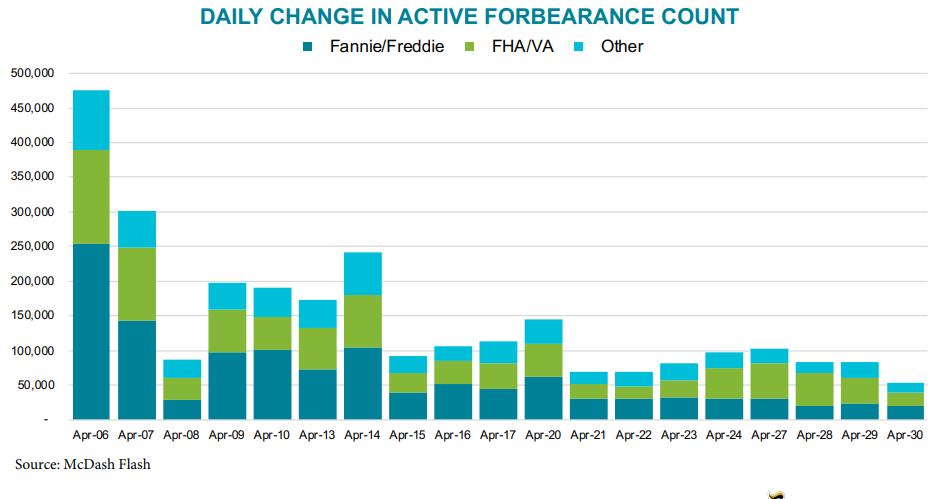

From April 21 and April 30, between 53,000 and 102,000 new forbearances have been enacted daily. While a lot, that’s less than a quarter of the surge Black Knight saw at the beginning of the month. As of April 30, there are currently more than 3.8 million homeowners in forbearance plans. What remains to be seen is whether there will be the same sort of spike in requests at the beginning of May as in April.

In an optimistic scenario in which daily forbearance volumes continue to decline by 10% per day, the number of forbearances could peak at approximately 4.5M in the coming months. On the other hand, should current forbearance volumes hold steady through mid-June, more than eight million homeowners could enter into forbearance plans, representing 16% or more of all mortgages.

If that adverse scenario holds true, servicers would be required to advance $4 billion in monthly principal and interest payments on GSE mortgages alone. Even under the FHFA’s recent four-month limit on P&I advances, servicers would still be bound to make $16 billion in advance payments over that time span.