OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

matt

Rates Rise, Reports Freddie Mac

- Thursday, 07 March 2019

Freddie Mac reported that mortgage rates rose after weeks of moderating, according to its “Primary Mortgage Market Survey.”

[caption id="attachment_9187" align="alignleft" width="241"] Sam Khater[/caption]

Sam Khater[/caption]

“While mortgage rates very modestly rose to 4.41 percent this week, they remain below year-ago levels for the fourth week in a row,” said Sam Khater, chief economist for Freddie Mac. “In late 2018, mortgage rates rose over a full percentage point from the prior year, which was one of the main reasons that weakness in home sales continued into early 2019. However, the impact of recent lower rates and a strong-labor market has led to a rise in purchase mortgage demand as we start the spring home-buying season.”

Other key takeaways are as follows:

- The 30-year fixed-rate mortgage averaged 4.41 percent with an average 0.5 point for the week ending March 7, 2019, up from last week when it averaged 4.35 percent. A year ago, the 30-year fixed-rate mortgage averaged 4.46 percent.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

- The 15-year fixed rate mortgage this week averaged 3.83 percent with an average 0.4 point, up from last week when it averaged 3.77 percent. A year ago, the 15-year fixed-rate mortgage averaged 3.94 percent.

- The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.87 percent with an average 0.3 point, up from last week when it averaged 3.84 percent. A year ago, the 5-year adjustable-rate mortgage averaged 3.63 percent.

.

Read more...

Mortgage Credit Availability Index Increases in February

- Thursday, 07 March 2019

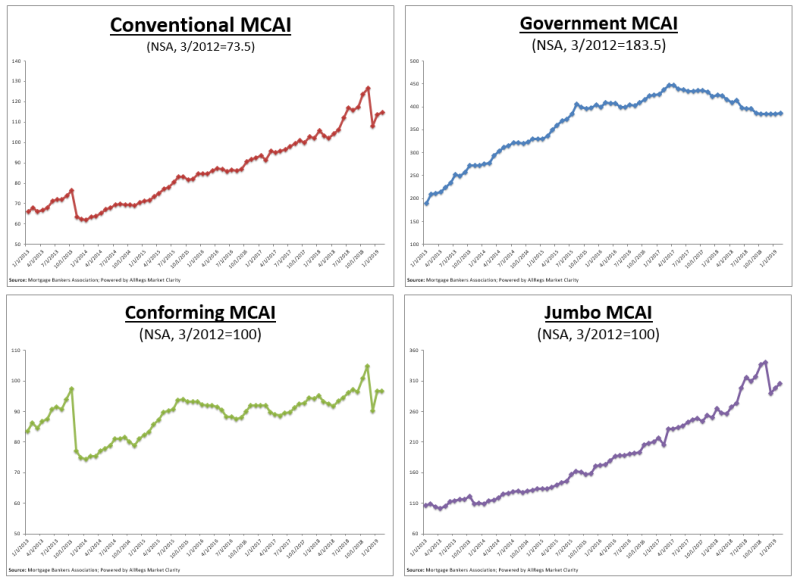

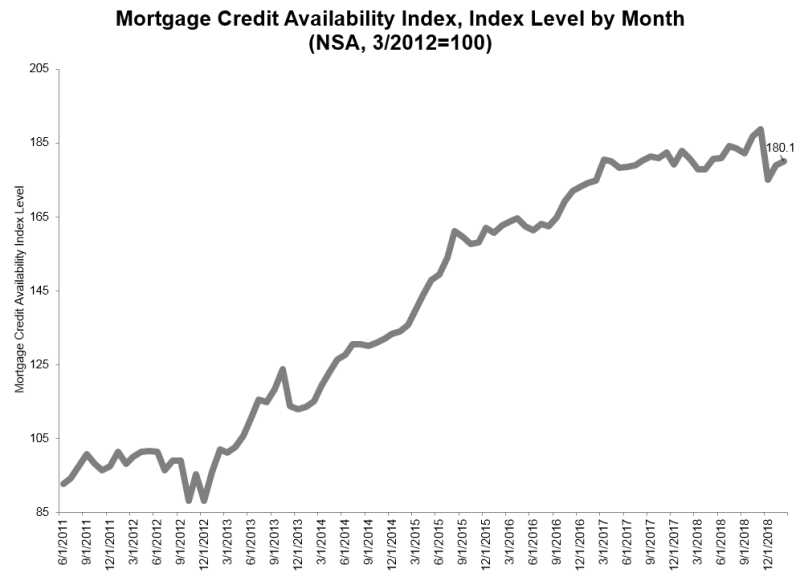

The Mortgage Credit Availability Index rose 0.6 percent to 180.1 in February, according to a report from the Mortgage Bankers Association that analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool.

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The Conventional MCAI increased 1.1 percent, while the Government MCAI increased slightly 0.1 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 2.2 percent while the Conforming MCAI decreased by 0.2 percent.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

“Credit availability increased in February as a result of new jumbo offerings brought to the market, both for agency jumbo and non-agency jumbo programs,” said Mike Fratantoni, MBA senior vice president and chief economist for the MBA. “We also saw some expansion in credit for borrowers with lower credit scores and higher LTVs, although credit availability for government programs remains tighter following the scaling back of VA refinance programs.”

“Credit availability increased in February as a result of new jumbo offerings brought to the market, both for agency jumbo and non-agency jumbo programs,” said Mike Fratantoni, MBA senior vice president and chief economist for the MBA. “We also saw some expansion in credit for borrowers with lower credit scores and higher LTVs, although credit availability for government programs remains tighter following the scaling back of VA refinance programs.”

The Conventional MCAI increased (1.1 percent), while the Government MCAI increased slightly (0.1 percent). Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 2.2 percent while the Conforming MCAI decreased by 0.2 percent.

Read more...LoanBeam Integrates with Freddie Mac’s Automated Underwriting System

- Tuesday, 05 March 2019

LoanBeam, a provider of automated income calculations from digital tax return data, that their technology was integrated with Freddie Mac's automated underwriting system. Loan Product Advisor's asset and income modeler for self-employed borrowers, along with LoanBeam's platform, can speed the loan-origination process for them.

"In today's competitive housing market, lenders rely on technology to help them stay competitive," said Sri Gajjala, chief product officer at LoanBeam. "We are proud that our fully integrated solution can help expedite the loan closing process."

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

In 2018, Freddie Mac introduced automated income capabilities, including LoanBeam's Qualified Income Calculator. LoanBeam's technology works seamlessly with Loan Product Advisor AIM for self-employed to promote automation, accuracy and consistency in the complex process of assessing income for self-employed borrowers during the underwriting process.

"Technology is advancing the housing industry in ways that can help all borrowers," said Rick Lang, vice president of loan advisor strategy and integration at Freddie Mac. "Our partnership with LoanBeam keeps Freddie Mac on the cutting edge of providing innovative solutions and the best service to lenders in the industry."

Read more...