-

The Current Landscape of Mortgage Origination: Trends and Challenges

The Current Landscape of Mortgage Origination: Trends and Challenges Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Explore current trends and challenges in the U.S. mortgage origination market, including interest rate fluctuations, digital mortgage solutions, and compliance needs.

Mortgage Credit Availability Index Increases in February

- Thursday, 07 March 2019

- Lending

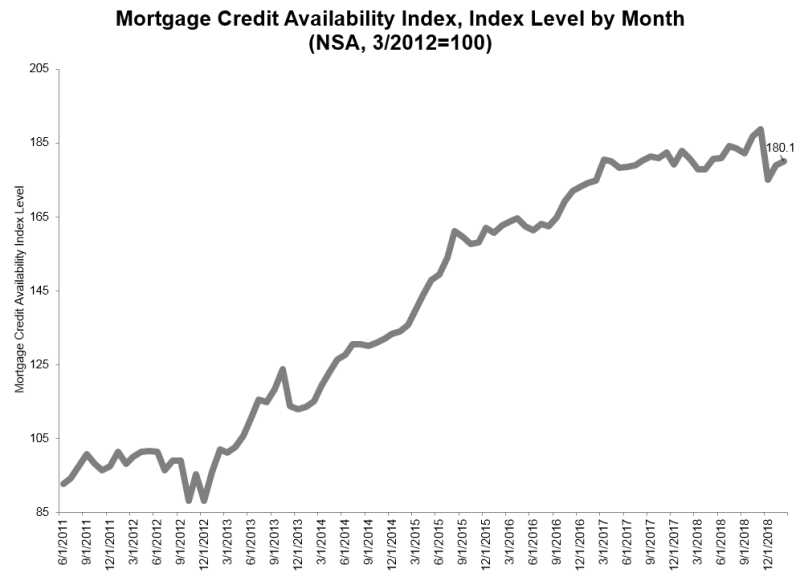

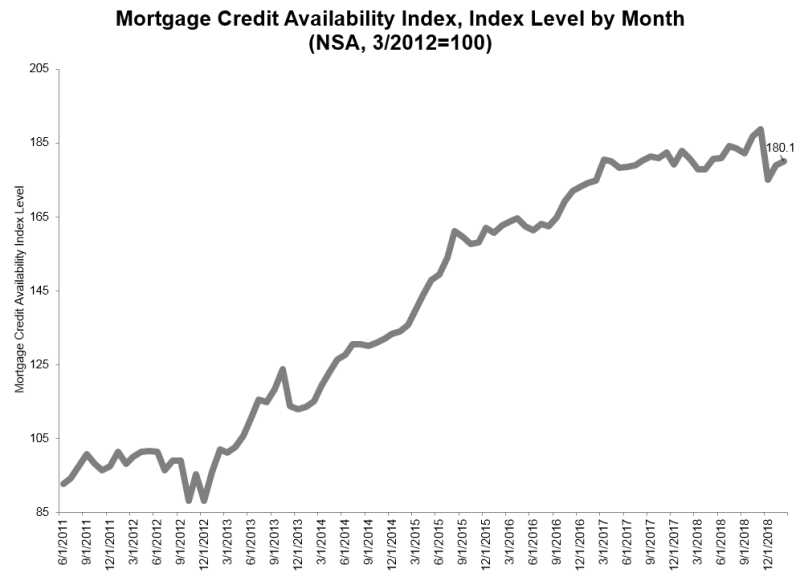

The Mortgage Credit Availability Index rose 0.6 percent to 180.1 in February, according to a report from the Mortgage Bankers Association that analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool.

