-

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Lending (1549)

Open Mortgage Hires Live Well Financial Executives and Their Core Team

Open Mortgage, a multi-channel mortgage lender dedicated to empowering the dream of home ownership, has hired Live Well Financial's core team of mortgage lending executives: Bruce Barnes, Jim Cory and Joshua Moran, formerly Executive Vice President, Senior Vice President of Operations and Senior Vice President of Wholesale & Correspondent Lending, respectively. Additionally, approximately 50 sales… Read more...

Wells Fargo to Donate $1 Billion to Address Housing Affordability Crisis

Wells Fargo today announced an evolution of its philanthropic strategy to help address three critical issues affecting underserved communities: housing affordability, financial health and small business growth. The Company, through its business and the Wells Fargo Foundation, will use its resources and expertise to develop new ideas and implement solutions in communities of need in… Read more...

Redfin: Millennials Could Buy Homes 3 Years Faster under Sen. Warren's Student Debt Cancellation Plan

A typical aspiring first-time homebuyer could save a down payment three years faster under Senator Elizabeth Warren's plan to cancel up to $50,000 of student loan debt per person, according to a new analysis of student loan and home price data from Redfin (www.redfin.com), the tech-powered real estate brokerage. The Redfin analysis looked at a… Read more...

Consumer Financial Protection Bureau Settles with BSI Financial Services

The Consumer Financial Protection Bureau (Bureau) today announced a settlement with BSI Financial Services (BSI), a mortgage servicer headquartered in Irving, Texas. BSI Financial Services is the operating name for Servis One, Inc. The Bureau found that BSI violated the Consumer Financial Protection Act of 2010, the Real Estate Settlement Procedures Act, or the Truth… Read more...

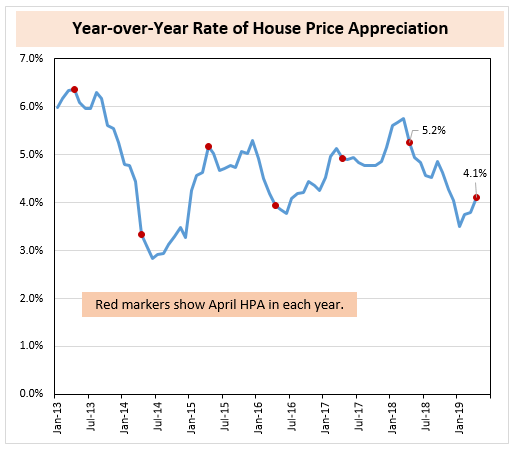

AEI Releases It's Home Price Appreciation Index and Market Conditions Report

Key Takeaways: Home Price Appreciation Rose 4.1% Year-over-Year in April 2019; Low Price Tier Continues to Overheat; Seller’s Market Conditions Persist, but Show Some Moderation on a National Basis. Home price appreciation (HPA) for April 2019, as reported by the AEI Housing Center, was 4.1%, down from 5.2% in April 2018. However, HPA has begun… Read more...

