TRENDING WHITEPAPERS,VIDEOS & MORE

tim

March Foreclosure Rate at 20 Year Low, Delinquencies at 13 Year Low

- Wednesday, 12 June 2019

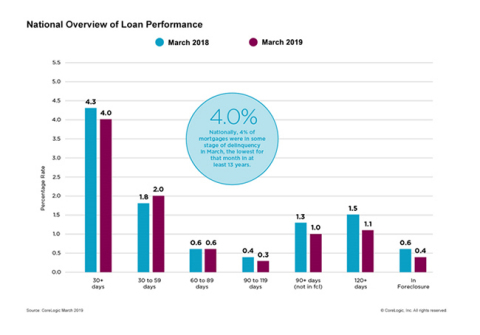

CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report. The report shows that nationally 4% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in March 2019, representing a 0.3-percentage-point decline in the overall delinquency rate compared with March 2018, when it was 4.3%. This was the lowest for the month of March in 13 years.

As of March 2019, the foreclosure inventory rate – which measures the share of mortgages in some stage of the foreclosure process – was 0.4%, down 0.2 percentage points from March 2018. March 2019 marked the fifth consecutive month that the foreclosure inventory rate remained at 0.4% and was the lowest for any month since at least January 1999.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To monitor mortgage performance comprehensively, CoreLogic examines all stages of delinquency, as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 2% in March 2019, up from 1.8% in March 2018. The share of mortgages 60 to 89 days past due in March 2019 was 0.6%, unchanged from March 2018. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.4% in March 2019, down from 1.9% in March 2018. The serious delinquency rate of 1.4% this March was the lowest for that month since 2006 when it was also 1.4%.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 0.9% in March 2019, up from 0.7% in March 2018. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2%, while it peaked in November 2008 at 2%.

The nation's overall delinquency rate has fallen on a year-over-year basis for the past 15 consecutive months. However, 21 states did experience a slight increase in the overall delinquency rate in March 2019. Mississippi had the nation’s highest overall delinquency rate at 8.2%, a 0.5-percentage-point gain from March 2018, while Alabama’s gain was 0.3 percentage points. The other 19 states experienced annual gains of 0.1 or 0.2 percentage points.

“The increase in the overall delinquency rate in 42% of states most likely indicates many Americans were caught off guard by their expenses in early 2019,” said Dr. Frank Nothaft, chief economist at CoreLogic. “A strong economy, labor market and record levels of home equity should limit delinquencies from progressing to later stages.”

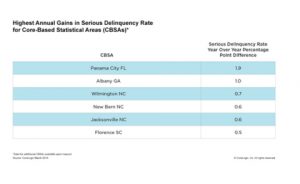

In March 2019, 166 U.S. metropolitan areas posted at least a small annual increase in the overall delinquency rate. Some of the highest gains were in several hurricane-ravaged parts of the Southeast (in Florida, Georgia and North Carolina), and in Northern California’s Chico metropolitan area, home of last year’s devastating “Camp Fire.”

“Delinquency rates and foreclosures continue to drop through March and should decline further in the months ahead barring any serious dislocations from recent flooding in the Midwest or a severe Atlantic hurricane and/or wildfire season on the coasts,” said Frank Martell, president and CEO of CoreLogic.

“Delinquency rates and foreclosures continue to drop through March and should decline further in the months ahead barring any serious dislocations from recent flooding in the Midwest or a severe Atlantic hurricane and/or wildfire season on the coasts,” said Frank Martell, president and CEO of CoreLogic.

Methodology

The data in this report represents foreclosure and delinquency activity reported through March 2019.

The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not typically subject to foreclosure and are, therefore, excluded from the analysis. Approximately one-third of homes nationally are owned outright and do not have a mortgage. CoreLogic has approximately 85% coverage of U.S. foreclosure data.

Read more...5 Security Best Practices for Mortgage Lenders

- Tuesday, 11 June 2019

Posted by Chelsea Mize of Maxwell

Mention data security to a mortgage executive and it’s enough to make them squirm. You can’t read the news without seeing a piece about a new security breach, even from some of the world’s most cutting-edge technology companies.

Data is the heartbeat of the mortgage industry. Protecting it should be the priority for all organizations, no matter their size. And it’s time to own up to the reality that the conventional methods of security are no longer sufficient.

Ken Kantzer knows a bit about data security. He’s the co-founder of PKC Security, a cybersecurity consulting firm. He has undertaken cybersecurity consulting and code audit efforts across multiple sectors: high-tech startups, financial services, oil & gas, industrial infrastructure, and high-security government systems. We sat down with him to identify 5 security best practices for mortgage lenders that will help them protect their business and their bottom line.

