-

The Rise of Modern Mortgage Lending: Embracing Digital Transformation Explore how digital transformation is revolutionizing the mortgage lending industry, with advancements in AI, blockchain, and user-friendly platforms enhancing the borrowing experience.

The Rise of Modern Mortgage Lending: Embracing Digital Transformation Explore how digital transformation is revolutionizing the mortgage lending industry, with advancements in AI, blockchain, and user-friendly platforms enhancing the borrowing experience.

Black Knight's Software Solutions Revenue Up 7% in Q3

- Tuesday, 30 October 2018

- Lending

Black Knight Inc. reported that adjusted revenues from its  software solutions increased 7% in the third quarter to $243.9 million, from $227.2 million in the same period a year earlier. The origination business rose 8%, while the servicing software business rose 7%. Black Knight delivers software, data and analytics to mortgage, real estate and capital markets companies.

software solutions increased 7% in the third quarter to $243.9 million, from $227.2 million in the same period a year earlier. The origination business rose 8%, while the servicing software business rose 7%. Black Knight delivers software, data and analytics to mortgage, real estate and capital markets companies.

Data and Analytics Adjusted Revenues for the third quarter increased 2%, to $38.4 million, from $37.6 million in the same quarter a year earlier. The revenue performance was due to an increase in the property data and multiple listing service businesses.

Revenues for the third quarter of 2018 increased 7% to $281.7 million, from $263.8 million compared with the same quarter a year earlier. Net earnings attributable to Black Knight for the third quarter of 2018 were $43.0 million, or $0.29 per diluted share, compared to $14.7 million, or $0.21 per diluted share, in the prior year quarter.

Adjusted Revenues for the third quarter of 2018 increased 7% to $282.3 million, from $264.8 million in the prior year quarter. Adjusted Net Earnings for the third quarter of 2018 increased 31% to $71.3 million, compared with $54.3 million in the same quarter in 2017.

Adjusted Net Earnings Per Share for the third quarter of 2018 increased 33% to $0.48 per diluted share compared to $0.36 per diluted share in the prior year quarter. Adjusted EBITDA for the third quarter of 2018 increased 8% to $138.4 million, from $128.2 million in the prior year quarter. Adjusted EBITDA Margin was 49.0%, an increase of 60 basis points compared to the prior year quarter.

Read more...FHFA, Fannie and Freddie Launch Mortgage Translations

- Thursday, 18 October 2018

- Lending

The Federal Housing Finance Agency, Freddie Mac, and Fannie Mae have launched Mortgage Translations, a centralized clearinghouse of online resources to assist lenders, servicers, housing counselors, and other real estate professionals in serving limited English proficient borrowers.

LEP borrowers make up a growing share of today’s mortgage market, a trend that is likely to continue in the coming decades, and lenders and other mortgage market participants are in need of tools to help them serve these consumers. FHFA, Freddie Mac, and Fannie Mae collaborated with industry experts, consumer advocates, and other government agencies in developing the online collection of mortgage documents, educational materials, and a new online Spanish-English glossary produced by the Consumer Financial Protection Bureau in collaboration with FHFA and the Enterprises. The glossary is expected to be particularly helpful in standardizing translations across the mortgage industry.

The first phase of the launch consists of Spanish-language documents. According to the U.S. Census, persons who speak Spanish as their primary language comprise more than 60 percent of the LEP population in the U.S. Resources in four other languages commonly spoken by LEP households--Chinese, Vietnamese, Korean, and Tagalog--will be added in the coming years.

[caption id="" align="alignright" width="158"]

“The Mortgage Translations clearinghouse is one part of a Language Across Multi-Year Plan and includes a number of meaningful resources to help mortgage industry professionals reach a broader range of borrowers," said Janell Byrd-Chichester, chief of staff at FHFA.

“Freddie Mac is pleased to work with FHFA and Fannie Mae on this language access multi-year plan, as it demonstrates our commitment to help make home possible for today’s borrower and the borrower of the future,” said Danny Gardner, senior vice president of single-family affordable lending and access to credit at Freddie Mac. “The materials included on this website will provide lenders, servicers, real estate professionals and housing counselors with tools to better assist, educate and engage LEP borrowers throughout the mortgage process.”

“Fannie Mae is excited to partner with FHFA and Freddie Mac to launch this central source of translated documents,” said Jonathan Lawless, vice president for product development and affordable housing at Fannie Mae. “This online resource will educate, engage and better assist LEP borrowers when shopping for a mortgage.”

