OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

matt

CFPB Report: Some Servicers’ Late Fees Run Amok of Regs

- Tuesday, 12 March 2019

The Consumer Financial Protection Bureau examinations determined that mortgage servicers charged borrowers late fees greater than the amount permitted by their mortgage notes.

To be sure, examiners identified several types of affected mortgage notes. For example, certain Federal Housing Authority mortgage notes permit servicers to collect late fees in the amount of 4 percent of the overdue principal and interest, according to the “Supervisory Highlights Issue 18, Winter 2019” from the CFPB. In practice, however, servicers charged late fees that included taxes and insurance, not just principal and interest.

Provisions that limit the amount of late fees, weren’t adhered to. For example, certain West Virginia mortgage notes permit servicers to collect “5 percent of that portion of the installment of principal and interest that is overdue, but not more than $15.”

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

Nonetheless, on large numbers of loans, the servicer charged a late fee greater than that amount. Programming errors in the servicing platform and lapses in service-provider oversight caused the overcharges.

As a result, thousands of borrowers paid more than was required, making the aggregate injury substantial. The fees could not be avoided since the servicer automatically imposed the late fees. In response to the findings of the CFPB, servicers conducted a review to identify and remediate affected borrowers. Also, they changed policies and procedures to ensure the amount of late fees that were charged were authorized by the mortgage note.

In addition, the CFPB found a pattern of misrepresenting private mortgage insurance cancellation reasons. The Homeowners Protection Act requires servicers to cancel private mortgage insurance in connection with a residential mortgage transaction if certain conditions are met as follows:

Among other conditions, the borrower has to request the cancellation in writing, and the principal balance of the mortgage must have reached 80 percent of the original loan to value of the property based solely on actual payments. Or reached the date on which it was first scheduled to fall to 80 percent of the original value of the property, based solely on the amortization schedule in effect at a particular point in time depending on the loan type--regardless of the outstanding balance.

According to the CFPB, that’s not what happened.

Borrowers who verbally requested PMI cancellation were informed that they were declined because they had not reached 80 percent loan to value. Although the relevant amortization schedules did not yet provide for 80 percent loan to value, examiners found that these borrowers had in fact reached that threshold--based on actual payments because they had made extra principal payments.

Although the borrowers did not satisfy other criteria necessary to trigger borrower initiated cancellation rights under the HPA, such as certifying that the property is unencumbered by subordinate liens or submitting the requests in writing, those reasons weren’t communicated to borrowers to explain denials.

To be sure, communications from servicers misled consumers about whether and when the HPA entitled them to request that the servicer cancel PMI, and about the actual reasons the borrowers were not eligible for PMI cancellation.

It would be reasonable for consumers to believe that they were not eligible for PMI cancellation for the reasons stated in the letters because most consumers would not have a basis to question the misrepresentations, according to the CFPB report. A consumer might think that she had miscalculated payments such that she had not yet reached 80 percent LTV or had misunderstood some other aspect of meeting the LTV requirement.

Last, the servicers’ misrepresentations were material because they were likely to affect a borrower’s choice as to whether to continue to request PMI cancellation, including whether to address the actual, uncommunicated reasons for ineligibility. For instance, borrowers receiving the incorrect denial reason may fail to address other eligibility requirements to obtain a cancellation.

They might be discouraged from requesting PMI cancellation in some circumstances in which federal law, or the servicer’s policies, would give them a right to cancel PMI. In response to examiners’ findings, servicers have changed their templates, as well as policies and procedures, to ensure that PMI cancellation notices state accurate denial reasons.

Read more...

