TRENDING WHITEPAPERS,VIDEOS & MORE

TD Bank's 6th Annual Mortgage Service Index Finds Homebuyers Value In-Person Guidance Amid Shift to Digital Channels

- Thursday, 30 May 2019

- Originating

While a record number of homeowners report their most recent home buying experience was excellent, their appetite for resources and guidance throughout the mortgage process is stronger than ever, according to recent research from TD Bank.

TD's Mortgage Service Index, a national survey of more than 1,800 consumers who purchased a home in the last 10 years, examines perceptions around the home buying and mortgage experience as well as the housing market.

Despite rate uncertainty and limited inventory, homebuyers are optimistic in the current environment. Of those surveyed, 83 percent said it's a good time to buy a home and 30 percent are very or extremely likely to buy a home in the next three years. This was particularly true for the New York City/Long Island market, where 48 percent said they are extremely likely to purchase a home in the next year or so.

Technology Enhances and Advances the Mortgage Process

The number of homeowners who applied for a mortgage online has increased from one in eight (13 percent) in 2014 to more than one in five (21 percent) this year, demonstrating a gradual shift to the online channel. What's more, 60 percent said the entire mortgage process lasted four weeks or less – an all-time high for the number of borrowers completing the process within the span of just a month.

"Digital platforms are speeding up mortgage processing on the front and back ends," said Rick Bechtel, Head of U.S. Residential Lending for TD Bank. "When borrowers leverage online platforms for providing documents and completing necessary forms, we have found it reduces information intake time by more than 60 percent on average."

The proportion of consumers who rated their home buying experience as excellent has doubled from 16 percent in 2014 to 32 percent this year. At the same time, 30 percent said the experience was very or extremely stressful, a figure which has remained stable since 2014.

Advice from Realtors, Bankers and Relatives Tops Buyers' Sources

Despite the proliferation of home buying resources online, fewer consumers today believe they have enough resources to educate themselves on the mortgage process than three years ago (82 percent in 2019 versus 90 percent in 2016). In fact, for the first time in six years, the top three sources of information used by homebuyers did not include online sources. This year's respondents instead turned to realtors (51 percent), in-person representatives at their local bank (42 percent) and family/friends (38 percent), signaling that prospective buyers are seeking personalized advice and guidance.

"Today, homebuyers can search online for the basics of the mortgage process, leading to remarkably more informed borrowers than we saw even a decade ago. But the reality is homebuying requires navigating financial options, legal obligations, local guidelines and complex processes that occur on tight timelines," said Bechtel. "It's up to mortgage bankers to provide borrowers with expert, personalized guidance to reduce stress and create clarity as they make one of the most significant financial decisions of their lives."

Aligned to TD's expectations, the survey uncovered substantial evidence that homebuyers need guidance on costs, loan options and affordability programs:

- Nearly a third (30 percent) of homeowners incurred $2,000 or more in unexpected charges during the home buying process.

- Nearly three quarters (74 percent) of homeowners took out a 30-year fixed rate or 15-year fixed rate mortgage, yet 52 percent plan to stay in their home for 10 years or less.

- Forty-two percent of homeowners are unaware of affordability programs, which is significant considering the increasing number of buyers contributing less than 20 percent to a down payment. In 2016, nearly half (48 percent) of homeowners said they put down 20 percent or more, as compared to just 36 percent in 2019.

Read more...

Dear Brian: How Do You Get Pre Quals To Share Their Information?

- Tuesday, 28 May 2019

- Originating

Dear Brian,

I am having challenges getting buyers who I am pre qualifying to share accurate information with me. Any suggestions?

Tammy P

Detroit Michigan

[caption id="attachment_11630" align="alignright" width="185"] Brian Sacks[/caption]

Brian Sacks[/caption]

Dear Tammy,

Thanks so much for writing in and asking your question. Of course, every originator including me have struggled with this question. I mean take a minute and think about our job when we are first meeting or speaking with client.

“ Hi How are you ? How’s your credit? How much do you make? How much money do you have in the bank?”

It’s awkward at best and very scary for most buyers. So let me share some ideas and suggestions with you. There are a number of areas to focus on.

HOW ARE THEY FINDING YOU?

When clients are referred to you from a professional they trust like an agent, attorney, financial planner or accountant they are often more likely to already have a degree of comfort with you.