Read more...

The Mortgage Files: Fannie Names (Interim) CEO, A Couple Deals

- Monday, 08 October 2018

- Lending

A New (Interim) Top-Man at Fannie Mae

A New (Interim) Top-Man at Fannie Mae

Fannie Mae named Hugh Frateras as interim chief executive officer. The appointment will be effective on Oct. 16, 2018, subject to final FHFA approval.

"I have great respect for Fannie Mae and the significant role it plays in our housing system," said Frater. “I look forward to working alongside the leadership team as we continue to look for new ways to serve our customers, implement our strategy and strengthen the company." He will succeed Timothy Mayopoulos, who announced his intention to depart in July 2018 and will leave the company on Oct. 15, 2018.

Frater has served on Fannie Mae's board since 2016. He has held a number of executive and management roles throughout his career. Frater currently serves as Vereit’s non-executive chairman of the board and as a director of ABR Reinsurance Capital Holdings. He previously led Berkadia Commercial Mortgage, a national commercial real estate company, which provides comprehensive capital solutions and investment sales advisory and research services for multifamily and commercial properties.

He served as chairman of Berkadia from April 2014 to December 2015, and he served as CEO of Berkadia from 2010 to April 2014.

M&A

- BancorpSouth Bank completed its merger with Icon Capital Corp., including subsidiary Icon Bank of Texas. Icon operates seven full-service banking offices in the Houston market, and two approved but unopened full-service banking offices will open as BancorpSouth offices in the next few months. BancorpSouth operates two full-service banking offices, as well as a mortgage loan production office, and a regional insurance office in the market.

- LoanLogics and Optimal Blue formed a strategic partnership aimed at delivering a real-time integration between LoanLogics’ LoanHD Correspondent Lending platform and Optimal Blue’s product eligibility and pricing platform. In conjunction with the partnership, Optimal Blue has acquired LoanLogics’ product, pricing, and eligibility technology business, LoanDecisions. Financial details were not disclosed.

VC Funding

- Cherre, a real estate data platform, closed a $9 million seed funding round led by Navitas Capital. Cherre provides large enterprises, insurance companies, banks and investors with a platform to collect, augment, and resolve property data in real-time from thousands of public, private, and internal sources, allowing them to evaluate investment and underwriting opportunities in a more more accurate and efficient manner than ever before. In addition to Navitas Capital, the funding round was also joined by Carthona Capital, iLookabout, Dreamit Ventures, and Red Swan Ventures. Pre-seed investors in Cherre included Recursive Ventures, Sarona Ventures, Wharton Angel Group, Harvard Angel Group, New York Angels and Angel Investor Forum.

US Foreclosure Rate hits 0.59 percent, lowest level in 15 years

- Monday, 02 July 2018

- Lending

Mortgage borrower are benefitting from the strong economy—if a recent survey is any indication.

The pre-sale inventory foreclosure ratein the U.S. is 0.59 percent, the lowest level in 15 years, and the number of mortgages in active foreclosure is a modest 303,000.If the current rate of decline continues,the market could achieve the 2000-2005pre-recession averageearly in the third quarter, according to Black Knight’s first look May Report. Foreclosure pre-sale inventory rate dropped 3.3% in May, on a month-over-month basis, and it fell 28.65 percent year-over-year.

The second lowest total of foreclosure starts in 17 years—44,900—was recorded last month.That’s a drop of 8.92 percent on a month-over-month basis and a decline of19.53 percent on a year-over-year basis.

Black Knight Inc.’s first look Report is a snapshot of month-end mortgage performance statistics gleaned from loan-level data derived from a majority of the national mortgage market.

Also, for the fifth consecutive month delinquencies declined, due to continued post-hurricane improvement.Delinquency improvements in hurricane-affected areas offset slight increases in non-affected markets in May, which dropped the national delinquency rate to its lowest level in 15 months.

The total U.S. loan delinquency rate, or loans 30 or more days past due, but not in foreclosure, is 3.64 percent. Month-over-month loan delinquencies dropped0.84percent; and year over year, they fell 4.08 percent.

The number of properties that are 30 or more days past due, but not in foreclosure, is 1.87 million, a decline of 18,000 on a month-over-month,and a decline of 60,000 on a year-over-year basis.

