!--more-->Ben Graboske, President of Black Knight Data & Analytics, says falling interest rates and a subsequent increase in rate/term refinances has worked in servicers’ favor. “As we’ve reported in the past, retention rates tend to be higher for rate/term refinances than any other type of transaction, and that’s just what we observed as of the end of Q2 2019,” Graboske said. “Falling rates and an abundance of refinance candidates were primary drivers behind servicers retaining 24% of all refinancing borrowers–the highest such retention rate since late 2017–and 30% of rate/term borrowers specifically.

"While losing the business of more than two out of every three rate-driven refinance customers is not exactly extraordinary performance, it is significantly better than the sub-20% retention rates seen throughout much of 2018. The good news is that interest rates are at three-year lows, and anecdotal evidence suggests that in recent weeks, mortgage lenders had been inundated with inbound refinance business that’s relatively easy to retain."

"While losing the business of more than two out of every three rate-driven refinance customers is not exactly extraordinary performance, it is significantly better than the sub-20% retention rates seen throughout much of 2018. The good news is that interest rates are at three-year lows, and anecdotal evidence suggests that in recent weeks, mortgage lenders had been inundated with inbound refinance business that’s relatively easy to retain."

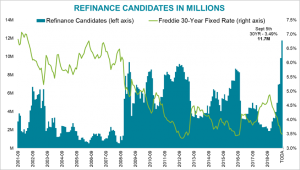

Graboske says that borrowers refinancing out of 2018 vintage mortgages–a group accounting for nearly 20% of all refinance transactions over the first half of 2019–have been especially so. "Some 35% of these borrowers were retained by their servicers post-refinance. Given that 17% of the 11.7 million current refinance candidates are in 2018 vintage loans, retaining their business should be a top priority given today’s market make-up."

He continued, saying that "the not-so-good news is that–in an environment of record-high levels of tappable equity and low interest rates that makes cash-out refinances an affordable option for accessing that equity–servicers are retaining just one in five cash-out borrowers. Even though rate-term refis are surging right now, cash-outs still made up some 62% of all refinances in the second quarter. Add to that the fact that borrowers refinancing out of 2012-2017 vintage loans account for nearly half of all refis so far in 2019, nearly 80% were cash-out transactions. Savvy lenders and servicers need to go beyond the low-hanging fruit of 2018 vintage loans in order to retain this business–and capture additional market share where others are missing out. The key to success is being able to identify and target these customers through an informed, data-driven growth and retention strategy.”

This month’s analysis found that tappable equity–the amount of equity available to homeowners with mortgages before reaching a maximum combined loan-to-value ratio of 80%–rose for the second consecutive quarter. Gaining $335 billion in Q2, tappable equity is now at an all-time high of $6.3 trillion.

Approximately 45 million homeowners with mortgages have an average of $140,000 in tappable equity available to them. As mentioned above, falling 30-year rates have made cash-out refinances an affordable alternative to HELOCs as a way for these homeowners to tap equity. These falling rates have also opened up a relatively low-risk pool of potential borrowers with high credit scores.

Nearly half of tappable equity holders have current first lien rates of 4.25%, while 76% have interest rates of 3.75% or higher, meaning they could potentially tap into home equity with little change to their existing 30-year rate, or perhaps even experience a slight improvement.

More than half of this population has credit scores of 760 or above, making for a relatively low-risk market segment; another 16% have credit scores between 720-759.

The full July 2019 Mortgage Monitor Report from Black Knight contains additional detail.