Ken Kantzer knows a bit about data security. He’s the co-founder of PKC Security, a cybersecurity consulting firm. He has undertaken cybersecurity consulting and code audit efforts across multiple sectors: high-tech startups, financial services, oil & gas, industrial infrastructure, and high-security government systems. We sat down with him to identify 5 security best practices for mortgage lenders that will help them protect their business and their bottom line.

1.) Reduce fractured business architecture

Many mortgage companies work in a way that is fundamentally fractured and insecure. Data resides on systems from the loan officer’s messaging app on their smartphone to their LOS and everywhere in between. Data sits in Word documents, lives in Outlook, and is transferred to third parties as part of the process every day.

Despite marketing promises to the contrary, there’s no single all-in-one platform. The idea of having one password to rule them all is more a fever dream than an actual possibility. But that’s not to say you can’t have a set of best-of-breed, modern systems that work together seamlessly.

“The best way to get hacked is to have systems on your hands that no one at your company understands. Given the choice, opt for platforms that employ the most modern security measures, and simple interfaces between your systems.” – Ken Kantzer, PKC Security

TO DO: Use an encrypted password manager

Switch to an encrypted password manager so you can maintain password integrity across all your accounts and devices without having to remember dozens of passwords. Just choose one of these top password managers to get started (I prefer LastPass myself).

2.) Protect your data

The conventional castle-and-moat approach to data security is outdated. The financial services industry — particularly the mortgage vertical — must take a more comprehensive approach than just using firewalls, antivirus, content filtering, and threat detection.

“The old idea of putting up a wall and standing watch just doesn’t hold true anymore,” says Ken. “The new approach to data protection focuses on resiliency — systems must ensure that even in worst-case scenarios where there is a data breach, the data can be rendered useless.”

Encryption is one such approach. Mortgage companies can maintain control of their data, even when it is deployed in the cloud or in their data center. By moving security controls as close as possible to the data, a mortgage company can ensure that even after the perimeter is breached, the information remains secure.

“At PKC, we always look at how cloud services use encryption, and how the encryption keys used by the service are protected. When encryption is properly implemented, it can be a huge help in strengthening the security of a service, but when it’s improperly implemented, it can actually hurt by lulling users into a false sense of security.”

If you haven’t been breached yet, you’re either lucky or you just don’t even know it happened.

TO DO: Shore up your data defenses

Only mortgage companies that adopt a combination of password managers, encryption-at-rest tools like BitLocker and FileVault, and two-factor authentication can be confident that their data is useless should it fall into unauthorized hands. At Maxwell, we use JumpCloud to manage all of the above.

3.) Facilitate better collaboration between sales and IT

Hopefully you’ve already got security basics in place, like security awareness training, security policies that are enforced across the organization, and a consistent process of monitoring and reviews. Though they might feel like shackles for the sales team, these are necessary precautions to take.

As many CIOs know, employees are generally your weakest link:

“The key to security is not a sexy new kind of technology. It’s not machine or deep learning,” says Ken. “Of all the awesome technology to deploy to catch bad things before they happen, it’s your frontline employees that will have the highest rates of detection.”

When IT and sales collaborate, it is an opportunity to confer the feeling that owning security is everyone’s responsibility. The key to security is getting every person to care about it and to set a shared value that we must ‘protect our house’ both at home and in the office.

TO DO: Implement a VPN for remote work

Connecting to public WiFi networks can be incredibly risky, but sometimes circumstances necessitate that you have to connect to a public network when you’re working on the go. A VPN (or Virtual Private Network) allows users to securely access a private network and share data remotely through public networks. Much like a firewall protects your data on your computer, VPNs protect it when you’re online. This list of top VPN providers will help you get started.

4.) Work with Sales, Not Against Them

Rather than IT attempting to shackle sales, arm the sales team with market-leading mobile communication and collaboration tools that solve their problems and make them more productive while maintaining high-level security.

Use the best technology on the market to reduce non-selling administrative or customer service aspects of a loan officer’s role. Too often, those activities take up more time than selling loans, and the time-wasting is often exacerbated by poorly designed tools that add to the problem rather than alleviate it.

As Ken notes, “A mortgage company that understands how to minimize the amount of time a loan officer and her team spends doing administrative tasks, such as data entry and chasing borrowers for documents, will win by helping them be more productive.”

TO DO: Deploy an enterprise-grade communication app

Instantaneous communication coupled with data security and privacy lead to better sales and customer experience, fewer errors, and employees that work as one cohesive force.

