By Laurie Goodman

Last year, we wrote about the need to address the expiration of the government-sponsored enterprise patch, or “GSE patch,” which currently allows higher debt-to-income ratio mortgages to qualify for the protections provided under the qualified mortgage rule.

We also offered several options for addressing the January 2021 expiration of the patch.

Recently, Recursion Co., a financial analytics firm, combined several databases and shared some of the results with us, allowing us to establish exactly why it’s important to address the expiration of the patch.

The patch disproportionately benefits minority and lower-income borrowers. Letting the patch expire in 2021 with no change will further disadvantage these already underserved groups.

The qualified mortgage rule, one of the most significant accomplishments of the Dodd-Frank Wall Street Reform and Consumer Protection Act, requires mortgage lenders to make a good faith determination of each borrower’s ability to repay a proposed loan, considering such factors as borrower income, assets, other debt, and employment. The mortgage itself must be fully amortizing, with maturities of no more than 30 years.

This rule eliminated the riskiest loans—such as interest only loans, balloon loans, and adjustable rate mortgages—that could experience negative amortization. The rule was designed to protect borrowers from obtaining loans they could not afford, while simultaneously giving lenders protection from lawsuits that claim a lender failed to verify a borrower’s ability to repay. A borrower who obtains a qualified mortgage is presumed to have the ability to repay that mortgage.

The Consumer Financial Protection Bureau codified the QM rule in January 2014, specifying a set of features that a mortgage must have to qualify for the rule. One of the required features was a DTI ratio of no more than 43 percent. There is a permanent exemption from this DTI cap for loans insured by the Federal Housing Administration, the Department of Veterans Affairs, or the Department of Agriculture or held in portfolio by a depository institution with $10 billion or less in assets.

[caption id="attachment_11651" align="alignleft" width="448"] GSE Patch led to higher DTIs and lower incomes.[/caption]

GSE Patch led to higher DTIs and lower incomes.[/caption]

Loans purchased by Fannie Mae and Freddie Mac had a temporary exemption to the DTI cap, known as the GSE patch, which expires on Jan. 10, 2021, or when the GSEs exit conservatorship, whichever comes first. All GSE loans, including those covered by the GSE patch, must still go through the rigorous GSE underwriting process.

Approximately 19 percent of GSE loans in the 2014–2018 period, or 3.3 million loans, were made possible by the patch. The number of loans taking advantage of the patch was higher in the later part of the period as interest rates rose and, in conjunction with higher home prices, forced many homebuyers to borrow more in comparison with their incomes. The CFPB is currently deciding the fate of this patch—whether to keep it in place, let it expire, or modify it.

In assessing the value of and determining the next steps for the patch, it would be helpful to know who it serves—both in terms of race and ethnicity and income. But until now, we haven’t had access to this information because neither of these variables is contained in publicly available mortgage origination data.

The tables below finally offer this critically important data, thanks to Li Chang of Recursion Co., who matched Home Mortgage Disclosure Act data (which has race and ethnicity and income information) with GSE origination data provided through eMBA, which reports on GSE securities data.

The results, while not surprising, confirm and quantify an important fact most believed to be true: That high DTI GSE borrowers are disproportionately minority borrowers with incomes that are, on average, less than those of borrowers with lower DTIs.

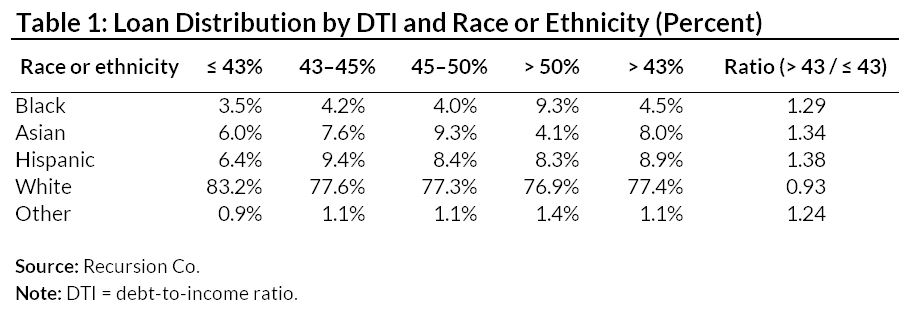

Table 1: Shows that as DTIs increase, the proportion of white borrowers decreases, and the proportion of all other minority borrowers increases.