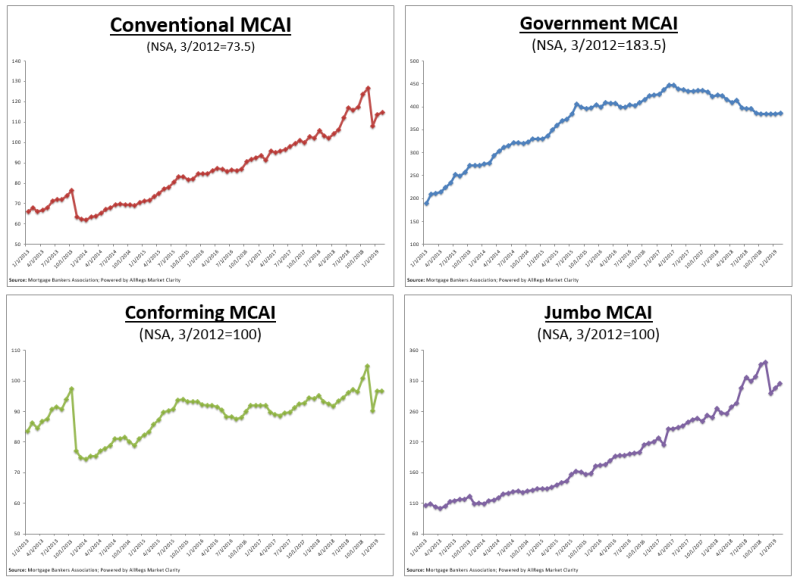

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The Conventional MCAI increased 1.1 percent, while the Government MCAI increased slightly 0.1 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 2.2 percent while the Conforming MCAI decreased by 0.2 percent.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

“Credit availability increased in February as a result of new jumbo offerings brought to the market, both for agency jumbo and non-agency jumbo programs,” said Mike Fratantoni, MBA senior vice president and chief economist for the MBA. “We also saw some expansion in credit for borrowers with lower credit scores and higher LTVs, although credit availability for government programs remains tighter following the scaling back of VA refinance programs.”

“Credit availability increased in February as a result of new jumbo offerings brought to the market, both for agency jumbo and non-agency jumbo programs,” said Mike Fratantoni, MBA senior vice president and chief economist for the MBA. “We also saw some expansion in credit for borrowers with lower credit scores and higher LTVs, although credit availability for government programs remains tighter following the scaling back of VA refinance programs.”

The Conventional MCAI increased (1.1 percent), while the Government MCAI increased slightly (0.1 percent). Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 2.2 percent while the Conforming MCAI decreased by 0.2 percent.

Read more...Black Knight: Prepayment Rate Marks 18 Year Low

- Sunday, 24 February 2019

- Lending

Despite recent declines in interest rates, January's prepayment rate was the lowest since November 2000.

Seasonal reductions in home sales outweighed any early, rate-driven rise in refinance incentive, according to the “first look” data from Black Knight. Housing turnover typically bottoms out in January and February, so prepayments could pick up again if rates remain low through the early spring home-buying season

The national delinquency rate fell by 3.5 percent and is now 13 percent below last year's level. Foreclosure starts rose seasonally month-over-month but were down more than 19 percent year-over-year. The number of loans in active foreclosure continued its downward trend; there are now 265,000 active foreclosures, down 72,000 from one year ago.

Total U.S. loan delinquency rate (loans 30 or more days past due, but not in foreclosure): 3.75%

Month-over-month change: -3.45%

Year-over-year change: -12.93%

Total U.S. foreclosure pre-sale inventory rate: 0.51%

Month-over-month change: -2.20%

Year-over-year change: -22.43%

Total U.S. foreclosure starts: 50,200

Month-over-month change: 8.42%

Year-over-year change: -19.42%

Monthly prepayment rate (SMM): 0.59%

Month-over-month change: -10.15%

Year-over-year change: -25.20%

Foreclosure sales as % of 90+: 1.93%

Month-over-month change: 40.39%

Year-over-year change: 10.83%

Number of properties that are 30 or more days past due, but not in foreclosure: 1,945,000

