TRENDING WHITEPAPERS,VIDEOS & MORE

matt

Mountain America Deploys Digital Deposit Account Tool

- Monday, 01 April 2019

Mountain America Credit Union has deployed a new digital deposit account tool from Blend.

The tool enables the credit union to offer a seamless digital-account opening experience to consumers across desktop and mobile, within existing mortgage or home-equity-lending workflows.

Mountain America Credit Union was able to roll-out Blend's deposit account product in one month, with all online account opening traffic now flowing through Blend's platform. The credit union reports that 53 percent of applications come through mobile, that hadn’t been used for deposits. Also, the time it takes to apply for and open an account has dropped by 46 percent.

"We knew Blend shared our vision for a simpler, more transparent consumer lending ecosystem," said Kelly Albiston, Mountain America's senior vice president of digital banking, deposits and card services. "By partnering with them on multiple products, including deposit account opening, we are providing a consistent and streamlined experience for our members across the board and taking friction out of the process."

Although critical to the health of banks and credit unions, the deposit account opening experience, hasn’t kept pace with changing consumer expectations. For instance, 32 percent of consumers begin their deposit account applications on mobile, though almost half of them don't complete their applications, forcing consumers offline or to tech-forward competitors, according to Javelin Strategy & Research. In comparison, 34 percent of consumers complete their applications in their local branches.

According to Blend, its deposit account product provides the capability for banks and credit unions to offer consumers a modern account opening experience on any device. The digital experience removes the need for a branch visit and eliminates paperwork by pre-filling applications with required data directly from the source, shortening the process to as little as two minutes for some customers.

"By making deposit account opening easier, Blend is enabling banks and credit unions, to deepen consumer relationships and stay competitive in a crowded market," said Olivia Teich, head of product at Blend. "This is an important step in our journey to build a single platform for lenders to provide exceptional customer experiences across their products."

Read more...CoreLogic Predicts Home Prices Will Rise 4.7%

- Tuesday, 02 April 2019

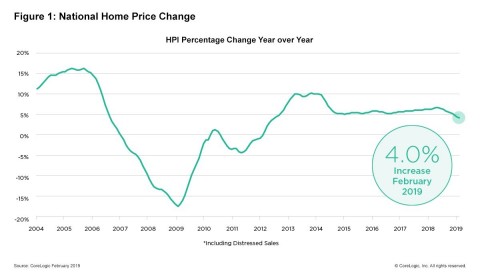

Home prices will rise by 4.7 percent on a year-over-year basis between February 2019 and February 2020, , according to the CoreLogic HPI Forecast. On a month-over-month basis, home prices are expected to decrease by 0.5 percent between February 2019 and March 2019.

The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic indicators.

“During the first two months of the year, home-price growth continued to decelerate,” said Dr. Frank Nothaft, chief economist for CoreLogic. “This is the opposite of what we saw the last two years when price growth accelerated early. With the Federal Reserve’s announcement to keep short-term interest rates where they are for the rest of the year, we expect mortgage rates to remain low and be a boost for the spring-buying season. A strong-buying season could lead to a pickup in home-price growth later this year.”

Home prices across the U.S. increased 4 percent year over year compared with February 2018. On a month-over-month basis, prices increased by 0.7 percent in February 2019, according to the CoreLogic Home Price Index.

According to the CoreLogic Market Condition Indicators, an analysis of housing values in the country’s 100-largest metropolitan areas, based on housing stock, 35 percent of metropolitan areas have an overvalued housing market as of February 2019.

The Market Condition Indicators analysis categorizes home prices in individual markets as undervalued, at value or overvalued, by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals, such as disposable income. Also, as of February 2019, 27 percent of the top-100 metropolitan areas were undervalued, and 38 percent were at value. When looking at only the top-50 markets based on housing stock, 40 percent were overvalued, 18 percent were undervalued, and 42 percent were at value in February 2019.

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

The Market Condition Indicators analysis defines an overvalued housing market as one in which home prices are at least 10 percent above the long-term, sustainable level. An undervalued housing market is one in which home prices are at least 10 percent below the sustainable level.

In all, 62 percent of residents in high-priced markets acknowledged that housing in these markets was unaffordable, compared to only 11 percent of respondents across all markets surveyed last year. Almost 71 percent of renters in these high-priced markets felt their housing costs were unaffordable, compared with just 16 percent of renters across all markets in 2018.

High-priced markets were identified as the 15 metropolitan areas with the highest median home prices. The study focused on the dynamics of housing decision making and the impact that the housing market had on the attitudes and perceptions of residents in high-priced markets.

“About 40 percent of the top 50 largest metropolitan areas in the country are now categorized as overvalued and we expect that percentage to grow over the remainder of 2019. The cost of either buying or renting in expensive markets puts a significant strain on most consumers,” said Frank Martell, president and CEO of CoreLogic. “Our research tells us that about 74 percent of millennials, the single largest cohort of homebuyers, now report having to cut back on other categories of spending to afford their housing costs.”

Read more...Constellation Mortgage Acquires Mortgage Builder

- Monday, 01 April 2019

Constellation Mortgage Solutions Inc has acquired Mortgage Builder, a provider of loan origination and servicing software systems.

Mortgage Builder provides software to mortgage banks, community banks, credit unions and other financial institutions. In addition to loan origination software, its offerings include, servicing, relationship management, document management and a production portal.

[caption id="attachment_11458" align="alignleft" width="147"] Scott Smith[/caption]

Scott Smith[/caption]

“Mortgage Builder fits nicely within our portfolio of real estate SaaS providers, while expanding our technology offerings to serve new markets,” said Scott Smith, president of Constellation Real Estate Group. “Their long-standing commitment to service and dedication to meeting the evolving needs of their clients is evident by the multitude of recognition they’ve received in the mortgage industry. As we continue to grow our software and services portfolio, we’re pleased to welcome Mortgage Builder as the newest member of the Constellation Real Estate Group.”

[adbutler zone_id="326314"]

[adbutler zone_id="326316"]

Constellation Real Estate Group has a buy-and-hold investment strategy, investing in vertical market software companies to manage and grow for the long-haul. Acquiring Mortgage Builder aligns is consistent with its strategy of investing in solutions that benefit the real-estate industry and professionals that use them.

“The Constellation Real Estate Group has a proven track record of delivering long-term value and stability to the companies it invests in,” said Stephen Ryczek, general manager of Mortgage Builder. “We look forward to leveraging their expertise and commitment to their brands and people to benefit and better serve our customers.”

According to Constellation, the acquisition of Mortgage Builder extends the company’s reach to more than 500,000 real estate agents, brokerages, franchises, and banks across the U.S. and Canada.

Read more...