OTHER NEWS

Trepp CMBS Delinquency Rate Dips Below 3%

- Friday, 08 March 2019

- Commercial Lending

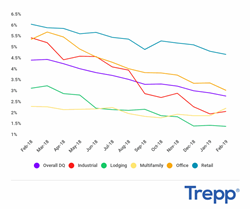

The Trepp CMBS Delinquency Rate crossed another threshold in February as it dipped below 3% for the first time since May 2009.

February’s reading clocked in at 2.87%, down 15 basis points from the prior month and a new post-crisis low for the delinquency rate, according to the “February 2019 US CMBS Delinquency Report” from Trepp.

The multifamily delinquency rate increased 34 basis points to 2.31 percent in February, from 1.97 percent in January. The multifamily delinquency rate was 1.67 percent, an increase of 35 basis points.

(Graph Below) CMBS Delinquency Rates by Property Type (Feb. 2019)

“Delinquencies fell again last month, driven once more by the squeezing out of more remnants from the pre-crisis era,” said Manus Clancy, senior managing director at Trepp. “While CMBS 2.0 has generally held up well, there are some pockets of concern that merit watching. In particular, some extra attention should be paid to student housing, grocery-anchored retail, and certain cities like Houston where several large assets are contending with sizable delinquencies.”

Although the overall CMBS 2.0+ rate dipped five basis points to 0.63% last month, the seriously delinquent reading for 2.0+ increased eight basis points to 0.60%. Delinquencies among CMBS 1.0 continue to slide as its overall rate dipped another 45 basis points to 44.83%. That reading has dropped 301 basis points since March 2018.

February's greatest month-over-month improvement by major property type belonged to the office segment. The office reading shed 34 basis points last month and now clocks in at 3.13%. Retail still has the worst performing rate among property types, but its reading fell once again in February. With its most recent decline of 15 basis points, the retail rate now sits at 4.77% and has improved in each of the last five months.

Read more...Freddie Mac, National Equity Make Three Low Income Housing Investments

- Monday, 04 March 2019

- Commercial Lending

Freddie Mac and National Equity Fund has made three Low-Income Housing Tax Credit Fund investments. The funding was made through a fund that the two organizations just opened.

They will help provide supportive housing for individuals experiencing homelessness and populations displaced by natural disasters:

- Aiding those displaced by Hurricane Harvey:A $15 million LIHTC equity investment in Houston’s New Hope Housing’s Dale Carnegie development will provide high quality housing and supportive services to 170 individuals and families displaced by Hurricane Harvey.

- Addressing homelessness on Skid Row:A $19.6 million LIHTC equity investment in Skid Row Housing Trust’s Flor 401 Lofts development in Los Angeles will serve nearly 100 veterans and special needs individuals experiencing homelessness with both housing and supportive services.

- Serving homeless veterans in South Los Angeles:A $26.5 million LIHTC equity investment in Hollywood Community Housing’s Florence Mills Apartments will help provide supportive housing in South Los Angeles--an area with a very high homeless rate. Fully 13 of the 74 units will be designated for homeless veterans.

“National Equity Fund has a more than 30-year track record of making investments that help the most underserved communities, and Freddie Mac is very proud to aid that mission through one of our LIHTC Equity funds,” said David Leopold, vice president of Targeted Affordable Sales and Investments at Freddie Mac. “The investments we have made through the fund thus far are making a home possible for those displaced by Hurricane Harvey and individuals experiencing homelessness in some of the most housing-challenged communities in the country.”

The closing marks Freddie Mac’s fifth LIHTC fund since re-entering the market in 2018, and the first fund managed by National Equity.

Read more...

Walker & Dunlop Arranges $60M in Financing for California Property

- Wednesday, 27 February 2019

- Commercial Lending

Walker & Dunlop has arranged almost $60 million in construction financing for the development of the Rise Walnut Creek apartments.

Located in Walnut Creek, Calif., the project benefits from its proximity to San Francisco, one of the nation's most active multifamily markets with above-average employment rates, sustained rent growth, and high occupancy.

The project also enjoys a strategic location at the center of Walnut Creek's downtown commercial and retail district, which serves as a business and entertainment hub for neighboring towns.

Capital Markets Managing Directors Kevin O'Grady and Eric McGlynn led the Walker & Dunlop team, which arranged the financing on behalf of the developer, Florida-based Rescore Property Corp., a private REIT founded by Arthur Falcone, Tony Avila, and Bill Powers, and their local partner, Align Real Estate.

Drawing from their broad network of capital providers, O'Grady and McGlynn identified Barings LLC as the developer's ideal partner for the senior financing. The nonrecourse loan represented 80 percent of the total project cost.

The Rise Walnut Creek is the seventh construction loan that the Walker & Dunlop team has sourced for Rescore's Rise product line, which features contemporary design and innovative amenities. Once complete, the six-story building will include 10,577 square-feet of retail space, luxury amenities, and a residential lobby with controlled access to the units. Averaging 754 square feet, 20 of the 97 apartment units are designated for short-term rentals. The project will also include two levels of dedicated basement

Based in Miami, Florida, O'Grady and McGlynn have been active in structuring nonrecourse construction loans nationwide for apartments, condominiums, hotels and mixed-use properties.

Walker & Dunlop is a leader in the multifamily space; the firm ranked No. 2 with Fannie Mae for multifamily lending in 2018 and was also ranked as a top-five multifamily lender with Freddie Mac and the Department of Housing and Urban Development.

Read more...MedCore, Trinity Close on Senior Living Portfolio

- Tuesday, 26 February 2019

- Commercial Lending

MedCore Partners and Trinity Private Equity Group, have closed on a 409-unit assisted living and memory care portfolio in Arizona and Utah.

With an acquisition cost of approximately $98 million, this transaction represents the first tranche of a $130 million portfolio acquisition of five properties and 531 units. The fifth property is under construction, and MedCore is slated to close on this community in May.

The communities involved in this initial acquisition include three assisted living and memory care assets in Arizona: Caliche Senior Living in Casa Grande with 105 units, Joshua Springs Senior Living in Bullhead City with 104 units, and White Cliffs Senior Living in Kingman with 103 units. In addition, the 97-unit Summit Senior Living in Kearns, Utah, completes the first tranche of the portfolio acquisition.

Situated in strategic markets with healthy demand and defined barriers to entry, the assets are on a strong lease-up trajectory toward stabilization.

The projects are being managed by Watermark Retirement Communities, a national leader in senior living design, programs and operations. Based in Tucson, Arizona, Watermark has substantial knowledge in the Arizona and Utah markets, and in total, Watermark owns or operates 56 communities in 21 states around the country.

SunTrust Bank provided the loan for the acquisition. “This group of assets is highly complementary to SunTrust’s strategic real estate underwriting objectives,” said Randall Loggins, senior vice president of SunTrust’s Aging Services practice.

Read more...