For example, 3.5 percent of the 43-DTI-or-under loans are made to African Americans, versus 4.5 percent of the over-43 DTI loans, suggesting African Americans are 29.0 percent more likely to have an over-43 DTI loan than an under-43 DTI loan. Similarly, 43-and-under DTI loans to Hispanics are 6.4 percent of the total, versus 8.9 percent for loans over 43 DTI, suggesting Hispanics are 38 percent more likely to have a high DTI loan.

For example, 3.5 percent of the 43-DTI-or-under loans are made to African Americans, versus 4.5 percent of the over-43 DTI loans, suggesting African Americans are 29.0 percent more likely to have an over-43 DTI loan than an under-43 DTI loan. Similarly, 43-and-under DTI loans to Hispanics are 6.4 percent of the total, versus 8.9 percent for loans over 43 DTI, suggesting Hispanics are 38 percent more likely to have a high DTI loan.

We looked at results for purchase and refinance loans broken down separately (not shown), and the results were consistent: Minority borrowers are overrepresented in the higher DTI buckets.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

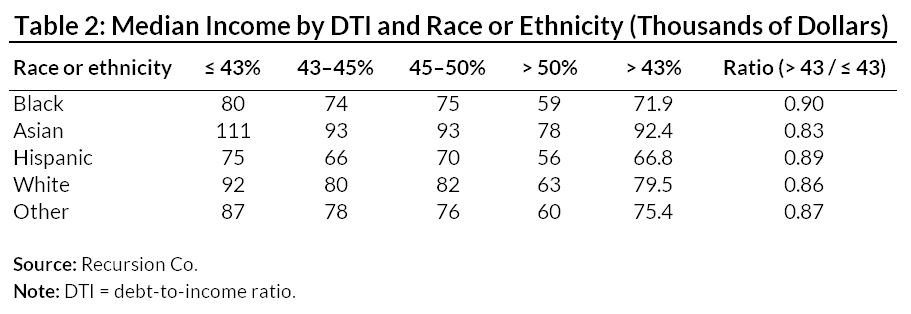

Table 2: Shows that as DTIs increase, the income of the borrowers decreases.

Specifically, the income of borrowers with DTIs over 43 is 10 to 15 percent lower than the income of borrowers with DTIs less than or equal to 43 DTI. This is true for all races and ethnicities.

The median income of non-Hispanic whites with a DTI at or below 43 was $92,000, compared with $79,000 for those with DTIs over 43. Similarly for African Americans, those with higher DTIs have a median income of $80,000, compared with $75,000 for lower DTI borrowers, and for Hispanic borrowers, the difference is $72,000, compared with $67,000 respectively.

The median income of non-Hispanic whites with a DTI at or below 43 was $92,000, compared with $79,000 for those with DTIs over 43. Similarly for African Americans, those with higher DTIs have a median income of $80,000, compared with $75,000 for lower DTI borrowers, and for Hispanic borrowers, the difference is $72,000, compared with $67,000 respectively.

Asian Americans have the highest incomes, as they are disproportionately concentrated in the highest cost areas, but the pattern is the same: Asian American borrowers with lower DTIs have a median income of $111,000, compared with $92,000 for those with higher DTIs.This new evidence firmly establishes that the GSE patch disproportionately benefits minority borrowers and borrowers whose incomes are at the lower end for new homeowners. This finding suggests that if the patch is not extended, a replacement should be found that supports credit availability for minority borrowers.

A word on the methodology

The Recursion Co. loan matching between HMDA and eMBS (GSE origination data) was done using 2014–2017 data; 2017 was the latest data available from HMDA. The matching was based on loan characteristics (loan amount, loan purpose, origination date, loan type, and occupancy), geographic location of the home, and originating lender. While Recursion was able to match virtually all loans, in most cases, there was more than one eMBS loan that matched a HMDA loan. They were able to successfully find a 1-to-1 match over 4 million loans, representing 38 percent of Freddie Mac loans and 18 percent of Fannie Mae loans. We used only 1-to-1 matches for this analysis. The Freddie Mac match rate was higher because the Freddie eMBS data has an MSA variable, while Fannie data has only state-level information.

About the Author: Laurie Goodman is a vice president at the Urban Institute and co-director of its Housing Finance Policy Center, which provides policymakers with data-driven analyses of housing finance policy issues that they can depend on for relevance, accuracy, and independence.