-

The Rise of Green Lending in the Commercial Real Estate Market Explore the rise of green lending in the commercial real estate market and its impact on sustainable development, property values, and financial institutions' strategies.

The Rise of Green Lending in the Commercial Real Estate Market Explore the rise of green lending in the commercial real estate market and its impact on sustainable development, property values, and financial institutions' strategies.

matt

Stewart, Fidelity 'Disagree' with New York Regulator’s Disapproval Notice on Merger

- Thursday, 14 February 2019

Stewart Information Services Corp. has reported consolidated pretax income of $19.7 million in the fourth quarter of 2018, compared to $17.5 million in the same period a year earlier.

The title business generated pretax income of $29.5 million in the fourth quarter of 2018, compared to $27.0 million in the same period a year earlier. Also, pretax margin improved 120 basis points in fourth quarter of 2018 over the prior year quarter.

Commercial fee income increased 3 percent a file and domestic residential fee income a file increased 11 percent compared to fourth quarter of 2017. Stewart reported net income of $11.4 million for the fourth quarter 2018, compared to net income of $15.1 million for the fourth-quarter of 2017.

A $3 million expense for a third-party to advise on the Fidelity National Financial merger was taken in the fourth quarter of 2018, compared to $2.9 million in the same period one year earlier. And Stewart is continuing to work on the regulatory process with Fidelity National to satisfy the regulatory requirements for closing a merger, including those of the Federal Trade Commission, the Texas Department of Insurance and the New York State Department of Financial Services.

[adbutler zone_id="326325"]

[adbutler zone_id="326327"]

As previously disclosed, on Jan. 31, 2019, the NYDFS provided written notice of its disapproval of Fidelity National's application to acquire control of Stewart Title Insurance Co., Stewart’s New York domiciled title insurance underwriter.

The companies are discussing the notice with NYDFS and seek to resolve the regulators concerns, with which Stewart and Fidelity National “respectfully disagree,” according to the fourth quarter earnings report from Stewart.

Title operating revenues in the fourth quarter of 2018 decreased 10 percent compared to the prior year quarter as direct title, decreased 7 percent, and independent agency revenues decreased 12 percent.

Non-commercial domestic revenues for the fourth quarter are revenues from purchase transactions, which decreased $5 million, and centralized title operations, processing primarily refinancing and default title orders, declined $5.7 million compared to the fourth quarter of 2017. These declines were due to the lower purchase and refinancing closed orders, which decreased 16 percent in the fourth quarter 2018 compared to the prior year quarter.

Fourth quarter 2018 commercial revenues decreased $5.9 million, or 8 percent, compared to the fourth quarter 2017. Fourth quarter 2018 commercial fee for each file increased 3 percent to around $10,300 due to increased transaction sizes, while the domestic residential fee for each file increased 11 percent to around $2,300 because of the switch to a mortgage purchase market.

Commercial and domestic residential fees per file for the full year 2018 increased to $8,600 (22 percent) and $2,200 (8 percent), respectively, compared to last year. Gross revenues from independent agency operations declined 12 percent in the fourth quarter 2018, as compared to last year's quarter, due to reduced activity in high-volume states, which include New York, Texas, Florida and California.

Read more...Black Knight Revenues Rise 6%; Loan Origination Solution up 35%

- Wednesday, 13 February 2019

Black Knight reported that its revenues for the year ended Dec. 31, 2018, increased 6 percent to $1,114.0 million, compared to $1,051.6 million in 2017. Earnings for the same time period were $168.5 million, or $1.14 per share, compared to $182.3 million, or $1.47 per diluted share, in 2017.

In the fourth quarter, revenues from the software solutions business increased 6% to $245.8 million.

Servicing software solutions generated revenue growth of 7% due to strong loan growth in the core servicing software platform from new and existing clients, higher average revenue per loan and new client wins.

Origination software revenue increased 4 percent, driven by 35 percent growth in the results of loan origination solution, which were negated by lower volumes on the exchange and eLending platforms, reflecting a 40 percent decline in refinancing activity, according to the Mortgage Bankers Association.

