-

The Rise of Green Lending in the Commercial Real Estate Market Explore the rise of green lending in the commercial real estate market and its impact on sustainable development, property values, and financial institutions' strategies.

The Rise of Green Lending in the Commercial Real Estate Market Explore the rise of green lending in the commercial real estate market and its impact on sustainable development, property values, and financial institutions' strategies.

matt

Nierenberg: NewRez to Originate Around $15B in 2019, Twice 2018's Volume

- Thursday, 21 February 2019

The volume of originations NewRez has targeted for 2019 is around $15 billion, double the $7.2 billion in originations the company completed in 2018. NewRez, formerly New Penn, is a subsidiary of New Residential Investment Corp.

“As we look at 2019, a lot of that [growth] has to do with our own recapture and some growth around some different divisions of the origination business,” said Michael Nierenberg, CEO of New Residential, during the company’s quarterly earnings call. The company distributed documentation prior to the call that projected 2019 origination volume of $10 billion to $15 billion.

For instance, non-quality mortgage origination volume increased to $380 million in the fourth quarter of 2018, from $20 million in the first quarter of 2018. “We've continued to be very excited about that business,” said Nierenberg. “And, you’ll see more and more issuance from us as we go forward.”

NewRez added 100 employees in 2018, for a total of 130, and a 300 percent increase since the start of the year, to handle the mortgage servicing recapture business.

The aim is to maintain the portfolio “to have somebody be able to call a mortgage customer and offer a suite of services under the NewRez name,” said Nierenberg. “We have a number of different folks working on different parts of that whether it would be the MSR portfolio and the net interest income generated from that, the ancillary services side, the origination side or the servicing side from a revenue stream that way.”

Last year, mortgage rates rose 56 basis points, and mortgage servicing rights increased in value. As rates rise prepayment slowdowns, the value of the asset goes up.

So mortgage servicing rights went up quite a bit. The share of mortgages eligible for refinancing dropped to 9 percent, from 29 percent, though New Residential’s “portfolio is even lower than that because we have some credit impaired assets on our balance sheet,” said Nierenberg.

“We have three million customers whether we own the full MSR or the excess MSR,” said Nierenberg. “Our goal is to keep that cash flow going for as long as possible and try to maintain 15 percent to 20 percent return on equity on that MSR asset. The more recapture we do around that asset the better it's going to be for our company and our shareholders.”

Read more...Construction Starts Rise 2%

- Friday, 22 February 2019

The value of new construction starts in January advanced 2% compared to December, reaching a seasonally adjusted annual rate of $722.5 billion, according to Dodge Data & Analytics.

The slight gain followed the loss of momentum that was reported toward year-end 2018, with

[caption id="attachment_5116" align="alignleft" width="319"] Robert Murray, chief economist for Dodge Data[/caption]

Robert Murray, chief economist for Dodge Data[/caption]

construction declines of 7% in November and 10% in December. Each of the three main construction sectors in January registered modest growth.

Each of the three main construction sectors in January registered modest growth. Residential building climbed 4%, lifted by a rebound for multifamily housing. Nonresidential building edged up 1%, reflecting a stronger pace for its commercial building segment including large office projects in Reston, V.a., Houston, Boston, Austin, Texas, and Seattle.

Nonbuilding construction edged up 1%, helped by the start of a $1.0 billion natural gas pipeline in Oklahoma and several large electric utility projects. On an unadjusted basis, total construction starts in January were $51.5 billion, down 12% from the same month a year ago.

The January statistics produced a reading of 153 for the Dodge Index (2000=100), compared to December’s 150.

“January’s slight increase suggests that construction starts are beginning to stabilize after the diminished activity reported at the end of last year,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “This is consistent with the belief that total construction starts for 2019 will be able to stay close to last year’s volume. It’s true that the rate of growth for total construction starts has subsided from the 7% annual gain reported back in 2017, but it’s still too early to say that construction activity has made the transition from deceleration to decline.”

| [adbutler zone_id="326314"] |

| [adbutler zone_id="326316"] |

Residential building in January was $309.8 billion (annual rate), up 4% and rebounding from its 9% slide in December. Multifamily housing bounced back 14% following its 15% December decline, and was up 1% compared to its average monthly pace during 2018. There were five multifamily projects valued at $100 million or more that reached groundbreaking in January, compared to four such projects in December.

The large January multifamily projects were led by the $150 million Watermark at Brooklyn Heights senior apartments in Brooklyn, N.Y., the $146 million multifamily portion of a $250 million mixed-use complex in Washington, D.C., and a $128 million multifamily complex in Oakland CA. The top-five metropolitan areas ranked by the dollar amount of new multifamily starts in January were--New York, Washington D.C., Boston, San Francisco, and Charlotte, N.C.

Single family housing in January was unchanged from the reduced dollar amount reported for December, which itself was down 6% from November. January’s rate of activity for single family housing was down 7% from the average monthly pace reported during 2018. By major region, single-family housing performed as follows in January compared to December--the West, up 3%; the South Central, up 2%; the South Atlantic, unchanged; the Northeast, down 3%; and the Midwest, down 9%.

Construction starts for the most recent twelve months held steady with the amount of the previous twelve months. Residential building advanced 4% compared to the previous period, with multifamily housing up 7%, and single-family housing up 3%.

Read more...

