TRENDING WHITEPAPERS,VIDEOS & MORE

tim

Urban Institute's Index Shows Credit Easing Has Room to Increase

- Tuesday, 23 April 2019

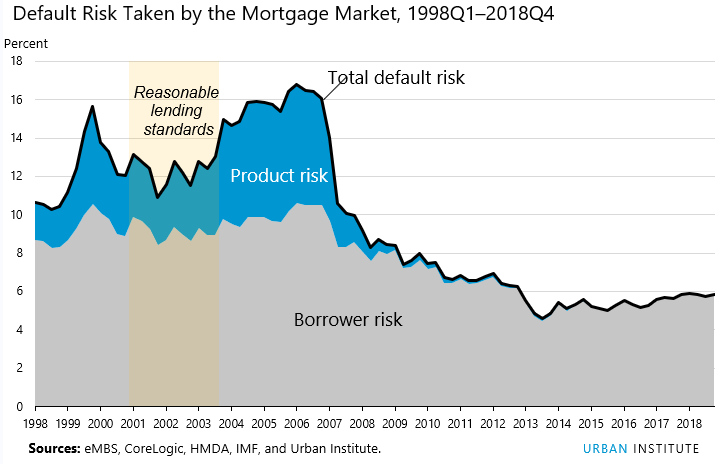

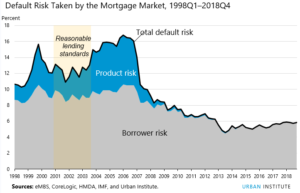

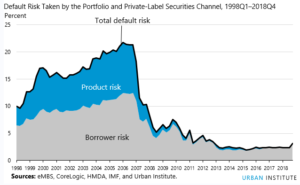

The Urban Institute’s Housing Finance Policy Center updated their Housing Credit Availability Index (HCAI) last Friday. The HCAI measures the percentage of owner-occupied home purchase loans that are likely to default—that is, go unpaid for more than 90 days past their due date. A lower HCAI indicates that lenders are unwilling to tolerate defaults and are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates that lenders are willing to tolerate defaults and are taking more risks, making it easier to get a loan.

What this index shows is that while credit seems to be easing it is nowhere near pre-crises levels.The study states that “If the current default risk was doubled across all channels, risk would still be well within the pre-crisis standard of 12.5 percent from 2001 to 2003 for the whole mortgage market.” This implies that there is still significant space remaining to safely expand the credit box, something we are seeing as more and more lenders move into non-QM.

The latest HCAI shows that mortgage credit availability increased to 5.85 percent in the fourth quarter of 2018 (Q4 2018), up from the previous quarter (5.75 percent), but still down from peak reached in the first quarter of 2018 (5.89 percent). This quarter’s increase was caused by an increase in risk taken in the portfolio and private-label securities channel. Credit also expanded in both the GSE and government channels, but by a smaller margin.

Mortgage credit availability in the GSE channel—Fannie Mae and Freddie Mac— has been increasing steadily since the financial crisis. Last quarter, Q3 2018, the index reached 3 percent for the first time since 2008, and this quarter, it continued to increase slightly. The government channel (FVR) increased to 11.8 percent, the highest level since 2009. The FVR channel includes the Federal Housing Administration, the US Department of Veterans Affairs, and the US Department of Agriculture’s Rural Development program. The portfolio and private-label securities channel increased to 3.1 percent, but still remains near the record low for the amount of default risk taken.

The HCAI by Channels

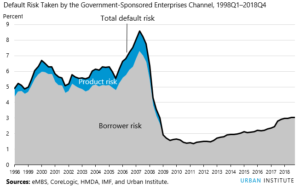

GSE Loans

The GSE market has expanded the credit box for borrowers more effectively than the FVR government channel has in recent years. The downward trend of credit availability in the GSE channel began a reversal in Q2 2011. From Q2 2011 to Q4 2018, the total risk taken by the GSE channel has more than doubled, from 1.4 percent to 3.0 percent.

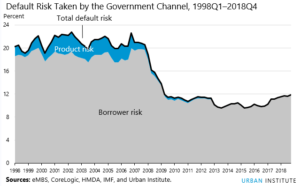

Government Loans

The total default risk the government loan channel is willing to take bottomed out at 9.6 percent in Q3 2013. It has fluctuated at or above that number since then. In the past nine quarters starting in Q4 2016, the risk in the government channel has risen significantly from 9.9 to 11.8 percent, the highest level since 2009, but still about half the pre-bubble level of 19 – 23 percent.