Black Knight has migrated PNC, Fifth Third, Navy Federal Credit Union and Santander Bank onto the Empower loan origination system. Also, around a year ago, JPMorgan Chase and CitiMortgage licensed Empower.

[caption id="attachment_9954" align="alignright" width="182"] Anthony Jabbour[/caption]

Anthony Jabbour[/caption]

“I'm thrilled to say that we completed the implementation for both JPMorgan Chase and CitiMortgage onto Empower in less than a year,” said Anthony Jabbour, chief executive officer for Black Knight, who was speaking at the firm’s quarterly earnings call with analysts. “We worked [with] our clients to achieve these expedited timelines and are continually focused on improving our implementation process.”

JPMorgan Chase, Union Bank and Santander will deploy the home equity capability that Empower offers.

Data and Analytics revenues for the fourth quarter of 2018 increased 7 percent to $39.8 million, compared to $37.2 million in the prior year quarter driven by increases in portfolio analytics and multiple listing service businesses.

On the servicing side, Black Knight added more than million loans to the Loan Sphere mortgage servicing platform through implementation, such as KeyBank, FirstBank, Old National and Lake Michigan Credit Union.

Home equity loans comprised 19 percent of loans on the mortgage servicing platform at year-end, up from 13 percent a year earlier. Commerce Bank, a client for more than 30 years, extended its use of the MSP to home equity loans and home equity lines of credit and KeyBank and Regions will implement the home equity capability that the platform offers. Black Knight inked a multi-year renewal deal with Quicken Loans and the signing of ServiceMac as an MSP client.

On the digital mortgage side, in 2018 Black Knight unveiled Servicing Digital, which gives customers the ability to perform tasks and find information related to their mortgages. “We've signed eight clients since the launch of Servicing Digital last summer, including two of our top five clients,” said Jabbour, who says more announcements are imminent.

Other new digital products include Artificial Intelligence Virtual Assistant, Actionable Intelligence Platform and Rapid Analytics Platform were designed to increase efficiency.

“We believe that our growing collection of innovative solutions will help us expand our market share because they help our clients grow revenue and reduce the overall cost to originate and service loan,” said Jabbour.

One benefit is that these complementary products have a shorter, easier sales and implementation cycle, and that was the case with Amerifirst who was signed and was live in 2018 on the Servicing Digital capability—which means revenue will be generated sooner.

So far, these products generate a small percentage of the—though they’re a long-term play for the company.

“We certainly are expecting, we've signed a few clients and we expect to see revenue from them in 2019,” said Kirk Larsen, chief financial officer. “They'll each contribute to revenue in 2019, but I would say it's still on a relatively small basis, but we'll grow overtime and then the other are also in the earlier stages.”