5.) Hack yourself

It sounds counterintuitive (if not downright scary), but the quickest way to identify vulnerabilities in your security infrastructure is to hire someone to find them. The biggest financial services companies swear by this tactic; companies like PayPal, Western Union, Square, and Simple have utilized these ‘bug bounty’ programs as an effective complement to their (often strapped) internal security teams.

And it’s not just financial companies — the U.S. government famously launched a “Hack the Pentagon” program. Through this program, more than 1,400 participants found hundreds of vulnerabilities in the Department of Defense’s systems and paid out the hackers who helped identify these problem areas.

Mortgage companies can only benefit from these bug bounty programs. Offering a bug bounty or undergoing a quarterly penetration test is quickly becoming a best practice for top-tier mortgage companies who understand the high stakes surround security issues.

TO DO: Hire a Hacker

Hire a hacker to analyze your systems and look for security holes and then pay them a bounty when they find them.

Hackers are going to hack. Wouldn’t you rather pay them to be on your side and work for you, rather than dealing with the legal, privacy, intellectual property, and cyberfraud issues that arise when less valiant hackers use your weaknesses against you?

Conclusion

Security must be at the forefront of all decisions made by mortgage professionals. Rather than letting security concerns slow down or cripple your organization, use security as an asset to grow your business. Empower your teams rather than limiting their capabilities, and challenge yourself to regularly audit your security infrastructure and make changes as needed.

Technology and proper processes unlock efficiencies and can improve not just the security of your clients’ information, but the stability of your bottom line as well.

Read more...Homebridge Financial Services, Inc. Acquires HomeStreet Bank’s Home Loan Center-Based Mortgage Origination Business

- Monday, 10 June 2019

-Homebridge Financial Services, Inc. (Homebridge), one of the largest independent mortgage lenders in the U.S., has completed phase one in the acquisition of the distributed retail mortgage banking segment of HomeStreet Bank, a wholly owned subsidiary of HomeStreet, Inc. (Nasdaq:HMST) (“HomeStreet”). Phase one of the acquisition includes the mortgage loan production branches and fulfillment functions in Washington, Oregon, and Idaho, including processing, underwriting and funding – and the hiring of related personnel. Phase two will include locations in California and Hawaii and is expected to be completed later this month.

This strategic acquisition is in line with Homebridge’s core belief that in today’s on-demand and digital economy, borrowers benefit the most by dealing with mortgage experts, not just algorithms.

The acquisition of HomeStreet’s home loan centers and related personnel raises Homebridge’s profile to now include 241 retail branches throughout the country and increases its personnel count to 2,344 associates. As a result, Homebridge will now be among the top 10 privately owned, independent mortgage lenders in the country based on volume.

The acquisition of HomeStreet’s home loan centers and related personnel raises Homebridge’s profile to now include 241 retail branches throughout the country and increases its personnel count to 2,344 associates. As a result, Homebridge will now be among the top 10 privately owned, independent mortgage lenders in the country based on volume.

In addition to its robust branch presence, Homebridge operates two thriving wholesale divisions, REMN Wholesale and Homebridge Wholesale.

“With Homebridge’s focus on customer satisfaction and a culture of growth and collaboration, we see the HomeStreet Mortgage team as a seamless fit,” said Peter Norden, CEO of Homebridge. “We look forward to the opportunity to incorporate the HomeStreet Mortgage team into our leading retail mortgage platform.”

HomeStreet first announced in February that it would seek buyers to acquire its stand-alone home loan centers and related mortgage origination personnel. Homebridge stood out from a group of qualified potential purchasers due to its strong focus on the end borrower, a commitment to the success of its internal associates, and a strong cultural fit.

“We are excited to bring together our high performing retail mortgage teams. We feel a deep alignment with the Homebridge vision and overall sense of purpose. We look forward to the opportunity to carry on our legacy as part of the Homebridge family,” said Rose Marie David, EVP – Director of Mortgage Lending at HomeStreet Bank. David will be joining Homebridge as the EVP, Divisional Manager of the former HomeStreet mortgage team after both phases of the closing are complete.

Homebridge offers borrowers and the residential builder communities it works with an almost unparalleled array of mortgage products, including FHA, FNMA, and jumbo loans. It was cited as the clear leader by the U.S. Department of Housing and Urban Development for 203(k) in renovation mortgages in both 2017 and 2018, a subset of loans that can breathe new life into distressed or outdated properties. Homebridge’s commitment to customer service in every aspect of the mortgage industry is tangible through its independent class-leading Net Promoter score, which is based entirely on customer feedback.

Read more...