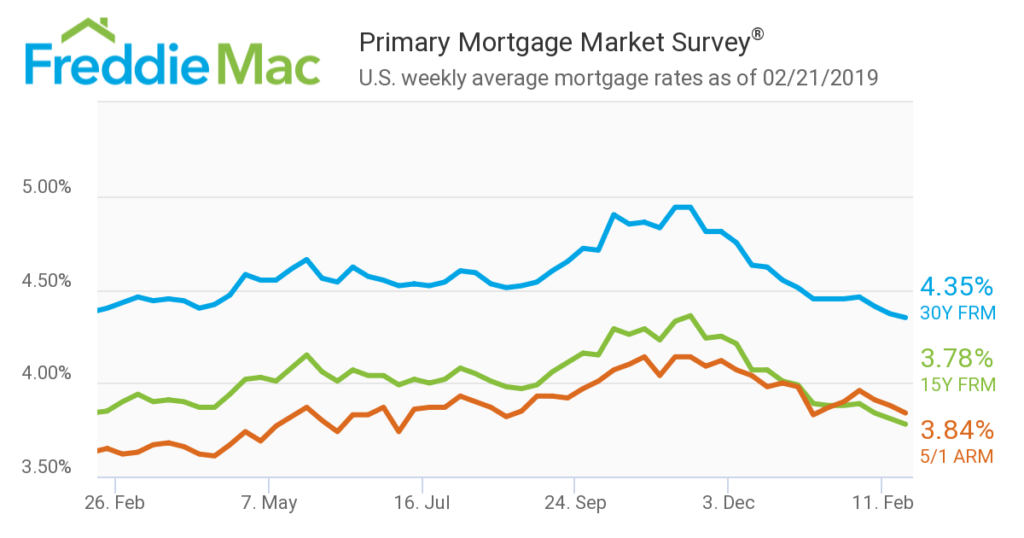

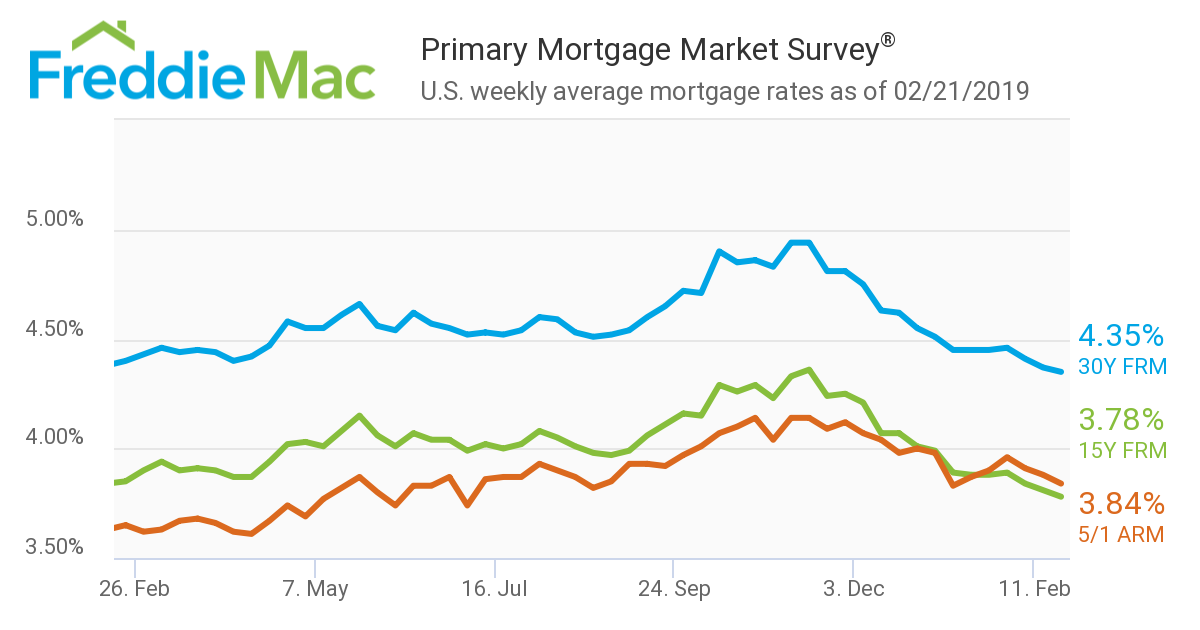

Mortgages Rates Continue Dropping

- Wednesday, 20 February 2019

Mortgages rates continue to drop, according to Primary Mortgage Market Survey from Freddie Mac.

“Mortgage rates fell for the third consecutive week, continuing the general downward trend that began late last year,” said Sam Khater, Freddie Mac’s chief economist. “Wages are growing on par with home prices for the first time in years, and with more inventory available, spring home sales should help the market begin to recover from the malaise of the last few months.”

- The 30-year fixed-rate mortgage averaged 4.35 percent with an average 0.5 point for the week ending Feb. 21, 2019, down from last week when it averaged 4.37 percent. A year ago, the 30-year fixed-rate mortgage averaged 4.40 percent.

- The 15-year fixed rate mortgage this week averaged 3.78 percent with an average 0.4 point, down from last week when it averaged 3.81 percent. A year ago, the 15-year fixed-rate mortgage averaged 3.85 percent.

- The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.84 percent with an average 0.3 point, down from last week when it averaged 3.88 percent. A year ago, the 5-year adjustable-rate mortgage averaged 3.65 percent.

Average commitment rates are reported along with average fees and points to reflect the upfront cost of obtaining the mortgage.

Read more...