TRENDING WHITEPAPERS,VIDEOS & MORE

matt

New Home Purchase Mortgage Apps Rise 7% in March

- Wednesday, 10 April 2019

The Mortgage Bankers Association Builder Application Survey data for March 2019 shows mortgage applications for new home purchases increased 7 percent compared with a year ago. Compared to February 2019, applications increased by 19 percent. This change does not include any adjustment for typical seasonal patterns.

“With a strong job market, rising wages and lower mortgage rates, housing demand remains strong, as shown by the solid 7 percent growth in new home purchase applications in March," said Mike Fratantoni, MBA's SVP and chief economist “The confluence of declining mortgage rates with the spring buying season is supporting stronger housing demand and activity. Additionally, the drop in average loan size suggests that builders are tilting production to lower-priced homes, which continues to see the tightest inventories and strongest home-price growth.”

MBA estimates new single-family home sales were running at a seasonally adjusted annual rate of 676,000 units in March 2019, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The seasonally adjusted estimate for March is a decrease of 2 percent from the February pace of 690,000 units. On an unadjusted basis, MBA estimates that there were 66,000 new home sales in March 2019, an increase of 11.9 percent from 59,000 new home sales in February.

By product type, conventional loans composed 68.7 percent of loan applications, FHA loans composed 18.8 percent, RHS/USDA loans composed 0.5 percent and VA loans composed 12 percent. The average loan size of new homes decreased from $340,692 in February to $331,794 in March.

MBA’s Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country.

Read more...Fannie Mae Completes $29.7B Single Family Risk Transfers

- Tuesday, 09 April 2019

Fannie Mae completed two Credit Insurance Risk Transfer transactions for almost $30 billion.

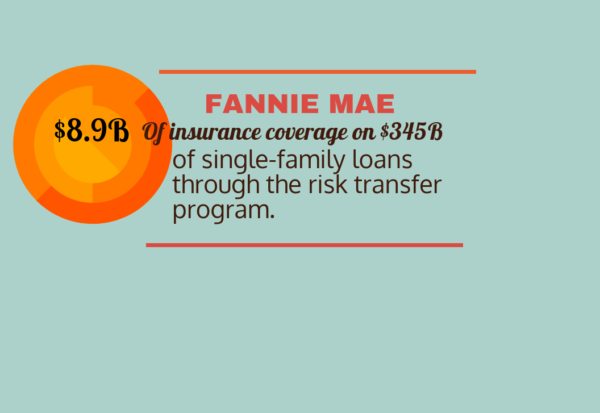

CIRT 2019-1 and CIRT 2019-2, which together cover $29.7 billion in unpaid principal balance of 21-year to 30-year original-term, fixed-rate loans, are part of Fannie Mae's ongoing effort to increase the role of private capital and reduce taxpayer risk in the mortgage market. To date, Fannie Mae has acquired about $8.9 billion of insurance coverage on $345 billion of single-family loans through the CIRT program.

"Twenty insurers and reinsurers provided coverage on these two CIRT transactions. CIRT 2019-1 and 2019-2 together covered the largest combined pool of loans and provided us the most coverage that we have ever acquired through CIRT at one time,” said Rob Schaefer, vice president for credit enhancement strategy and management at Fannie Mae. “These two transactions also marked the first time that the CIRT structure has covered the modification costs related to loan workouts, similar to the coverage that has been provided through our Connecticut Avenue Securities.”

In CIRT 2019-1, Fannie Mae will retain risk for the first 60 basis points of loss on a $11.8 billion pool of single-family loans with loan-to-value ratios greater than 60 percent and less than or equal to 80 percent.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

If the $70.6 million retention layer is exhausted, reinsurers will cover the next 325 basis points of loss on the pool, up to a maximum coverage of approximately $382 million. With CIRT 2019-2 Fannie Mae will retain risk for the first 60 basis points of loss on a $17.9 billion pool of single-family loans with loan-to-value ratios greater than 80 percent. If the $107 million retention layer is exhausted, reinsurers will cover the next 325 basis points of loss on the pool, up to a maximum coverage of approximately $582 million.

Coverage for these deals is provided based upon actual losses for a term of 10 years. Depending on the pay down of the insured pool and the principal amount of insured loans that become seriously delinquent, the aggregate coverage amount may be reduced at the one-year anniversary and each month thereafter. The coverage on each deal may be canceled by Fannie Mae at any time on or after the five-year anniversary of the effective date by paying a cancellation fee.

The covered loan pool for the CIRT 2019-1 and CIRT 2019-2 transactions consist of fixed-rate loans that were acquired by Fannie Mae from April 2018 through November 2018.

Read more...

New Data Confirm the Urgency of Addressing the Expiration of the GSE Patch

- Monday, 08 April 2019

By Laurie Goodman

Last year, we wrote about the need to address the expiration of the government-sponsored enterprise patch, or “GSE patch,” which currently allows higher debt-to-income ratio mortgages to qualify for the protections provided under the qualified mortgage rule.

