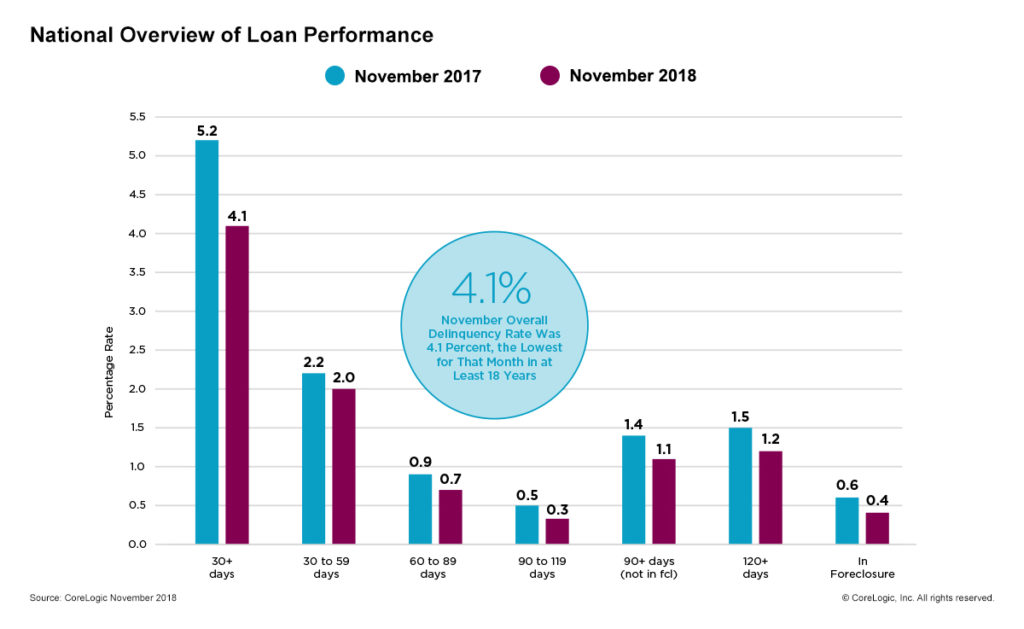

The percentage of mortgages that were in delinquency fell to 4.1 percent in November 2018, compared with the same time period a year earlier, when the rate stood at 5.2 percent, according to the “Loan Performance Insights Report” from Corelogic.

As of November 2018, the foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, was 0.4 percent, down 0.2 percentage points from November 2017. The November 2018 foreclosure inventory rate was the lowest for any month since at least January 2000.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To monitor mortgage performance comprehensively, CoreLogic examines all stages of delinquency, as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

The rate for early-stage delinquencies, defined as 30 to 59 days past due, was 2 percent in November 2018, down from 2.2 percent in November 2017. The share of mortgages that were 60 to 89 days past due in November 2018 was 0.7 percent, down from 0.9 percent in November 2017.

The rate for early-stage delinquencies, defined as 30 to 59 days past due, was 2 percent in November 2018, down from 2.2 percent in November 2017. The share of mortgages that were 60 to 89 days past due in November 2018 was 0.7 percent, down from 0.9 percent in November 2017.

The serious delinquency rate, defined as 90 days or more past due, including loans in foreclosure, was 1.5 percent in November 2018, down from 2 percent in November 2017. November 2018 marked the lowest serious delinquency rate for the month since 2006 when it was also 1.5 percent. It ties with August, September and October 2018 as the lowest for any month since March 2007 when it was also 1.5 percent.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 0.9 percent in November 2018, down from 1 percent in November 2017. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent, while it peaked in November 2008 at 2 percent.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 0.9 percent in November 2018, down from 1 percent in November 2017. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent, while it peaked in November 2008 at 2 percent.

“Solid income growth, a record amount of home equity and an absence of high-risk loan products put the U.S. homeowner on solid ground,” said Dr. Frank Nothaft, chief economist for CoreLogic. “All of this has helped push delinquency and foreclosure rates to the lowest levels in almost two decades and will provide a cushion if the housing market should turn down.

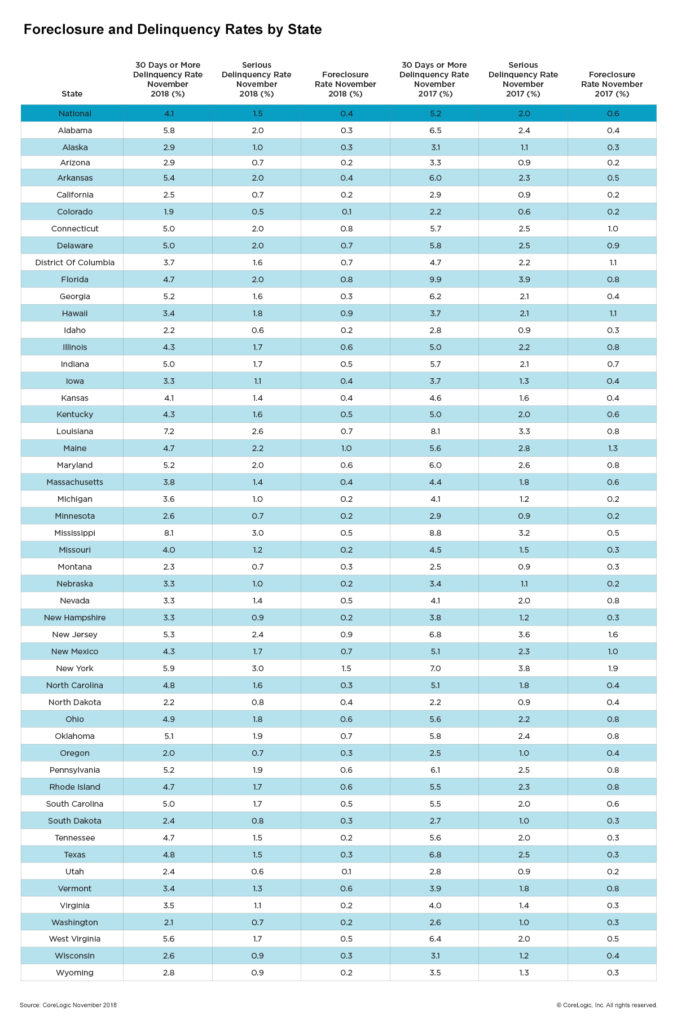

The nation's overall delinquency rate has fallen on a year-over-year basis for the past 11 consecutive months. However, loan vulnerability in several metropolitan areas in North Carolina are still struggling from Hurricane Florence. In November 2018, seven metropolitan areas logged an increase in their serious delinquency rates, with the largest gains occurring in the Wilmington and New Bern metropolitan areas.

“On a national basis, we continue to see strong loan performance,” said Frank Martell, president and CEO of CoreLogic. “Areas that were impacted by hurricanes or wildfires in 2018 are now seeing relatively large annual gains in the share of mortgages moving into 30-day delinquency. As with previous disasters, this is to be expected and we will see the impacts dissipate over time.”