-

The Rise of Green Lending in the Commercial Real Estate Market Explore the rise of green lending in the commercial real estate market and its impact on sustainable development, property values, and financial institutions' strategies.

The Rise of Green Lending in the Commercial Real Estate Market Explore the rise of green lending in the commercial real estate market and its impact on sustainable development, property values, and financial institutions' strategies.

matt

Black Knight Deploys Big-Data Platform

- Wednesday, 06 February 2019

Black Knight has launched the Rapid Analytics Platform, an interactive virtual analytics lab where users can source and upload data, execute queries, perform complex analytics and train machine-learning models, from a single workspace.

A cloud-based platform for working with big data, RAP features a unique, advanced workspace environment offering a dynamic mix of traditional analytics, machine learning and neural networks that help users create data-driven solutions and actionable analytic outputs.

RAP provides users with access to all of Black Knight’s diverse, comprehensive data assets, advanced analytics and pre-built queries and analytic models, while also allowing them to easily join their own data to tailor queries and models to support specific use cases.

RAP’s real-time, high-speed processing delivers instant results, enabling mortgage and capital markets professionals to work with complex data sets and advanced analytics.

Users have access to nationwide assessor data, recorder data and real-estate property and sales data; loan-level and historical mortgage data; automated valuation models; and home price indices. RAP has a vast analytics library that enables users to solve many challenges specific to the mortgage, real estate and capital markets industries.

The technology “was designed for the mortgage and capital markets industries and can be used out of the box, on day one, to support virtually endless possibilities,” said Anthony Jabbour, Black Knight’s CEO. It was designed with “computational power an order of magnitude greater than what most firms have in-house, and enables data scientists and analysts to deliver faster insights and help their companies enhance performance, identify new revenue opportunities, increase efficiencies, and reduce risk.”

“As a big-data incubator, there is simply nothing else like RAP on the market, particularly for those who focus on housing-related assets, whether it’s the mortgage industry, capital markets, or any of the fields adjacent to those,” said Ben Graboske, president of the data and analytics department of Black Knight. “The speed with which analysts and data scientists can now explore multiple scenarios, see results, change parameters and run whole scenarios again is unparalleled.”

Read more...

Mortgage Credit Availability Rose In January: MBA

- Thursday, 07 February 2019

Mortgage credit availability increased in January according to the Mortgage Credit Availability Index, a report from the Mortgage Bankers Association.

The MCAI rose 2.3 percent to 179.0 in January. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI increased (4.9 percent), while the Government MCAI was unchanged. Of the component indices of the Conventional MCAI, the Conforming MCAI increased by 7.3 percent, and the Jumbo MCAI increased by 3.0 percent. The report analyzes data from Ellie Mae’s AllRegs.

[caption id="attachment_9373" align="alignleft" width="144"] Joel Kan[/caption]

Joel Kan[/caption]

“There was an increase in the supply of mortgage credit in January, which was a reversal from the December pullback that was caused by the end of the Home Affordable Refinance Program and a reduction in jumbo offerings,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “Last month, investors and lenders added more programs to cater to lower credit score borrowers, in addition to new relief refinance programs. These relief refinance programs are not a direct replacement for HARP but do serve a similar purpose to assist borrowers who may have run into financial challenges.”

The MCAI increased 2.3 percent to 179.0 in January. The Conventional MCAI increased (4.9 percent), and the Government MCAI was unchanged. Of the component indices of the Conventional MCAI, the Conforming MCAI increased by 7.3 percent, and the Jumbo MCAI increased by 3.0 percent.

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index.

The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs.

The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

Read more...

Seniors Opt to Stay in Homes Longer, Leaving Slim Pickings for Buyers

- Tuesday, 05 February 2019

Seniors who were born after 1931are less likely to sell their homes than were previous generations—and it’s a significant cause of the housing shortage, according to the “February Insight” report from Freddie Mac.

The result is around 1.6 million houses weren’t for sale through 2018, representing about one year’s supply of new construction, or more than 50 percent of the shortfall of 2.5 million housing units—that the market faces. The scarcity factor serves to increase housing prices and make renting more attractive to younger generations. However, a shortfall of new construction increases house prices and rental rates.

