OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

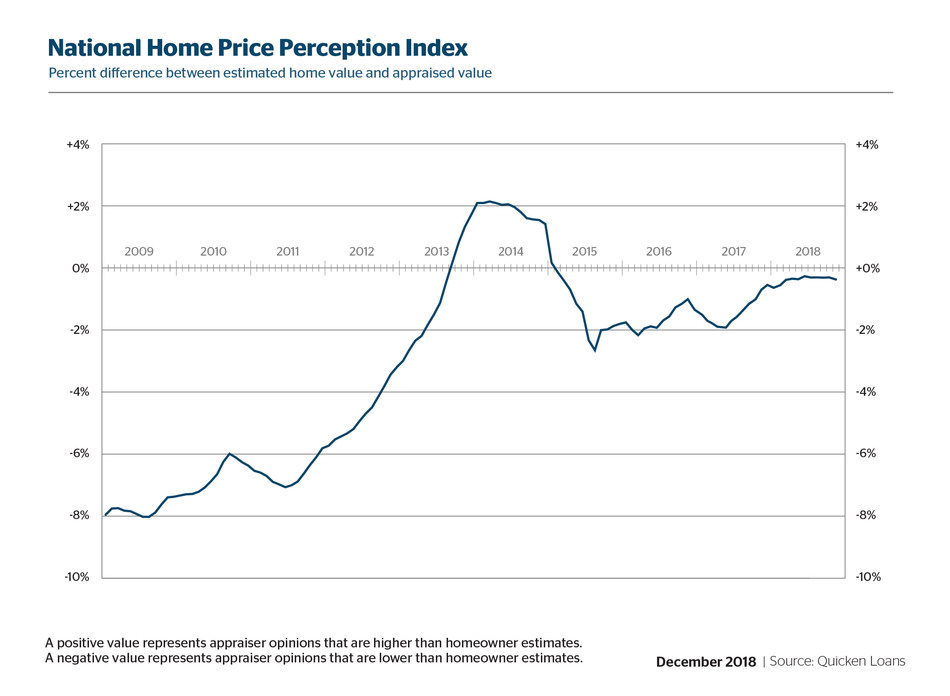

Home Price Perception Index Holding Steady

- Tuesday, 11 December 2018

- Originating

The difference between owners' estimates of home values and appraisal values increased slightly in November across the U.S.

Appraised values were an average of 0.36 percent lower than what homeowners expected, according to Quicken Loans' National Home Price Perception Index. The index represents the difference between appraisers' and homeowners' opinions of home values. The index compares the estimate that the homeowner supplies on a refinance mortgage application to the appraisal that is performed later in the mortgage process.

In addition to owners and appraisers aligning on home values, there’s the growth of appraisal values across the country. Quicken Loans' National Home Value Index erased a slight dip from the previous month with a 0.53 percent increase in November. The annual gains follow a trend that has been consistent the last few months. Nationally, the average home appraisal was 5.01 percent higher than it was in November 2017.

This year has not produced much monthly movement in the gap between home appraisals and homeowners' expectations. In fact, the difference has remained below half a percent since March, with little month-to-month variation. At a metro level, Chicago is the only area with appraisals more than 2 percent lower than what homeowners estimated. Boston, Denver and Charlotte were on the other side of the spectrum--each with the average appraisal coming back more than 2 percent higher than expected in November.

[caption id="attachment_8296" align="alignleft" width="265"] Banfield: The housing market is sturdy.[/caption]

Banfield: The housing market is sturdy.[/caption]

"Homeowner perception staying at a steady level is a sign of a sturdy housing market," said Bill Banfield, executive vice president of capital markets at Quicken Loans. "Some homeowners may not be as aware of home value changes as the professionals who study the real estate market every day, so any large, sudden, spikes or drops in home values, are often reflected by a swift widening gap in the HPPI."