Portfolio and Private-Label Securities Loans

The portfolio and private-label securities (PP) channel took on more product risk than the FVR and GSE channels during the bubble. After the crisis, the channel’s product and borrower risks dropped sharply. The numbers have stabilized since 2013, with product risk fluctuating below 0.6 percent and borrower risk around 2.0 percent. Borrower risk increased substantially in the fourth quarter of 2019, driven primarily a decline in FICO scores and an increase in high-LTV lending. Total risk in the PP channel was 3.1 percent in Q4 2019, the highest level since 2012.

Read more...

Ask the Expert: Build a Relationship Before Answering Phone Questions

- Monday, 22 April 2019

I keep getting the same question over the phone—what is your rate on a 30-year fixed mortgage? How do I reply in a way that will assure that I get the loan? Eddie from New Hampshire

This question goes to the crux of sales within the industry. It is so important that I may take two or three issues to answer the question—

- Telephone sales are an important factor in our industry. Everyone will have to sell over the phone at one point or another, even if the relationship starts online.

- If you are dealing with cold calls, you will find selling over the phone that much more difficult. It is difficult to develop a relationship in a five-minute conversation.

- If you choose to answer the question and do it honestly—you will typically lose the caller. That is because everyone else will be low-balling over the phone. Yet, if you low-ball to get the prospect’s attention you are setting yourself up for failure—you will never deliver more than you promised.

- If you start hitting them with qualification questions so you can give an accurate quote (such as—what is your credit score?)—you are putting them on the defensive. It is never a good idea to get personal before you have built a relationship.

[adbutler zone_id="325884" type="asyncjs1.1" ]

[adbutler zone_id="325888" type="asyncjs1.1" ]

So, what do you do? You start the relationship-building process. The most important question to start with is asking the prospect how they were directed to you. If there is any basis for a relationship already, this will quickly become evident. If they say—from the yellow pages—it is a cold call. If they say they were referred from a previous customer, you can start by inquiring about their relationship with that person, because that relationship is what you have in common.

You need to follow with letting them know that you will need some information in order to best serve them and ask their permission. Too many of us just seem to start “firing away” with such questions as “purchase or refinance?” or “what is your credit score”?

The purpose of these questions is to get them comfortable talking about their needs. What they ask you for initially may have nothing to do with their needs. It is your job to attain a comfort level, get them talking and then listen. The deeper you get, the better you will be able to determine their real needs, rather than the answer to the superficial rate question.

Dave

Dave Hershman is Senior VP of Sales of Weichert Financial and the top author in the mortgage industry. Dave has published seven books, as well as hundreds of articles and is the founder of the OriginationPro Marketing System and Mortgage School – the online choice for expert

Read more...What Percentage Of Your Originators Are Really Producing?

- Monday, 22 April 2019

By Pat Sherlock

In recent conversations with a Board Chairman and the President of a mortgage company, I asked each one separately “What percent of your sales staff meet the company’s annual volume goals?” This productivity percentage is a critical standard for any mortgage company because it is a predictor of profitability.

The Board Chairman said 80% of the loan officers made the company’s volume goal. The mortgage company President said the percentage was only 40% of the sales staff. This raises the question of how two executives at the same company can have such different understanding of the reality of their organization’s sales performance.

[adbutler zone_id="325884" type="asyncjs1.1" ]

[adbutler zone_id="325888" type="asyncjs1.1" ]

While the disparity between the executives’ perception of their firm’s sales performance can be attributed to a number of factors, the ramifications of not having an accurate view of this critical metric is a recipe for disaster. Let me explain why.

If 80% of a company’s sales force is meeting volume goals, they are achieving at acceptable levels. In this scenario, only 20% of the originators would need to be on a performance plan and managed out if they failed to change their sales results. It also implies that hiring managers have done a fairly good job of correctly identifying sales talent and matching candidates to the company’s culture.

But if the true percentage is 40% or less, there are major problems with a company’s recruiting efforts and the skillsets of their managers. This performance level means 60% of the sales staff are underperformers and not profitable. As Stratmor’s research indicates, carrying a majority of low performers over a long period of time can lead to financial ruin for a company.

Based on my company’s nearly 20 years of research on personality traits of above-average originators, the simple reality is that only certain individuals are matched for a career in mortgage origination. If an originator is not a match for origination, no amount of investment in training or coaching will make up for a lack of sales talent. These individuals are better suited to be customer service reps than creators of loan demand.

Another important issue is that when companies hire those not matched for the sales position, they make their firm unattractive to top producers. Why would a top producer want to join a company that has a majority of poor performers? In a sales organization where only 40% of the sales group is making volume goals, the top producer has the burden of carrying too many underperformers. At the same time, operations has to devote their limited resources to handling poorly originated production. This is not an inviting proposition for top producers.

Read more...