TRENDING WHITEPAPERS,VIDEOS & MORE

matt

TD Bank Increases Commercial Lending 6.8%

- Sunday, 10 March 2019

TD Bank expanded its commercial real estate lending by 6.8 percent in fiscal year 2018, issuing $6.6 billion in new loans and renewals.

"Changing market trends, including global and political uncertainty, are expected to have a significant impact on the real estate and business communities going forward," said Gregg Gerken, head of commercial real estate for TD Bank. "We're still seeing an increase in demand and more building of industrial space and affordable housing, but retail and office is changing. Our ability to be a strategic resource for our clients throughout the economic cycle will be key to our success."

One of the most influential market trends is the growing need for affordable housing across the country. TD's commercial real estate business extended over $1 billion in community development financing to projects that included affordable housing developments in local communities in the form of debt and equity.

Some of the financing includes:

- More than $450 million to housing authorities and nonprofit organizations, a majority of which are in low- and moderate- income communities.

- More than $125 million to restore and adapt buildings named on the national register of historic places

- Financial commitments to major metro cities in the Northeast including $360 million in New York City, $70 million in the greater Philadelphia area and $202 million in Boston.

Recent commitments also include $39.5 million in the form of debt and equity to MHANY Management Inc. and We Stay/Nos Quedamos, Inc., for a new mixed use project of 180 affordable apartments including a community facility for low-income seniors in the Bronx, and $16.7 million in the form of debt and equity to Peabody Properties and the Affordable Housing and Services Collaborative Inc., for the development of 50 apartment units with onsite support services for formerly homeless and disabled veterans in New Jersey.

In 2018, TD backed affordable housing and supportive housing for people with disabilities, veterans, formerly homeless families, and people managing HIV/AIDS, survivors of domestic violence, LGBTQ young adults and other vulnerable and special needs residents, all of which included onsite support services. The bank also provides numerous grants for both affordable housing developments and programs for low income communities through its TD Charitable Foundation, the charitable giving arm of the bank.

"In 2019, there will continue to be a growing need for affordable housing across the country," said Andrew Warren, senior vice president, commercial real estate for TD Bank. "The number of households needing affordable housing has grown and the supply has not kept pace. In the years ahead, the industry will need to pursue different financing strategies to find a solution."

Read more...

Trepp CMBS Delinquency Rate Dips Below 3%

- Friday, 08 March 2019

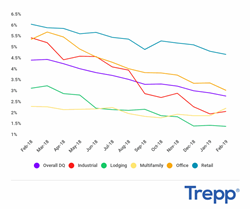

The Trepp CMBS Delinquency Rate crossed another threshold in February as it dipped below 3% for the first time since May 2009.

February’s reading clocked in at 2.87%, down 15 basis points from the prior month and a new post-crisis low for the delinquency rate, according to the “February 2019 US CMBS Delinquency Report” from Trepp.

The multifamily delinquency rate increased 34 basis points to 2.31 percent in February, from 1.97 percent in January. The multifamily delinquency rate was 1.67 percent, an increase of 35 basis points.

(Graph Below) CMBS Delinquency Rates by Property Type (Feb. 2019)

“Delinquencies fell again last month, driven once more by the squeezing out of more remnants from the pre-crisis era,” said Manus Clancy, senior managing director at Trepp. “While CMBS 2.0 has generally held up well, there are some pockets of concern that merit watching. In particular, some extra attention should be paid to student housing, grocery-anchored retail, and certain cities like Houston where several large assets are contending with sizable delinquencies.”

Although the overall CMBS 2.0+ rate dipped five basis points to 0.63% last month, the seriously delinquent reading for 2.0+ increased eight basis points to 0.60%. Delinquencies among CMBS 1.0 continue to slide as its overall rate dipped another 45 basis points to 44.83%. That reading has dropped 301 basis points since March 2018.

February's greatest month-over-month improvement by major property type belonged to the office segment. The office reading shed 34 basis points last month and now clocks in at 3.13%. Retail still has the worst performing rate among property types, but its reading fell once again in February. With its most recent decline of 15 basis points, the retail rate now sits at 4.77% and has improved in each of the last five months.

Read more...Hunt Makes Two Fannie-Backed Loans Totaling $8.84M

- Thursday, 07 March 2019

Hunt Real Estate Capital provided two Fannie Mae DUS loans totaling $8.84 million to refinance two multifamily properties located in Winchester, Va.

The loan term with both deals is 10-years. Yield maintenance will apply during the first 9.5 years with a 1% prepayment fee thereafter, with no fee due for the last 90 days.

The two properties include:

- Fay Street Apartments: Hunt provided a $4.6 million loan to refinance Fay Street Apartments, a 78–unit apartment community that is comprised of nine, two-story residential buildings. The property is situated on 2.77 acres of land. The two- and three‐bedroom units are all two‐level townhouse units. The property offers 130 parking spaces and has only one vacant unit.

- Fort Colliers Apartments:Hunt provided a $4.2 million loan to refinance Fort Colliers Apartments, a 72–unit apartment community that consists of two- and three-story garden style buildings that were built in the 1980s. The property offers a unit mix of one-bedroom apartments as well as two- and three‐bedroom townhouses on two levels. Fort Colliers has only two vacant units.

"Both properties are self-managed by the borrower, an experienced local investor in the rental market with a proven track record for success," said Chad Musgrove, vice president at Hunt. "They own and manage five multifamily properties totaling 262 units, as well as one hotel property."

Winchester is a smaller market within the greater suburban Virginia, Maryland, Washington, D.C. area.

"Both Fay Street and Fort Colliers benefit from good highway access which has a positive impact on the regional economy and ensures access to employment opportunities from Pennsylvania to the north and to western Virginia to the south," said Musgrove.

Read more...