OTHER NEWS

The Learning Center

Our Learning Center ensures that every reader has a resource that helps them establish and maintain a competitive advantage, or leadership position. For instance, loan originators and brokers will have one-click access to resources that will help them increase their productivity. Search topics by category and keyword and generate free videos, webinars, white papers and other resources. If you would like to add your content to the learning center, please click here or email Tim Murphy at [email protected].

“SPRAY AND PRAY” MARKETING IS DEAD

- Monday, 17 June 2019

- Originating

By Pat Sherlock, Founder QFS Sales Solutions

When speaking to originators and their managers, I hear frequent complaints about how tough origination is now. Many executives lament that their usual marketing efforts aren’t working as they once did. Unfortunately, many are still using a “spray and pray” approach to marketing. This strategy involves distributing mass marketing pieces and hoping that the message will reach the right prospect. The premise is that the more marketing messages you send, there will always be a certain number of prospects who will respond. Whether it is an email blast or postcard mailing, these marketing efforts just don’t have the impact that they once did for a number of important reasons. Spray and pray is dead.

[caption id="attachment_9789" align="alignright" width="300"] Pat Sherlock[/caption]

Pat Sherlock[/caption]

One of the main problems with “spray and pray” marketing is that it often features generic information that is not relevant to prospects which makes it easy to discard. Statistics bear this out. According to Constant Contact, the response rate for emails is only 6.53% and drops to 4.9% for direct mail. Both numbers are disappointing to say the least.

The popularity of on demand TV vs. regularly scheduled programming underscores the shift in consumer response to general advertising. Many prospects aren’t interested in receiving marketing content that is not tailored for their individual needs. They want to be in control of how and when they are contacted. This is not unique to the financial industry.

In the retail landscape, all sales professionals must convey WIIFM (What’s In It For Me) every time they reach out to prospects. Whether it is Realtors, car dealers or lenders, the supply chain is larger than the demand. It is no surprise that the winning strategy is one where lenders and originators must take market share from their competitors. The size of the market doesn’t guarantee success anymore. Winners and losers are determined faster than ever.

Just think about this: An estimated 290 billion emails are sent every day. There is no way that any individual can handle all the information that salespeople are sending to them. Is it any wonder that response rates are poor and sales professionals are frustrated when consumers ignore their marketing messages?

Today, consumers are living in a real time, on demand world. If a person wants a new bookcase or even a car, it is just a few clicks away. There is an endless supply of products and services and all vendors have to face the reality that the consumer has the power, not the seller. The truth is that consumers want personalized solutions to their problems on their terms and not determined by how the seller wants to sell to them. Consumers disregard everything else as “white noise” if it isn’t targeted to their current wants and needs.

What should producers and their companies do to navigate this new terrain?

Originators must recognize that building trust and credibility is a top priority. It is an originator’s responsibility to communicate to their marketplace why they should be trusted and why buying a house and financing is important to the consumer. This means reaching out on a consistent basis to tell their story and how housing fits into an individual’s financial wealth profile.

While lenders promote themselves through branding and advertising, originators must establish why prospects should do business with them at the consumer level. As mentioned in previous blogs, an originator who knows the product menu isn’t enough anymore; companies need them to generate new business. If the marketplace doesn’t know that the originator exists and what differentiates them from the hundreds of other originators in their territory, the sales professional will never get a real shot at being the consumer’s first contact.

Building an effective personal brand starts with understanding that it is a time investment more than anything else. It is centered on sharing information that is relevant to an originator’s targeted customers. It requires consistently delivering valuable insights on the housing and financial industries. It is about having a long-term view that positions the originator as a trusted advisor as opposed to a short-term view that is focused on a transactional relationship.

Our selling world is changing dramatically. Consumers have short attention spans, unlimited options and the ability to filter out unwanted marketing. It is time to stop “spray and pray” marketing efforts that are not a match with today’s consumer preferences.

Read more...Statewide Closing Costs Avg Between .88% and 4.95% of Sales Price

- Tuesday, 11 June 2019

- Originating

SAN DIEGO--(BUSINESS WIRE)--ClosingCorp, a leading provider of residential real estate closing cost data and technology for the mortgage and real estate services industries, today released its most recent closing cost data, which showed that in 2018 national average closing costs for a single-family property were $5,779 including taxes, and $3,344 excluding taxes.