Month-over-month change: -68,000

Year-over-year change: -257,000

Number of properties that are 90 or more days past due, but not in foreclosure: 504,000

Month-over-month change: -7,000

Year-over-year change: -203,000

Number of properties in foreclosure pre-sale inventory: 265,000

Month-over-month change: -6,000

Year-over-year change: -72,000

Number of properties that are 30 or more days past due or in foreclosure: 2,210,000

Month-over-month change: -73,000

Yea

Delinquency Performance Improving: Corelogic

- Wednesday, 13 February 2019

- Lending

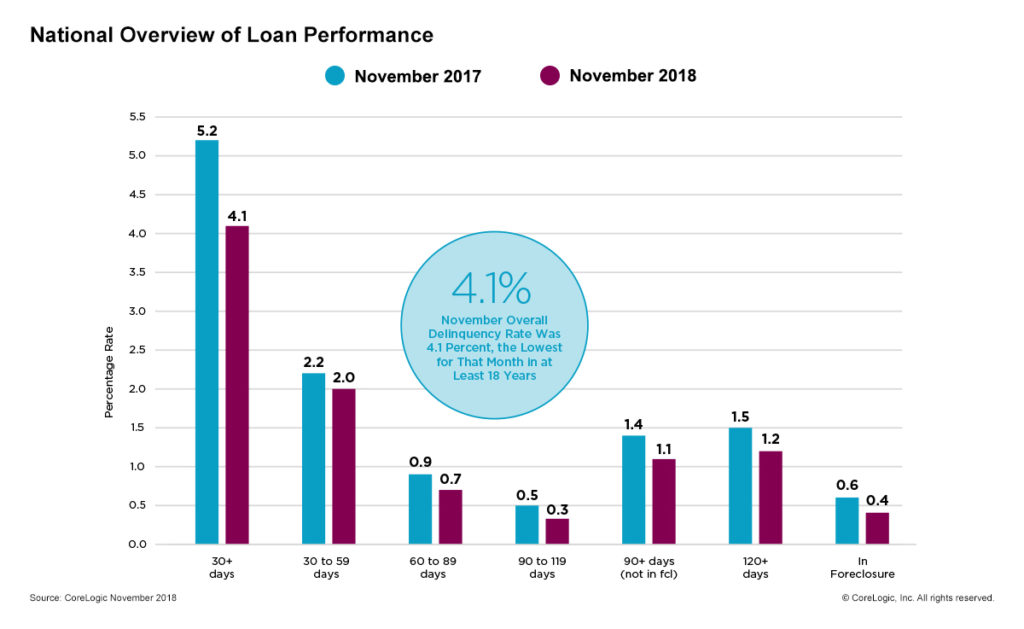

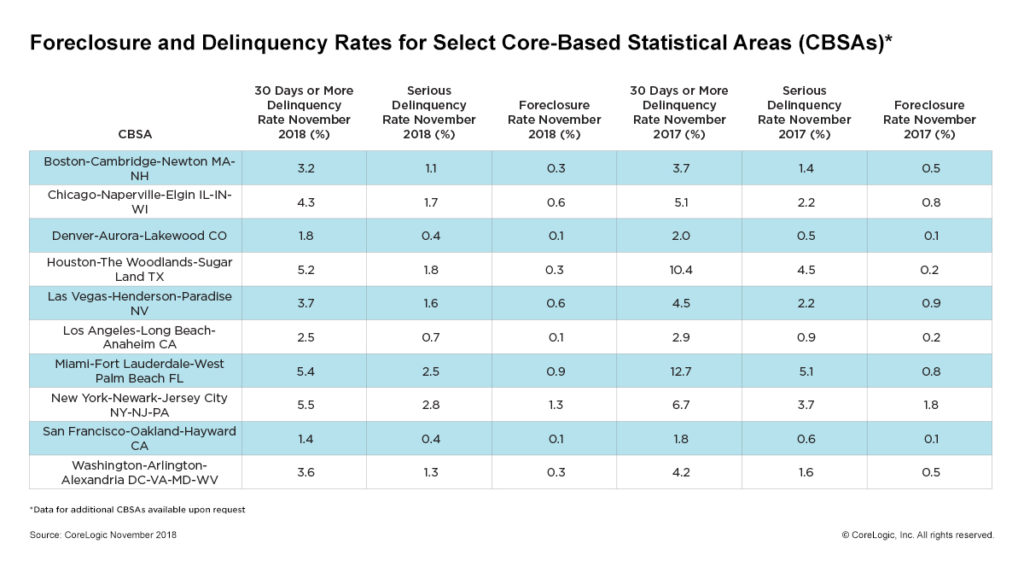

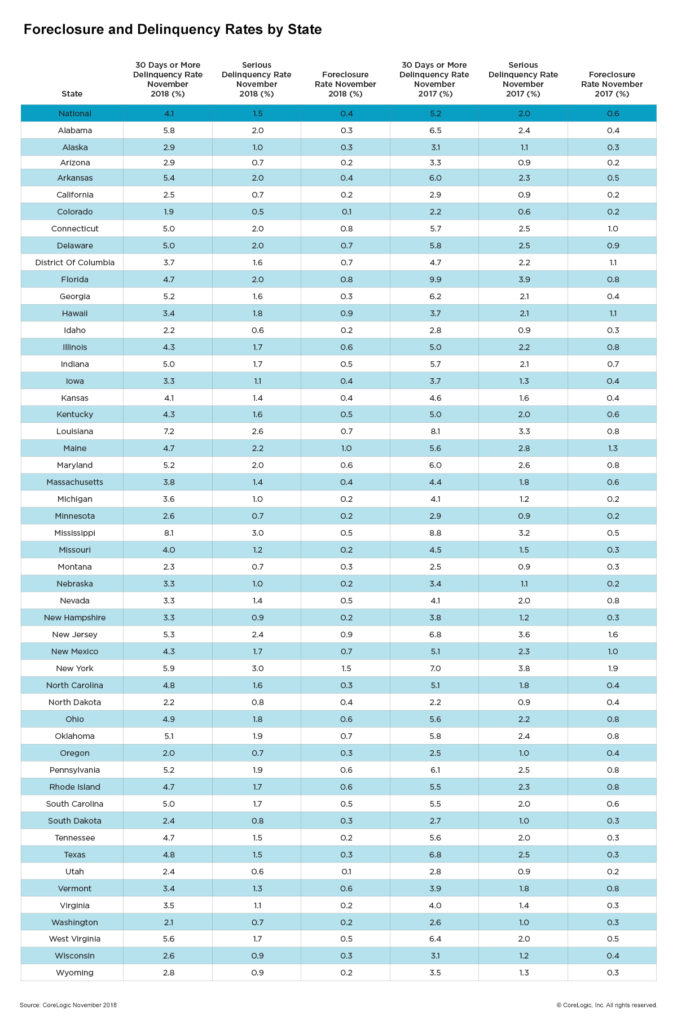

The percentage of mortgages that were in delinquency fell to 4.1 percent in November 2018, compared with the same time period a year earlier, when the rate stood at 5.2 percent, according to the “Loan Performance Insights Report” from Corelogic.

As of November 2018, the foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, was 0.4 percent, down 0.2 percentage points from November 2017. The November 2018 foreclosure inventory rate was the lowest for any month since at least January 2000.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To monitor mortgage performance comprehensively, CoreLogic examines all stages of delinquency, as well as transition rates, which indicate the percentage of mortgages moving from one stage of delinquency to the next.

The rate for early-stage delinquencies, defined as 30 to 59 days past due, was 2 percent in November 2018, down from 2.2 percent in November 2017. The share of mortgages that were 60 to 89 days past due in November 2018 was 0.7 percent, down from 0.9 percent in November 2017.