Home Value Index

The Quicken Loans Home Value Index reported annual home equity growth continuing to march ahead at a consistent pace. Monthly change, however is a reflecting slower, more measured increases. This is the story across the country. Not only from the national, aggregate, level but in every region – to varying degrees. Home values rose by about half of a percent in all four regions measured by the Home Value Index, while they all posted annual growth from 4 to 6 percent.

"Home values continue to increase but the rate of increases has started to slow. For much of 2018, interest rates have been rising causing the combined price and associated payment to give some buyers pause," said Banfield. "The economy appears to remain strong with a low unemployment rate suggesting home prices could continue to increase even if at a slower rate."

Chart Below: Shows Quicken's HPPI By Metro Areas

|

Metropolitan Areas

|

HPPI

November 2018

Appraiser Value |

HPPI

October 2018

Appraiser Value |

HPPI

November 2017

Appraiser Value |

| Boston | +2.92% | +2.93% | +1.63% |

| Denver | +2.47% | +2.46% | +2.36% |

| Charlotte, NC | +2.26% | +2.21% | +1.16% |

| Minneapolis | +1.94% | +1.94% | +0.70% |

| San Jose, CA | +1.94% | +2.47% | +2.11% |

| Seattle, WA | +1.87% | +2.24% | +2.19% |

| San Francisco, CA | +1.57% | +1.63% | +1.93% |

| Dallas, TX | +1.39% | +1.46% | +3.25% |

| Las Vegas, NV | +1.24% | +1.28% | +0.61% |

| Kansas City, MO | +1.08% | +1.26% | +0.64% |

| San Diego, CA | +0.98% | +0.91% | +1.13% |

| Portland, OR | +0.86% | +1.15% | +1.47% |

| Washington, D.C. | +0.84% | +0.88% | -0.12% |

| Atlanta, GA | +0.81% | +0.80% | -0.36% |

| Phoenix, AZ | +0.67% | +0.71% | +0.46% |

| Sacramento, CA | +0.64% | +0.70% | +1.06% |

| Riverside, CA | +0.45% | +0.57% | +0.32% |

| Los Angeles, CA | +0.32% | +0.45% | +0.99% |

| New York, NY | +0.10% | +0.26% | -0.43% |

| Miami, FL | -0.14% | +0.00% | +0.86% |

| Detroit, MI | -0.16% | +0.05% | +0.28% |

| Houston, TX | -0.48% | -0.62% | -0.31% |

| Tampa, FL | -0.65% | -0.68% | -0.01% |

| Baltimore, MD | -1.06% | -1.02% | -2.24% |

| Cleveland, OH | -1.09% | -0.97% | -2.35% |

| Philadelphia, PA | -1.10% | -1.03% | -2.33% |

| Chicago, IL | -2.11% | -2.12% | -1.37% |

(A positive value represents appraiser opinions that are higher than homeowner perceptions. A negative value represents appraiser opinions that are lower than homeowner perceptions.)

Read more...CFPB Alleges Village Capital Misled Veterans

- Thursday, 06 December 2018

- Originating

The Bureau of Consumer Financial Protection filed a complaint in federal court that alleges Village Capital & Investment LLC, a non-bank mortgage company headquartered in Henderson, Nev., misled veterans by overstating the benefits of refinancing their mortgages. The case was filed in the United States District Court District of Nevada on Dec. 4.

Village Capital offers a product known as an Interest Rate Reduction Refinancing Loan, which allows veterans, with a loan guaranteed by Veterans Affairs, to refinance their mortgages at lower interest rates.

As described in the complaint and proposed order, the Bureau alleges that Village Capital violated the Consumer Financial Protection Act of 2010 by misleading veterans regarding its Interest Rate Reduction Refinancing Loans, which allow veterans to refinance their mortgages at lower interest rates with a loan guaranteed by Veterans Affairs.