ClosingCorp cost calculations include lender’s title, owner’s title, appraisals, settlement fees, recording fees, land surveys and transfer tax. To determine the average single-family home sale ranges, ClosingCorp uses home price data from CoreLogic, a leading global property information provider, to create a $100,000 price range. ClosingCorp uses ranges, rather than average sales prices, because it allows them to see real transactions.

Dori Daganhardt, senior vice president of Data Strategy, explained it this way: “The average home price is a number, but not necessarily a real property with a real closing. To get a sense of what is really going on in the market, we compared real cost data on more than 1.5 million purchase transactions that went through our SmartFees platform in 2018. We also used ‘market-specific’ rates and fees charged by the most active settlement services providers in each geographic area, not just network averages.”

Dori Daganhardt, senior vice president of Data Strategy, explained it this way: “The average home price is a number, but not necessarily a real property with a real closing. To get a sense of what is really going on in the market, we compared real cost data on more than 1.5 million purchase transactions that went through our SmartFees platform in 2018. We also used ‘market-specific’ rates and fees charged by the most active settlement services providers in each geographic area, not just network averages.”

The 2018 report shows the states with the highest average closing costs, including taxes, were: District of Columbia ($24,613), New York ($13,581), Delaware ($13,309), Washington ($12,667) and Maryland ($11,395). The states with the lowest closing costs, including taxes, were: Missouri ($1,887), Indiana ($2,002), South Dakota ($2,149), Iowa ($2,248) and Nebraska ($2,267).

The states with the highest average closing costs, excluding taxes, were: District of Columbia ($5,694), New York ($5,586), Hawaii ($5,318), California ($5,284) and Washington ($4,701). The states with the lowest closing costs, excluding taxes, were: Missouri ($1,887), Nebraska ($1,919), South Dakota ($1,995), Indiana ($2,002) and Iowa ($2,011).

“Because closing costs are based on sale price and taxing jurisdictions, the rankings of high and low-cost states tend to be relatively static,” said Bob Jennings, chief executive officer of ClosingCorp. “However, that doesn’t mean that various jurisdictions aren’t continually contemplating increases and adjustments. Our research showed more than one-third of all counties considered an adjustment to their taxes in 2018 and adjustments in more than 200 counties actually went into effect. These include some interesting twists. For example, four New York counties let their local mortgage tax expire and then reinstated the same tax; and the city of Baltimore introduced a ‘yield tax,’ which is essentially a ‘tax on tax.’ We expect to see even more adjustments in 2019, including a new law which increases the mansion tax on a sliding scale for transfers where the consideration is in excess of $2 million in New York City—already one of the cities with the highest closing costs.”

| Average Closing Costs by State | ||||||||

|

State

|

||||||||

| Avg Home Sales Price | Avg Total Closing Cost w Taxes | Avg Total Closing Cost w/out Taxes | % of Sales Price | |||||