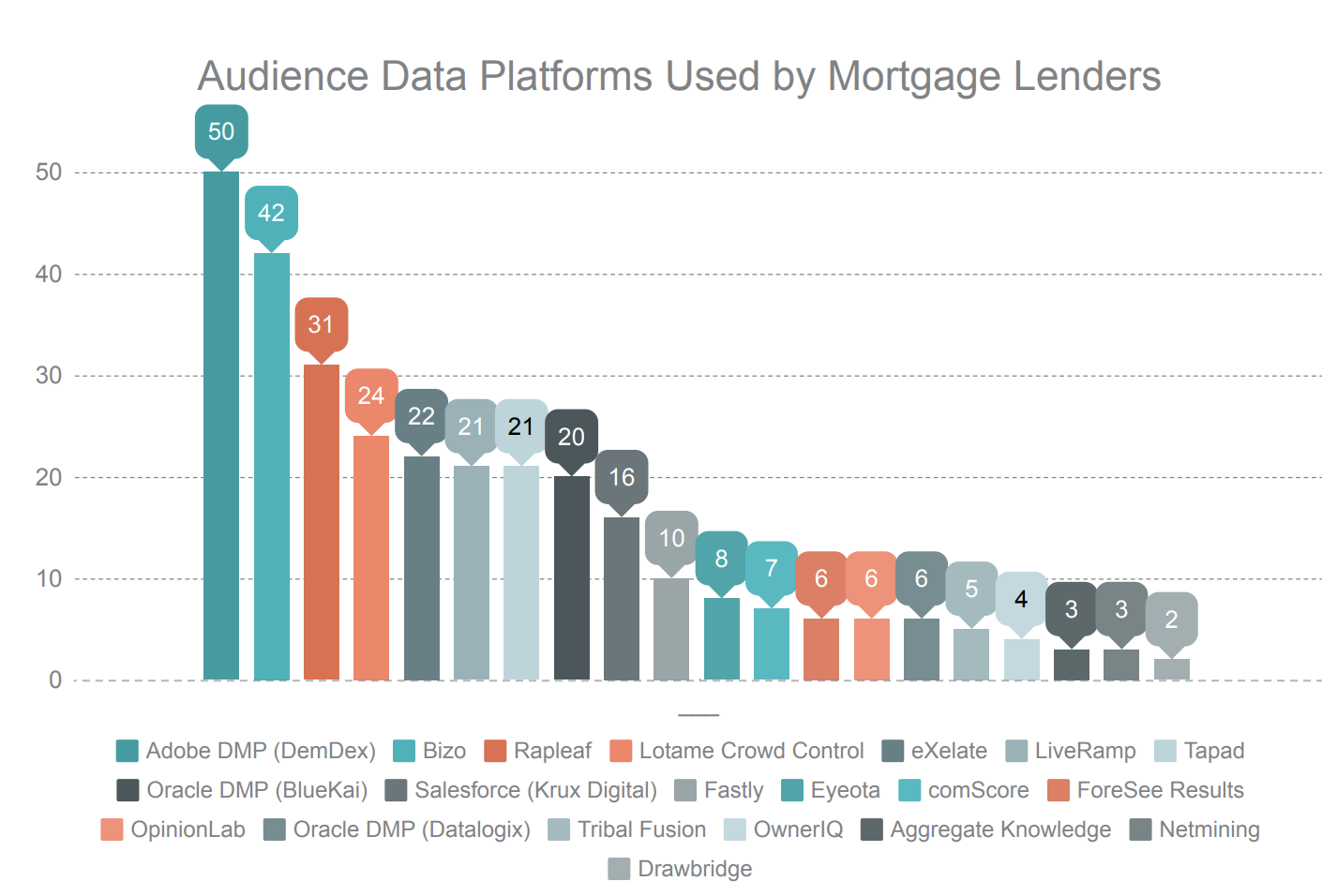

NestReady Study Finds Lenders Not Using Audience Data, Cross-Channel Marketing Platforms as Much as They Could

NestReady, a technology firm that develops platforms to put lenders at the center of the homebuying process, released its 2019 Marketing Technology Report. The report is based on a survey of the use of digital marketing technologies by mortgage lenders this year. NestReady surveyed 500 of the largest mortgage lenders in the U.S. about 350… Read more...

Regrets About Mortgages Don't Dim Millennials' Love for Their Homes

Younger homeowners more often say they rushed through the buying process and have regrets about their mortgage, likely resulting from the challenges young buyers face entering today's expensive housing market. Still, homeowners of all ages are, for the most part, happy with their home purchases, a recent Zillow® survey shows. The Zillow Housing Aspirations Report… Read more...

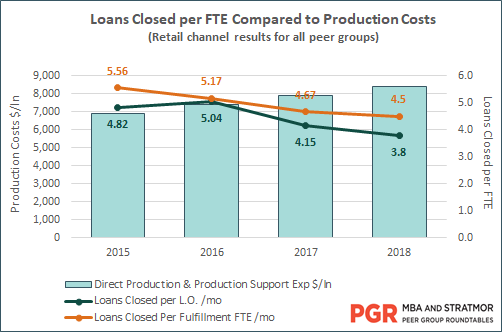

STRATMOR: Lenders Turn to Alternative Technologies as Loan Origination Costs Continue to Climb

As mortgage loan origination costs continue to climb, a growing number of mortgage lenders are starting to consider alternatives to the traditional loan origination system (LOS) deployment, mortgage advisory firm STRATMOR Group reports. The average cost to originate a loan now averages almost $9,000 and continues to rise, according to STRATMOR's May 2019 Insights Report,… Read more...

HAVE CHANGES IN FINANCING CONTRIBUTED TO THE LOSS OF LOW-COST RENTAL UNITS AND RENT INCREASES?

by Michael Reher, 2018 Meyer Fellow, Joint Center for Housing Studies of Harvard University. Over one-third of U.S. households rent their home and, since the Great Recession, rents for many of these households have grown faster than either inflation or renters’ wages. The years since the Great Recession have also seen record-high levels of residential… Read more...

Affordability Improves for the First Time Since 2016, According to First American Real House Price Index

First American Financial Corp released the March 2019 First American Real House Price Index (RHPI). The RHPI measures the price changes of single-family properties throughout the U.S. adjusted for the impact of income and interest rate changes on consumer house-buying power over time at national, state and metropolitan area levels. Because the RHPI adjusts for… Read more...More...

MOST READ STORIES

Fast,Easy & Free