TRENDING WHITEPAPERS,VIDEOS & MORE

Survey Reveals That Consumer Knowledge about Credit Scores Has Steadily Declined over the Past Eight Years

- Wednesday, 12 June 2019

- Originating

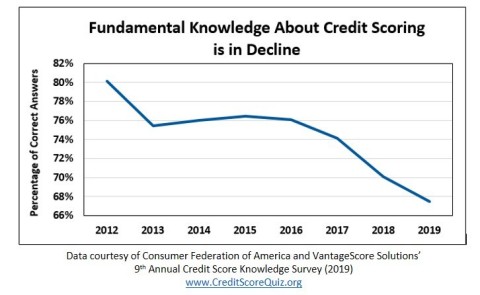

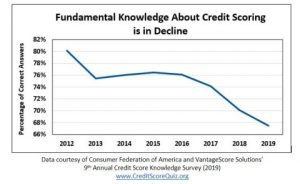

The ninth annual credit score survey, released today by the Consumer Federation of America (CFA) and VantageScore Solutions, LLC, shows that consumer knowledge about credit scores is at the lowest level in the past eight years. On most knowledge questions (as the enclosed table and charts show), correct scores declined by more than ten percentage points, and sometimes by more than 20 percentage points. For example:

- 78% of respondents in 2012, but only 62% in 2019, correctly indicated that people have more than one credit score.

- 85% in 2012, but only 66% in 2019, correctly answered that keeping a low credit card balance helps raise a low credit score or maintain a high one.

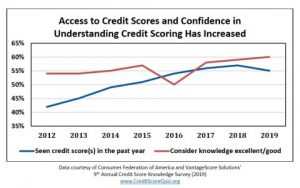

However, in the same period, the proportion of respondents who said they considered their knowledge of credit scores excellent or good rose from 54% to 60%.

“Consumers know less about credit scores but think they know more,” said Stephen Brobeck, CFA senior fellow. “Taking our online credit score quiz provides an easy way for consumers to update their credit score knowledge,” he added. More than 230,000 individuals have taken the Credit Score Quiz, developed and maintained by CFA and VantageScore.

“We are pleased that many consumers now have free access to their credit scores, but consumers must also take advantage of all the additional information about credit scores and credit files in order to make better credit decisions,” said Barrett Burns, president and CEO of VantageScore Solutions.

Consumer knowledge levels may have deteriorated, in part, because of improvements in the overall economy and consumers’ financial condition. In 2012, large numbers of Americans faced challenging credit card and mortgage debts, so consumers may have been especially concerned about credit scores. Since then, as the nation’s economy and family finances recovered, and as consumers reduced unsustainable credit card and mortgage debts, consumers may have felt that it was less important to fully understand credit scores. Reports of increases in average credit scores nationwide may also have lessened people’s feelings of financial vulnerability and the need to fully learn about their scores and its impact.

Despite overall rising score levels – now averaging 680 according to Experian – a large minority of consumers have fair or poor scores (below 670). Low scores can especially harm these people by:

- Denying then access to needed credit

- Increasing the costs of consumer and mortgage credit that can obtain. Subprime auto loans will likely cost several thousand dollars more, and subprime mortgage loans can cost over ten thousand dollars more compared to conventional loans.

- Increasing deposits required by utilities and cell phone companies to obtain service

Low credit scores also are an indicator that people may have difficulty obtaining a job. While credit scores themselves are not used by employers, the credit reports the scores are based on are frequently utilized. “Those with low credit scores should be aware that they are at risk not only for paying higher costs for credit and utility services, but may also struggle to obtain a good job with which to afford those higher costs,” noted CFA’s Brobeck.

While consumers’ knowledge of their actual credit scores has declined overall, the latest survey shows large majorities of consumers did correctly answer key knowledge questions related to important facts:

- Mortgage lenders and credit card issuers use credit scores (83% and 82% respectively).

- Missed payments are used in calculating credit scores (86%)

- Making all loan payments on time helps a consumer raise a low credit score or maintain a high one (87%).

However, significant minorities of respondents did NOT know other key facts, for example:

- Cell phone companies might use credit scores in pricing services (41%).

- Borrowing from a 401k retirement account or paying a parking ticket late will not lower your credit scores (30% and 22% respectively).