| AK | $200,000 - $300,000 | $3,197 | $3,197 | 1.07% | ||||

| AL | $100,000 - $200,000 | $2,580 | $2,361 | 1.56% | ||||

| AR | $100,000 - $200,000 | $2,530 | $2,027 | 1.57% | ||||

| AZ | $200,000 - $300,000 | $3,561 | $3,561 | 1.26% | ||||

| CA | $600,000 - $700,000 | $6,765 | $5,284 | 1.09% | ||||

| CO | $400,000 - $500,000 | $3,570 | $3,496 | 0.88% | ||||

| CT | $300,000 - $400,000 | $7,003 | $3,416 | 2.11% | ||||

| DC | $600,000 - $700,000 | $24,613 | $5,694 | 3.87% | ||||

| DE | $200,000 - $300,000 | $13,309 | $3,322 | 4.83% | ||||

| FL | $200,000 - $300,000 | $6,459 | $3,585 | 2.35% | ||||

| GA | $200,000 - $300,000 | $3,600 | $2,733 | 1.61% | ||||

| HI | $600,000 - $700,000 | $6,665 | $5,318 | 1.02% | ||||

| IA | $100,000 - $200,000 | $2,248 | $2,011 | 1.34% | ||||

| ID | $200,000 - $300,000 | $3,066 | $3,066 | 1.17% | ||||

| IL | $200,000 - $300,000 | $5,523 | $4,454 | 2.31% | ||||

| IN | $100,000 - $200,000 | $2,002 | $2,002 | 1.10% | ||||

| KS | $200,000 - $300,000 | $2,532 | $2,428 | 1.10% | ||||

| KY | $100,000 - $200,000 | $2,311 | $2,162 | 1.39% | ||||

| LA | $100,000 - $200,000 | $3,445 | $3,120 | 1.82% | ||||

| MA | $400,000 - $500,000 | $5,924 | $3,820 | 1.21% | ||||

| MD | $300,000 - $400,000 | $11,395 | $3,667 | 3.59% | ||||

| ME | $200,000 - $300,000 | $3,563 | $2,461 | 1.40% | ||||

| MI | $100,000 - $200,000 | $3,983 | $2,696 | 2.37% | ||||

| MN | $200,000 - $300,000 | $3,790 | $2,446 | 1.56% | ||||

| MO | $100,000 - $200,000 | $1,887 | $1,887 | 0.95% | ||||

| MS | $200,000 - $300,000 | $2,475 | $2,475 | 1.14% | ||||

| MT | $200,000 - $300,000 | $2,741 | $2,741 | 0.96% | ||||

| NC | $200,000 - $300,000 | $2,850 | $2,316 | 1.24% | ||||

| ND | $200,000 - $300,000 | $2,501 | $2,501 | 1.18% | ||||

| NE | $100,000 - $200,000 | $2,267 | $1,919 | 1.24% | ||||

| NH | $200,000 - $300,000 | $6,183 | $2,405 | 2.37% | ||||

| NJ | $300,000 - $400,000 | $6,026 | $3,658 | 1.71% | ||||

| NM | $200,000 - $300,000 | $2,964 | $2,964 | 1.26% | ||||

| NV | $300,000 - $400,000 | $5,489 | $3,801 | 1.74% | ||||

| NY | $400,000 - $500,000 | $13,581 | $5,586 | 3.36% | ||||

| OH | $100,000 - $200,000 | $3,347 | $2,877 | 2.08% | ||||

| OK | $100,000 - $200,000 | $3,010 | $2,649 | 2.01% | ||||

| OR | $300,000 - $400,000 | $3,921 | $3,568 | 1.14% | ||||

| PA | $200,000 - $300,000 | $9,950 | $4,050 | 4.95% | ||||

| RI | $300,000 - $400,000 | $4,563 | $2,940 | 1.52% | ||||

| SC | $200,000 - $300,000 | $3,276 | $2,352 | 1.48% | ||||

| SD | $100,000 - $200,000 | $2,149 | $1,995 | 1.31% | ||||

| TN | $200,000 - $300,000 | $3,746 | $2,581 | 1.86% | ||||

| TX | $200,000 - $300,000 | $3,770 | $3,770 | 1.42% | ||||

| UT | $300,000 - $400,000 | $3,960 | $3,960 | 1.18% | ||||

| VA | $300,000 - $400,000 | $5,842 | $3,150 | 1.81% | ||||

| VT | $200,000 - $300,000 | $5,750 | $2,756 | 2.56% | ||||

| WA | $400,000 - $500,000 | $12,667 | $4,701 | 3.02% | ||||

| WI | $100,000 - $200,000 | $2,595 | $2,143 | 1.41% | ||||

| WV | $100,000 - $200,000 | $3,367 | $2,490 | 2.27% | ||||

| WY | $200,000 - $300,000 | $2,523 | $2,523 | 0.95% | ||||

| CBSAs with the Highest Average Closing Costs | ||||||||

|

CBSA

|

||||||||

| Avg Home Sales Price | Avg Total Closing Cost w Taxes | Avg Total Closing Cost w/out Taxes | % of Sales Price | |||||

| Seattle-Tacoma-Bellevue, WA | $500,000 - $600,000 | $15,045 | $5,266 | 2.71% | ||||

| New York-Newark-Jersey City, NY-NJ-PA | $500,000 - $600,000 | $13,763 | $5,380 | 2.54% | ||||

