TRENDING WHITEPAPERS,VIDEOS & MORE

tim

House Financial Services Committee Offers Rulings on FHA, Flood Insurance and DACA Loan Eligibility

- Friday, 14 June 2019

It was a busy week for the House Financial Services Committee who, among other things, passed bills that addressed the cost of FHA loans, countered a recent HUD proposal on DACA borrowers and once again renewed The National Flood Insurance Program.

Yesterday, the House Committee on Financial Services overwhelmingly passed U.S. Congresswoman Joyce Beatty’s (OH-03) bill, the Housing Financial Literacy Act of 2019, H.R. 2162. If enacted, the bill would give first-time homebuyers who complete a Department of Housing and Urban Development (HUD)-certified housing counseling course a discount on their Federal Housing Administration (FHA) mortgage insurance premium of 25 basis points (or 0.25 percent).

“Motivating first-time homebuyers to seek vital pre-purchase counseling and equipping them with the much-needed financial skills and tools to make informed financial decisions benefits their families, the surrounding neighborhood, and our entire economy,” Beatty said. “I am pleased to see my bill move one step closer to becoming law, and many thanks to my Democratic and Republican colleagues for their support.”

“Motivating first-time homebuyers to seek vital pre-purchase counseling and equipping them with the much-needed financial skills and tools to make informed financial decisions benefits their families, the surrounding neighborhood, and our entire economy,” Beatty said. “I am pleased to see my bill move one step closer to becoming law, and many thanks to my Democratic and Republican colleagues for their support.”

Studies confirm that homebuyers who receive pre-purchase housing counseling are nearly one-third less likely to fall behind on their mortgage and thereby face a reduced risk of foreclosure. The bill now moves out of Committee to the House Floor for full consideration by the entire U.S. House of Representatives.

The second bill affecting FHA was The FHA Loan Affordability Act (H.R. 3141), introduced by Dean Phillips (D-MN). This would repeal the requirement that borrowers with FHA loans pay premiums on FHA mortgage insurance for the life of their loan. The bill would reinstate the previous policy which allowed borrowers to drop the insurance when the outstanding balance of their loan is reduced to 78 percent of the original value of the home. The wording of the bill appears to specifically disallow consideration of equity accrued through home price appreciation. The bill passed the committee 34 to 25.

A third bill, H.R.3167, The National Flood Insurance Program Reauthorization Act of 2019, reauthorizes the NFIP for five years and also includes a number of reforms to increase affordability, improve mapping, enhance mitigation, and modernize the NFIP.This bill was introduced by Rep. Maxine Waters (D-CA), Chairwoman of the House Financial Services Committee. It was passed unanimously by a bipartisan vote of 59 to 0.

Finally, The Homeownership for DREAMers Act, legislation was passed to clarify that Deferred Action for Childhood Arrivals (DACA) recipients cannot be denied mortgage loans backed by FHA, Fannie Mae, Freddie Mac or the U.S. Department of Agriculture (USDA) solely on the basis of their DACA status.This bill was introduced by Rep. Juan Vargas (D-CA). It was passed by a bipartisan vote of 33 to 25.

This bill was passed in response to a recent HUD clarification in a letter sent to Representative Pete Aguilar (D-CA) that stated that “DACA recipients remain ineligible for FHA loans.” HUD policy, currently reflected in HUD Handbook 4000.1, provides that “[n]on-U.S. citizens without lawful residency in the U.S. are not eligible for FHA-insured Mortgages.”

These bills will now move to the full house for further consideration.

Survey Reveals That Consumer Knowledge about Credit Scores Has Steadily Declined over the Past Eight Years

- Wednesday, 12 June 2019

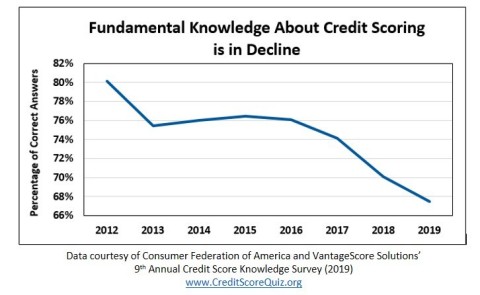

The ninth annual credit score survey, released today by the Consumer Federation of America (CFA) and VantageScore Solutions, LLC, shows that consumer knowledge about credit scores is at the lowest level in the past eight years. On most knowledge questions (as the enclosed table and charts show), correct scores declined by more than ten percentage points, and sometimes by more than 20 percentage points. For example:

- 78% of respondents in 2012, but only 62% in 2019, correctly indicated that people have more than one credit score.

- 85% in 2012, but only 66% in 2019, correctly answered that keeping a low credit card balance helps raise a low credit score or maintain a high one.

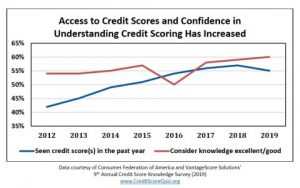

However, in the same period, the proportion of respondents who said they considered their knowledge of credit scores excellent or good rose from 54% to 60%.

“Consumers know less about credit scores but think they know more,” said Stephen Brobeck, CFA senior fellow. “Taking our online credit score quiz provides an easy way for consumers to update their credit score knowledge,” he added. More than 230,000 individuals have taken the Credit Score Quiz, developed and maintained by CFA and VantageScore.

