OTHER NEWS

Mortgage Market Guide's Bodnar: Smooth Sailing Ahead, Unless Inflation Returns

- Thursday, 14 March 2019

- Originating

https://youtu.be/l8RisdUNEpw

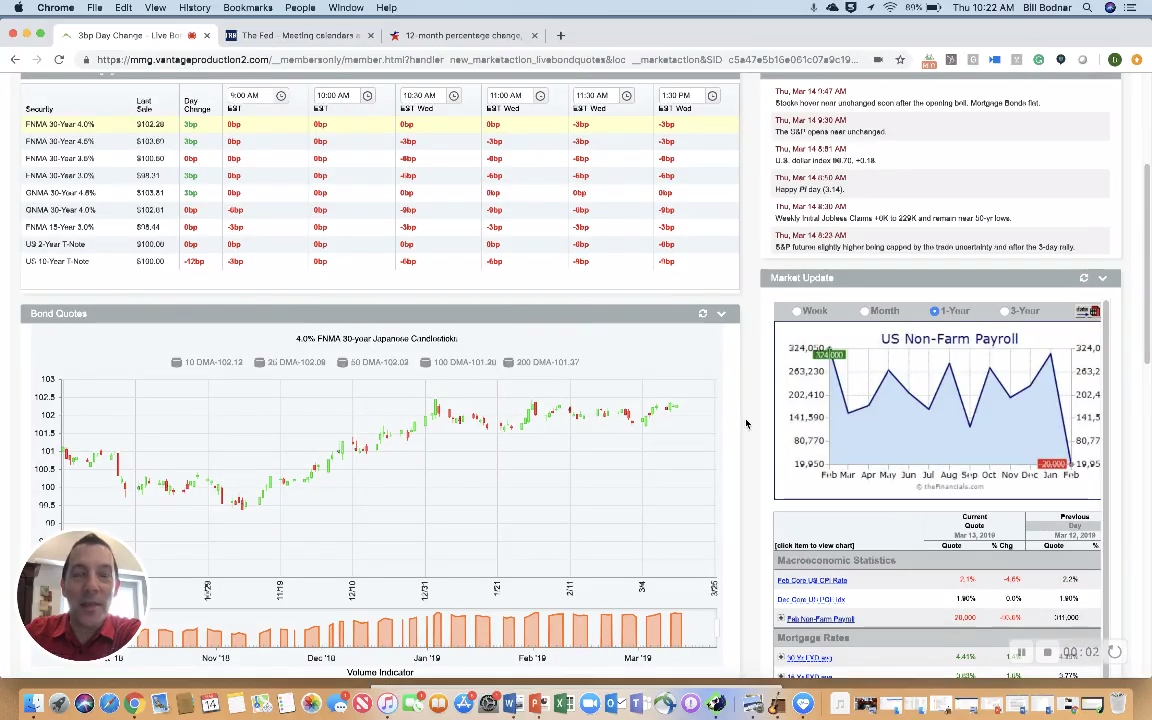

Hi, Bill Bodnar here from the Mortgage Market Guide. Thanks for tuning in for our MMG weekly recap.

So there's a trend developing right now, or has developed, that we want to make you aware of

heading into the spring market. And there's one word: It's called complacency, so we're going to talk about the charts and the price action because it really does highlight the complacent nature of the bond market.

Right now, you can see we are moving pretty much in a sideways trend. Volatility has gone away a lot.

And, we are right now again on the right side of the chart, right near 2019 highs as it relates to price, which is also a one-year high in price. At the same time watching stocks power higher, so you have this beautiful market of people's 401(k)s and portfolios moving higher in value. And you have interest rates

moving sideways in a beautiful trend worldwide.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Let's take a look back in October and November, the Fed was very hawkish, talking about hiking rates three times in 2019 reckless abandon. You know we talked about it and said it can't happen. Well they did

a 180, and since December 24th stocks have been in a rally mode.

Why? Because the Fed you know they're sitting on their hands right now waiting to see what happens with the global slowdown.

And then the second thing is inflation. We talk about inflation a lot. Inflation is the driver of interest rates. You can see after peaking out, this is CPI, you can see here in recent months that has ticked down. You can see the trend here in recent times is lower or the rate of inflation is slowing.