| Dover, DE | $200,000 - $300,000 | $13,398 | $3,356 | 6.49% | ||||

| Easton, MD | $300,000 - $400,000 | $12,154 | $3,515 | 3.12% | ||||

| Key West, FL | $500,000 - $600,000 | $11,535 | $5,258 | 1.93% | ||||

| CBSAs with the Lowest Average Closing Costs | ||||||||

|

CBSA

|

||||||||

| Avg Total Closing Cost w Taxes | Avg Total Closing Cost w/out Taxes | % of Sales Price | ||||||

| Warrensburg, MO | $100,000 - $200,000 | $1,653 | $1,653 | 0.85% | ||||

| Joplin, MO | $100,000 - $200,000 | $1,682 | $1,682 | 1.21% | ||||

| Columbia, MO | $200,000 - $300,000 | $1,726 | $1,726 | 0.83% | ||||

| Branson, MO | $100,000 - $200,000 | $1,813 | $1,813 | 1.05% | ||||

| Jefferson City, MO | $100,000 - $200,000 | $1,846 | $1,846 | 1.14% | ||||

| Counties with the Highest Average Closing Costs | ||||||||

|

County

|

||||||||

| Avg Home Sales Price | Avg Total Closing Cost w Taxes | Avg Total Closing Cost w/out Taxes | % of Sales Price | |||||

| Kings, NY | $900,000 - $1,000,000 | $39,352 | $7,480 | 4.09% | ||||

| Queens, NY | $600,000 - $700,000 | $28,729 | $6,784 | 4.44% | ||||

| Washington, DC | $600,000 - $700,000 | $24,617 | $5,696 | 3.87% | ||||

| Richmond, NY | $500,000 - $600,000 | $23,662 | $5,684 | 4.08% | ||||

| Westchester, NY | $700,000 - $800,000 | $19,173 | $6,336 | 2.64% | ||||

| Counties with the Lowest Average Closing Costs | ||||||||

|

County

|

||||||||

| Avg Home Sales Price | Avg Total Closing Cost w Taxes | Avg Total Closing Cost w/out Taxes | % of Sales Price | |||||

| Jasper, MO | $100,000 - $200,000 | $1,689 | $1,689 | 1.21% | ||||

| Jefferson, MO | $0 - $100,000 | $1,693 | $1,693 | 1.78% | ||||

| Boone, MO | $200,000 - $300,000 | $1,716 | $1,716 | 0.80% | ||||

| Jasper, IN | $100,000 - $200,000 | $1,793 | $1,793 | 0.99% | ||||

| Clark, IN | $100,000 - $200,000 | $1,805 | $1,805 | 0.97% | ||||

Additional CBSAs and county-level data available upon request.

Methodology

ClosingCorp average closing costs are defined as the average fees and transfer taxes required to close a conventional purchase transaction in a geographical area. These costs consist of fees from the following service types: title policies (both owners and lenders), appraisals, settlement fees, recording fees, land surveys and transfer tax. Actual closing fees for 1.5 million single-family home purchases from January 1 through December 31, 2018 were analyzed. Homes within a $100,000 range of the average home price (source: CoreLogic, a leading global property information, analytics and data-enabled solutions provider) were used to estimate closing costs for an average home at the state, core-based statistical area (CBSA) and county levels.

The average service type component fee was computed for every geographical area where at least 30 transactions occurred in the specified range during the period under review. Total cost to close was then computed as the sum of the service type averages. Land survey fees only were included for Florida and Texas single-family homes where land surveys are required. If a geographic area did not contain at least 30 data points for a given service type (excluding transfer tax), the average of the next largest geographical unit within the $100,000 range was used as an estimate. Only one estimate was allowed per geography. Cost to close was computed with and without transfer taxes.

Read more...Zillow Suggests 25 Things You Can Do Right Now To Grow Your Mortgage Business.

- Thursday, 06 June 2019

- Originating

By Katies

Growing your mortgage business doesn’t always require a major brand makeover or complete change in processes. There are many small things that you can do to improve and grow your business in the immediate future, and different steps that can keep your business moving forward and bringing in more prospective borrowers.

Here are 25 things you can do to grow your business right now.