Gap Between Appraiser Opinions, Homeowner Perception of Value Widens: Quicken

- Tuesday, 12 March 2019

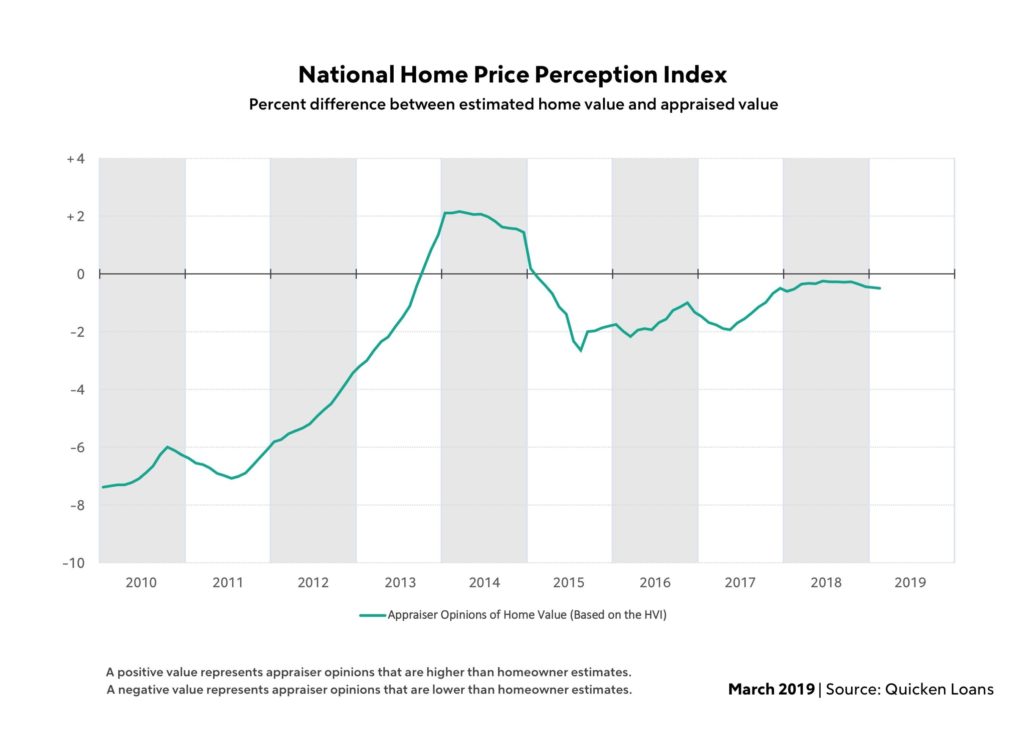

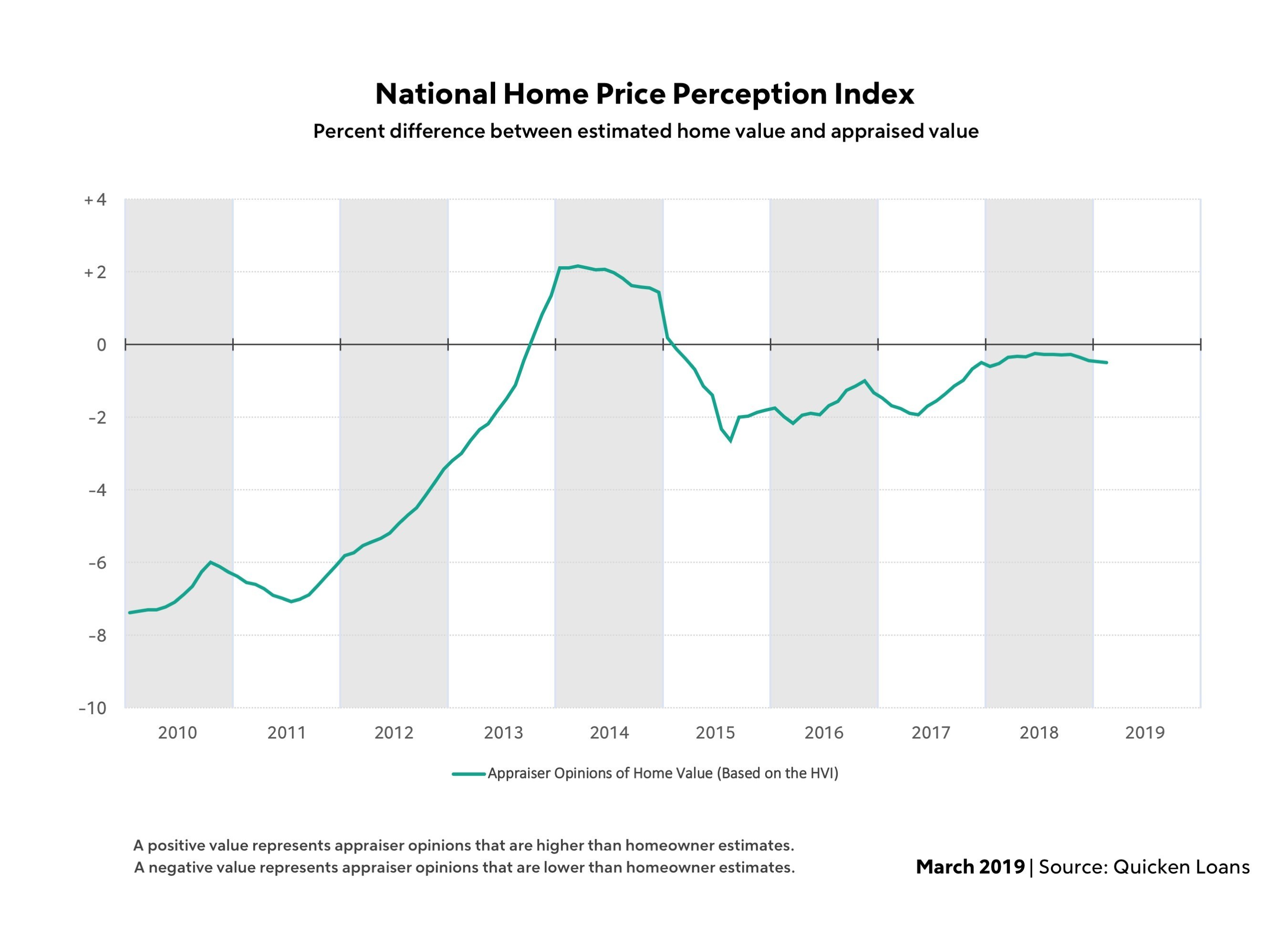

February marks the fourth consecutive month the gap between owner estimates and appraiser opinions of home value has widened, though the difference remains small at a national level.