We also offered several options for addressing the January 2021 expiration of the patch.

Recently, Recursion Co., a financial analytics firm, combined several databases and shared some of the results with us, allowing us to establish exactly why it’s important to address the expiration of the patch.

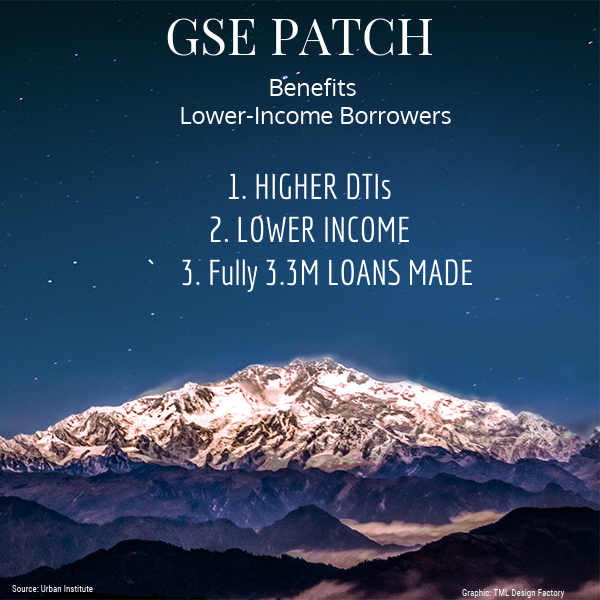

The patch disproportionately benefits minority and lower-income borrowers. Letting the patch expire in 2021 with no change will further disadvantage these already underserved groups.

The qualified mortgage rule, one of the most significant accomplishments of the Dodd-Frank Wall Street Reform and Consumer Protection Act, requires mortgage lenders to make a good faith determination of each borrower’s ability to repay a proposed loan, considering such factors as borrower income, assets, other debt, and employment. The mortgage itself must be fully amortizing, with maturities of no more than 30 years.

This rule eliminated the riskiest loans—such as interest only loans, balloon loans, and adjustable rate mortgages—that could experience negative amortization. The rule was designed to protect borrowers from obtaining loans they could not afford, while simultaneously giving lenders protection from lawsuits that claim a lender failed to verify a borrower’s ability to repay. A borrower who obtains a qualified mortgage is presumed to have the ability to repay that mortgage.

The Consumer Financial Protection Bureau codified the QM rule in January 2014, specifying a set of features that a mortgage must have to qualify for the rule. One of the required features was a DTI ratio of no more than 43 percent. There is a permanent exemption from this DTI cap for loans insured by the Federal Housing Administration, the Department of Veterans Affairs, or the Department of Agriculture or held in portfolio by a depository institution with $10 billion or less in assets.

[caption id="attachment_11651" align="alignleft" width="448"] GSE Patch led to higher DTIs and lower incomes.[/caption]

GSE Patch led to higher DTIs and lower incomes.[/caption]

Loans purchased by Fannie Mae and Freddie Mac had a temporary exemption to the DTI cap, known as the GSE patch, which expires on Jan. 10, 2021, or when the GSEs exit conservatorship, whichever comes first. All GSE loans, including those covered by the GSE patch, must still go through the rigorous GSE underwriting process.

Approximately 19 percent of GSE loans in the 2014–2018 period, or 3.3 million loans, were made possible by the patch. The number of loans taking advantage of the patch was higher in the later part of the period as interest rates rose and, in conjunction with higher home prices, forced many homebuyers to borrow more in comparison with their incomes. The CFPB is currently deciding the fate of this patch—whether to keep it in place, let it expire, or modify it.

In assessing the value of and determining the next steps for the patch, it would be helpful to know who it serves—both in terms of race and ethnicity and income. But until now, we haven’t had access to this information because neither of these variables is contained in publicly available mortgage origination data.

The tables below finally offer this critically important data, thanks to Li Chang of Recursion Co., who matched Home Mortgage Disclosure Act data (which has race and ethnicity and income information) with GSE origination data provided through eMBA, which reports on GSE securities data.

The results, while not surprising, confirm and quantify an important fact most believed to be true: That high DTI GSE borrowers are disproportionately minority borrowers with incomes that are, on average, less than those of borrowers with lower DTIs.

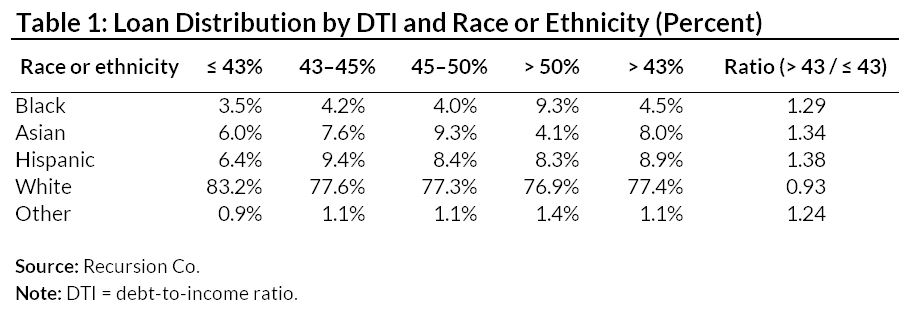

Table 1: Shows that as DTIs increase, the proportion of white borrowers decreases, and the proportion of all other minority borrowers increases.