1 – FOLLOW UP WITH CURRENT AND FORMER BORROWERS

1 – FOLLOW UP WITH CURRENT AND FORMER BORROWERS

While the internet has a significant effect on the way people research and shop for products and services, consumers still rely heavily on word of mouth when deciding who to do business with. This is no different in mortgages, and you can bet that prospective borrowers are doing their research before choosing a lender. By following up with current and former borrowers, you’re demonstrating that you’re still thinking about them and care about their business. That, in turn, can prompt them to tell others about their positive experiences with you, leading to a greater chance of referrals and new business.

2 – GATHER REVIEWS AND TESTIMONIALS

Once you’ve followed up, go a step further and ask your clients to write a review or short testimonial about your company. Consumers put a lot of trust in this type of feedback, so reviews are an important way to show prospective borrowers that you’re the best fit for their needs. Prospective borrowers are actively researching lenders before they choose one — having your current and former clients’ positive reviews easily accessible and viewable online is an easy way to help new, potential borrowers learn more about your company, see how good you are at what you do and feel confident that you are the right lender for them.

3 – SEND A HAND WRITTEN NOTE TO A PROSPECTIVE BORROWER

Sending a personalized note is a great way to start building a relationship. It shows that you’re thinking about them and not just treating them like another customer on a list. A hand written note can pay huge dividends when the client ultimately decide on a lender, as they’re likely to remember your willingness to go out of your way to follow up and send them a note of your appreciation.

4 – COLLECT AND ANALYZE YOUR DATA

Numbers help you measure, assess and track your company’s progress and direction. Gathering performance data is an excellent way to decide how to move forward, understand what’s working well, and determine what needs to be fixed or eliminated. From looking at website visitors to analyzing individual performance, data can drive everything that a company does. Following positive data can keep your company moving in the right direction and provide insight into what needs to be done to bring in and retain more borrowers. Data gives you and your company something concrete on which to base your decisions and helps you feel confident that your strategy is the best course of action.

5 – IMPROVE YOUR LEAD ENGAGEMENT TIMES

Once a lead comes in, make sure you’re responding to them as fast as possible. This can be accomplished with technological solutions like multiple dialers or auto-responders. Customers expect an immediate response, and if they don’t get one, they’ll move to the next lender on their list. Reducing the time between points of contact is hugely important to improving lead conversion and establishing relationships with your prospective and current borrowers right from the start.

6 – SET CONSISTENT, ACHIEVABLE GOALS

Setting business-oriented goals that are achievable yet challenging can be a healthy motivator. Maybe your goal is to bring in X more leads for the month, or increase total website visitors by X%. No matter what the goal is, creating a plausible strategy and getting all of the right people on board is essential. Goal setting will not only improve company performance, but also encourage collaboration between co-workers and departments.

7 – PREPARE FOR THE BUSY SEASON NOW

While summer and early fall are typically the busiest seasons for lenders, you shouldn’t spend the slower months simply sitting around waiting for the busier lending season to return. Begin preparing for the busy seasons early, and reach out to current and prospective clients to get them thinking about home buying as well. Establishing early contact with borrowers will ensure that your company is fresh in their minds when they start looking at houses and thinking about a mortgage.

8 – GET INVOLVED IN THE COMMUNITY

Whether through a charity event or a festival with corporate sponsors, getting involved in the community is a simple and easy way to get your company in front of a lot of people in a short span of time. Make your efforts recognizable, and show your community that you’re committed to contributing and giving back. Even if it’s something as simple as a logo appearing on a charity’s website, it can go a long way toward conveying the culture and attitude of your company, and it can give current and potential clients something to appreciate.

9 – BE CREATIVE WITH YOUR MARKETING SWAG

A good way to get your company in front of people daily is to offer marketing giveaways that people will actually use. Pens and water bottles are practical and timeless, but also consider items like coasters, koozies and power banks. There are many unique yet useful products that serve as effective branding tools for your business.

10 – RESEARCH CURRENT INDUSTRY TRENDS

Stay tuned in to the current buzz, the big and upcoming news, and the general industry trends. Not only can you use this information to further your own business efforts, you can also share it with current and potential borrowers to show them what’s going on and tell them how you’re using that knowledge to their advantage. This demonstrates your credibility and expertise, and shows that you know your industry inside and out.