Read more...Delinquency Performance Improving: Corelogic

- Wednesday, 13 February 2019

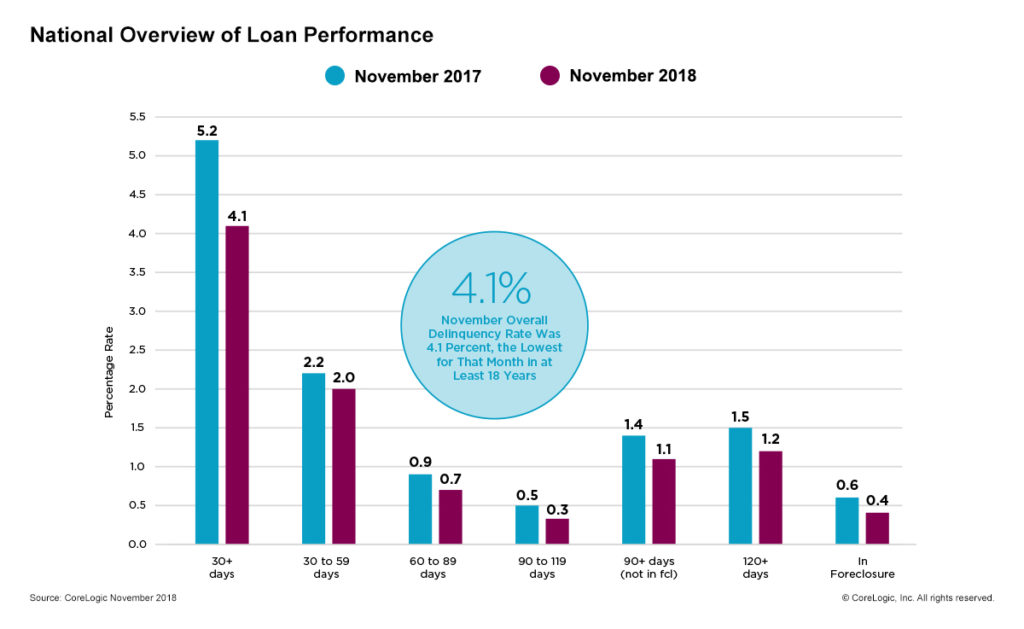

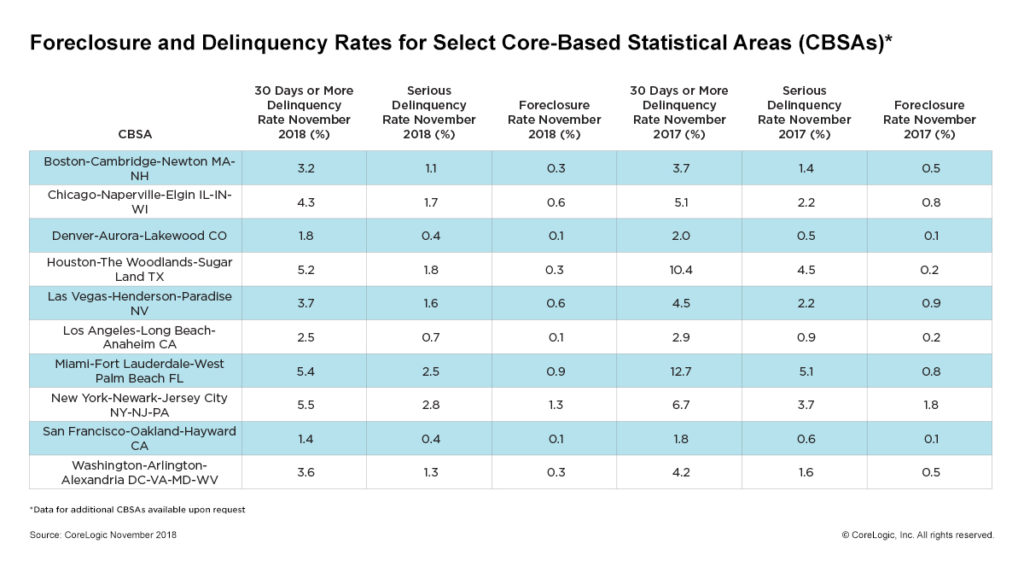

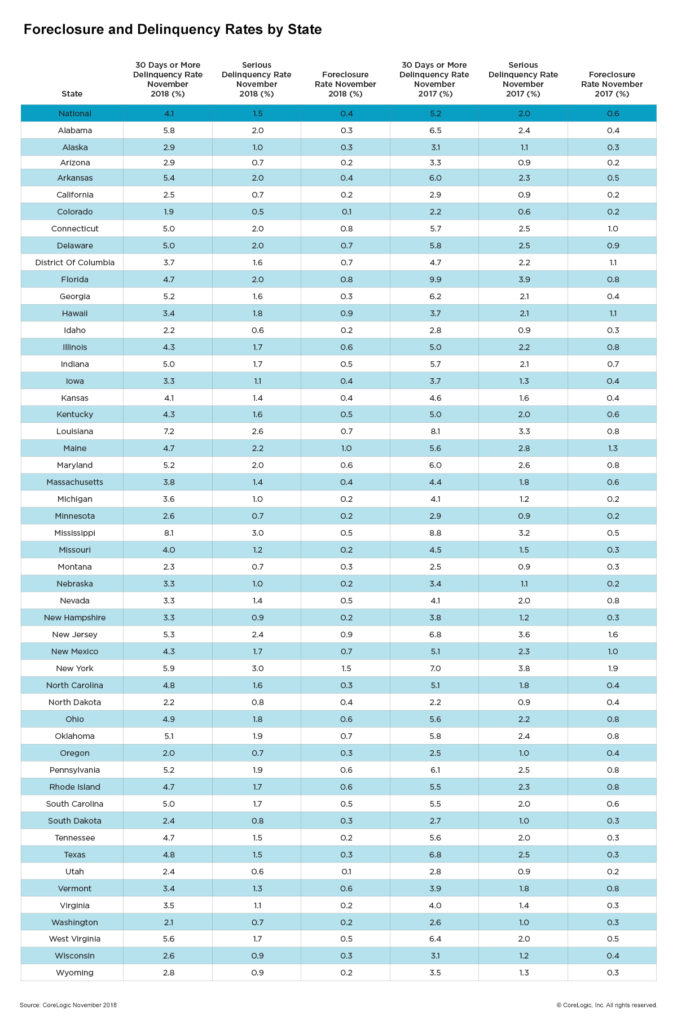

The percentage of mortgages that were in delinquency fell to 4.1 percent in November 2018, compared with the same time period a year earlier, when the rate stood at 5.2 percent, according to the “Loan Performance Insights Report” from Corelogic.

As of November 2018, the foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, was 0.4 percent, down 0.2 percentage points from November 2017. The November 2018 foreclosure inventory rate was the lowest for any month since at least January 2000.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To monitor mortgage performance comprehensively, CoreLogic examines all stages of delinquency, as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

The rate for early-stage delinquencies, defined as 30 to 59 days past due, was 2 percent in November 2018, down from 2.2 percent in November 2017. The share of mortgages that were 60 to 89 days past due in November 2018 was 0.7 percent, down from 0.9 percent in November 2017.

The rate for early-stage delinquencies, defined as 30 to 59 days past due, was 2 percent in November 2018, down from 2.2 percent in November 2017. The share of mortgages that were 60 to 89 days past due in November 2018 was 0.7 percent, down from 0.9 percent in November 2017.

The serious delinquency rate, defined as 90 days or more past due, including loans in foreclosure, was 1.5 percent in November 2018, down from 2 percent in November 2017. November 2018 marked the lowest serious delinquency rate for the month since 2006 when it was also 1.5 percent. It ties with August, September and October 2018 as the lowest for any month since March 2007 when it was also 1.5 percent.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 0.9 percent in November 2018, down from 1 percent in November 2017. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent, while it peaked in November 2008 at 2 percent.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 0.9 percent in November 2018, down from 1 percent in November 2017. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent, while it peaked in November 2008 at 2 percent.

“Solid income growth, a record amount of home equity and an absence of high-risk loan products put the U.S. homeowner on solid ground,” said Dr. Frank Nothaft, chief economist for CoreLogic. “All of this has helped push delinquency and foreclosure rates to the lowest levels in almost two decades and will provide a cushion if the housing market should turn down.

The nation's overall delinquency rate has fallen on a year-over-year basis for the past 11 consecutive months. However, loan vulnerability in several metropolitan areas in North Carolina are still struggling from Hurricane Florence. In November 2018, seven metropolitan areas logged an increase in their serious delinquency rates, with the largest gains occurring in the Wilmington and New Bern metropolitan areas.

“On a national basis, we continue to see strong loan performance,” said Frank Martell, president and CEO of CoreLogic. “Areas that were impacted by hurricanes or wildfires in 2018 are now seeing relatively large annual gains in the share of mortgages moving into 30-day delinquency. As with previous disasters, this is to be expected and we will see the impacts dissipate over time.”

Read more...