- Opening several credit card accounts at the same time might lower scores (38%).

- Frequently checking credit scores will not lower their scores (38%).

- Checking the accuracy of one’s credit reports is very important (33%). Lenders may have provided inaccurate information or failed to supply accurate information to credit bureaus; thus, the bureaus may have made mistakes such as adding information to the wrong file of a person with the same name.

In brief, consumers can raise their credit scores or maintain high scores by:

- Consistently making loan payments on time every month. A late payment may lower one’s credit scores by dozens of points.

- Using a small portion of the credit available on a credit card. In general, the higher the percentage of credit line that is drawn down, the lower one’s credit scores.

- Paying down credit card debt rather than just shifting it to another credit card or to a home equity loan.

- Regularly checking one’s credit reports to make sure they are error-free. This can be done for free annually by going to comor by calling 800-322-8228.

The survey was conducted by the Engine Telephone CARAVAN survey, who on April 25-28, 2019, interviewed 1,002 representative adult Americans by landline or cell phone. The survey’s margin of error is plus or minus three percentage points.

Read more...Maxwell Suggests Three Ways to Improve Your Website

- Tuesday, 04 June 2019

- Originating

As a mortgage industry professional, having a website is an essential. Your site can help build your brand, get you referral partners, and of course, drive new customers

But there’s a big difference between having just any website and having a great website. If your website is missing key components, like an effective lead form, it may not be serving as a successful tool for your business. Even worse, there are certain mistakes that could actually be turning borrowers off!

Read on for three essential ways to improve your mortgage website, with lots of specific strategies to tackle each upgrade.

Read on for three essential ways to improve your mortgage website, with lots of specific strategies to tackle each upgrade.

1.) Nail the basics

Here are the “basics” we consider essential for a successful mortgage lender’s website:

- Display a unique and cohesive brand. Consistent branding (logo, colors, font, etc.) throughout the entirety of your site design looks professional.

- A simple, effective lead form is essential. While it can be tempting to just give your contact information on your site and wait for the calls to roll in, many borrowers want you to put the work in to reach out to them.

- Absolutely no grammatical errors or site bugs! This comes across as sloppy and unprofessional, and can definitely hurt business. Grammarly is a great tool to ensure your copy is always pristine.

- Mobile optimization is a must. The volume of mobile search inquiries overtook desktop years ago, so if you’re site isn’t geared up for mobile, you’re losing valuable traffic. Learn more here.

2.) Convey trustworthiness

A top trait homebuyers look for in a loan officer? Someone they can trust. Some suggestions to get this message across on your site:

- Give potential clients some background on yourself and your team. Fun fact: the “Bio” or “About Me” pageis usually the most clicked page on company websites! Sharing your background and some personal information will help borrowers feel closer to you, and they’re much more likely to trust you once they get to know you.

- This is not the place to go super sales-y. Your website should display professionalism, not deals, so save your sales pitch for another venue.

- Include information about your license and certification. Borrowers will be on the lookout.

- Mention security. This can just be a one-liner or short blurb on your process for keeping borrowers’ data protected. With data security as a top concern for many homebuyers, a quick nod to this topic will go a long way.

- Show off your 5 star reviews! Potential customers love reviews. They’re reassuring and prove your solid track record.

3.) Put your website to work

What good is a great website if no one sees it? Improve your sites traffic with the following strategies:

- Create helpful, high-quality content that homebuyers will love. Drive eyes to your site with blog posts for first time homebuyers or through a bi-monthly newsletter with mortgage information.

- Learn about and implement SEO best practices to gain organic search traffic. Do some research on top keywords and incorporate them into your content.

- Effectively use paid ads through Google or other platforms to drive high-opportunity traffic to your site.

- Develop a social media presence. Share articles, such as your blog posts, on Facebook, take pictures at your closings and put them on Instagram, and connect with all of your referral partners on LinkedIn. Be sure to link to your site in your profiles

Read more...

Mat Ishbia of UWM Talks About FHFA, VA and FHA Changes.

- Monday, 03 June 2019

- Originating

https://www.youtube.com/watch?v=56O2rviycQA&list=PLAmCrPlNHx57dmjBx-kKrZZW7I1avHwQs&index=37&t=0s

Read more...