11 – START UTILIZING A CRM SYSTEM

A good customer relationship management (CRM) system allows you to keep your customers organized, respond to their needs quickly, provide personalized service and create effective marketing campaigns that you can use to reach hundreds of online borrowers. Strong customer relationships are your lifeblood, and having a tool that helps you manage, maintain and foster those relationships can be a great benefit to your business.

12 – NETWORK WITH REAL ESTATE AGENTS

Networking and partnering with real estate agents is a mutually beneficial way to get more borrower contacts. If an agent has a client who needs a good mortgage loan, they’ll be more likely to refer them to a lender who has also referred borrowers to them when needing an agent. By working together, agents and lenders can expand their clientele and ensure that borrowers have all the resources they need.

13 – REDESIGN YOUR WEBSITE

The digital space is competitive, and an outdated website that’s unattractive or hard to navigate can really set you back. Review your website and think about what might need to be changed or updated. . Borrowers want a lending professional who stays current with trends and technology, and your website should be a reflection of that.

14 – KEEP YOUR WEBSITE CONTENT UP TO DATE

Along with refreshing your design, it’s important to ensure that all of the information displayed on your website — including reviews and testimonials, marketing copy, and company information — is accurate and current. If a potential borrower sees that your website information hasn’t been updated for months, they’ll be far less likely to consider you as a reliable source of timely information and service.

15 – FOCUS ON YOUR BORROWERS, NOT YOURSELF

While your website should include a headshot and general information about you and your company, dedicate more space to information that is relevant to consumers and worth their time. A prospective borrower is less likely to stay on a website that doesn’t offer any immediate value toward their mortgage needs, and while your personal and corporate accolades can give you an edge, they don’t need to be at the forefront.

16 – REVIEW WEBSITE ANALYTICS

Once you’ve updated all of your website content, you’ll want to track everything to see what works, what doesn’t, and how you can further improve your website for the best possible user experience. By monitoring site analytics, you can see what pages, links and calls to action (CTAs) are generating the most clicks and bringing in the most visitors. Having that data allows you to optimize your site based on the content visitors want and refine keywords to capture more traffic. Track the number of unique and total visitors to your site, and note what pages those returning users are looking at.

17 – START AND MAINTAIN A BLOG

One way to encourage repeat visits to your site is to offer your wealth of mortgage knowledge in the form of a blog. Having a well-written and regularly updated blog can help start the conversation with potential borrowers, giving you an opportunity to listen, share your input and establish a relationship before the borrowing process has even started.

18 – CREATE A CONTENT CALENDAR

When updating content or writing a blog, it’s important to create a content calendar that you can stick with. Providing new content on a consistent schedule makes it easier for site visitors to develop the habit of consuming and sharing your content. When creating a content calendar, don’t plan too much; if it’s too hard to maintain, you’ll be less likely to do it, and your readership will drop off.

19 – LEVERAGE SOCIAL MEDIA

Social media is one of the easiest ways to connect with potential borrowers and make your company, website and people accessible. People expect companies to have a presence on Facebook and Twitter, and want the ability to send a quick post or tweet when they have a question. Social media gives you another way to interact with potential borrowers and provides an outlet for sharing your own site content as well.

20 – SET UP AUTOMATED POSTING

Once your blog and social media accounts are up and running, and you have a content calendar that you’re following and updating, maintain a steady stream of content with automated blog and social media posting. You’ll keep your content flowing even when you’re out of the office, and your borrowers will always have fresh information to consume.

21 – OPTIMIZE YOUR CONTENT FOR SEARCH

Search engine optimization (SEO) helps you be discovered by more borrowers searching online, and many businesses put a lot of time and resources into improving their ranking in search results. To gain an edge on competitors trying to bring in the same borrowers you are, every keyword, title, page description and piece of content on your website needs to be optimized so your site appears in front of the most borrowers and generates more traffic. There are many programs that will help you optimize your site content, but researching what keywords your target market are searching for is a good place to start.

22 – SEND AN EMAIL CAMPAIGN

Perhaps you have a seasonal special coming up, or maybe there was some recent mortgage news that affects a large portion of your borrowers. Email is a quick and easy way to reach a lot of potential borrowers at once and share important and pertinent information. Email also offers a point of contact with your company should they want more information. When sending email campaigns, be brief and only include the information your prospective borrowers will want to see. Offering something of value in an easy-to-consume format increase the chances of your contacts reaching out to you for their mortgage needs.