Appraisal values in February were an average of 0.5 percent lower than what homeowners expected, according to the National Quicken Loans Home Price Perception Index. Home-value perception continues to vary at a metro level but remains in a tight band. Of the metro areas that had average appraisals lower than expected, none of them were more than 2 percent lower than the owner's estimate.

At the other side of the spectrum, Boston is the outlier with the average appraisal 2.51 percent higher than what the homeowner expected—potentially adding more than $11,000 in equity based on local median home prices.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

Charlotte follows closely behind, surprising the average homeowner with an appraisal 2.10 percent higher than what they estimated. In total, 62 percent of the metro areas are reporting average appraisals higher than expected.

"Even though the home value perceptions are declining at a national level, the majority of metro areas are getting appraisals at, or above, what the homeowner expected," said Bill Banfield, executive vice president of capital markets at Quicken Loans. "This is particularly exciting news at a time when we are seeing heightened interest in cash out refinances. More and more, owners are choosing to invest in their home by making improvements instead of moving. If appraisals are higher than expected, an owner could find it more [affordable] to do the home improvements they always had in the back of their mind."

Home values were practically frozen in the height of winter. The National Quicken Loans Home Value Index, which measures of home value changes based on appraisals, reported the average appraisal increased a mere 0.05 percent in February. Annual growth continues to be strong, with year-over-year growth of 5.47 percent--increasing at a higher clip than in January.

The regional appraisal changes are mixed.

No region saw appraisal values swinging more than half a percent in either direction. Appraisals were an average of 0.33 in the West and 0.50 in the Northeast. However, values dipped 0.25 in the Midwest and 0.56 percent in the South. On the other hand, all regions have year-over-year growth in common, from a 3.72 percent increase in the Midwest, to a 5.60 percent jump in the West.

"Home values are still making modest annual gains, despite being practically stagnant when measured monthly. What everyone has their eye on is what will happen as the spring selling season kicks off," said Banfield. "Home prices, and in turn home values, are mostly driven by the balance of how many homes are on the market and the volume of buyers vying for them. Most of the industry is expecting the demand will remain high, like in years past, but what remains to be seen is how many owners will choose to list their home, creating availability for both first time and move up buyers."

Read more...First United Reports Net Income of $10.7M for 2018

- Sunday, 10 March 2019

First United Corp. reported consolidated net income available was $10.7 million for the year ended Dec. 31, 2018, compared to $4.1 million for 2017. First United is a holding company and the parent company of First United Bank & Trust.

Basic and diluted net income per common share for the year ended Dec. 31, 2018 were $1.51, compared to $0.58 in 2017. The increase in earnings for 2018 was attributable to a $4.6 million increase in net-interest income, an increase of $0.7 million in other operating income, exclusive of gains, a $0.4 million decrease in provision expense, and a $4.2 million decrease in income-tax expense

"During 2018 we delivered improved core earnings, a higher net interest margin, and enhanced earnings per common share,” said Carissa Rodeheaver, chairman, president and CEO. “We were pleased to have positive loan growth, resulting in growth in our total assets. In 2019, we will continue our focus on growing our loan portfolio, growing core deposits, increasing fee income and becoming a more efficient organization."

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

Comparing Dec. 31, 2018 to Dec. 31, 2017, loans outstanding increased by $115.2 million. Commercial real-estate loans increased by $23.7 million due to several new clients in 2018.

Residential mortgage loans increased $38.3 million due to the purchase of a $15 million mortgage pool in the first quarter of 2018 as well as production in the professional's program. Growth occurred in both fixed and adjustable products.

At Dec. 31, 2018 and 2017, 27% and 28%, respectively, of the commercial loan portfolio was collateralized by real estate.

Adjustable interest rate loans made up 52% of loans at Dec. 31, 2018 and 58% at Dec. 31, 2017, with the balance being fixed–interest rate loans as customer preference shifted to fixed-rate products in the rising-rate environment. Residential mortgage loans had a net charge-off ratio of 0.01% at Dec. 31, 2018, compared to a net recovery ratio of 0.01% as of Dec. 31, 2017, and the consumer loan charge-off ratios were 0.95% and 0.53% for Dec. 31, 2018 and Dec. 31, 2017, respectively.

Read more...