OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

3 Twitter Secrets That Don’t Require You to Tweet

- Monday, 17 June 2019

- Originating

Ben Smidt, MA, Digital Strategy Manager, MGIC

Working in social media can be challenging. Staying atop new trends, features and functions in an ever-changing digital world is non-stop. This challenge only increases when working in a regulated industry, and I have found many professionals in the mortgage industry are hesitant to send tweets of their own on Twitter.

[caption id="attachment_9966" align="alignright" width="110"] Ben Smidt[/caption]

Ben Smidt[/caption]

What people may not realize is that Twitter can offer you a number of benefits, without ever sending a single tweet. Having a Twitter account opens the door to participation. But instead of tweeting, try using Twitter as a listening tool to stay engaged with your industry and businesses. Here are three Twitter secrets that don’t require you to tweet.

1. Twitter Lists

I love lists. Twitter Lists is one of my favorite Twitter secrets, and are the perfect way to organize all of the people and companies that are of interest to you on Twitter. Adding a Twitter user to a List does not require you to follow them. This is important to note when considering how you choose to use Lists. I use Twitter Lists to manage who I want to listen to. I also use Twitter Lists as a way to monitor the activity of users, who I do not wish to follow. Lists can be public or private, and provide the flexibility to stay in touch with your audience so you can listen more effectively.

Snapshot of my Twitter lists

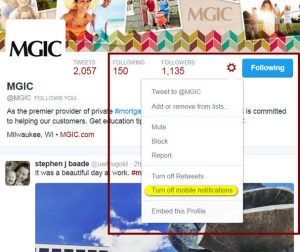

2. Twitter Notifications

Setting up mobile notifications on my phone is another way I listen and stay connected to companies, schools, news sources and people that matter most to me. A Twitter notification will alert me, via my phone, when that specific Twitter user (Twitter handle) has tweeted. This is important if you are interested in knowing what a company or person is saying on Twitter in real-time. It also helps you to develop a better understanding of what that user likes to tweet about or what their interests are. Twitter notifications do require you to follow that user on Twitter. For example, I have notifications for MGIC turned on so I can stay up-to-date with mortgage industry news and events.

3. Twitter Monitoring

Being aware of what others are saying about you or your brand on social media is incredibly important. A simple Google search on ‘monitoring tools for Twitter’ reveals that there are a number of applications available to users. Some are free and some cost money. Most offer you the ability to monitor and analyze who is saying what on any topic or term you decide. The true value of monitoring tweets is that it allows you to stay informed about the industry you serve and the world you live in.

These Twitter secrets are three ways to rethink how you can use Twitter in a regulated industry and will help guide your social media use. Finding a balance with social media is the key. Participating does not mean you need to abandon the use of popular platforms, like Twitter. Hopefully you now have a bit more information on how you can use Twitter to stay engaged and informed, without ever having to actively tweet.

Fannie Mae's U.S. Economic Forecast for 2019 and 2020 Downgraded as Businesses Confront Heightened Uncertainty

- Tuesday, 18 June 2019

- Originating

The Fannie Mae Economic and Strategic Research (ESR) Group downgraded its projections for full-year 2019 and 2020 U.S. economic growth to 2.1 percent and 1.5 percent, respectively, due to expected weakness in business fixed investment and softening global economic conditions. The ESR Group had previously forecast growth of 2.3 percent in 2019 and 1.8 percent in 2020. The ESR Group now projects that the Federal Reserve will cut the federal funds rate by 25 basis points at the September meeting of its Federal Open Market Committee to fend off greater deceleration in domestic growth. The ratcheting up of international trade tensions, including tariffs applied by the U.S. and China as well as the threat to impose tariffs on Mexico, could lead to higher prices and a possible reduction in consumer and business confidence, potentially effecting a further pull back in consumer spending and business fixed investment. This same uncertainty could also impact the previously invulnerable job market, which reported only 75,000 new nonfarm payroll jobs in May and downward revisions to its March and April numbers.

The ESR Group continues to expect housing to provide an economic cushion via a lower and stabilizing mortgage rate environment and a modest rise in the inventory of homes available for sale. Some of March's increase in pending sales is likely to be reflected in May's final existing home sales data, and second quarter existing home sales are still expected to grow 2.2 percent from the first quarter on a seasonally-adjusted basis before growth decelerates through the rest of 2019. Supporting affordability, home price appreciation remains near its slowest pace in seven years.

"This month, escalating trade tensions and concerns about weakening global growth led us to revise lower our full-year 2019 and 2020 forecasts of real GDP growth to 2.1 percent and 1.5 percent, respectively," said Fannie Mae Senior Vice President and Chief Economist Doug Duncan. "Despite a strong start to the year, we expect growth to slow beginning in the second quarter as macro-level uncertainty disincentivizes business fixed investment and starts to weigh on consumer spending. In order to sustain the longest expansion in more than 70 years, we expect the Fed to once again begin easing monetary policy and to cut its interest rate target by 25 basis points in September."

"We expect housing to add to growth for the foreseeable future, and our projection of a 1.0 percent year-over-year increase in home sales in 2019 remains unchanged," Duncan continued. "Moderating home price appreciation and attractive mortgage rates continue to support affordability, particularly as home builders are now paying more attention to the entry-level portion of the housing market."

Read more...Three Signs That It Is Time to Fire an Originator

- Monday, 10 June 2019

- Originating

By Pat Sherlock

During one of my recent presentations, there was a lot of discussion about how to handle underperformers. The managers I spoke with agreed that some originators were not performing and needed to be fired. Many managers blamed HR for not letting them terminate the underperformers for fear of triggering a lawsuit. This is something I hear quite a lot. Unfortunately, this is an excuse for why managers are not addressing sub-par sales professionals. Considering that an estimated 60% of mortgage originators are not meeting performance standards (Stratmor), I thought it would be a great time to review the parameters for firing originators who are not making budgeted goals. As we all know, the marketplace is changing dramatically and underperformers can no longer be financially supported.