Disinflation is kind of kicking in, and we're seeing that around the globe. So, there is a search of global

yield that makes the U.S. Treasury market kind of attractive compared to other bonds around the country. It also makes mortgage-backed securities rather attractive.

It also makes high yielding stocks attractive. So right now with low inflation, a Fed out of the picture, and interest rates stable that's keeping stocks moving higher. It's keeping bonds at an elevated level, but

it's complacent for now.

What will be the trigger? What could change this story? It’s inflation. So that’s what we are watching, or wages. It's the one piece that is starting to emerge that the Fed has always looked at and said, “Hmm, it would be nice to see wages grow.”

And they're growing at around 3.4 percent year-over-year, the highest in a decade. And something we need to watch carefully, that if we get one inflation print higher sparked by wages, and it could certainly happen in months ahead.

This complacent trend will end like this [in an instant], so we need to be mindful in the months

ahead. We're watching inflation carefully but right now it is low to non-existent threat and that is really

fueling this beautiful, complacent trend, and interest rates are moving sideways at the best levels of the year.

Ask The Management Expert: How Can Managers Reduce Stress, Increase Productivity

- Monday, 11 March 2019

- Originating

By Dave Hershman

Question: I am the manager of a mid-size office with multiple loan officers. I have multiple areas of responsibility as a manager and each could be a full-time job. I jump from task to task each day but end up in the same spot the next day. How can I lessen my stress and be more productive?--Kevin from Ohio

For anyone who has too many tasks to undertake and not enough time to accomplish these tasks, there are two choices:

- Prioritize the tasks: A great leader must decide what is important and focus upon these tasks.

Other tasks should be delegated to others, postponed or eliminated. - Use synergy: If you want to get more done in less time, you need to find a way to achieve more that one goal with the same activity. The implementation of synergistic principals will not only increase productivity, but it will also help lessen the stress of manager.

There are seven rules of maximum synergy.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

These rules will help managers achieve more with less time, energy and money. Loan officers will also benefit from the use of these principals. Managers who are efficient in using these concepts will be more effective as mentors to their team, as well as recruiters.

- Everything you do must have a second objective.

- If you are marketing by yourself—you are wasting synergy.

- Some targets are more effective than others.

- Some tools are more effective than others.

- Everything you do can be made more effective through additional doses of synergy.

- Do not market without a response mechanism.

- Do not market unless you are delivering value.

Our industry has a tremendous number of managers. What we need is more leadership. The use of synergy will help you get there.

About the Author: Dave Hershman is a VP of Sales for Weichert Financial Services and founder of OriginationPro (www.OriginationPro.com), providing marketing content and training programs for the industry. Email him with “Ask the Mortgage Management Expert” questions or comments at This email address is being protected from spambots. You need JavaScript enabled to view it.

Read more...

Angel Oak’s Hutchens: Stellar Performance of Non-QM Loans Attracts Originators

- Tuesday, 05 March 2019

- Originating

Angel Oak Mortgage Solutions has offered non-qualified mortgage loans to brokers and correspondents since 2013.

Its strategy is to offer loan programs to borrowers who can’t meet the agencies’ financing guidelines—but who are worthy borrowers, based on Angel Oak’s manual underwriting and risk analysis. The company works with third-party originators in 40 states and is the largest non-qualified mortgage lender in the U.S. The lender originated $2.2 billion in loans in 2018, more than double the $1 billion Angel Oak originated in 2017.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

[caption id="attachment_10816" align="alignleft" width="186"] Tom Hutchens[/caption]

Tom Hutchens[/caption]

The Mortgage Leader spoke with Tom Hutchens, executive vice president of production at Angel Oak, on why the volume of non-QM originations has increased, what he thinks is the most misunderstood aspect of these loans and the reasons for their stellar performance.

TML: Why is it that at a time when the mortgage market is contracting, non-QM loans are expanding?

Hutchens: There is growing awareness in the marketplace of these loans. There are borrowers that don’t fit the agency and government boxes. It’s means that originators can expand their product offerings. That’s why we’ve worked to increase awareness of the non-QM market and have had an education campaign. We have 100 account executives, knocking on doors, talking to loan originators, and making them aware of the product.

TML: What do you think is the most misunderstood aspect of non-qualified mortgages?