“We believe the additional demand for homeownership from seniors aging in place will increase the relative price of owning versus renting, making renting more attractive to younger generations,” said Sam Khater, chief economist at Freddie Mac. “This further highlights the importance of addressing barriers to the production of new housing supply to help accommodate long-term housing demand.”

Improved health and higher levels of education are causes of the trend. And it’s likely to increase over time as improvements in health care and technology make aging in place easier. For example, the capability to Skype with a doctor.

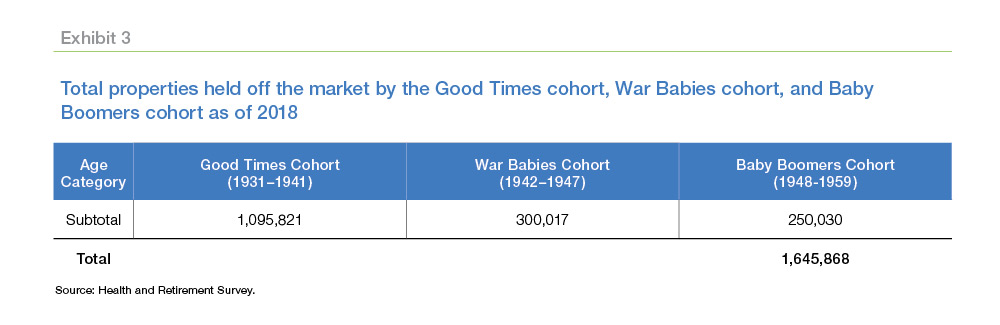

Exhibit 1 displays the homeownership rates for seniors aged 67 to 85 for two cohorts. The first is the “Good Times” cohort, who were born during the bad times between 1931 and 1941, though they have received the advantages of good times through their lifetime.

The second cohort includes the previous generations for which data are available in the Health and Retirement Survey as of 2014: Those born before 1924 and the “children of the Depression” born between 1924 and 1930.

The second cohort includes the previous generations for which data are available in the Health and Retirement Survey as of 2014: Those born before 1924 and the “children of the Depression” born between 1924 and 1930.

There are significant differences in these two groups in the age in which households cease being homeowners. Starting right after age 67, Good Times households stay in their homes at higher rates. Between the ages of 67 and 82, while the homeownership rate had dropped by 11.6 percent for previous generations, it fell by only 3.6 percent for the Good Times cohort.

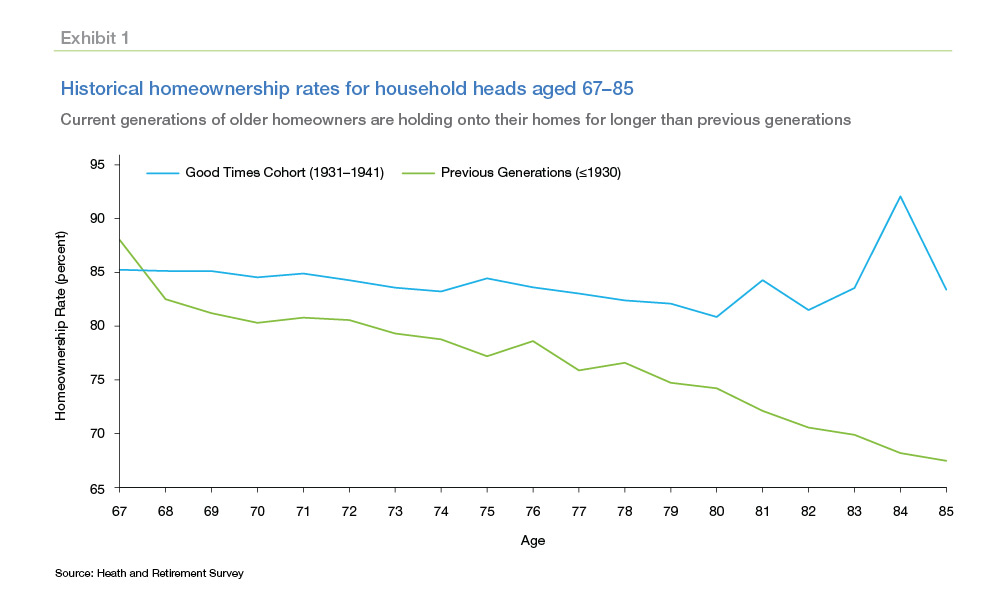

As shown in Exhibit 2, even at ages 81 to 85, the homeownership rates for the Good Times cohort are still above 80 percent. By contrast, homeownership rates fell to 71 percent for previous generations. The homeownership gap between the two groups swells to 15 percent at ages 81 to 85.