This is the same with clients referred by their friends or family. But there is also another way to establish trust and creditability and that is by using the media.

Many of my clients find me from articles I have written or tv and radio appearances.

DO THEY UNDERSTAND YOUR ROLE AND WHY IT’S IMPORTANT TO GET PRE-APPROVED?

It’s important that the client understands that they are going thru this process so they know what programs are best for them and what their options are. They will also need to know what their own comfort levels are for out of pocket cash and monthly payments and that all starts with your conversation getting pre-approved.

IS IT BY PHONE OR IN PERSON or VIDEO CALL?

I may be old school but I always prefer to meet with my clients in person. If they are out of state, or not able to come in, I like to arrange a skype or join.me call so we can actually see each other.

Talking to a faceless person on the phone is scary since they can not see your expressions or exactly what you are intending to get across. The benefit of in person meetings is often your ability to have them get to know you and this leads to referrals!

WOULD YOU GIVE ME A 1000 QUESTION ?

When all else fails I will ask them the 1000 dollar question. I ask them if they would give me 1000 dollars if I promised to never give it back. There is usually a pause on their part as they try to process this question.

I then go on to explain that if they go out and don’t get pre- approved they risk losing 1000 dollars. If they go to contract and their mortgage is not approved they will have spent 500 for an appraisal and another 500 on other inspections. This money will not be refunded since services were performed.

Aside from the fact that getting pre-approved allows the seller to know that they are able to move forward and will likely help them get their offer accepted. This is also important to explain to your prospects.

This usually breaks the ice and allows them to understand that this is an important starting point for purchasing a new home.

Tammy, I hope this helps and gives you some ideas you can implement right away.

If you have a question in an upcoming Dear Brian column please send them to me at This email address is being protected from spambots. You need JavaScript enabled to view it.with the Subject line DEAR BRIAN ARTICLE

Brian Sacks is a branch manger and originator with HomeBridge Financial in Owings Mills Maryland. He is also the author of 48 Proven Ways To Immediately Close More Loans and the founder of http://toporiginatorsecrets.com

Read more...

Redfin Survey Says Tax Reform Not Having A Big Impact On Home Searches

- Tuesday, 21 May 2019

- Originating

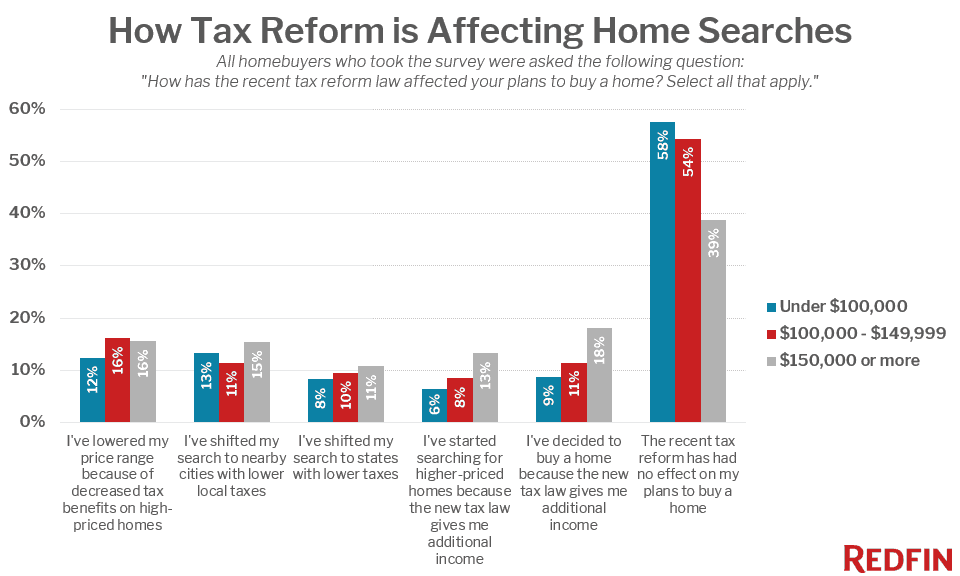

More than a year after the historic tax code overhaul, less than half of homebuyers (47%) say that tax reform has had an effect on their home search, according to a March survey commissioned by Redfin, the technology-powered real estate brokerage. That's down from 56 percent last year, when tax reform's effects were still mostly speculative and not yet realized in people's paychecks. The tax reform law lowered the caps on the tax deductions allowed for mortgage interest payments and state and local taxes.