Hutchens: That non-qualified mortgages doesn’t mean non-qualified borrowers. They don’t qualify for an agency loan, but they are very qualified borrowers. They have had a bad credit event, were out of work, or in some cases had medical bills they had to pay and that set them back. Agencies want the borrower to wait seven years from the credit event. With a non-QM loan, borrowers will qualify as soon as their record justifies extending a loan to them.

TML: Has non-QM opened doors with influencers?

Hutchens: Yes. Realtors, for instance, are aware of the product and understand that it means more deals will close. They want to expand their business, and non-QM is a way for them to do that. They get excited about the opportunity non-QM offers.

TML: Could you give us a sense of how these loans have performed?

Hutchens: There is five years of production history and non-QM loans perform better than Federal Housing Finance Authority loans. Fitch rated the actual underwriting performance of 11,000 non-QM loans--and only eight had gone into foreclosure. As originators become more aware of the performance, the desire to participate has grown.

TML: Why have the loans performed so well?

Hutchens: Performance has been good because the real estate market has performed well. In addition, we manually underwrite every loan, so we are able to analyze risk, and make good decisions. Automated underwriting systems, in contrast, don’t always provide a complete picture of the borrower. Angel Oak retains the loans for servicing and securitization, and we are required to own a percentage of the securities. We have to have skin in the game.

Read more...

Do You Suffer from Productionitis?

- Monday, 04 March 2019

- Originating

By Brian Sacks

Many years ago, when I was just starting out in the mortgage business, I had a dream of becoming a top producer. With no special relationships or advantages, I did what any normal person would do.

[caption id="attachment_7900" align="alignleft" width="332"] Brian Sacks[/caption]

Brian Sacks[/caption]

I looked around at what everyone else was doing and started doing it too. Please take a moment and read that sentence again, because it will help you understand an error most of us make in our marketing efforts.

Back then it was visiting offices, trying to get past the receptionist and saying “Hi” to agents. Of course there was also the stuffing of rate sheets in mail boxes and the occasional drop off of food, mostly doughnuts.

[adbutler zone_id="326324"]

[adbutler zone_id="326327"]

Read what Jim Rohn, the well-known entrepreneur, author and motivational speaker, says about these activities: “If you want to be successful in any field, simply look at what everyone else is doing and do the opposite.”

So stop now and take a look at what you are doing to generate new business. Too often, I find that we are all doing exactly the same things. We are saying the same things. We all look exactly the same.

Let’s look at some of the activities that we are being taught to do:

- Use a script to meet agents for coffee or lunch.

- Visit open houses and meet agents.

- Stalk agents on Facebook and LinkedIn.

- Send cold direct mail to un-targeted prospects.

- Buy social media ads on Facebook, Twitter and Instagram.

There are more of course.

But how are they working out for you? Don’t worry, I have tried them all, so I already know the answers. It leads to a disease that affects originators called Productionitis. This is the term I coined that explains what it feels like at the end of a month when you have worked your tail off but only closed one or two loans--or maybe no loans.

Here’s what it all boils down to. Read this because it’s very important.

There are a few cold hard truths about selling regardless of what it is you sell.

It comes down to who is chasing who.

Your job is to get business chasing you because when you use the tactics above you are actually chasing business instead of being in control.

Since I don’t want to tease you, let me share just a few ways that will getting agents and buyers chasing you.

- Become the expert in a niche. There are actually three niches I work on daily and love.

Boomerang buyers, clients going thru a divorce and renovation loans. - Become the celebrity originator in your current market.

You do this by being a sought-after expert on television, radio and in print. You can also use social media and other media like webinars and seminars to just dispense great advice that is helpful to consumers and referral partners. - Control the buyers. If you are able to create systems that generate buyers that you get pre- approved then of course you will be the one agents are chasing!I would suggest printing out this article and really giving it some thought and as always I would love your comments and feedback.

About the Author: Brian Sacks is an originator with Homebridge Financial in Baltimore, Md., with over 35 years of experience and closings of over $1.5 billion and 5,977 loans. He is the author of “48 Proven Ways to Close More Loans.” To learn more, visit https://48waysbook.com/special . He is also the founder of the “Top Originator Secrets Blog” which is available online at http://toporiginatorsecrets.com

Read more...