-

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Mortgage Industry Adapts to Rising Interest Rates The U.S. mortgage industry is adapting to rising interest rates, transforming lending strategies, and borrower behaviors. This article explores the implications for lenders and borrowers, offering insights into new trends and strategies.

Lending (1549)

Refinance Boom Decreasing Fraud Risk: First American

- Tuesday, 03 September 2019

- Lending

- Written by Chris Frankie

Waterstone Mortgage Names Andy Peach As CEO

- Thursday, 05 September 2019

- Lending

- Written by Chris Frankie

Opendoor Launches Mortgage Lending Arm

- Wednesday, 04 September 2019

- Lending

- Written by Chris Frankie

GSE Offers Mortgage Relief for Hurricane Dorian Victims

- Monday, 02 September 2019

- Lending

- Written by Chris Frankie

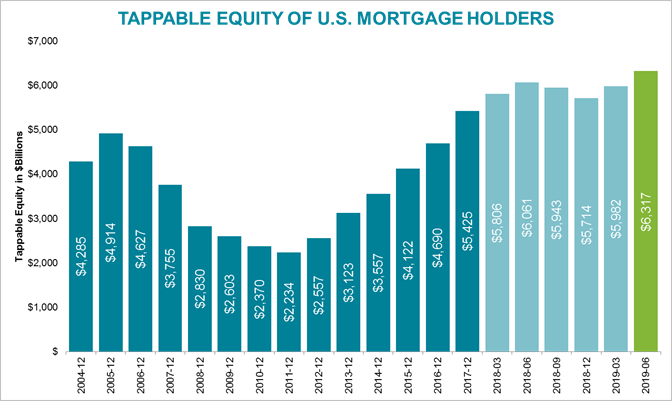

Tappable Equity Hits All-Time High: Black Knight

- Thursday, 29 August 2019

- Lending

- Written by Chris Frankie

Fed Minutes Show Split Over Rate Cuts

- Monday, 26 August 2019

- Lending

- Written by Chris Frankie

Fannie Adds Ex-FDIC Chair Sheila Bair to Board

- Tuesday, 27 August 2019

- Lending

- Written by Chris Frankie

Santander Banks Trims Mortgage Workforce

- Wednesday, 28 August 2019

- Lending

- Written by Chris Frankie

Sequoia Mortgage Capital CEO Arrested on Sexual Assault Charge

- Thursday, 29 August 2019

- Lending

- Written by Chris Frankie

Black Knight: July Prepayment Activity Hits Highest Level Since 2016

- Thursday, 22 August 2019

- Lending

- Written by Chris Frankie

MOST READ STORIES

Fast,Easy & Free