To demonstrate the savings the refinances generated, Village Capital relied on flawed formulas that produced inaccurate results, so the figures used in [Excel] worksheets and quoted to consumers were misleading. According to the filing, the Excel spreadsheets, and therefore the worksheets presented to consumers, were deceptive because they misrepresented the cost savings to the consumer of the refinanced loan including: Inflating the future amount of principal owed under the existing mortgage by underestimating the proportion of the consumer’s existing monthly payment that is applied to principal. Underestimating the future amount of the refinanced mortgage’s monthly payments by overestimating the loan’s term and overestimating the total monthly benefit of the loan after the first month.

The Bureau and Village Capital also filed a proposed stipulated final judgment and order to resolve the claim. If entered by the court, the proposed order would require Village Capital to pay $268,869 in redress to consumers and a civil penalty of $260,000.

Read more...

Credit Availability Loosening (Slightly)

- Thursday, 06 December 2018

- Originating

The Mortgage Credit Availability Index increased 1.1 percent to 188.8 in November, signaling that credit was loosened last month.

“The supply of credit continues to drift higher, driven once again by growth in the conventional credit space, while credit supply in government loans was essentially unchanged from the previous month,” said Joel Kan, associate vice president of economic and industry forecasting for the Mortgage Bankers Association. “There were more mortgage programs offered with high LTV and low-credit-score characteristics, likely attributable to rising demand from first-time buyers.”

The Conventional MCAI increased, 2.4 percent, while the Government MCAI decreased, 0.1 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.1 percent, while the Conforming MCAI increased by 4.0 percent.

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk and availability for their respective index.

The primary difference between the total MCAI and the Component Indices are the population of loan programs they examine. The Government MCAI examines FHA, VA, and USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings.

The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

Read more...

Mortgage Applications Increase, Including Refis

- Wednesday, 05 December 2018

- Originating

Mortgage applications increased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s Weekly Mortgage Applications Survey for the week ending Nov. 30, 2018. The results for the week ending November 23, 2018, included an adjustment for the Thanksgiving holiday.

“Application activity increased over the week for both purchase and refinance loans, and were 10 percent and 7 percent higher, respectively, than the week before the Thanksgiving holiday,”

said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

The Market Composite Index, a measure of mortgage loan application volume, increased 2.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 42 percent compared with the previous week. The Refinance Index increased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 36 percent compared with the previous week and was 0.2 percent higher than the same week one year ago.

“Treasury rates continued to slide last week, driven mainly by concerns over slowing global economic growth and U.S. and China trade uncertainty. The 30-year fixed-rate fell for the third week in a row to 5.08 percent and has declined a total of nine basis points over this span,” said Kan. “Additionally, we saw a decrease in the average loan size for purchase applications to the lowest amount since December 2017 ($298,000 from $313,000). This is perhaps an indication that there are fewer jumbo borrowers, or maybe first-time buyers are having better success reaching the market as we close out the year.”

The refinance share of mortgage activity increased to 40.4 percent of total applications from 37.9 percent the previous week. The adjustable-rate mortgage share of activity decreased to 7.4 percent of total applications.

The FHA share of total applications increased to 10.2 percent from 9.6 percent the week prior. The VA share of total applications increased to 10.0 percent from 9.9 percent the week prior. The USDA share of total applications decreased to 0.6 percent from 0.7 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 5.08 percent from 5.12 percent, with points decreasing to 0.44 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $453,100) increased to 4.89 percent from 4.88 percent, with points decreasing to 0.30 from 0.31 (including the origination fee) for 80 percent LTV loans. The effective rate remained unchanged from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 5.05 percent from 5.11 percent, with points decreasing to 0.62 from 0.63 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 4.50 percent from 4.53 percent, with points increasing to 0.60 from 0.51 (including the origination fee) for 80 percent LTV loans. The effective rate remained unchanged from last week.

The average contract interest rate for 5/1 ARMs increased to 4.33 percent from 4.29 percent, with points decreasing to 0.21 from 0.42 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

Read more...