23 – GET YOUR RATES IN FRONT OF YOUR CUSTOMERS

Whether through email or on your website home page, make sure you’re putting your rates in front of your borrowers. Don’t force your borrowers to search through your site; this is critical information that they expect to find, and if you don’t make it easy, they will likely move on to another lender’s site.

24 – START A NEWSLETTER

Along with targeted email campaigns, you can also create a monthly or quarterly newsletter to demonstrate your mortgage expertise, give borrowers important news and information about the industry and your company, and share your blog and site content. On your blog or website, offer a “subscribe” option so site visitors can opt in to your newsletter updates. Think about what content readers are likely to share; if your borrowers are forwarding your newsletter to family and friends, you’re likely to gain more site visitors, newsletter subscribers and, most importantly, potential customers.

25 – EXPERIMENT WITH VIDEO

Many online platforms and social media channels optimize video playback for users, and finding ways to use this to your advantage allows you to provide potential borrowers with a unique look into different aspects of your business. Whether you create small, learning-based videos about different mortgage processes or offer a weekly “vlog” to keep viewers informed about mortgage updates and news, videos are a rich medium for sharing your knowledge and can be archived and accessible on your own website as well.

Summary

There are many ways to grow your business now, both offline and online, and engage with new and current clients. Implementing these tips will help you bring more borrowers through your door and keep your business growing.

Read more..."Doorbells Before Wedding Bells" - SunTrust Survey Finds Millennials Are Buying Homes on Their Own Terms

- Tuesday, 28 May 2019

- Originating

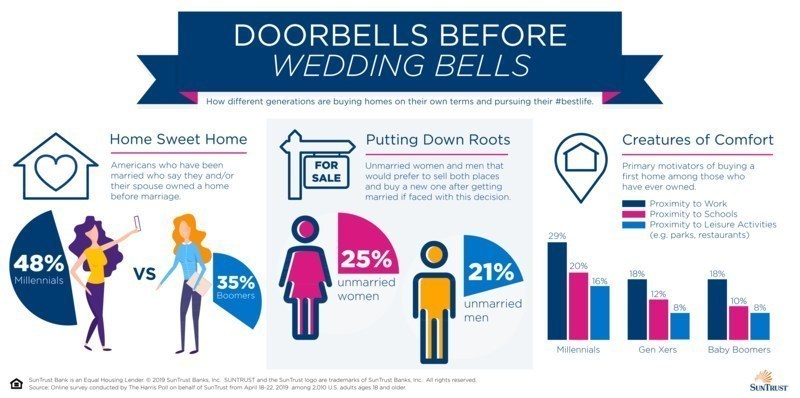

While the adage, "first comes love, then comes marriage," may ring true, for many millennials, "first comes home, then comes marriage." According to a new SunTrust survey conducted online by The Harris Poll among over 2,000 U.S. adults, nearly half of millennials (ages 22-38) who have been married say they and/or their spouse owned a home before marriage (48 percent), compared to only 35 percent of Baby Boomers (ages 55-73).

"People are choosing from many different paths and reaching common life milestones at a wider age span than before, changing when they decide to purchase a home," said Sherry Graziano, mortgage transformation officer at SunTrust.

The survey found additional trends across generations:

Putting Down New Roots

Today, it's increasingly common for both parties in a relationship to own a property when entering a marriage. However, some individuals not currently married would still prefer to start fresh with their significant other and sell both properties before tying the knot. According to the survey, 25 percent of unmarried women and 21 percent of unmarried men said if faced with this decision, they would prefer to sell both places and buy a new one after getting married.

Creature Comforts

When it comes to motivations for buying their first house, millennials seem to have been driven by convenience more so than their older counterparts. According to the survey, millennials who have owned homes were more likely than their older counterparts to cite proximity to work (29 percent, versus 18 percent of Gen X and 18 percent of Baby Boomers), schools (20 percent versus 12 percent and 10 percent), and leisure activities (16 percent versus 8 percent each) as primary motivators.

"It is easier to live life to the fullest – whether you are buying a home, downsizing, or selling – when you are financially confident. While everyone has different goals, across generations and lifestyle choices, it is important to make sure your financial habits are supporting, rather than preventing, the moments that matter most to you," Graziano said.

Read more...