TRENDING WHITEPAPERS,VIDEOS & MORE

tim

CFPB Proposes New Rules for Debt Collecting

- Tuesday, 07 May 2019

Today the Consumer Financial Protection Bureau (Bureau) issued a Notice of Proposed Rulemaking (NPRM) to implement the Fair Debt Collection Practices Act (FDCPA). Among other things, the NPRM would set clear, bright-line limits on the number of calls debt collectors may place to reach consumers on a weekly basis; clarify how collectors may communicate lawfully using newer technologies, such as voicemails, emails and text messages, that have developed since the FDCPA’s passage in 1977; and require collectors to provide additional information to consumers to help them identify debts and respond to collection attempts.

Today’s proposal would:

- Establish a clear, bright-line rule limiting call attempts and telephone conversations: The proposed rule generally would limit debt collectors to no more than seven attempts by telephone per week to reach a consumer about a specific debt. Once a telephone conversation between the debt collector and consumer takes place, the debt collector must wait at least a week before calling the consumer again.

- Clarify consumer protection requirements for certain consumer-facing debt collection disclosures: The proposed rule would require debt collectors to send consumers a disclosure with certain information about the debt and related consumer protections. This information would include, for example, an itemization of the debt and plain-language information about how a consumer may respond to a collection attempt, including by disputing the debt. The proposal would require the disclosure to include a “tear-off” that consumers could send back to the debt collector to respond to the collection attempt.

- Clarify how debt collectors can communicate with consumers: The proposed rule would clarify how debt collectors may lawfully use newer communication technologies, such as voicemails, emails and text messages, to communicate with consumers and would protect consumers who do not wish to receive such communications by, among other things, allowing them to unsubscribe to future communications through these methods. The proposed rule would also clarify how collectors may provide required disclosures electronically. In addition, if consumers want to limit ways debt collectors contact them, for example at a specific telephone number, while they are at work, or during certain hours, the rule clarifies how consumers may easily do so.

- Prohibit suits and threats of suit on time-barred debts and require communication before credit reporting: The proposed rule would prohibit a debt collector from suing or threatening to sue a consumer to collect a debt if the debt collector knows or should know that the statute of limitations has expired. The proposed rule also would prohibit a debt collector from furnishing information about a debt to a consumer reporting agency unless the debt collector has communicated about the debt to the consumer, such as by sending the consumer a letter.

Read more...

Recent Drop In Rates Puts More Government Loans "In the Money" for Refinancing.

- Tuesday, 07 May 2019

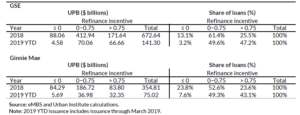

The Urban Institutes published its Monthly Chartbook for April. The data showed that a lot of loans are "in the money" when it comes to refinancing. This indicates that the increase in refinancing that that has been seen in the first quarter might be likely to continue.

According to Urban Institute "Freddie Mac’s benchmark primary mortgage market survey (PMMS) rate stood at 4.17 percent in mid-April, 2019 down significantly from nearly 5 percent in November 2018. For the majority of 2018, the PMMS rate was well above 4 percent. The most immediate implication of falling interest rates is that eligible borrowers who received a mortgage in 2018 and YTD 2019 can now save money by refinancing. Moreover, if rates stay here more borrowers will be able to refinance in the coming months, as they pass the required seasoning period. That is, to refinance a government mortgage, Ginnie Mae requires that a minimum of 210 days elapse between the first payment on the existing mortgage and the issuance of a new mortgage, as well as at least six months of payments.

The GSEs have no seasoning requirement on rate/term refinances, but some lenders do require it. Cash out refinances require that the property have been owned for a minimum of six months for conventional mortgages. How many of these borrowers actually end up refinancing will determine prepayment speeds for mortgage-backed securities in the coming months.

By comparing the interest rate on recently originated loans to current interest rates, we create a measure for “refinance incentive”, and can size the population of borrowers that could benefit from refinancing. Since 2018, Fannie Mae, Freddie Mac, and Ginnie Mae collectively issued $1.2 trillion in mortgage-backed securities. Approximately 85 percent, or $1.1 trillion of these loans have interest rates that are above the current PMMS rate.

However, this does not make it economical for all of these borrowers to refinance, due to both the costs and “hassle factor” of obtaining a new mortgage.

We use 75 basis points as a threshold for loans that are “in the money”-where borrowers are willing to refinance. The threshold is actually different for different borrowers, some may require less, others more.

This equates to $354 billion, or approximately 29 percent of 2018 and 2019 YTD issuance, not accounting for seasoning requirements.

Just over a quarter of GSE issuance in 2018 is now in the money; for Ginnie Mae, just under a quarter of issuance is in the money. The share is higher for 2019 YTD issuance, standing at 47.2 percent for the GSEs and 43.1 percent for Ginnie Mae.

These estimates are measured at a point in time, and are sensitive to movements in mortgage rates. If rates continue to increase, as they have been in recent weeks, the volume of loans in the money will shrink. If rates decrease again, the volume will increase."

Read more...Short Takes From Around the Industry

- Monday, 06 May 2019

New Day Financial: Rob Posner, founder and CEO of NewDay USA, the nation's 8th largest VA mortgage lender, announced the company has renewed its warehouse facility with BankUnited for $100 million. The company now has a total of $400 million in warehouse commitments, that also includes Texas Capital Bank and People's United Bank.

Wolters Kluwer: Wolters Kluwer's Lien Solutions has launched Portfolio Sync, a lien management solution designed for lenders who use multiple methods of submitting Uniform Commercial Code (UCC) filings. As an addition to iLien, Lien Solutions’ flagship lien management product, Portfolio Sync combines customers’ existing ILien filings with public records data into one view, providing greater visibility into one’s entire lending portfolio—and identifies associated gaps that may require risk mitigation or other actions to maintain a lender’s secured interests.

Penny Mac: PennyMac Mortgage Investment Trust (NYSE: PMT) today announced that it is offering 8,000,000 common shares of beneficial interest (“shares”) in an underwritten public offering. The underwriters will have a 30-day option from the date of the offering to purchase up to an additional 1,200,000 shares from the Company. All of the shares will be offered by the Company and will be issued under the Company’s currently effective shelf registration statement filed with the Securities and Exchange Commission.

Penny Mac: PennyMac Mortgage Investment Trust (NYSE: PMT) today announced that it is offering 8,000,000 common shares of beneficial interest (“shares”) in an underwritten public offering. The underwriters will have a 30-day option from the date of the offering to purchase up to an additional 1,200,000 shares from the Company. All of the shares will be offered by the Company and will be issued under the Company’s currently effective shelf registration statement filed with the Securities and Exchange Commission.

The Company intends to use the net proceeds from the offering for general corporate purposes, including funding its investment activity, which may include investments in credit risk transfer securities, mortgage servicing rights, mortgage-backed securities and new products such as home equity lines of credit or prime, non-qualified mortgage loans, as well as the repayment of indebtedness and working capital.

Gateway Mortgage: Gateway Mortgage Group, LLC, a full-service mortgage company licensed in 40 states and the District of Columbia, announced it has completed its merger with Farmers Exchange Bank to form Gateway First Bank, an Oklahoma banking corporation

“This acquisition and resulting transformation is a very important achievement for Gateway,” said Stephen Curry, Gateway’s Chief Executive Officer. “By combining two successful Oklahoma companies to form Gateway First Bank we have created a robust foundation for future growth. Over the next year we intend to deliver significant enhancements to the customer experience and new products, while maintaining the superior service, great culture and nationally-recognized workplace we’re known for.”

Read more...