Mortgage borrower are benefitting from the strong economy—if a recent survey is any indication.

The pre-sale inventory foreclosure ratein the U.S. is 0.59 percent, the lowest level in 15 years, and the number of mortgages in active foreclosure is a modest 303,000.If the current rate of decline continues,the market could achieve the 2000-2005pre-recession averageearly in the third quarter, according to Black Knight’s first look May Report. Foreclosure pre-sale inventory rate dropped 3.3% in May, on a month-over-month basis, and it fell 28.65 percent year-over-year.

The second lowest total of foreclosure starts in 17 years—44,900—was recorded last month.That’s a drop of 8.92 percent on a month-over-month basis and a decline of19.53 percent on a year-over-year basis.

Black Knight Inc.’s first look Report is a snapshot of month-end mortgage performance statistics gleaned from loan-level data derived from a majority of the national mortgage market.

Also, for the fifth consecutive month delinquencies declined, due to continued post-hurricane improvement.Delinquency improvements in hurricane-affected areas offset slight increases in non-affected markets in May, which dropped the national delinquency rate to its lowest level in 15 months.

The total U.S. loan delinquency rate, or loans 30 or more days past due, but not in foreclosure, is 3.64 percent. Month-over-month loan delinquencies dropped0.84percent; and year over year, they fell 4.08 percent.

The number of properties that are 30 or more days past due, but not in foreclosure, is 1.87 million, a decline of 18,000 on a month-over-month,and a decline of 60,000 on a year-over-year basis.

The number of properties that are 90 or more days past due, but not in foreclosure is 568,000, representing on a month-over-month decline of 30,000, and a year-over-year change of plus 6,000.

The number of properties in foreclosure pre-sale inventory is 303,000, a drop of 11,000 on a month-over-month basis; and a decline of -118,000 year-over-year.

The number of properties that are 30 or more days past due or in foreclosure is 2.17 million, a month-over-month drop of 28,000and a year-over-year decline of 177,000.

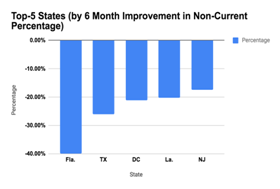

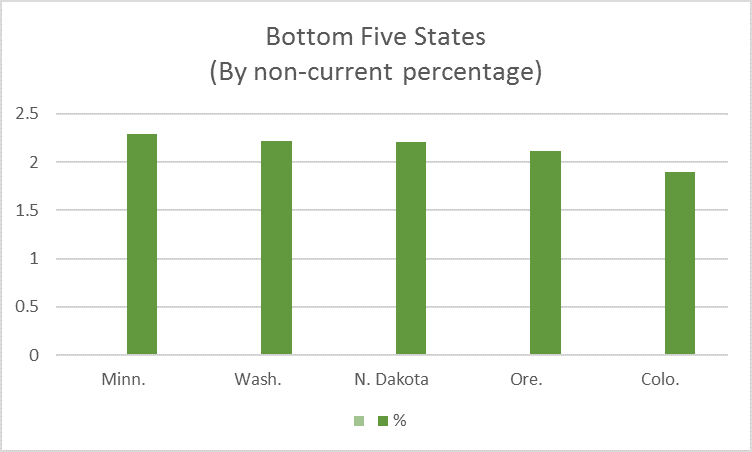

A look at the best and worst-performing states, according to Black Knights May 2018 performance statistics.

| Top 5 States (by Non-Current Percentage) | |

| Mississippi | 9.49% |

| Louisiana | 7.47% |

| Alabama | 6.56% |

| West Virginia | 6.27% |

| Florida | 6.07% |

|

|

|

| Minnesota: | 2.29% |

| Washington: | 2.22% |

| North Dakota: | 2.21% |

| Oregon: | 2.12% |

| Colorado: | 1.90%

|

| Top 5 States by 90+ Days Delinquent Percentage | |

| Mississippi: | 2.94% |

| Florida: | 2.55% |

| Louisiana: | 2.05% |

| Alabama: | 1.90% |

| Texas: | 1.68% |

Top 5 States (by 6-Month Improvement in Non-Current Percentage) |

|

| Florida: | -40.00% |

| Texas: | -25.99% |

| District of Columbia: | -21.14% |

| Louisiana: | -20.25% |

| New Jersey: | -17.43% |

| Top 5 States by 6-Month Deterioration in Non-Current* Percentage | |

| Alaska: | -2.30% |

| North Dakota: | -5.32% |

| Montana: | -8.80% |

| Maine: | -10.18% |

| Delaware: | -10.47% |

Bottom 5 States (by Non-Current Percentage)

Bottom 5 States (by Non-Current Percentage)