For example, 3.5 percent of the 43-DTI-or-under loans are made to African Americans, versus 4.5 percent of the over-43 DTI loans, suggesting African Americans are 29.0 percent more likely to have an over-43 DTI loan than an under-43 DTI loan. Similarly, 43-and-under DTI loans to Hispanics are 6.4 percent of the total, versus 8.9 percent for loans over 43 DTI, suggesting Hispanics are 38 percent more likely to have a high DTI loan.

For example, 3.5 percent of the 43-DTI-or-under loans are made to African Americans, versus 4.5 percent of the over-43 DTI loans, suggesting African Americans are 29.0 percent more likely to have an over-43 DTI loan than an under-43 DTI loan. Similarly, 43-and-under DTI loans to Hispanics are 6.4 percent of the total, versus 8.9 percent for loans over 43 DTI, suggesting Hispanics are 38 percent more likely to have a high DTI loan.

We looked at results for purchase and refinance loans broken down separately (not shown), and the results were consistent: Minority borrowers are overrepresented in the higher DTI buckets.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

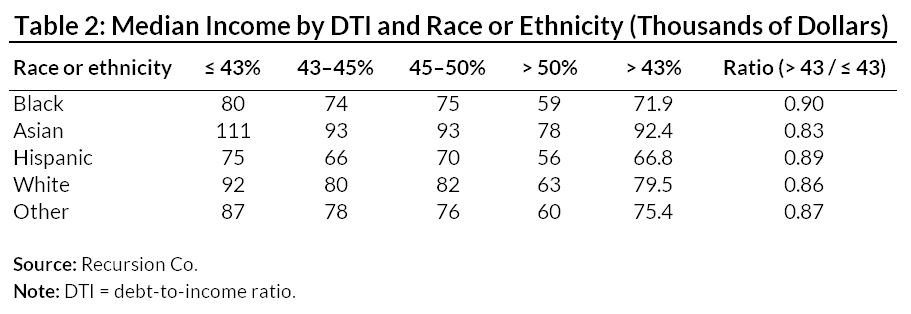

Table 2: Shows that as DTIs increase, the income of the borrowers decreases.

Specifically, the income of borrowers with DTIs over 43 is 10 to 15 percent lower than the income of borrowers with DTIs less than or equal to 43 DTI. This is true for all races and ethnicities.

The median income of non-Hispanic whites with a DTI at or below 43 was $92,000, compared with $79,000 for those with DTIs over 43. Similarly for African Americans, those with higher DTIs have a median income of $80,000, compared with $75,000 for lower DTI borrowers, and for Hispanic borrowers, the difference is $72,000, compared with $67,000 respectively.

The median income of non-Hispanic whites with a DTI at or below 43 was $92,000, compared with $79,000 for those with DTIs over 43. Similarly for African Americans, those with higher DTIs have a median income of $80,000, compared with $75,000 for lower DTI borrowers, and for Hispanic borrowers, the difference is $72,000, compared with $67,000 respectively.

Asian Americans have the highest incomes, as they are disproportionately concentrated in the highest cost areas, but the pattern is the same: Asian American borrowers with lower DTIs have a median income of $111,000, compared with $92,000 for those with higher DTIs.This new evidence firmly establishes that the GSE patch disproportionately benefits minority borrowers and borrowers whose incomes are at the lower end for new homeowners. This finding suggests that if the patch is not extended, a replacement should be found that supports credit availability for minority borrowers.

A word on the methodology

The Recursion Co. loan matching between HMDA and eMBS (GSE origination data) was done using 2014–2017 data; 2017 was the latest data available from HMDA. The matching was based on loan characteristics (loan amount, loan purpose, origination date, loan type, and occupancy), geographic location of the home, and originating lender. While Recursion was able to match virtually all loans, in most cases, there was more than one eMBS loan that matched a HMDA loan. They were able to successfully find a 1-to-1 match over 4 million loans, representing 38 percent of Freddie Mac loans and 18 percent of Fannie Mae loans. We used only 1-to-1 matches for this analysis. The Freddie Mac match rate was higher because the Freddie eMBS data has an MSA variable, while Fannie data has only state-level information.

About the Author: Laurie Goodman is a vice president at the Urban Institute and co-director of its Housing Finance Policy Center, which provides policymakers with data-driven analyses of housing finance policy issues that they can depend on for relevance, accuracy, and independence.

Read more...