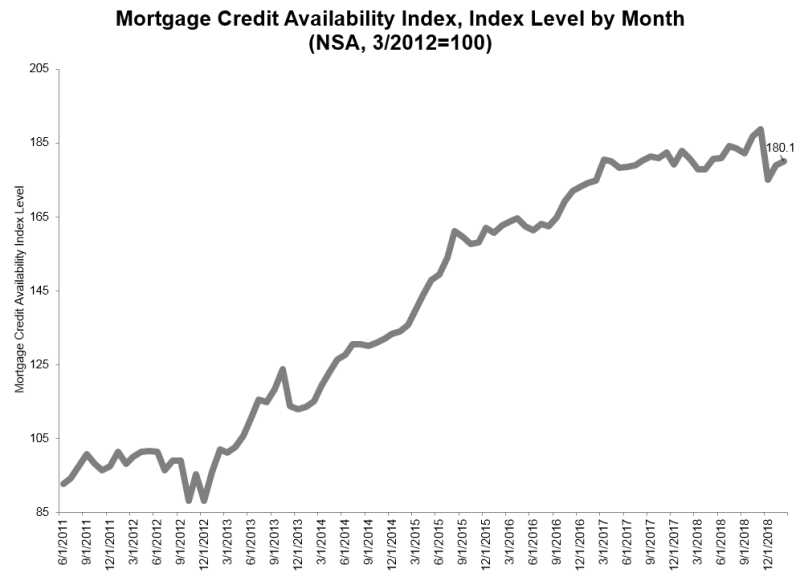

The Mortgage Credit Availability Index rose 0.6 percent to 180.1 in February, according to a report from the Mortgage Bankers Association that analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool.

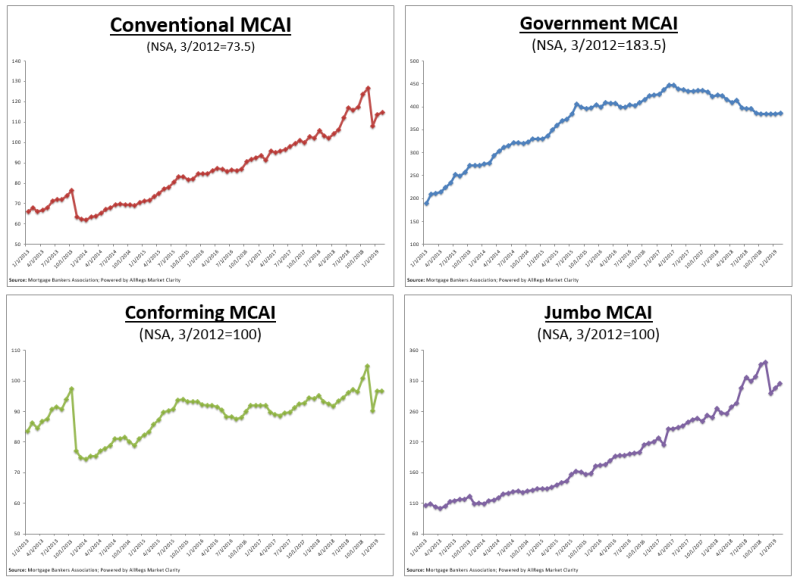

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The Conventional MCAI increased 1.1 percent, while the Government MCAI increased slightly 0.1 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 2.2 percent while the Conforming MCAI decreased by 0.2 percent.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

“Credit availability increased in February as a result of new jumbo offerings brought to the market, both for agency jumbo and non-agency jumbo programs,” said Mike Fratantoni, MBA senior vice president and chief economist for the MBA. “We also saw some expansion in credit for borrowers with lower credit scores and higher LTVs, although credit availability for government programs remains tighter following the scaling back of VA refinance programs.”

“Credit availability increased in February as a result of new jumbo offerings brought to the market, both for agency jumbo and non-agency jumbo programs,” said Mike Fratantoni, MBA senior vice president and chief economist for the MBA. “We also saw some expansion in credit for borrowers with lower credit scores and higher LTVs, although credit availability for government programs remains tighter following the scaling back of VA refinance programs.”

The Conventional MCAI increased (1.1 percent), while the Government MCAI increased slightly (0.1 percent). Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 2.2 percent while the Conforming MCAI decreased by 0.2 percent.