[caption id="attachment_9789" align="alignright" width="300"] Pat Sherlock[/caption]

Pat Sherlock[/caption]

In my opinion, there are three signs that a manager should seriously consider terminating an underperforming originator:

1. When the time and resources needed to change the originator would be better spent with other team members. If sales professionals barely hit production goals after a manager has spent considerable time in trying to help them, it may be time to cut the cord. Inconsistent sales performance is an indicator that an originator does not have the sales talent to match what is required to succeed in today's difficult marketplace.

2. After sales training or coaching, the originator is not progressing or changing his or her sales activities. One topic to focus on is prospecting. If the underperformer is not prospecting and getting new referral sources, it is time to hire someone who will.

3. When the sales professional constantly complains that operations (or everyone else) is at fault for poor production. This is a clear sign that the producer is not self-aware enough to change his or her behaviors. Frankly, these individuals are not willing to learn new selling techniques.

Of course, there are other red flags but in my experience, most managers know the warning signs but are hesitant to terminate sales professionals because it is difficult to recruit new originators. Producing managers who are the primary volume generators may also feel that any volume from secondary players is fine with them.

While no one wants to say the words "you're fired," these dreaded words are needed now more than ever. Letting go of underperformers is something that no manager wants to do but in a more challenging market, it is a requirement for sustainable success. The fact that an originator is on 100% commission does not mean that there is no cost of having someone in the position who is not generating a profit, clogging operations, has a negative impact on the group or is wasting the manager's time. I haven't even mentioned the lost sales opportunities associated with having the wrong hire in the position.

While HR gets cited as the reason that underperformers are still in place at many banks or mortgage groups, the real reason is that managers have failed to document poor performance. Managers need to keep a written record of all warnings; any improvement plans agreed upon and any probation plans provided. A paper trail is an essential component when termination is being considered.

While firing an employee is never easy, sometimes an employee's performance does not match a lender's current needs. The time to take an honest, objective look at originator performance is now.

Read more...Ask The Expert: Am I Better Hiring Quality or Quantity?

- Monday, 10 June 2019

- Originating

I am having a bit of a debate with those who run this firm. I am a high-producing branch manager who would like to limit the number of loan officers I hire to higher-quality and consistent producing loan officers. Others want to hire “numbers,” no matter how little they produce or how much trouble they cause. It seems to me that five loan officers producing six loans each month is much better than 15 each producing two. And if one of the five is causing an issue with every loan—I would rather go without the production. What is your opinion? Branch Manager from Delaware

I had to shorten this question a bit—and the fact that your question was so detailed tells me a lot about your frustrations.

When I entered the industry over 30 years ago—it was a full-time profession for 99.0% of those in the industry. We were dominated by banks and savings and loans —not by brokers. The good loan officers looked “down” upon many Realtors—because many were part-time. Times have changed. As the brokerage industry has grown, the residential lending industry has come closer to the real estate industry from a personnel standpoint -- especially during the real estate boom more than ten years ago. It has returned closer to its original state during the financial recovery, but there is still a strong broker segment. Most traditional lenders operate in accordance to the “older traditions,” but there are many others that operate under the “numbers” concept you have just described.

[caption id="attachment_9654" align="alignright" width="268"] Dave Hershman[/caption]

Dave Hershman[/caption]

It is true that some companies in the past tried to hire 1,000 loan officers and put them in their homes with minimal training. If they get a loan from half of them each month—they had a winning business model. What the consumer got was 1,000 untrained and unprofessional loan officers—and the potential for predatory lending including fraud. And this contributed to the financial crisis and the rules that followed--including licensing requirements.

So there are two models. In one, a manager hires numbers and hopes each hire brings in a few loans. In the second model, the manager hires fewer originators, but tries to make each hire a quality producer. My vote is for the second model. Why?

First, because of profitability. Some managers would argue that an extra loan officer who is on 100% commission does not cost the company anything. I beg to differ. There are many costs. These costs include support—no matter how little support you give to each loan officer. Even answering questions uses precious resources. For example, if you provide processing, the efficiency of that processor falls significantly if they have to deal with many untrained loan officers. And, of course, the numbers game prevents you from providing quality support and advancing these loan officers. So turnover increases and it becomes a vicious cycle. There is nothing which is more expensive and detrimental to the bottom line than turnover.

Second, because of quality. Think from a customer’s prospective (this is called empathy). What kind of experience is it for them when they deal with an untrained, unsupported and probably part-time originator? Is this how they should be supported in the most important financial decision they will ever make? What kind of experience do you want your company to be known for? And that is the good scenario. In the “bad” scenario—unsupported loan officers commit fraud -- sometimes just out of ignorance.

Finally, quality attracts quality. No quality originator wants to be surrounded by a company of originators that don’t know what they are doing and have the potential to hurt the quality name the originator brings to the organization. Top originators want to be challenged—not only by their boss, but by their peers. In this case, the strong get stronger. Dave

Dave Hershman is Senior VP of Sales of Weichert Financial and the top author in the mortgage industry. Dave has published seven books, as well as hundreds of articles and is the founder of the OriginationPro Marketing System and Mortgage School – the online choice for expert mortgage learning and marketing content. His site is www.OriginationPro.comand he can be reached at This email address is being protected from spambots. You need JavaScript enabled to view it.

Read more...