In addition to the Good Times cohort, later cohorts such as War Babies, 1942–1947; as well as Baby Boomers, 1948–1959, are expected to stay in their homes at higher rates, and increase the number of houses held off the market.

In addition to the Good Times cohort, later cohorts such as War Babies, 1942–1947; as well as Baby Boomers, 1948–1959, are expected to stay in their homes at higher rates, and increase the number of houses held off the market.

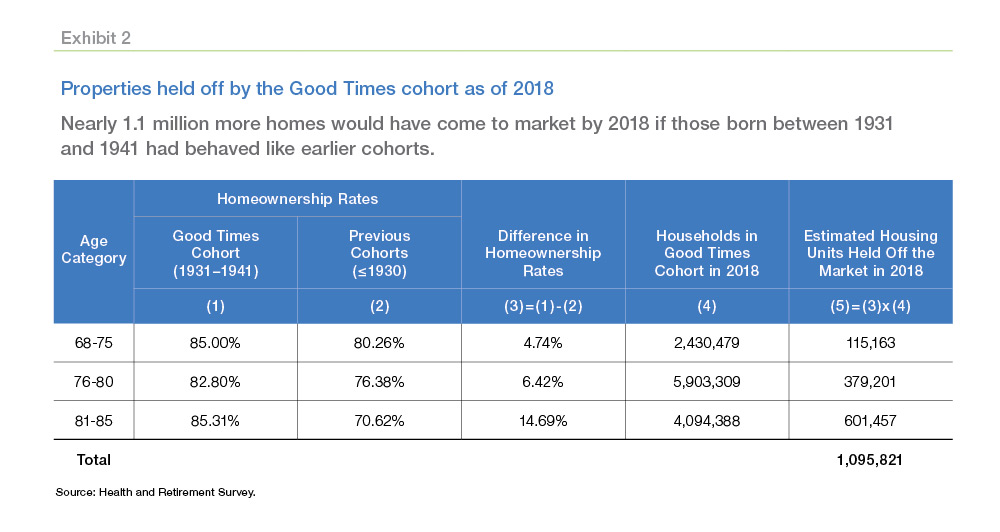

Freddie made a similar calculation for the War Babies and Baby Boomers and estimates that an additional 550,000 homes were held off the market by these cohorts by 2018, as shown in Exhibit 3.

Freddie estimates there were around 1.6 million housing units held off the market by those three cohorts as of 2018. This amounts to 2.1 percent of owner-occupied housing units in the U.S. as of 2018. The seniors that transition from homeownership to renting would free up more owner-occupied housing units, but also would increase demand for rental units. Also, the higher propensity of homeownership would not lead to shortages in markets with elastic supply because shortfalls would be offset by an increase in housing stock.

Despite the weakening of the housing market in 2018, early 2019 data signals a possible turnaround for the year to come. This recent uptick in activity proves that homebuyers are very sensitive to changing rates and will likely respond positively if mortgage rates remain low.

After steadily increasing for years, home prices have finally begun to cool, and while they're still increasing, Freddie Mac expects the rate of growth to slow. The growth rate of the Freddie Mac House Price Index, for instance, fell slightly to 0.7 percent in the fourth quarter of 2018. It forecasts home prices will increase 4.1 percent in 2019 and 2.7 percent in 2020.

The most important fundamental in today's housing market is the lack of houses for sale. This shortage has been identified as an important barrier to young adults buying their first homes.

Older Americans prefer to age in place because they are satisfied with their communities, their homes, and their quality of life, according to Freddie Mac. The result is more senior households are staying in place than would have been the case--if they behaved like older generations of homeowners.

The number of homes retained by seniors is likely to grow as both the number of seniors increases and the barriers to staying in place are reduced. Removing barriers that can prevent the production of new housing supply is key if housing supply can meet the demand from borrowers in the future.

Read more...