The number of properties that are 90 or more days past due, but not in foreclosure is 568,000, representing on a month-over-month decline of 30,000, and a year-over-year change of plus 6,000.

The number of properties in foreclosure pre-sale inventory is 303,000, a drop of 11,000 on a month-over-month basis; and a decline of -118,000 year-over-year.

The number of properties that are 30 or more days past due or in foreclosure is 2.17 million, a month-over-month drop of 28,000and a year-over-year decline of 177,000.

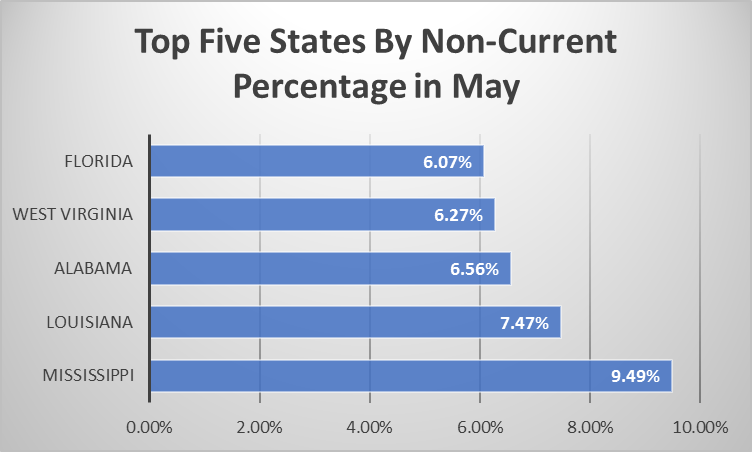

A look at the best and worst-performing states, according to Black Knights May 2018 performance statistics.

| Top 5 States (by Non-Current Percentage) | |

| Mississippi | 9.49% |

| Louisiana | 7.47% |

| Alabama | 6.56% |

| West Virginia | 6.27% |

| Florida | 6.07% |

|

|

|

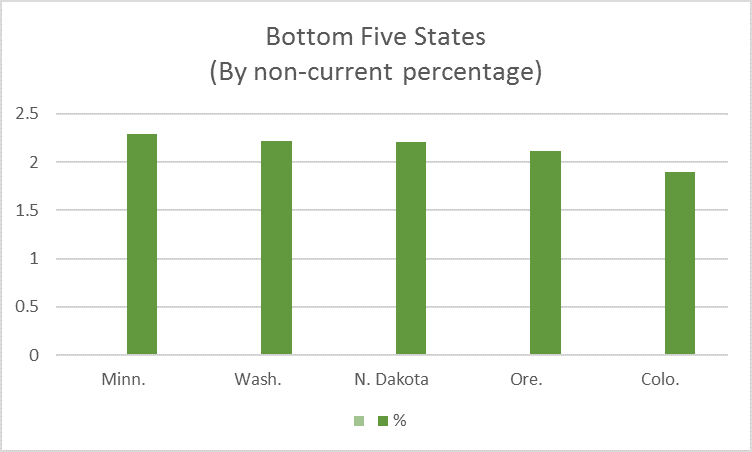

| Minnesota: | 2.29% |

| Washington: | 2.22% |

| North Dakota: | 2.21% |

| Oregon: | 2.12% |

| Colorado: | 1.90%

|

| Top 5 States by 90+ Days Delinquent Percentage | |

| Mississippi: | 2.94% |

| Florida: | 2.55% |

| Louisiana: | 2.05% |

| Alabama: | 1.90% |

| Texas: | 1.68% |

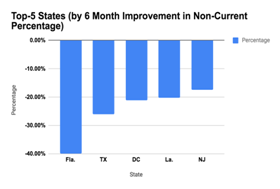

Top 5 States (by 6-Month Improvement in Non-Current Percentage) |

|

| Florida: | -40.00% |

| Texas: | -25.99% |

| District of Columbia: | -21.14% |

| Louisiana: | -20.25% |

| New Jersey: | -17.43% |

| Top 5 States by 6-Month Deterioration in Non-Current* Percentage | |

| Alaska: | -2.30% |

| North Dakota: | -5.32% |

| Montana: | -8.80% |

| Maine: | -10.18% |

| Delaware: | -10.47% |

Read more...

Bottom 5 States (by Non-Current Percentage)

Bottom 5 States (by Non-Current Percentage)