“We are pleased that many consumers now have free access to their credit scores, but consumers must also take advantage of all the additional information about credit scores and credit files in order to make better credit decisions,” said Barrett Burns, president and CEO of VantageScore Solutions.

Consumer knowledge levels may have deteriorated, in part, because of improvements in the overall economy and consumers’ financial condition. In 2012, large numbers of Americans faced challenging credit card and mortgage debts, so consumers may have been especially concerned about credit scores. Since then, as the nation’s economy and family finances recovered, and as consumers reduced unsustainable credit card and mortgage debts, consumers may have felt that it was less important to fully understand credit scores. Reports of increases in average credit scores nationwide may also have lessened people’s feelings of financial vulnerability and the need to fully learn about their scores and its impact.

Despite overall rising score levels – now averaging 680 according to Experian – a large minority of consumers have fair or poor scores (below 670). Low scores can especially harm these people by:

- Denying then access to needed credit

- Increasing the costs of consumer and mortgage credit that can obtain. Subprime auto loans will likely cost several thousand dollars more, and subprime mortgage loans can cost over ten thousand dollars more compared to conventional loans.

- Increasing deposits required by utilities and cell phone companies to obtain service

Low credit scores also are an indicator that people may have difficulty obtaining a job. While credit scores themselves are not used by employers, the credit reports the scores are based on are frequently utilized. “Those with low credit scores should be aware that they are at risk not only for paying higher costs for credit and utility services, but may also struggle to obtain a good job with which to afford those higher costs,” noted CFA’s Brobeck.

While consumers’ knowledge of their actual credit scores has declined overall, the latest survey shows large majorities of consumers did correctly answer key knowledge questions related to important facts:

- Mortgage lenders and credit card issuers use credit scores (83% and 82% respectively).

- Missed payments are used in calculating credit scores (86%)

- Making all loan payments on time helps a consumer raise a low credit score or maintain a high one (87%).

However, significant minorities of respondents did NOT know other key facts, for example:

- Cell phone companies might use credit scores in pricing services (41%).

- Borrowing from a 401k retirement account or paying a parking ticket late will not lower your credit scores (30% and 22% respectively).

- Opening several credit card accounts at the same time might lower scores (38%).

- Frequently checking credit scores will not lower their scores (38%).

- Checking the accuracy of one’s credit reports is very important (33%). Lenders may have provided inaccurate information or failed to supply accurate information to credit bureaus; thus, the bureaus may have made mistakes such as adding information to the wrong file of a person with the same name.

In brief, consumers can raise their credit scores or maintain high scores by:

- Consistently making loan payments on time every month. A late payment may lower one’s credit scores by dozens of points.

- Using a small portion of the credit available on a credit card. In general, the higher the percentage of credit line that is drawn down, the lower one’s credit scores.

- Paying down credit card debt rather than just shifting it to another credit card or to a home equity loan.

- Regularly checking one’s credit reports to make sure they are error-free. This can be done for free annually by going to comor by calling 800-322-8228.

The survey was conducted by the Engine Telephone CARAVAN survey, who on April 25-28, 2019, interviewed 1,002 representative adult Americans by landline or cell phone. The survey’s margin of error is plus or minus three percentage points.

Read more...Commercial/Multifamily Originations Increase 12 Percent in the First Quarter

- Tuesday, 14 May 2019

Commercial and multifamily mortgage loan originations rose 12 percent in the first quarter compared to the same period last year , according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. In line with seasonality trends, originations the first three months of the year were 34 percent lower than the fourth quarter of 2018.

“The momentum seen in 2018’s record year of borrowing and lending continued in the first quarter of this year,” said Jamie Woodwell, MBA’s Vice President of Commercial Real Estate Research. “First quarter volumes were higher for nearly every property type, and double-digit growth in loan volume for Fannie Mae and Freddie Mac led the increase among capital sources. Low interest rates and strong property values continue to make commercial real estate an attractive market for borrowers.”

Compared to a year earlier, a rise in originations for industrial, health care and hotel properties led the overall increase in commercial/multifamily lending volumes. By property type, industrial (73 percent), health care (41 percent), hotels (14 percent), retail (9 percent) and multifamily (9 percent) all saw year-over-year gains by dollar volume. The dollar volume of office property loans was unchanged.

Among investor types, the dollar volume of loans originated for Government Sponsored Enterprises (GSEs – Fannie Mae and Freddie Mac) increased by 14 percent year-over-year. Life insurance company loans increased 7 percent, commercial bank portfolios increased 6 percent, while loans originated for Commercial Mortgage Backed Securities (CMBS) decreased 4 percent.

As is typical in the first quarter, originations decreased in comparison to last year’s fourth quarter, with total activity falling 34 percent. Among property types, declines were seen in health care (49 percent), hotels (45 percent), multifamily (40 percent), retail (32 percent) and office space (30 percent). Industrial properties bucked the overall trend, rising 17 percent from the fourth quarter of 2018.

Among investor types, the dollar volume of loans for GSEs decreased 43 percent, originations for commercial banks decreased 34 percent, loans for life insurance companies decreased by 28 percent, and loans for CMBS decreased 22 percent.

Read more...