The Redfin-commissioned survey included more than 2,000 U.S. residents who planned to buy or sell a primary residence in the next 12 months. More than 1,800 homebuyers responded to the question: "How has the recent tax reform law affected your plans to buy a home?" Results from this survey were compared to over 1,300 responses to the same question in a similar survey commissioned in March 2018.

The most common tax-reform effect reported by homebuyers this year was that they lowered their price range because of decreased benefits on high-priced homes (14%, down from 16% last year).

Another way tax reform has been affecting the housing market is in the form of migration to places with lower taxes, a trend we've noted in reports on Redfin.com user search patterns. This March, 13 percent of buyers said they shifted their search to nearby cities with lower taxes, and 9 percent said they shifted their search to states with lower taxes, down from 16 percent and 12 percent, respectively, last year.

This year, 8 percent of respondents said they are searching for higher-priced homes because the new tax law gives them additional income, down from 17 percent last year. Eleven percent of buyers this March said they decided to buy a home because the new tax law gives them additional income, down from 19 percent in the March 2018 survey.

"Last year more homebuyers were worried that tax reform would hurt their homebuying budgets, but it turns out tax reform wasn't all bad or all good for homebuyers," said Redfin chief economist Daryl Fairweather. "Some homebuyers, especially in low-tax states, are now paying less in taxes overall, which has left them with more cash for a more expensive home. For others, not being able to deduct as much of their property taxes or mortgage interest from their taxable income was the other shoe that needed to drop to make them pick up and move to a more affordable area. In the long run, we will see demand for luxury homes in high-tax states suffer the most because those homes have been hit the hardest by this tax reform, and there's actually early evidence of that already happening."

How Were Households with Different Incomes Affected by Tax Reform?

High-income homebuyers were the most likely to report in this year's survey that tax reform has had some sort of effect on their home search. Of those homebuyers earning $150,000 or more, 61 percent said that the new tax law had an effect on their home search, which was true for less than half of households earning under $150,000.

The largest reported effect on high-income homebuyers was that 18 percent said they have now decided to buy a home thanks to their extra take-home income, but 16 percent said they are now lowering their price range due to decreased tax benefits on high-priced homes.

Which States Were Most and Least Affected by Tax Reform?

New York had the largest share of homebuyers who said that tax reform had affected their home search—61 percent. Homebuyers in New York were most likely to have lowered their price range (17%) or shifted their home search to cities with lower taxes (17%). California had the next-highest share of homebuyers impacted by tax reform at 55 percent. The largest effect there was homebuyers shifting their search to cities with lower taxes (18%). Thirteen percent of both New York- and California-based respondents said they were moving to a state with lower taxes.

On the other end of the spectrum, Kansas and Indiana had the smallest share of homebuyers whose search was affected by tax reform, each at 24 percent. Washington, D.C., was just behind with 25 percent of homebuyers saying tax reform had some effect on their search.

To read the full report, complete with market-level survey data and detailed methodology, please visit: https://www.redfin.com/blog/how-tax-reform-impacts-homebuyers.

Read more...Ask Brian: What to Say When You Meet an Agent

- Thursday, 16 May 2019

- Originating

I have watched your videos and have also been reading your blog. The problem I have is that I know I need to do business with agents but the scripts I have been using aren’t working well.

I get the meeting but am not able to get business from them after the meeting. Would appreciate your thoughts.

Thanks

Adrianna C.

Georgia

Hi Adrianna

Thanks so much for the question. My answer is going to be very simple, yet extremely powerful. You should be interviewing them not them interviewing you. That to me is biggest mistake I see originators making with their marketing.They are begging and hoping which can only set you up for failure. The more you chase and beg the less likely that person is going to do business with you.

SO WHAT SHOULD YOU DO?

There is no rule that says a buyer looking for a home has to start with an agent. In fact, the truth is that they need to have their financing in place before they even start that search.

If you can control the buyers than you are able to control the agent relationship. Simple right!

Your timing is actually perfect because I just did a training yesterday on the step by step formula that you can use to generate these pre-approved buyers.

Before I finish, I want to also mention that not all agents are worth pursuing and I actually covered that too in the training which will be up until midnight eastern May 19. I hope you can take the time to watch it.

Here’s the link https://rentersintoloans.com/tmlreplay/

Read more...