indicates home prices will begin to pick up and increase by 4.8% on a year-over-year basis from March 2019 to March 2020. On a month-over-month basis, home prices are expected to decrease by 0.3% from March 2019 to April 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

[adbutler zone_id="325884" type="asyncjs1.1" ]

[adbutler zone_id="325888" type="asyncjs1.1" ]

“The U.S. housing market continues to cool, primarily due to some of our priciest markets moving into frigid waters,” said Dr. Ralph McLaughlin, deputy chief economist at CoreLogic. “But the broader market looks more temperate as supply and demand come into balance. With mortgage rates flat and inventory picking up, we expect more buyers to take advantage of easing housing market headwinds.”

According to the CoreLogic Market Condition Indicators (MCI), an analysis of housing values in the country’s 100 largest metropolitan areas based on housing stock, 35% of metropolitan areas have an overvalued housing market as of March 2019. The MCI analysis categorizes home prices in individual markets as undervalued, at value or overvalued, by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals (such as disposable income). Additionally, as of March 2019, 26% of the top 100 metropolitan areas were undervalued, and 39% were at value.

When looking at only the top 50 markets based on housing stock, 40% were overvalued, 16% were undervalued and 44% were at value in March 2019. The MCI analysis defines an overvalued housing market as one in which home prices are at least 10% above the long-term, sustainable level. An undervalued housing market is one in which home prices are at least 10% below the sustainable level.

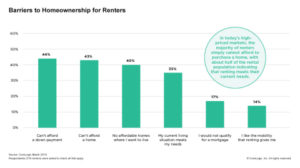

During the first quarter of 2019, CoreLogic together with RTi Research of Norwalk, Connecticut, conducted an extensive survey measuring consumer-housing sentiment in high-priced markets. The survey respondents indicated high home prices have an impact on high rental prices as well. Nearly 76% of renters and buyers in high-priced markets agreed housing prices in these markets appeared to be driving rental rates up.

“The cost of either buying or renting in expensive markets puts a significant strain on most consumers,” said Frank Martell, president and CEO of CoreLogic. “Nearly half of survey respondents – 44% of renters – cited the cost to rent in high-priced housing markets as the number one barrier to entry into homeownership. This is potentially forcing renters to wait longer to have the necessary down payment in these communities.”

“The cost of either buying or renting in expensive markets puts a significant strain on most consumers,” said Frank Martell, president and CEO of CoreLogic. “Nearly half of survey respondents – 44% of renters – cited the cost to rent in high-priced housing markets as the number one barrier to entry into homeownership. This is potentially forcing renters to wait longer to have the necessary down payment in these communities.”