-

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Lending (1549)

Apartment Demand Jumps, Home Rentals Gain Favor

- Thursday, 11 July 2019

- Lending

- Written by Chris Frankie

California, Hawaii Have the Most Mortgage Debt

- Wednesday, 10 July 2019

- Lending

- Written by Chris Frankie

Stearns Holdings Files for Bankruptcy in Deal to Stay Open

- Thursday, 11 July 2019

- Lending

- Written by Chris Frankie

Mortgage Delinquency Falls to 20-Year Low

- Thursday, 11 July 2019

- Lending

- Written by Chris Frankie

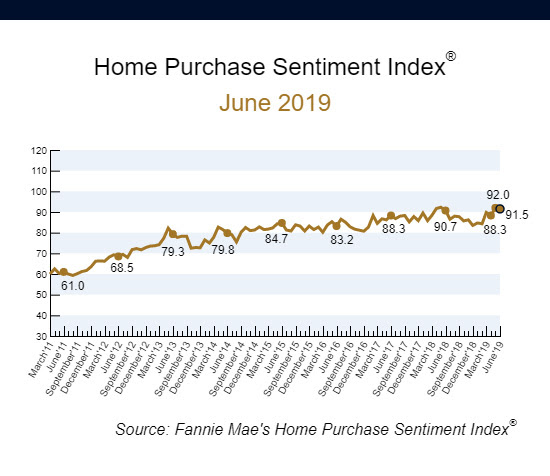

Housing Confidence Dips But Remains Near Survey High

- Monday, 08 July 2019

- Lending

- Written by Chris Frankie

Mortgage Rates Inch Up, Vets to Pay More

- Friday, 05 July 2019

- Lending

- Written by Chris Frankie

U.S. Economic Expansion is Longest in History

- Friday, 05 July 2019

- Lending

- Written by Chris Frankie

MBA Releases Q1 Commercial-Multifamily DataBook

- Wednesday, 03 July 2019

- Lending

- Written by Chris Frankie

MBA Statement on Trump Housing Affordability Exec Order

- Wednesday, 03 July 2019

- Lending

- Written by Chris Frankie

Austin Niemiec Named New Executive Vice President of Quicken Loans Mortgage Services

Quicken Loans Mortgage Services (QLMS), the second largest mortgage lender serving the needs of brokers, regional banks and credit unions, today announced that Austin Niemiec has been named Executive Vice President. Niemiec began his career with the company 10 years ago as a mortgage banker and he embodies a “street” focus that came from working… Read more...More...

MOST READ STORIES

Fast,Easy & Free