The rate for early-stage delinquencies, defined as 30 to 59 days past due, was 2 percent in November 2018, down from 2.2 percent in November 2017. The share of mortgages that were 60 to 89 days past due in November 2018 was 0.7 percent, down from 0.9 percent in November 2017.

The serious delinquency rate, defined as 90 days or more past due, including loans in foreclosure, was 1.5 percent in November 2018, down from 2 percent in November 2017. November 2018 marked the lowest serious delinquency rate for the month since 2006 when it was also 1.5 percent. It ties with August, September and October 2018 as the lowest for any month since March 2007 when it was also 1.5 percent.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 0.9 percent in November 2018, down from 1 percent in November 2017. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent, while it peaked in November 2008 at 2 percent.

Since early-stage delinquencies can be volatile, CoreLogic also analyzes transition rates. The share of mortgages that transitioned from current to 30 days past due was 0.9 percent in November 2018, down from 1 percent in November 2017. By comparison, in January 2007, just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent, while it peaked in November 2008 at 2 percent.

“Solid income growth, a record amount of home equity and an absence of high-risk loan products put the U.S. homeowner on solid ground,” said Dr. Frank Nothaft, chief economist for CoreLogic. “All of this has helped push delinquency and foreclosure rates to the lowest levels in almost two decades and will provide a cushion if the housing market should turn down.

The nation's overall delinquency rate has fallen on a year-over-year basis for the past 11 consecutive months. However, loan vulnerability in several metropolitan areas in North Carolina are still struggling from Hurricane Florence. In November 2018, seven metropolitan areas logged an increase in their serious delinquency rates, with the largest gains occurring in the Wilmington and New Bern metropolitan areas.

“On a national basis, we continue to see strong loan performance,” said Frank Martell, president and CEO of CoreLogic. “Areas that were impacted by hurricanes or wildfires in 2018 are now seeing relatively large annual gains in the share of mortgages moving into 30-day delinquency. As with previous disasters, this is to be expected and we will see the impacts dissipate over time.”

Read more...

What FinTech Firm Is KKR’s Largest Holding?

- Tuesday, 05 February 2019

- Lending

The largest holding in KKR & Co. Inc. portfolio is First Data Corp., the company Fiserv plans to acquire. KKR owns more than $998 million dollars of the stock ,or 10.1 percent of the portfolio, according to the firm’s most recent earnings report. That investment is made through private equity funds the company manages.

“Since December 31 through last night, First Data stock price has gone up by about $7.50 per share, or a 45% increase,” said William Janetschek, CFO of KKR, during the firm’s recent fourth quarter and year-end analyst call. Shares of First Data will be exchanged with Fiserv shares. The acquisition was announced in mid-January, after the end of the third quarter. Henry Kravis, co-chairman and co-chief executive officer of KKR, sits on First Data’s board.

[caption id="attachment_9693" align="alignright" width="300"] William Janetschek[/caption]

William Janetschek[/caption]

In addition, an affiliate of Kohlberg Kravis Roberts & Co. L.P., New Omaha Holdings L.P., which controls around 39% [including KKR & Co's shares] of the outstanding First Data common stock and 86% of the voting rights of First Data, has entered into a voting agreement in support of the transaction. Upon closing, New Omaha Holdings will own around 16% of the outstanding common stock of the combined company.

Among First Data’s clients in the mortgage arena is Ellie Mae, who integrated secure payments technology to process mortgage and appraisal fees That allows Ellie Mae customers to accept payment for loan origination, processing, underwriting, and credit report costs through the company's platform.

After the merger is complete, Fiserv will invest $500 million to enhance solutions and accelerate growth. It expects to generate $4 billion in cash flow in the third year after the transaction closes.

Efficiency gains will be around $900 million over five years, and Fiserv will refinance $17 billion in debt that First Data will have on its books when the deal closes.

Read more...